Good golly what a mess!

The California wildfires are on the way to being one of the biggest catastrophes of all-time and the cascading effects of that will be hitting us for a very long time. The winds are forecast to pick up again this week and the fires are barely contained as it is. Those Santa Anna winds they used to write songs about have been turbo-charged by Global Warming and are now throwing burning ash around at 100 miles per hour…

The Futures are down yet again this morning for many reasons – the top of which is the Dollar punching over the 110 mark – getting stronger and making everything priced in Dollars (like stocks) weaker:

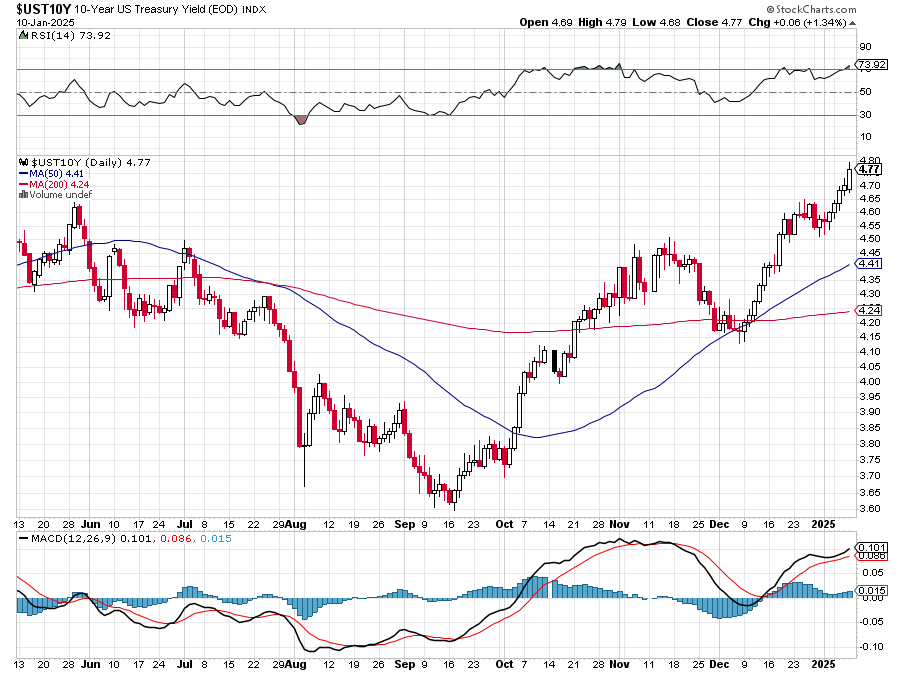

The market’s Trump bump is gone. The Dow is down from its pre-election levels, and the Russell 2000 (small caps) is down 10% from its recent high. Friday’s strong Jobs Data has significantly dampened hopes for Fed rate cuts in 2025. This is putting upward pressure on bond yields, which in turn is hurting stocks as well.

The 10-year Treasury yield hit 4.772% on Friday, its highest since November 2023, and is still climbing this morning. The 30-year yield is approaching 5%. Global yields are also surging, with UK gilts seeing a notable spike, forcing the new government there to look for cost savings.

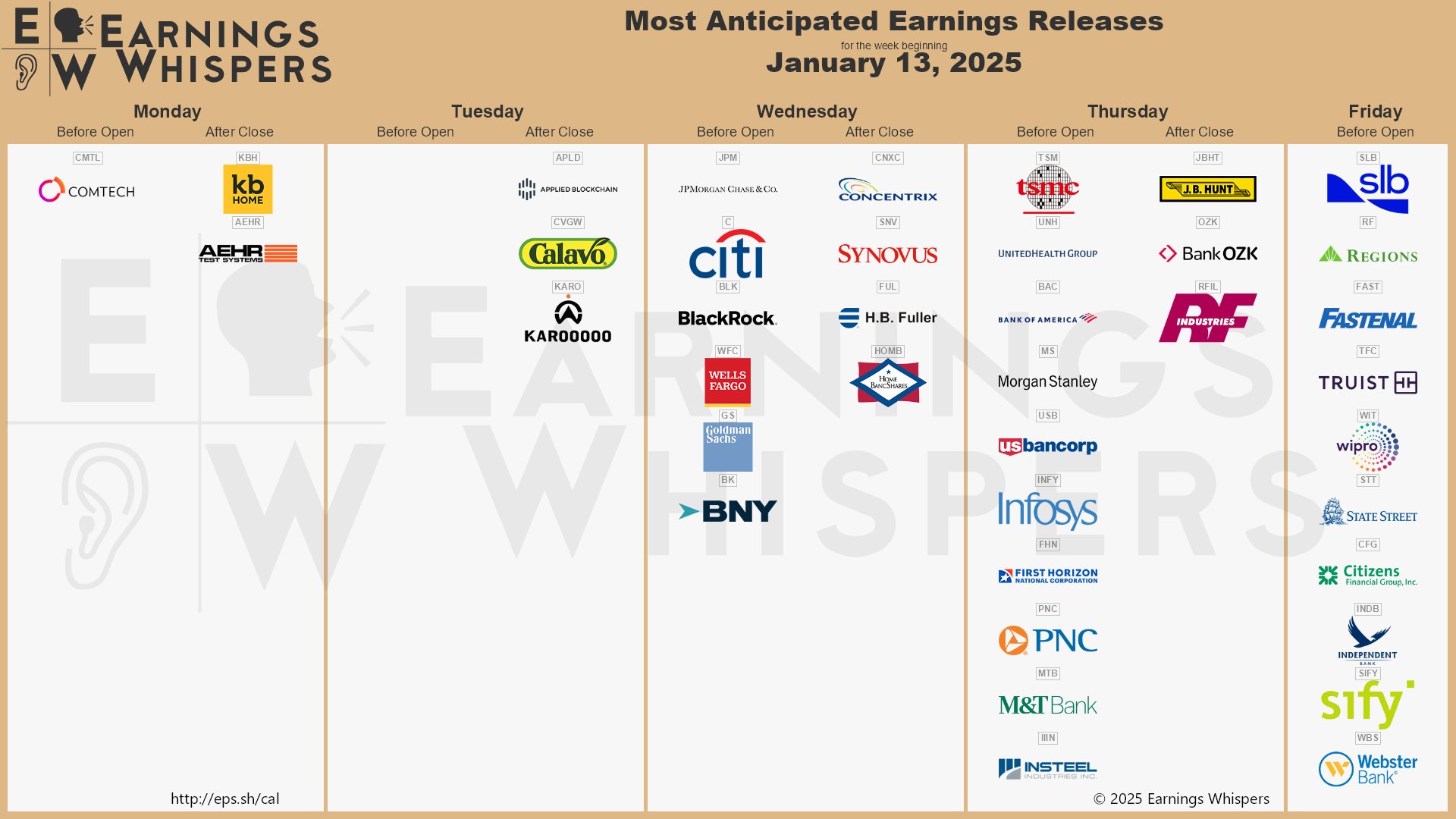

The S&P 500 is trading at 22x FORWARD earnings verses a 10-year average of 18.5x so companies need to deliver strong results AND strong guidance to justify these levels. Earnings growth needs to broaden beyond the Big Tech names. While Big Tech is projected to have 22% Q4 earnings growth, the other 493 companies are estimated at only 8.7%. Financials are expected to lead the rest – but will it be enough?

We’re going to want to stay away from companies who rely heavily on a few large customers and, of course, we are VERY suspicious of companies with high valuations – which is most of them, unfortunately – see our Top Trade Review for more insights.

- Trump’s proposed tariffs and trade policies, along with his mass deportation plans, could reignite inflation and further delay rate cuts. This will put pressure on companies that import goods or have a large labor component.

- Banks are expecting deregulation, which could boost profits. However, rising yields could also pressure consumer spending and borrowing.

Trump’s policies create significant uncertainty. Company guidance on navigating this new landscape will be critical but no one will have a clear picture until about 3 months from now – when Q1 earnings begin to come out. We will listen closely to earnings calls for clues about how companies are planning for the new administration’s policies.

Major banks report earnings this week and Analysts are optimistic about a potential revival in dealmaking and capital markets activity, fueled by deregulation and tax cuts under Trump but he hasn’t been sworn in yet, nor have his regulators been approved. The steepening yield curve could benefit banks’ Net Interest Margins but higher yields could also hurt loan demand and increase the risk of defaults. We will pay close attention to bank guidance on Loan Growth, Net Interest Margins, and Capital Markets Activity.

Holiday shopping showed a divergence between High-Income (splurging) and Low-Iincome (struggling) Consumers. Nike, FedEx, and Conagra have all already reported weak sales or lowered guidance, citing economic pressures on consumers. Be wary of companies heavily reliant on discretionary spending, particularly those targeting lower-income consumers.

Oil is back at $78.50 and Brent crude is above $81, which is a five-month high, driven by new US sanctions on Russia, colder weather, and expectations of tighter curbs on Iran under Trump. This could add to Inflationary pressures and impact Corporate Margins. Energy stocks could benefit, but keep an eye on the impact of higher oil prices on the broader economy and Energy is not the big deal component it used to be so they won’t be propping up the indexes like they used to.

iPhone sales are down 5% in China and China’s Trade Surplus hit a record $1Tn – possibly due to exporters front-running shipments ahead of Trump’s expected tariffs (unintended consequences).

Overall, the market is facing a reality check. The “easy money” days of falling rates are likely over, at least for now. Earnings season will be a crucial test of whether current valuations are justified and Investors need to be selective, focus on Fundamentals, and be prepared for increased volatility. The “Trump Wildcard” adds another layer of complexity and uncertainty.

It’s going to be a stock-pickers market and that’s the kind we like as earnings season kicks off this week on Wednesday as the Big Banks weigh in:

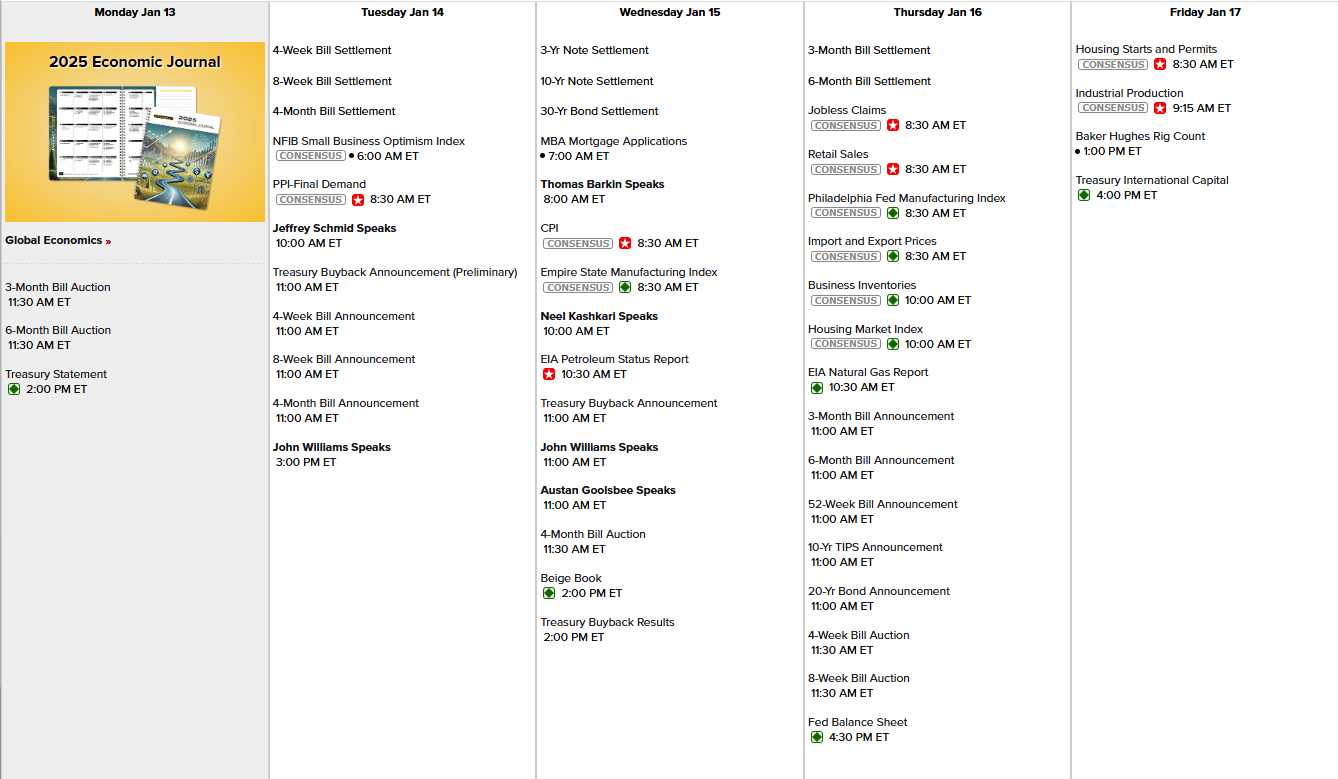

On the Economic Calendar, we have 6 Fed speakers in the next two days and a bunch of short-term note auctions. Tomorrow we have Small Business Optimism and PPI, Wednesday it’s CPI, Empire Manufacturing (usually terrible) and the Beige Book. Thursday we have Retail Sales, the Philly Fed and Housing Data and Friday we get Housing Starts and Industrial Production but only Earnings will matter by then:

It is not going to be dull – that’s for sure and we have 52 Top Trades from our 2024 Reviews and another 100 stocks on our Watch List and 100 more in our Member Portfolios so 2025 is officially off to the races – let’s not forget to have a good time as we monitor the markets together!

[ctct form=”12730731″ show_title=”false”]