The selling continues:

The Futures were up a bit early this morning but the Dollar blasted back over 109 and pooped that party with a 1% gain on the day and that’s putting downward pressure on EVERYTHING – but not enough so that Oil (/CL) is not testing $75 for the first time since early October, when it was Middle East war stuff that was driving it higher.

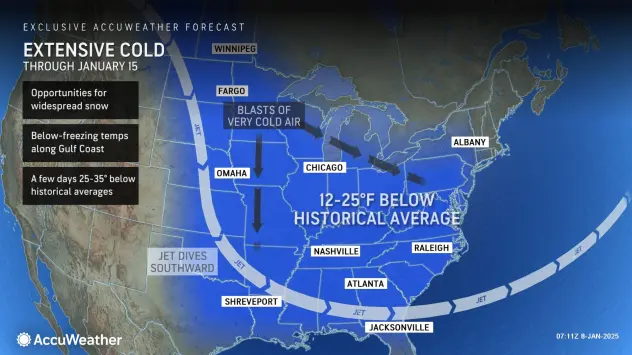

Today it’s more about the very, very cold arctic font that is CAUSED by Global Warming – NOT a repudiation of it. Not only does the cold increase demand but it is SO COLD that the weather is shutting down production in the northern US and Canada. Also, thanks to the Ukraine war, Russian Oil production is coming in below OPEC targets and then we have expectations of Chinese Stimulus and the US’s main hub at Cushing has the lowest levels of Oil in the tanks since 2014.

Last night’s API Report showed a headline 4M barrel draw in crude stocks (3M from Cushing) BUT there was a 7Mb BUILD in Gasoline and a 3Mb BUILD in Diesel so, in reality, it was a net 6Mb BUILD but try telling that to the manipulators who have gained control of the market to start the year.

Our friends in Los Angeles are doing their best to keep us warm by burning down Pasadena, Altadena, Palisades Village and the San Fernando Valley (en route to Santa Clarita) with fires that are 0% contained at the moment with 49,000 residents evacuated, 200,000 homes without power and wind gusts of up to 100 mph as it gets sucked through the mountains. This image is from a plane landing at LAX!

Our friends in Los Angeles are doing their best to keep us warm by burning down Pasadena, Altadena, Palisades Village and the San Fernando Valley (en route to Santa Clarita) with fires that are 0% contained at the moment with 49,000 residents evacuated, 200,000 homes without power and wind gusts of up to 100 mph as it gets sucked through the mountains. This image is from a plane landing at LAX!

1,400 firefighters have been deployed and if you want a good short it’s insurance companies in the area and the next good short will be home prices as insurance costs could double after this one – these are multi-Million dollar homes they are lighting up!

State Farm, for example, cancelled 72,000 policies in California last year, 30,000 of them in Los Angeles County. The median home price in Malibu is $5.6M and the coverage limits are $3M – 13% of LA County Real Estate deals cancelled in 2024 due to “insurance issues.” New state regulations require insurers to increase their coverage in high-risk areas to 85% of their market share by 2027 but higher premiums are also authorized through new “catastrophe modeling“, which is getting a MASSIVE BUMP thanks to this actual catastrophe.

Allstate (ALL – $186) and Hartford (HIG – $109) are at-risk from the current fires but I’d be more inclined to bottom fish whichever one drops too much AFTER we get a realistic assessment of the damages because, going forward, they are going to be able to jack rates up miles higher. It’s the property owners that will truly suffer over the long-term.

Speaking of Housing, Mortgage Applications plunged 3.7% last week and that’s no surprise as rates keep rising – making housing even more expensive. ADP (jobs) came in weak at 122,000 this morning, below 140,000 expected and Friday we get the Non-Farm Payroll Report, which will be critical just after today’s Fed Minutes (2pm). At 3pm we get Consumer Credit and tomorrow we shut down – crazy week!

So let’s forgive the markets for not being in a great mood this morning and all this is nothing compared to Trump’s speech yesterday where he indicated he’s not taking a military takeover of Greenland, the Panama Canal or even Canada off the table and it’s all very entertaining to watch his allies spin what he says or say “he’s just kidding” but he is the President-elect and he will be given the launch codes in exactly two weeks.

Good night and good luck!

- Phil

[ctct form=”12730731″ show_title=”false”]