Weekend already?!?

Weekend already?!?

All our weeks should start on Thursday! Or maybe we should just have every Wednesday off – it breaks up the week quite nicely. When I was a waiter, back in the day, we used to get a weekday off and it was so great to be able to take care of stuff during the week rather than having “homework” to do on a Saturday or Sunday. Well, I guess AIs will give us all a lot of time off in the near future…

For now, let’s get some work done while we can. Only 17 days to Trump so we’ll have a whole new set of things to watch in two weeks but, for now, let’s see what we should be watching in the first week of 2025:

- U.S. Surgeon General Calls for Cancer Warnings on Alcohol – Dr. Vivek Murthy’s report cites studies linking alcoholic beverages to at least seven malignancies, including breast cancer. But to add warning labels, Congress would have to act. This will likely be buried and burned by the Trump Administration so – Party On!!! (BUT, STZ, TAP, DEO)

- South Korean Officials Thwarted in Attempt to Detain President After Standoff – Police officers and investigators tried to bring President Yoon Suk Yeol in for questioning about his declaration of martial law last month.

- Eyeing Potential Bird Flu Outbreak, Biden Administration Ramps Up Preparedness – The White House is committing an additional $306 million to battling the virus, and will distribute the money before President-elect Trump takes office. Will this be enough to stop the new Trump Administration from mishandling another pandemic? (PFE, MRNA)

China facing new Covid-like pandemic? – China is experiencing a surge in Human Metapneumovirus (HMPV) infections after five years of the Covid-19 pandemic. Reports and online posts indicate widespread transmission, with some claiming hospitals and crematories are overwhelmed. Videos circulating online depict crowded hospitals, and users mention the simultaneous circulation of influenza A, HMPV, Mycoplasma pneumoniae, and Covid-19. Some reports link the rise in HMPV to an increase in deaths, particularly among people aged 40 to 80. Have no fear – Team Trump is here! (again)

China facing new Covid-like pandemic? – China is experiencing a surge in Human Metapneumovirus (HMPV) infections after five years of the Covid-19 pandemic. Reports and online posts indicate widespread transmission, with some claiming hospitals and crematories are overwhelmed. Videos circulating online depict crowded hospitals, and users mention the simultaneous circulation of influenza A, HMPV, Mycoplasma pneumoniae, and Covid-19. Some reports link the rise in HMPV to an increase in deaths, particularly among people aged 40 to 80. Have no fear – Team Trump is here! (again) - BlackRock’s Bitcoin ETF Posts Record Outflow After Banner Year – Investors yanked a net $333 million from BlackRock Inc.’s iShares Bitcoin Trust ETF (IBIT) on Thursday, the most withdrawn from the record-breaking fund since its launch. The fund also suffered a third consecutive day of outflows, its longest losing streak, according to data compiled by Bloomberg.

- Emerging-Market Currencies Diverge From Gold on Trump Haven Bid – Gold and emerging-market currencies — two assets that typically move in the same direction against the dollar — have been diverging as investors prepare for Donald Trump’s return to the US presidency.

- China Lets Yuan Weaken After Defending 7.3 Per Dollar for Weeks – The onshore yuan weakened past a level that China had been defending throughout December, opening up room for the managed currency to drop further amid a sluggish economy. Looking ahead, China’s economic fundamentals point to further depreciation. Risk sentiment is so poor that the benchmark stock index just closed at the weakest level since September and sovereign yields hit fresh record lows.

- A Year After Boeing’s Blowout, Quality Remains Work in Progress – It was a year ago today that the door blew out on a 737 Max 9. (ALK, BA)

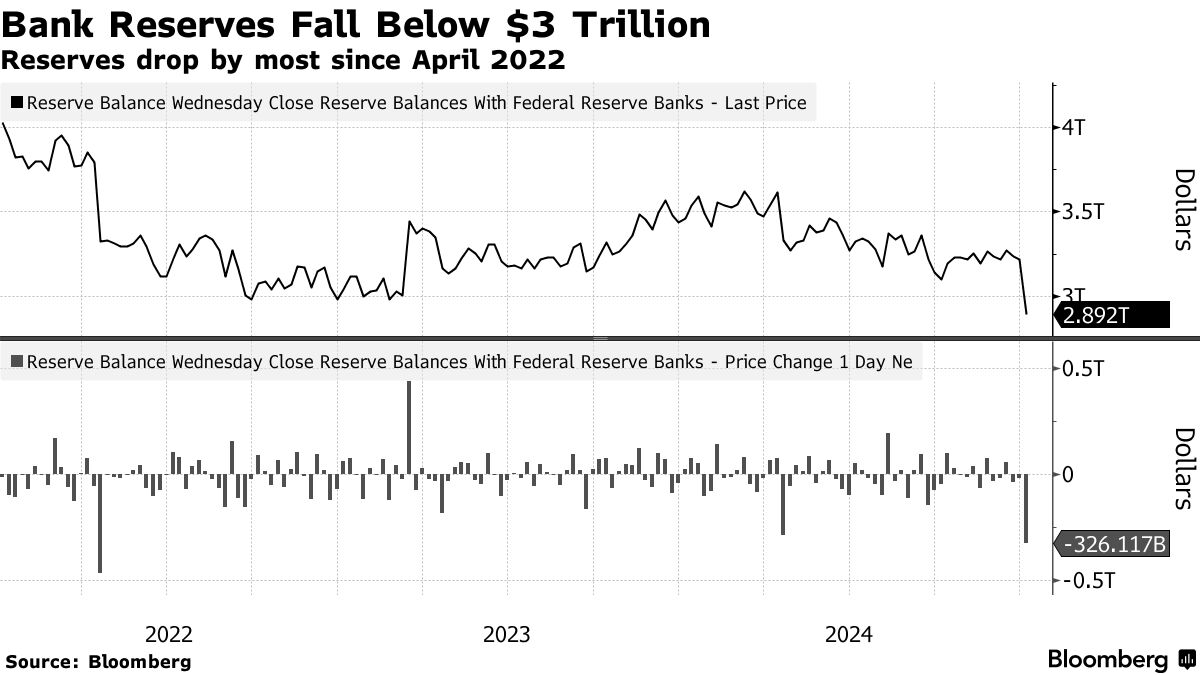

- Reserves at Fed Sink Below $3 Trillion to the Lowest Since 2020 – Bank reserves fell by about $326 billion in the week through Jan. 1 to $2.89 trillion, according to Fed data released on Thursday. That’s the largest weekly slide in over two and a half years. At the same time, the Fed has also been removing excess cash from the financial system through its quantitative tightening program, just as institutions continue to repay loans from the Bank Term Funding Program.

[ctct form=”12730731″ show_title=”false”]