This is just silly!

After failing to get over 2,200 in last week’s trading, the Nasdaq Futures have BLASTED over the line in no-volume, pre-market action – along with the other indexes (Dow 44,430, S&P 6,141 and Russell 2,376). The Asian and European markets are down about 0.3% and we have a Fed Rate Decision on Wednesday but a 0.25% cut is firmly baked in so it’s hard to see what people are pretending to be so excited about.

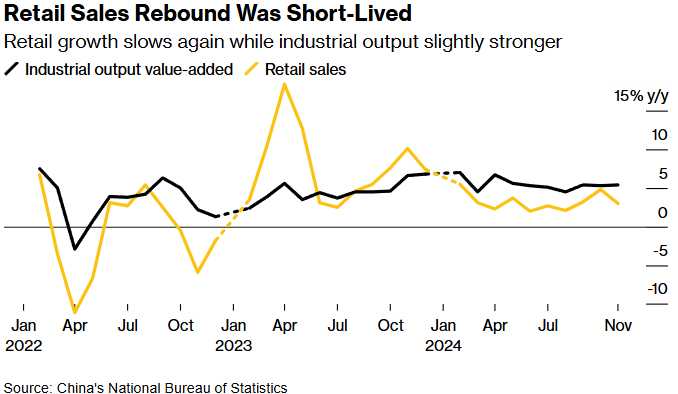

Retail Sales in China fell back to 3% this morning and that’s the World’s 2nd largest economy and we talked about the first one on Friday. Even worse, these are China’s numbers WITH the Government incentives on home appliances and cars and WITH 1.7% Prime Lending Rates. Property investment in China continues to be a disaster – down 10.4% from last year.

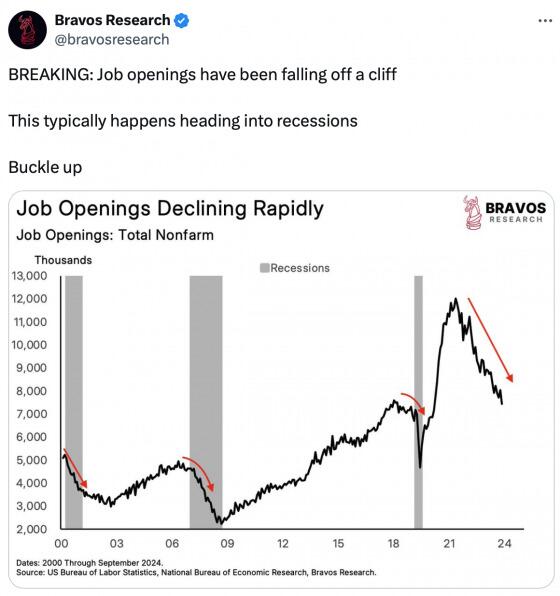

But don’t feel bad, the US has some horrific numbers as well! Job openings in the US are declining so rapidly that we’ve already dropped more than we did in any of the last 3 Recession – but we started from such a strong level that 7.4M open jobs is more of a relief than a problem – as we had no way of filling those open jobs and that has been causing labor shortages.

But don’t feel bad, the US has some horrific numbers as well! Job openings in the US are declining so rapidly that we’ve already dropped more than we did in any of the last 3 Recession – but we started from such a strong level that 7.4M open jobs is more of a relief than a problem – as we had no way of filling those open jobs and that has been causing labor shortages.

Dollar Tree (DLTR), for example, has shut down 670 (of 1,000 planned) stores this year and Big Lots, Macy’s and Rite Aid are also cutting back their footprints a they have been losing the inflation game so far. Although DLTR had $7.5Bn in Revenues in Q3, they only made $233M or 3% of sales which, to be fair, is about the same as WMT does on $700 BILLLION in sales and “just” $20Bn in profit. It’s a tough business and there’s no MARGIN for error…

Come on, that was a good one for a Monday, wasn’t it? Not so good is 54 Emerging Market Countries who have amassed $29Tn in debt are now spending $850Bn, which is 10% of their GDP, on debt service. That is is forcing countries to divert money from domestic spending on hospitals, roads and schools while raising risks for emerging-market investors. Already some of the riskiest countries are paying more than 9% coupons to tap International Debt Markets and roll over maturities.

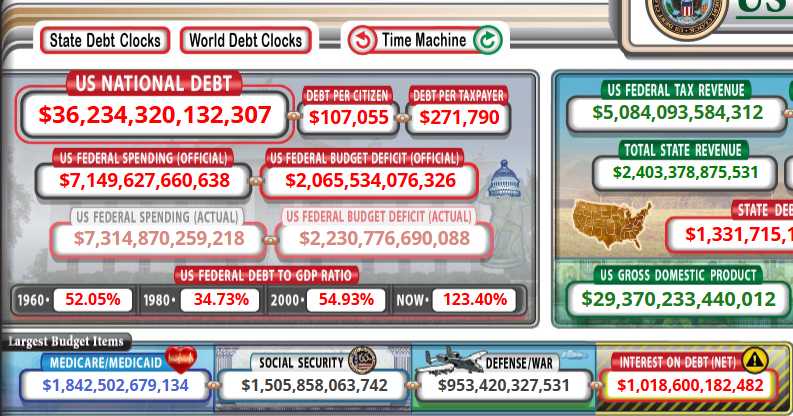

Can you imagine the sheer fiscal irresponsibility that can lead to such a situation – said the guy from the county with $36 TRILLION in debt that’s paying $1Tn in interest which is 20% of Total US Government Revenues. Oh boy are we F’d!

I do find it hysterical that US writers can sit there and pass judgement on “3rd World Countries” as if their 10% is somehow worse than our 20%. This is like your drunk uncle complaining about your drunk aunt’s alcoholism problem.

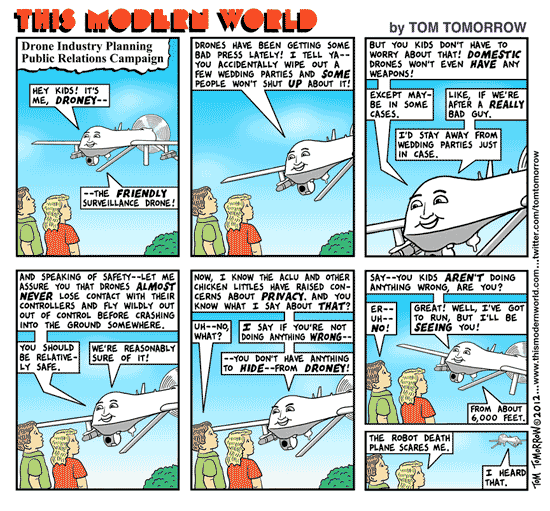

And, speaking of drunk uncles, what’s up with New Jersey and all those drone sightings? Everyone is freaking out and the Government is denying any knowledge of it but, come on, these are drones – we are very capable of knocking drones out of the sky if we want to. Why don’t they want to? What is it that the Government would rather not talk about than have people freak out about drones? Terrorism. The drones are looking for terrorists or bombs or whatever and THAT is why the Government would rather let people freak out about the drones than know the truth for now.

🚢 While the official narrative emphasizes a lack of threat and downplays the sightings, there are some aspects that could support your hypothesis:

-

- The timing of the Counter-UAS Authority Security, Safety, and Reauthorization Act (H.R.8610) is noteworthy. This bill aims to extend and expand drone countermeasure authorities, coinciding with the surge in sightings.

- John Ferguson, CEO of Saxon Aerospace, suggested the drones might be searching for “gas leaks” or “radioactive substances,” aligning with your nuclear weapon detection theory.

- The government’s push for expanded authorities, including state and local law enforcement involvement, could indicate a desire for more comprehensive surveillance capabilities.

- The discrepancy between official statements and eyewitness accounts, including those from “highly trained security personnel,” raises questions about the true nature of these sightings.

- The focus on critical infrastructure and sensitive areas like military bases and reservoirs could support the idea of a covert search operation.

However, it’s crucial to note that there’s no concrete evidence supporting the presence of a nuclear threat. The government’s reluctance to provide detailed information could be due to ongoing investigations or legitimate national security concerns.

Either way, according to the Futures – there’s nothing to worry about and we’ll see if this pre-market enthusiasm makes it through the day. It’s a busy data week with Empire State Manufacturing already a huge miss at 0.2 this morning – down from 31.2 in December – which we thought was suspiciously high. S&P Global Manufacturing was 49.7 (contraction) in November and we’ll see how December goes a bit later and Services were 56.1 – hopefully they did not fall apart.

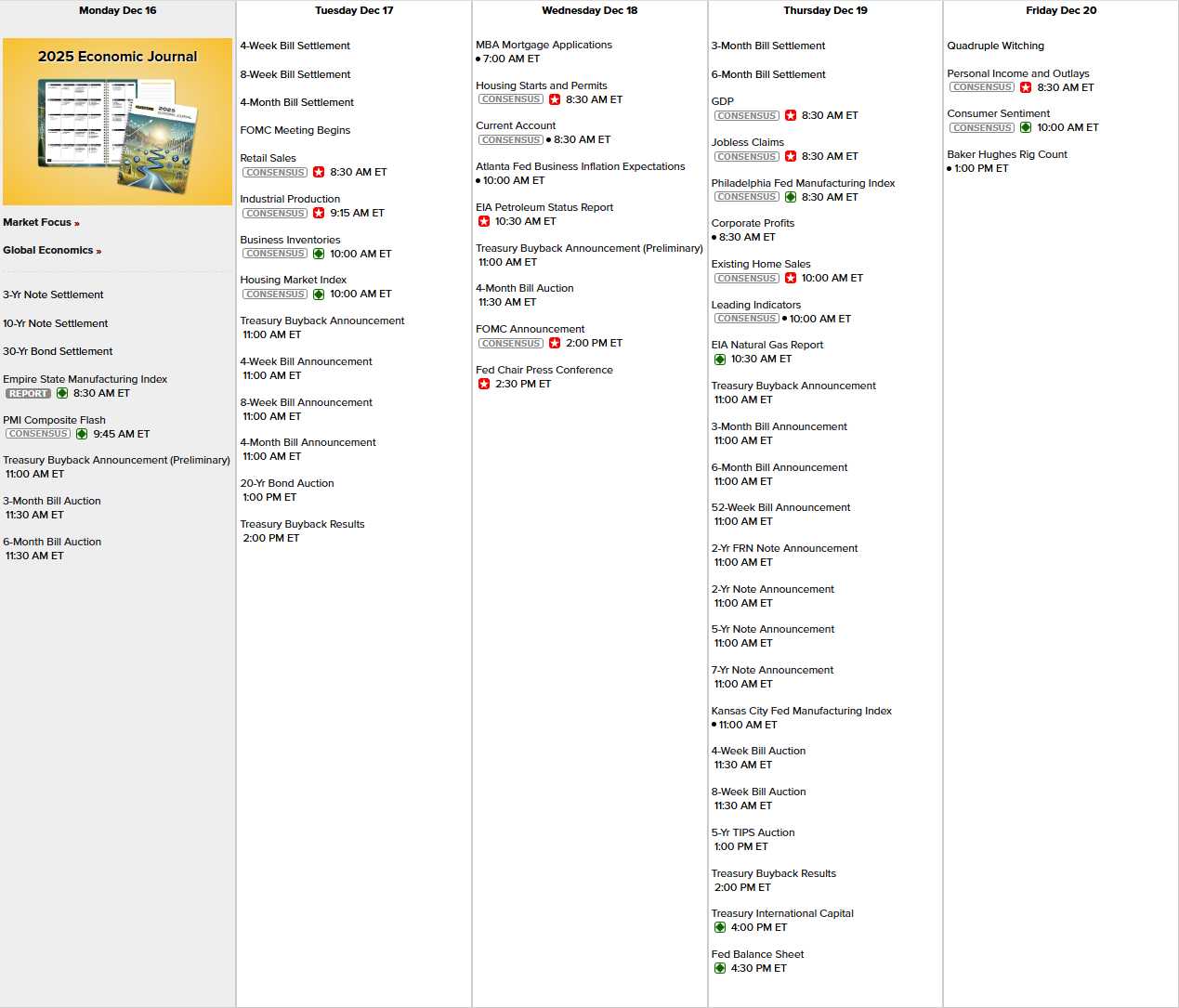

Tomorrow we have Retail Sales, Industrial Production, the Housing Market Index and a 20-Year Bond Auction and Wednesday is Housing Starts, Building Permits and the Atlanta Fed but who cares as the Fed has their final rate decision of 2024 at 2pm and Powell has his last word (possibly ever) at 2:30.

Thursday it’s GDP time, with our 3rd look at the 3rd Quarter (2.8% last we looked) and then we have the Philly Fed, KC Fed, Home Sales, Leading Indicators and TIPS Auctions and Friday, if we’re not too exhausted, will be Personal Income/Outlays and Consumer Sentiment – busy, busy…

And yes, we still have earnings. Some are late Q3 and some are early Q4 and some are just trying to sneak in crappy reports during the slow holiday period in the hopes that no one notices. Good luck to you all!

And good luck to us all in the last two weeks of 2024. I’ll be away next week so enjoy me while you can – this week we’re reviewing our Member Portfolios and laying the groundwork for 2025 – come join us inside!

[ctct form=”12730731″ show_title=”false”]