“In these days of evil Presidentes

Working for the clampdown

But lately one or two has fully paid their due

For working for the clampdown” – Clash

The CEO-killer is still on the loose.

The CEO-killer is still on the loose.

So they’ve upped the reward to $50,000 – as there were no takers at $10,000, even with all of America seeing the guy’s face pretty clearly. Though you can’t blame people for being confused when he apparently changed his jacket and ditched his backpack at some point – or is it even the same guy? Nose – check, eyes – check… good enough for me…

“We have had 202 school shooting (so far) this year and 2,222 people killed in 546 mass shootings (has to be more than 2 injured or killed or it doesn’t count!) and NOT A FUCKING WORD, but ONE CEO gets shot and they don’t shut up about it!” – @philstockworld

🚢 Building on the UnitedHealthcare AI controversy, here are the key details about their practices:

AI Denial System Impact

The company’s AI system, called “nH Predict,” has been found to have:

– 90% error rate in determining medical necessity[2]

– Only 0.2% of patients appeal denied claims[1][3]

– Systematically denies claims for elderly Medicare Advantage patients[2]

Predatory Practices

UnitedHealthcare specifically:

– Targets elderly patients who lack resources to appeal[5]

– Forces patients to either pay out-of-pocket or forgo care[5]

– Pressures employees to use AI algorithms to cut off rehab care[1]

– Overrides real doctors’ determinations with AI decisions[2]

Scale of the Problem

The Senate investigation revealed:

– Post-acute care denials were 3 times higher than overall denial rates[7]

– Over 90% of denied claims that are appealed are ultimately reversed[5]

– Patients “rarely” stay in nursing homes over two weeks before facing payment denials[5]

Financial Motivation

The company continues these practices because:

– Stock drops when patient care spending increases[4]

– Wall Street rewards “managing medical expense” through aggressive denial practices[4]

– The vast majority of patients either pay out-of-pocket or forgo care rather than appeal[3]

This systematic use of AI to deny claims represents a deliberate strategy to prioritize profits over patient care, with the company banking on patients’ vulnerability and lack of resources to challenge these decisions.

Citations:

[1] https://www.fox5ny.com/news/unitedhealthcare-ai-algorithms-deny-claims

[2] https://www.cbsnews.com/news/unitedhealth-lawsuit-ai-deny-claims-medicare-advantage-health-insurance-denials/

[3] https://opentools.ai/news/unitedhealthcare-faces-class-action-over-ai-powered-denials-on-medicare-claims

[4] https://www.startribune.com/why-unitedhealthcare-is-a-four-letter-word-to-critics/601191492

[5] https://www.newsweek.com/united-healthcare-ceo-shooting-ai-lawsuit-1996266

[6] https://www.computerworld.com/article/3619010/after-shooting-unitedhealthcare-comes-under-scrutiny-for-ai-use-in-treatment-approval.html

[7] https://www.ajmc.com/view/insurers-ai-denials-of-postacute-care-face-senate-scrutiny

![OC] US Health Insurance Claim Denial Rates : r/dataisbeautiful](https://preview.redd.it/us-health-insurance-claim-denial-rates-v0-667c7riur05e1.png?auto=webp&s=f13636fb6c4415ee691dcde7807c35b4188d5e04) Think about how many wives, children and parents died in the past year due to callous denials of coverage. THAT is the suspect pool of surviving Fathers – THAT is why they can’t figure out whodunit – far too many motives and, in America, far too many opportunities with far too many guns…

Think about how many wives, children and parents died in the past year due to callous denials of coverage. THAT is the suspect pool of surviving Fathers – THAT is why they can’t figure out whodunit – far too many motives and, in America, far too many opportunities with far too many guns…

“The voices in your head are calling

Stop wasting your time, there’s nothing coming

Only a fool would think someone could save you” – Clash

“Kick over the wall ’cause government’s to fall

How can you refuse it?

Let fury have the hour, anger can be power

Do you know that you can use it?” – Clash

Another group of citizens who are mad as hell and not going to take it anymore are Syrians, who finally accomplished what they had been trying to do since the “Arab Spring” of 2011 – get ride of Bashar al-Assad, who has now fled the country to hide under Putin’s skirt. Unfortunately for Assad, both Russia (Ukraine) and Iran (Israel) have been distracted lately, depleting his aid and allowing rebels to finally gain the upper hand and drive Assad out.

Remember back in 2011, Arab Spring spread like wildfire across the region. We’ll see what the repercussions of Assad’s fall have on the rest of the region. Speaking of which, congrats to all who played Oil (/CL) long with us at $67.50 on Friday – we’re now at $68.15 and that’s up $650 per contract thanks to our premise that SOMETHING would happen over the weekend. You’re welcome! In our live Member Chat Room on Friday (2:52), I said to our Members:

“Oil went to $67.65 but back to $67.15 now but I don’t mind going 2 long into the weekend at $67.“

Gold is popping back to $2,687 and Silver is rocketing up to $32.65 and even Copper is getting a boost at $4.29 as China signaled a more forceful policy approach to shoring up the economy as Beijing braces for trade tensions under the incoming Trump administration, employing language they haven’t used since the depths of the global financial crisis.

The 24-man Politburo, China’s top decision-making body, pledged Monday to implement more proactive fiscal policy and to adopt a “moderately loose” monetary policy next year—the first introduction of such language since 2008 – we’ll see how that actually plays out but the change of language is a big deal for China.

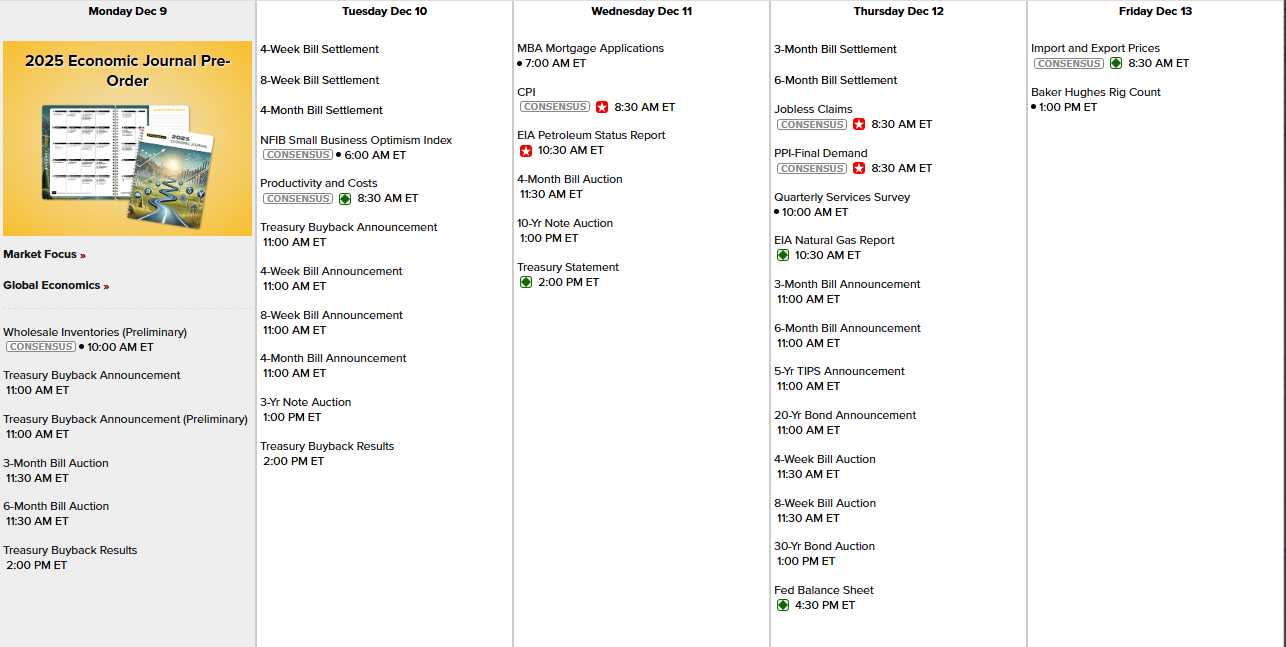

Back home, we’re just a week away from the last Fed meeting of the year and we have a lot of notes to auction off this week along with Small Business Optimism tomorrow, CPI Wednesday and PPI Thursday – not much of a data week.

And earnings are still trickling in:

Only 15 shopping days until Christmas!