Are we still inflating?

Are we still inflating?

Leading Economorons expect that CPI will be 0.2% for November with Core CPI at 0.3%, which is 3.6% INFLATION for the year – still over the Fed’s 2% target by 80 PERCENT (80%) which leading Mathematicians refer to as A LOT!!! Still, the popular opinion is that the Fed will lower the Fed Funds Rate next week from 4.58% to 4.33% EVEN THOUGH the 10-Year Note is at 4.25% and the 30-Year Note is at 4.50% – this creates (artificially) an almost flat yield curve, which historically signals economic uncertainty.

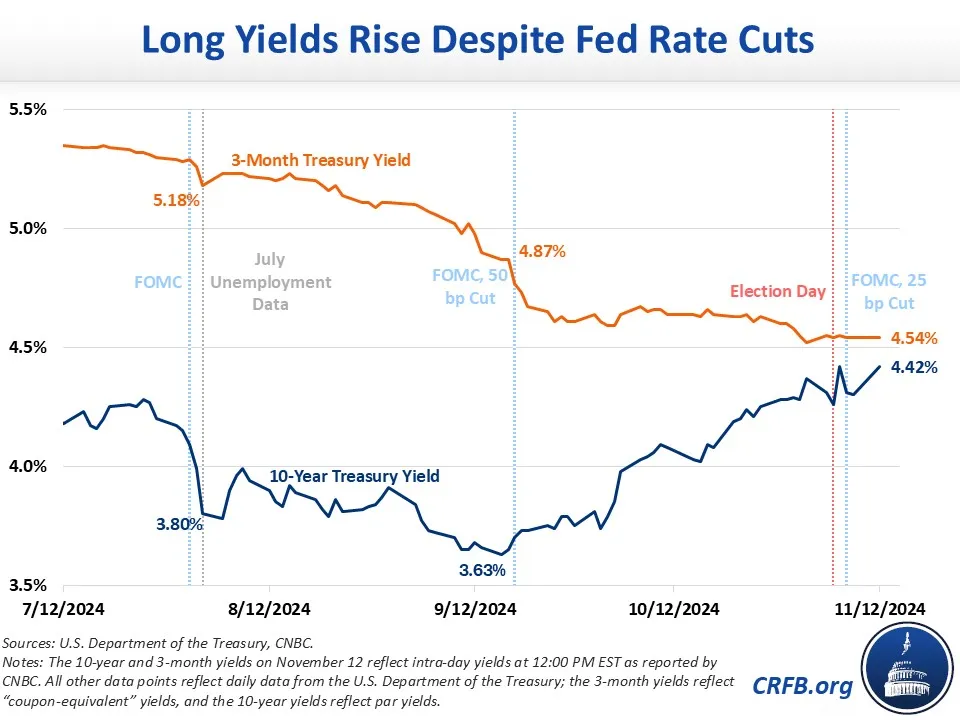

What makes this particularly unusual is that Treasury yields are moving in the opposite direction of Fed policy. When the Fed cut rates by 75 basis points over the past eight weeks, the 10-year Treasury yield actually increased by 79 basis points. This suggests the market expects either stronger economic growth, higher inflation, or more likely, both.

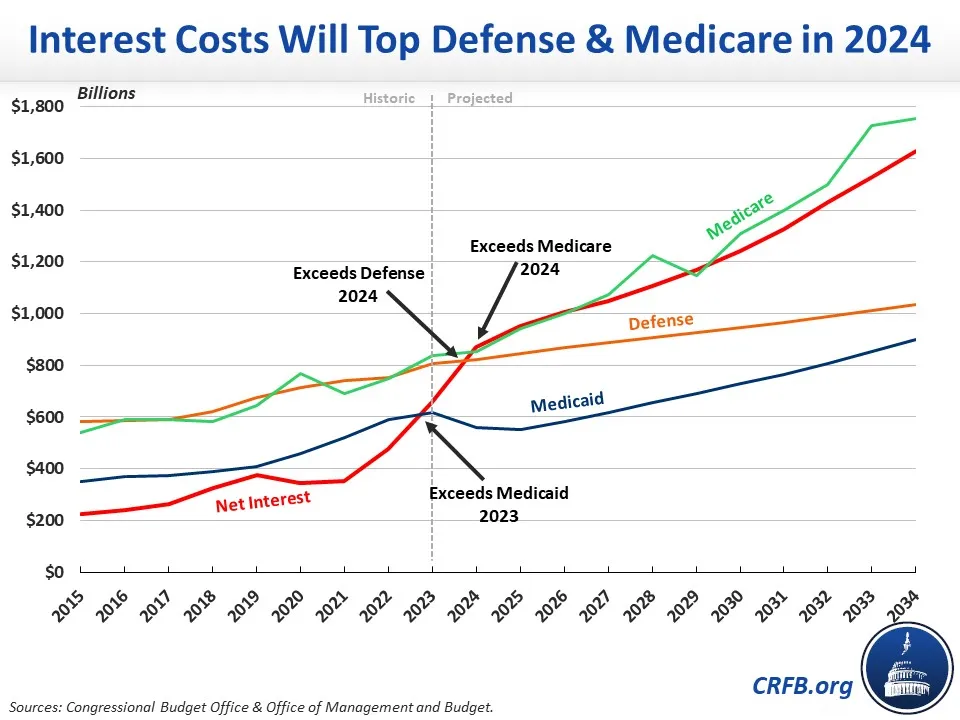

The disconnect becomes even more concerning when we look at the debt implications. With national debt already projected to grow by more than $22 Trillion over the next decade (BEFORE Trump makes it worse) these higher yields reflect growing market concerns about U.S. Debt Levels. Investors are starting to question the “risk-free” status of Treasury Securities, demanding ADDITIONAL YIELD to compensate for additional risks. J.P. Morgan now expects the Fed to conclude its cutting cycle at 3.5%, higher than their previous 3.0% Terminal Rate Forecast.

JPM’s adjustment suggests that the market believes Inflation will remain more persistent than previously thought, even as the Fed attempts to normalize rates. This unusual relationship between short-term and long-term rates is likely to lead to increased Market Volatility and potentially force the Fed to reconsider its rate-cutting plans, especially if inflation remains significantly above target – so today’s data is CRITICAL!

Oil (/CL) and Gasoline (/RB) were down 5% in November but Natural Gas (/NG) was 15% higher. Bonds topped out at 4.5% (10-year) just before Thanksgiving and Cocoa & Coffee jumped 40% while Lumber popped 13% but Gold, Silver and Copper came down about 10% and Corn was up 7% but the rest of the Grains were flat or down slightly.

The Dollar, for it’s part, rose from 104 to 106 (2%) in November and THAT put downward pressure on everything else BUT, when the Fed lowers their rate, it weakens the Dollar and should the Dollar fall 2% – that will add a massive inflationary spin back into December’s prices – just in time for Christmas…

8:30 Update: 3% in both Headline and Core means it’s MADNESS for the Fed to be cutting rates. Shelter, Food and Energy led the advances and that makes sense since people use more Nat Gas in the Winter and Nat Gas did jump a lot. Also, Nat Gas is used to make electricity for those hungry AIs…

Eggs were up 8.2%, Cereal was down 1.1%, New Cars were up 0.6% and Insurance for those cars jumped 12.7%! The data shows Inflation is VERY persistent above the Fed’s 2% target. The acceleration from 0.2% to 0.3% monthly, combined with broad-based price increases across categories, indicates inflation pressures are NOT contained.

According to EVERYTHING the “data dependent” Fed speakers have said, the Fed should RAISE rates or, in the least, pause at next week’s meeting BUT we know the Fed is full of crap and the US has notes to sell and interest payments to make so they will more likely extend and pretend – as if all this is OK (spoiler – it is NOT!).

[ctct form=”12730731″ show_title=”false”]