What a year this has been!

Sure we still have another day but it’s a half day – so we may as well look back a bit while people are still paying attention. Driven by the “Magnificent 7“, who popped 67.5% this year, the S&P gained 24.8% after hitting 48 “new highs” – from 4,818 on Jan 2nd to 6,014.75 in this morning’s Futures.

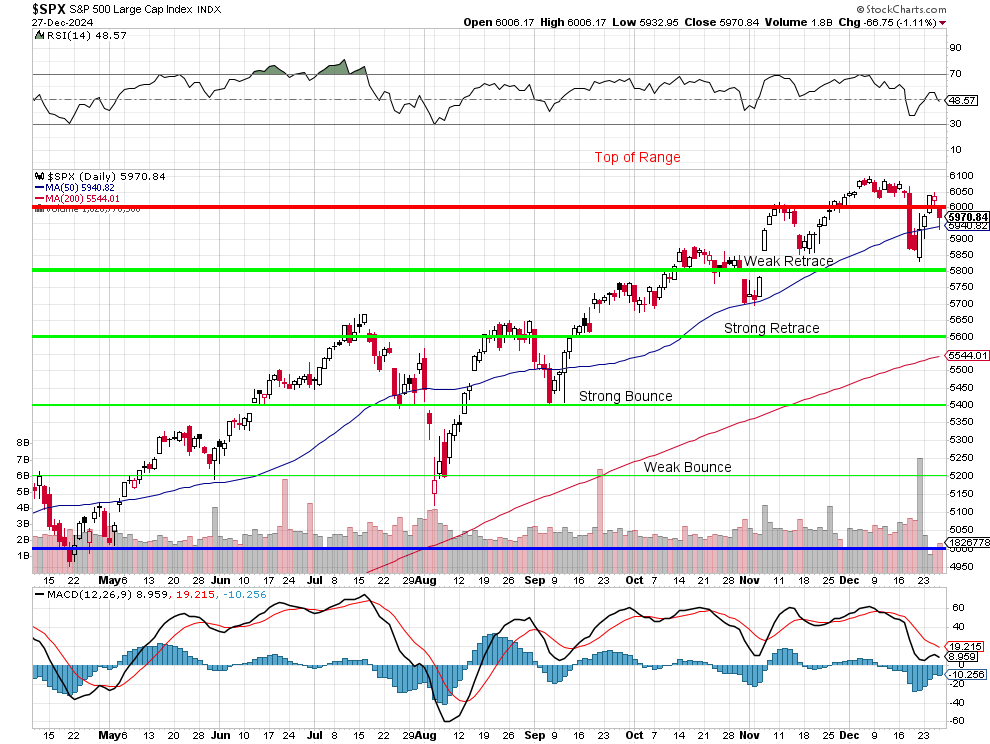

As you can see from the chart above – we’re finishing exactly at the top of our predicted range – which we’ve been using with our Fabulous 5% Rule™ all year long so this move is “surprising” but not “shocking” and now we have to consider our targets for 2025 and boy is that tricky with Trump coming in!

I’ll save that for after the holiday but, to be real, our GDP is only growing at a 3.1% pace and, more importantly from an investor’s standpoint, Corporate Profits hit $3.6Tn (after taxes and depreciations and write-offs) this year and that’s up 5.9% from last year for which we are paying 24.8% more per share for the companies making those profits – inflated…

I’ll save that for after the holiday but, to be real, our GDP is only growing at a 3.1% pace and, more importantly from an investor’s standpoint, Corporate Profits hit $3.6Tn (after taxes and depreciations and write-offs) this year and that’s up 5.9% from last year for which we are paying 24.8% more per share for the companies making those profits – inflated…

It should also be noted that US Corporations paid $480M in taxes on $4Tn in pre-tax profits or 12% while US workers paid $4.1Tn in taxes on $12.65Tn in wages or 32.4% – not exactly a fair and balanced system, is it?

Still, the whole thing can be a huge rip-off but that doesn’t stop us from finding bargains that are out there. We have our Watch List, of course and NKE is on there from $72.81 on our list (around Thanksgiving) and now it’s $76.18 but still not bad but not good enough for us so we’re waiting on earnings. Certainly worth “watching” though.

BA is down 31% for the year and will be even lower today after a major crash in South Korea, where the landing gear failed to deploy on a 737-800 – NOT what you want to hear if you are a Boeing investor (or one of the 181 passengers!). This was not a “Max” – this was the normal 737s that are about half the planes in the skies.

Not to be an unfeeling investor but accidents DO happen and parts get old and fail at certain points – it’s just with most products, a single part failure doesn’t lead to hundreds of deaths so BA is always subject to these sort of things but, coming on the heels of a tragic few years for BA. We added them to our Watch List in November at $145 – catching the dead lows and I still like them long-term but it’s dicey at the moment depending on what this investigation uncovers.

FIVE is down 50% for the year and that seems a little extreme as it brings them down to $6Bn in market cap while earnings should be good for $300M so this ($109) is 20x – so it’s a good price and FIVE’s top-line in 2021 was $1.9Bn and now it’s $4Bn so if Profits catch up with Revenues in the next few years – this debt-free company will seem like a real bargain at $109.

OXY is down 20% for the year, despite Warren Buffett BUYBUYBUYing it all year. I have not liked them over $50 but now under $50 is kind of interesting at 15x their $3.4Bn in earnings and Trump should be very, very good for companies like OXY for the next 4 years.

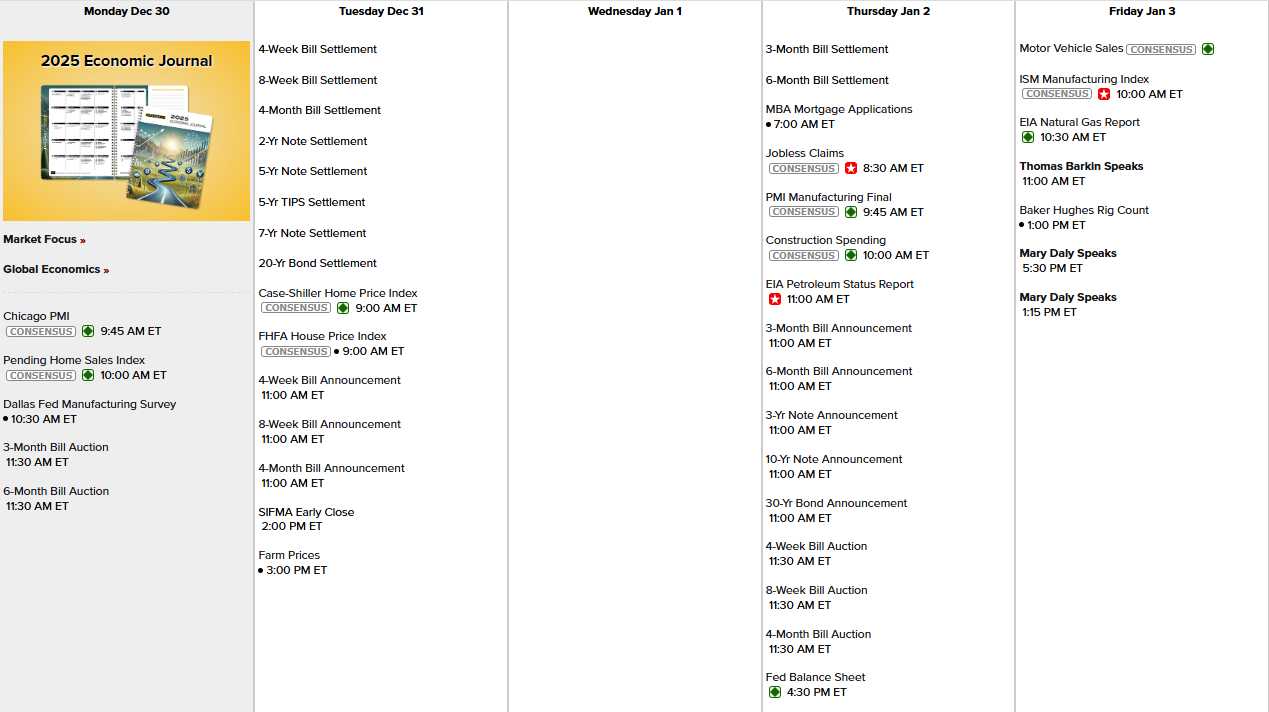

So there are PLENTY of things to buy and those are just a few examples with 100 more on our Watch List already – and the year hasn’t started yet! Meanwhile, we still have some business to take care of in 2024 like Chicago PMI, Pending Home Sales and the Dallas Fed this morning, Home Prices and Farm Prices tomorrow and then Wednesday is off. Thursday we begin 2025’s data with PMI and Construction Spending and, of course, some note auctions. Friday the Fed is back with 3 speeches to start off the new year along with Motor Vehicle Sales and ISM:

And you know we are done with the year when the Earnings Calendar looks like this:

It’s another slow, meaningless week so enjoy time with your friends and family as we reflect back on 2024 and look forward to the year ahead…

[ctct form=”12730731″ show_title=”false”]