Saved by the Dollar!

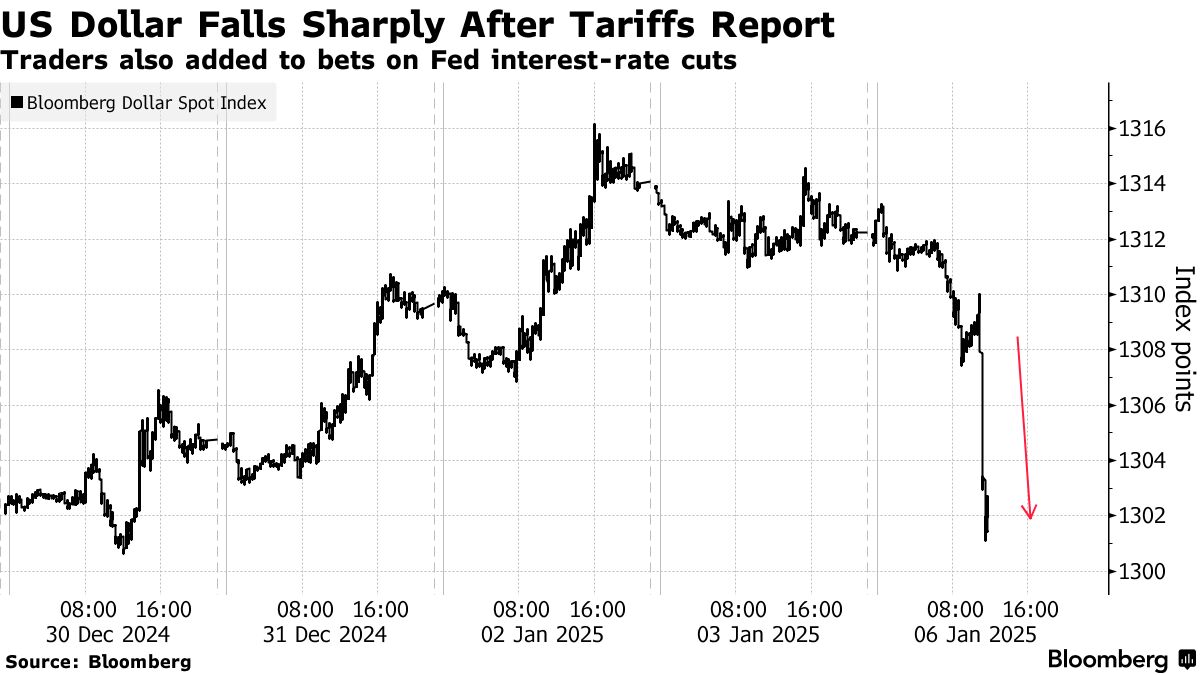

As you can see from this chart, the Dollar has taken quite a tumble since Thursday and that has driven a rally in things that are priced in Dollars – like stocks and commodities. The dollar hit 2-year highs last week as the Fed seemed to be on a much slower rate-cutting path than the other Central Banks and we knew the BOJ was bound to Yentervene as the Yen fell back below 0.0064, topping out at 157.54 Yen to the Dollar – a five-month low.

The Dow is back to 43,200 and all the other indexes have popped Thursday’s highs so it would be strange if the Dow does not – we’ll see when the market opens. Brent Crude (/BZ) is testing $77 and WTIC is $74.40 with Gasoline (/RB) popping back to $2.06 and Natural Gas (/NG) blasting from $3.37 at Friday’s close to $3.63 this morning.

I had called for longs on /NG and /HG (Copper) in our Live Member Chat Room on Friday morning and Copper has blasted up over 0.10, which doesn’t sound like much but /HG contracts pay $250 per penny so that’s a SWEET $2,500 gain PER CONTRACT over the weekend – you’re welcome!

Now we don’t make a lot of commodity calls – only when they are obvious but the Dollar was OBVIOUSLY overbought and, when the Dollar comes down, Commodities go up so all we had to do was wait for the inevitable – and here we are…

The catalyst that took down the Dollar over the weekend was a Washington Post Report that Trump was narrowing the range of proposed tariffs and that revitalized competing currencies but it’s all still VERY up in the air. Right now, we’re very much in a rumor-driven economy so we’ll have to see how this plays out but enjoy the boost while we can.

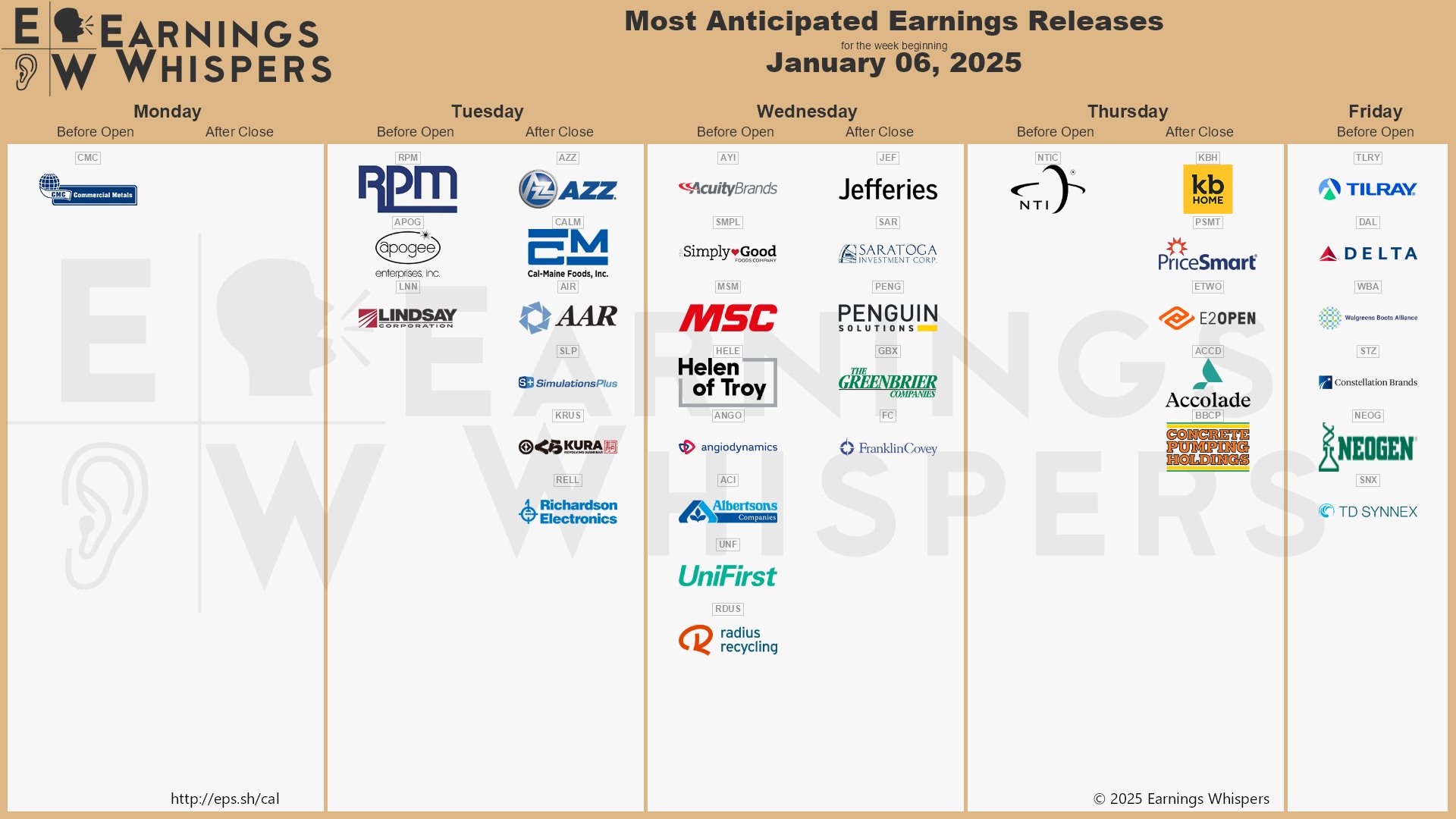

Earnings are back already with early reporters coming in but it doesn’t matter much until next week, when the Big Banks begin reporting.

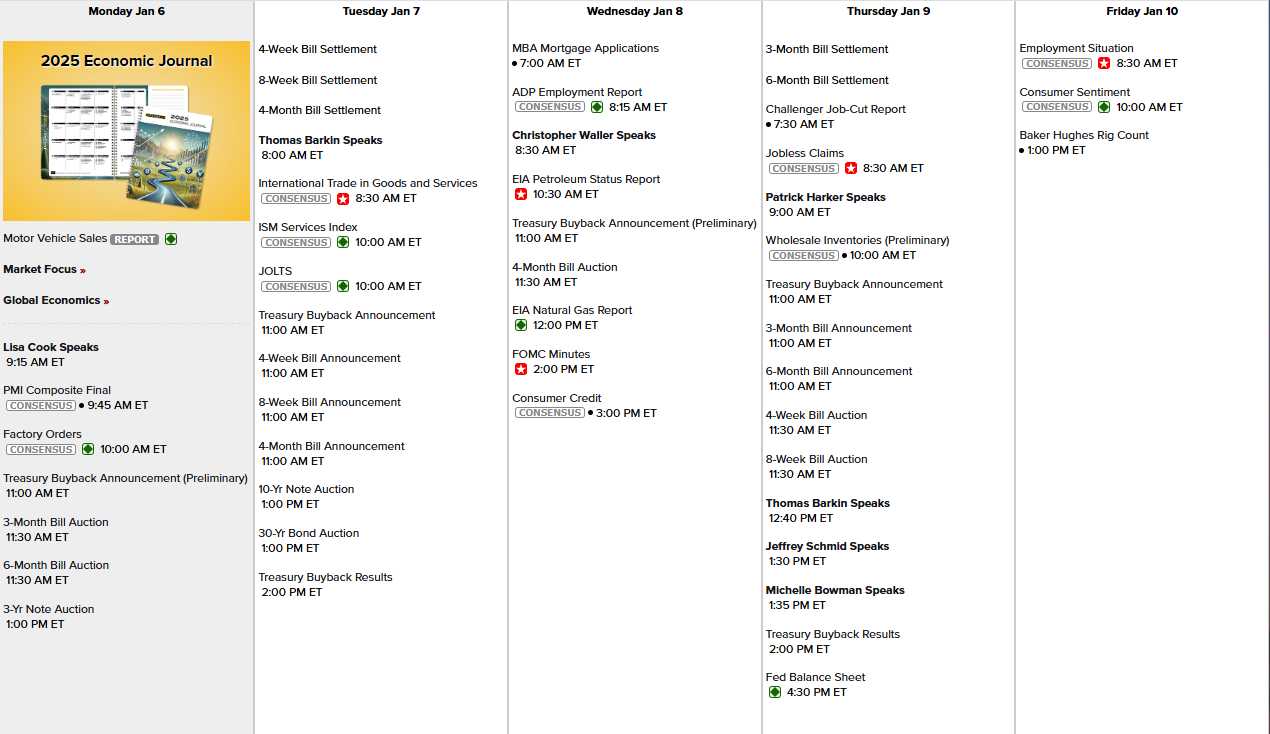

On the economic front, however, we have FOMC Minutes on Wednesday and 7 Fed Speeches with hundreds of Billions of Dollars worth of notes being auctioned off during the week – including both a 10-Year and a 30-Year Auction tomorrow at 1pm. Today we also have PMI and Factory Orders, tomorrow ISM Services and JOLTS, Wednesday is the Fed Minutes and Consumer Credit and Thursday is weird as it’s been declared a holiday in memory of Jimmy Carter.

That means we don’t know for sure if the 4 scheduled Fed Speakers will actually be heard that day but Friday is the biggie – Non-Farm Payrolls and Consumer Sentiment. Nothing to do but watch and wait as this is a very unusual situation.

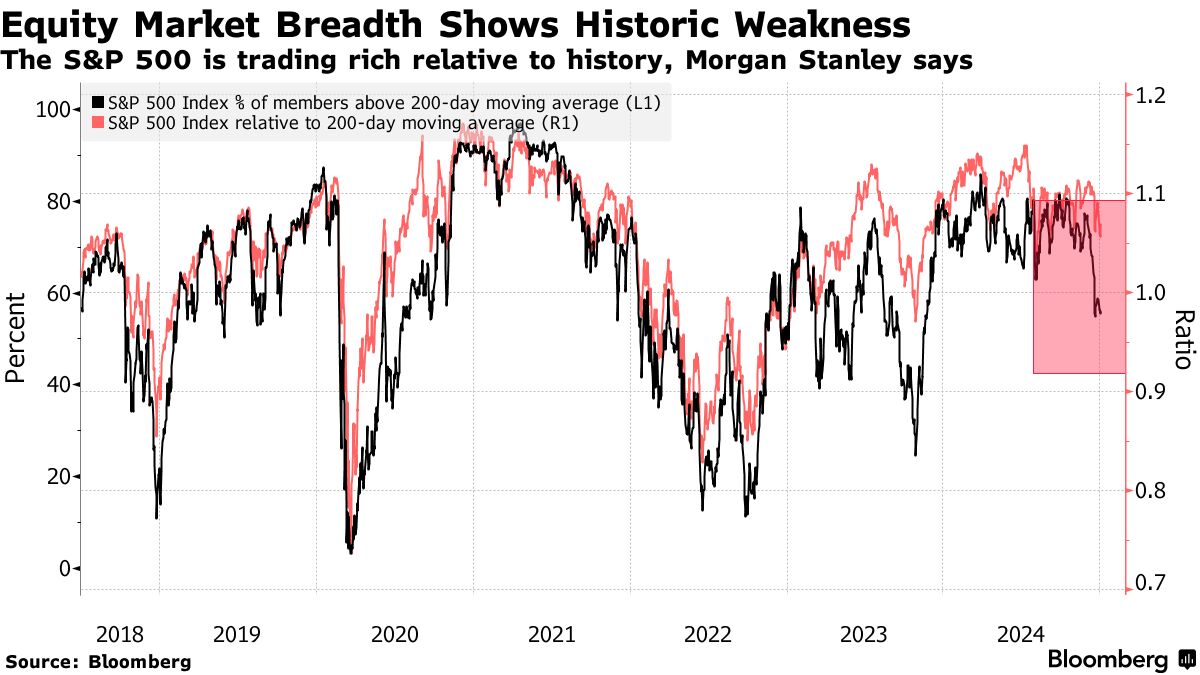

Morgan Stanley’s Michael Wilson is warning that rising yields and Dollar strength could pressure stocks in the first half of 2025, particularly companies with large international exposure. The correlation between the S&P 500 and bond yields has turned “decisively negative” as the 10-year yield climbed above 4.5%.

The Fed’s hawkish December meeting and concerns over the U.S. fiscal situation continue to put upward pressure on rates. Adding to market uncertainty is a looming battle over the debt ceiling, with the Treasury preparing to use special accounting maneuvers to avoid breaching it from mid-January – the first stage of what could be a prolonged fiscal policy tussle given Trump’s desire to raise or eliminate the ceiling.

S&P valuations remain historically stretched and this earnings season could not be more critical in determining whether all these rosy predictions for 2025 earnings are going to hold any water. If not – prepare for a sizeable correction to start off 2025:

Of course we’re all still counting on those drastic Trump Tax Cuts to give Corporate America a big boost and we’re not worried about Bird Flu or Monkey Pox or Metapneumovirus or Norovirus and certainly not Covid – because Trump is back in town and we know how well he handled things last time – and now we have Kennedy instead of Faucci – what could possibly go wrong?

[ctct form=”12730731″ show_title=”false”]