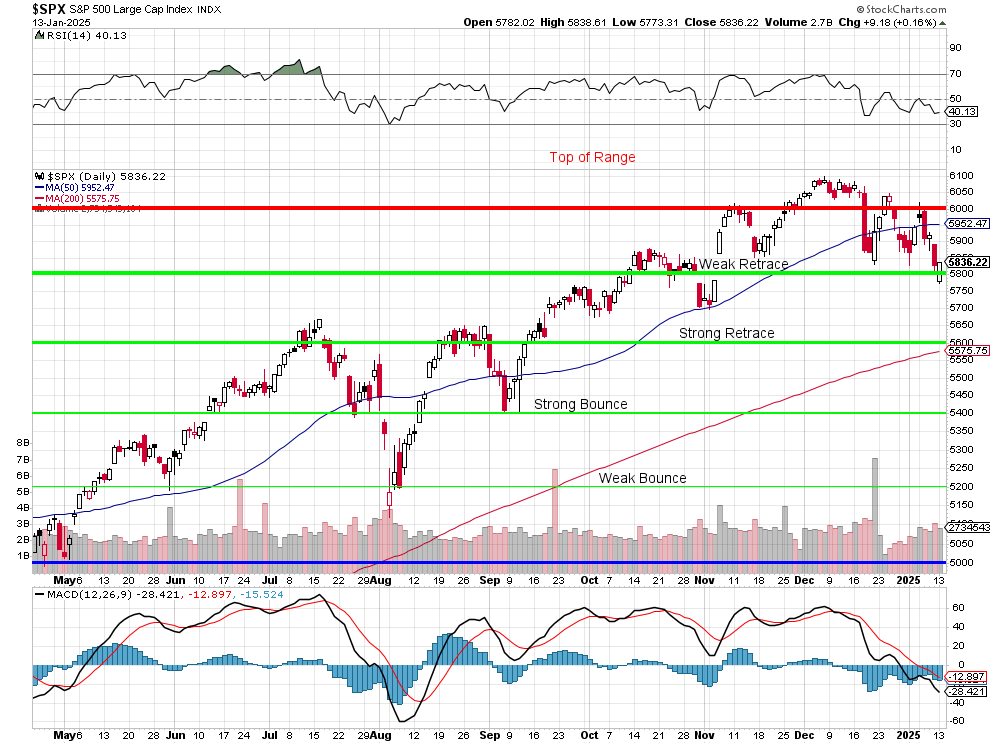

S&P 5,836!

That is down 297 (4.8%) points from our Dec 17th Review and we since took a spill and a recovery and now a spill again - very exciting! Fortunately, our hedges are holding things together and, as I just so happened to say last month, at S&P 6,133:

"We actually could have done better if we didn’t hedge but, then again, if we didn’t hedge – we would not have felt comfortable taking the long-side risks that brought us to this point – would we? If we didn’t hedge, I would certainly be calling for us now to take the money and run but we’re well-hedged for a 20% drop in our Short-Term Portfolio (STP) – so we’re not expecting to get caught by surprise and, to some extent, these recent gains are also a hedge – though it’s hard to think of them that way, isn’t it?"

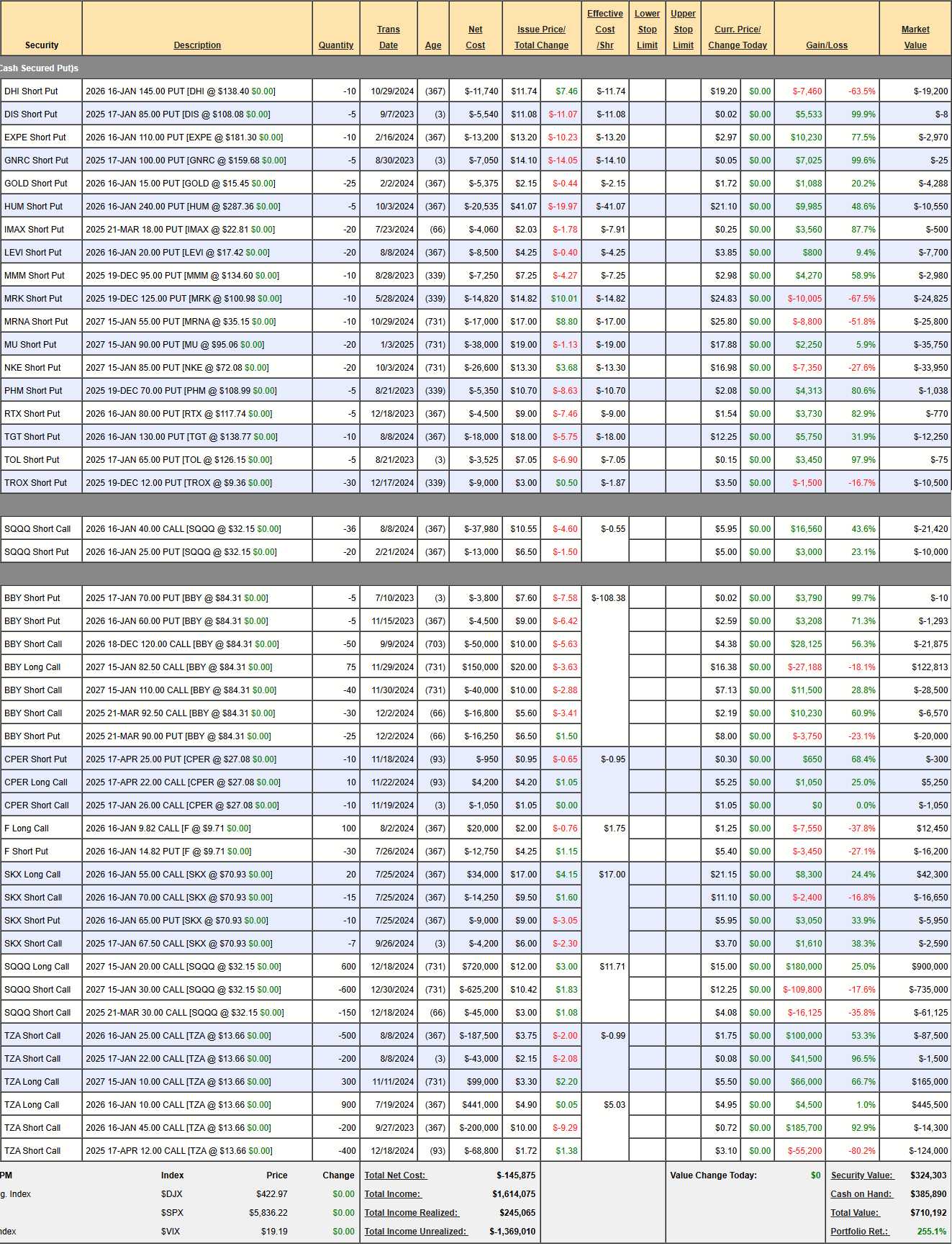

BALANCE is the key to long-term success in trading so let's start this Review off by looking at the Short-Term Portfolio (STP), where our hedges reside. $710,192 is up $198,782 (38.8%) since our last review and that's exactly what our $1M worth of hedges are supposed to do when the S&P drops 4.8% (as 20% should be $1M).

Our long trades and short puts are hedges on hedges in the STP and we're quick to take profits as they are only there to help pay for our greater insurance plays:

-

- Short Puts: DIS, GNRC and TOL are about to expire worthless for a gain of $16,115. Let's make sure we're comfortable with the rest:

- DHI - It's down 63.5% but it's a net $133.26 entry and DHI is at $138.40 so we're not actually in trouble, other than the premiums - which will eventually burn off. I'd save a roll for if we ACTUALLY get in trouble.