Trump is coming!

Trump is coming!

Everything changes at noon on Monday but for now we can still pretend that things will continue as they were and that’s fun, right? CPI will come out this morning at 8:30 and 0.3% is expected, which will be 3.3% for the year but yesterday’s PPI came in at just 0.2% and if CPI comes in at 0.2% as well, that will be just 3.2% for the year and the Futures are already rallying in anticipation – how crazy is that?

Of course over-reacting is what the markets do best and thank God for that because that’s how we make our money – by acting rationally during the madness. Napoleon’s definition of a military genius was “The man who can do the average thing when all those around him are going crazy” and that’s all we aspire to be – NOT crazy. Good luck with that over the next 4 years…

Earnings Season Kicks Off with Banks: JPM, WFC, GS, and C all reported this morning. Early results are mixed, with WFC showing strength pre-market. GS beat on profits and revenue, but missed on fixed-income trading. C missed on revenue. JPM is down 1.2% so far as profits were down but they did beat expectations. The real story will be their guidance and comments on the economy, especially in light of the CPI data.

BlackRock (BLK), the world’s largest asset manager reported a record $641 BILLION in client inflows for 2024, with total assets now at a staggering $11.6 TRILLION. Despite market volatility, investors are still pouring money into the markets, probably because it simply has no place else to go. BK also announced the acquisition of another private credit shop, further expanding into alternative assets.

BlackRock (BLK), the world’s largest asset manager reported a record $641 BILLION in client inflows for 2024, with total assets now at a staggering $11.6 TRILLION. Despite market volatility, investors are still pouring money into the markets, probably because it simply has no place else to go. BK also announced the acquisition of another private credit shop, further expanding into alternative assets.

“This is just the beginning,” CEO Larry Fink said in the statement. “BlackRock enters 2025 with more growth and upside potential than ever.” Shares of BlackRock rose 26% in 2024, just ahead of the 23% advance of the S&P 500 Index, but that’s because BLK OWNS the S&P 500 – just look for the largest shareholder of ever one of those stocks! BLK has fallen about 6% so far this year as of the market close yesterday but they’ll get half of that back this morning.

The firm’s assets are set to grow considerably over the next few months with the announced deal to buy HPS Investment Partners, which manages roughly $150 billion and stands to propel BlackRock into the top leaders in private credit. BlackRock is preparing to almost double its haul of alternative assets and compete against industry leaders Blackstone Inc., KKR & Co. and Apollo Global Management Inc.

Pay close attention to what the bank CEOs say about the economy, loan demand, and the outlook for interest rates. Their comments could move the markets more than the actual earnings numbers. Look for clues about the health of the consumer and the impact of higher borrowing costs. Banks are expected to lead the market higher this quarter and today is the beginning of that test.

Meanwhile, in Macro News, Germany’s economy is shrinking as Europe’s largest economy contracted for the second year in a row in 2024, raising concerns about a broader EU slowdown. This could be a drag on global growth and put pressure on our multinational companies, who collect 60% of their revenues overseas. It also highlights the potential impact of protectionist policies, a timely reminder as we await Trump’s Coronation.

Probably the most critical variable this week is the 10-year Treasury yield is currently down slightly at 4.77% but we’re still watching that 5% level like a hawk. A sustained move above 5% would be a major red flag for stocks. The 2-year is at 4.36% so a very inverted curve at the moment. We’ll be looking closely at today’s Beige Book release by the Fed (2pm) to get some clues as to rate policy for 2025.

We touched 5.02% in October of 2023, after which we pulled back all the way to 3.78% to end the year and we’ve retested that range twice this year so that’s our range – call it 3.75 to 5% and that’s 1.25 points which makes our bounce lines 0.25 at 4.75% (weak retrace), 4.5% (strong retrace), 4.25% (strong bounce) and 4% (weak bounce). As the 200 dma is at 4.25% – it’s not too likely the strong bounce line will fail without a change in the Fundamentals.

With the inauguration just days away, the market is increasingly focused on the potential impact of Trump’s policies. Tariffs, deregulation, and trade relations with China are all major wildcards. Germany’s economic woes are a stark reminder of what protectionism can do to an export-driven economy. The US economy continues to outperform while Europe and parts of Asia are struggling. This divergence can create opportunities for investors but also adds to the overall uncertainty as we leap into 2025.

This morning we have (8am):

- Wells Fargo (WFC): Up pre-market on better-than-expected earnings. A positive sign for the banking sector. They are now up 3.2%.

- JPMorgan (JPM): Down 1.2% so far after they reported earnings that beat expectations, but with lower profits. Guidance will be key.

- Citigroup (C): Down 0.7% pre-market after reporting this morning. Also a mixed bag. They also beat but profits were down – a trend?

- Goldman Sachs (GS): Up 0.8% so far after reporting earnings. They beat on top and bottom lines, but fixed-income trading was weak.

- Eli Lilly (LLY): Still down 5% after yesterday’s plunge. Investors are clearly worried about their growth prospects.

- Tesla (TSLA): Up 1.3% this morning after being down 4 of the last 5 sessions. They are down about 10% for the year so far.

We’re standing by cautiously until we get the CPI report and digest the market’s reaction. This is not a time to make big, impulsive bets! Bank earnings calls will be crucial. Pay attention to their comments on the economy, loan growth, and the impact of higher rates. The rotation from growth to value should continue, especially if yields keep rising. Banks, Energy, and SOME Industrial stocks could benefit.

As noted in our Member Portfolio Reviews, hedging is more important than ever – please make sure you have adequate hedges in place to protect your portfolio from a potential downturn. If anything, we are OVER-hedged at the moment and we’ll be looking for value opportunities during this earnings season.

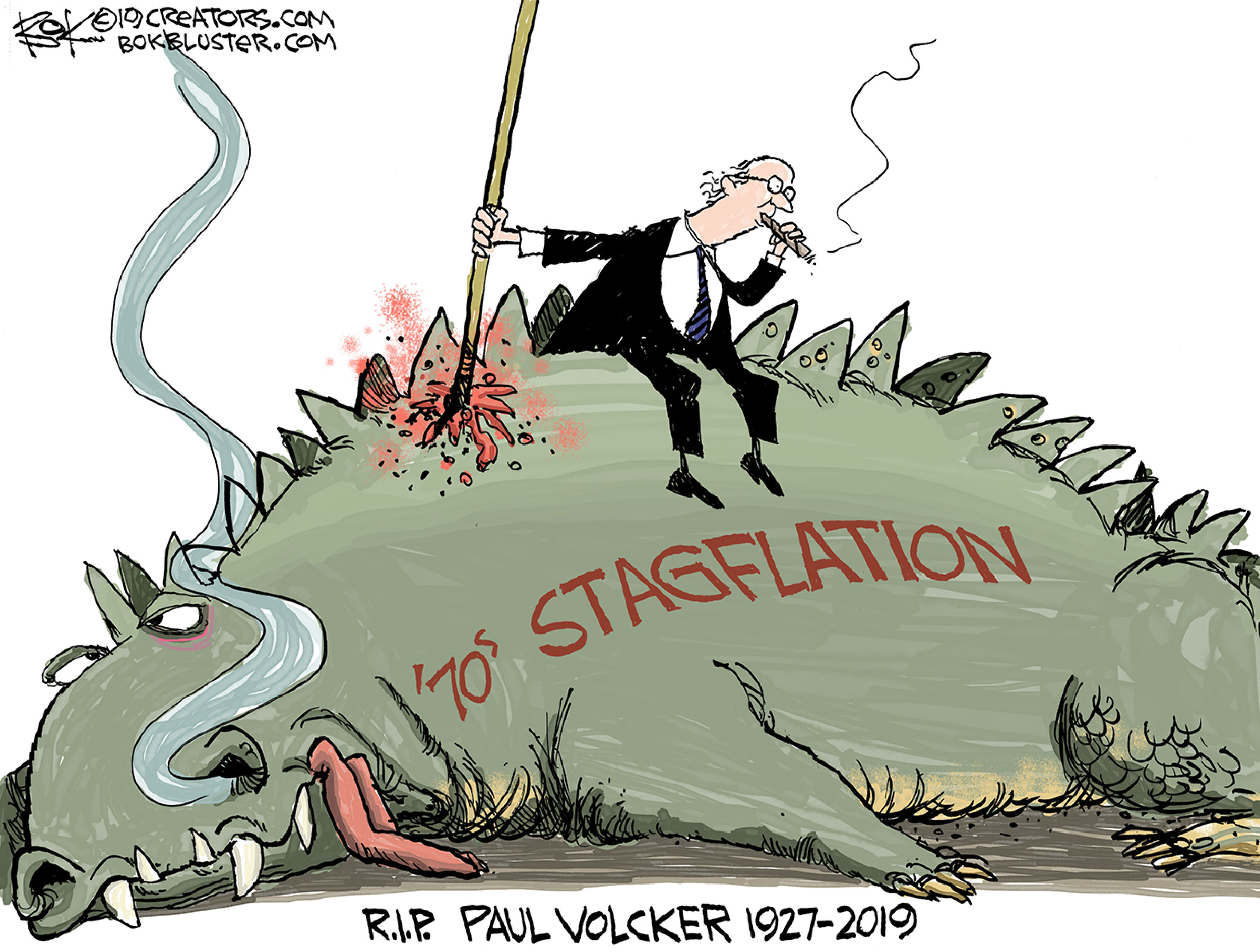

The Fed is likely to slow rate cuts and Trump’s policies are likely to be inflationary but Tariff Inflation is not the same as the demand inflation we’ve been experiencing since Covid – Tariff Inflation can SLOW the Economy while prices inflate and that is called STAGFLATION – a very, very nasty economic situation we haven’t experienced since the 70s.

The Fed is likely to slow rate cuts and Trump’s policies are likely to be inflationary but Tariff Inflation is not the same as the demand inflation we’ve been experiencing since Covid – Tariff Inflation can SLOW the Economy while prices inflate and that is called STAGFLATION – a very, very nasty economic situation we haven’t experienced since the 70s.

🚢 Paul Volcker’s battle against stagflation was a watershed moment in Federal Reserve history. Here’s the key timeline and actions:

## Initial Phase (1979)

– August 6: Volcker appointed Fed Chairman with inflation at 11%

– October 6: Announced dramatic policy shift from targeting interest rates to targeting money supply

– Began pushing federal funds rate higher from 11.2%

## First Attempt (1979-1980)

– December 1979-February 1980: First “inflation scare” with 10-year bond rates soaring to 12%

– Early 1980: First recession began

– Mid-1980: Policy temporarily abandoned due to credit controls and recession

## Decisive Action (1980-1982)

– November 1980: Inflation still over 10%

– Late 1980: “Deliberate disinflation” began with federal funds rate raised to 19%

– June 1981: Federal funds rate peaked at 20%

– Prime lending rate reached 21.5%

– Unemployment rose above 10%

– By 1982: Inflation dropped to around 5%

## Results (1983)

– End of 1983: Inflation fell below 4%

– Economy entered long period of growth

– Fed established credibility for controlling inflation

– Unemployment gradually decreased

– Period known as “The Great Moderation” began

The cost was significant – two recessions and double-digit unemployment – but Volcker’s actions successfully broke the back of inflation that had plagued the U.S. economy since the mid-1960s[1][3][8].

Citations:

[1] https://www.stlouisfed.org/publications/regional-economist/january-2005/volckers-handling-of-the-great-inflation-taught-us-much

[2] https://taxpolicycenter.org/taxvox/paul-volcker-taught-us-how-tax-and-monetary-policy-can-work-together-enhance-growth

[3] https://socialsci.libretexts.org/Bookshelves/Economics/Economics_(Boundless)/28:_Monetary_Policy/28.4:_Historical_Federal_Reserve_Policies

[4] https://www.richmondfed.org/-/media/richmondfedorg/publications/research/econ_focus/2006/summer/pdf/federal_reserve.pdf

[5] https://www.federalreservehistory.org/essays/anti-inflation-measures

[6] https://www.bu.edu/econ/files/2011/01/GKcr2005.pdf

[7] https://www.investopedia.com/articles/economics/08/1970-stagflation.asp

[8] https://www.vox.com/future-perfect/2022/7/13/23188455/inflation-paul-volcker-shock-recession-1970s

[9] https://en.wikipedia.org/wiki/Paul_Volcker

[10] https://www.federalreservehistory.org/essays/great-inflation

Would the modern Fed or anyone in the Trump Administration have the balls to do what Volcker knew needed to be done? He caused a lot of economic hardship in order to prevent our Economy from being destroyed by hyper-inflation that was snowballing after Nixon took us off the Gold Standard and Vietnam plunged us into debt (a joke in comparison to today’s debt, of course).

Today is all about inflation and bank earnings. The CPI report will likely dictate the market’s direction in the short term. Be prepared for volatility, stay hedged, and focus on quality. The market is facing a lot of headwinds, but there are still opportunities for smart investors – and that is what we teach you to be at PhilStockWorld!

This is a stock-picker’s market – as value investors – it’s our favorite kind of market because picking stocks is what we do best! As always, CASH!!! IS KING (or at least a very good friend to have right now).

8:30 Update: +0.4% is the most since Aug of 2023 – that’s a disaster BUT CORE CPI is only 0.2% so, for those of us who get through the month without Food or Energy – things are great!

The key takeaway is that Inflation is NOT going away but it’s the Core CPI that the Fed hangs their hats on so the Indexes are flying higher at the moment but don’t fall for it – it’s BS! Mortgage applications popped 33.3% for the week ending Jan 11th and that sounds amazing (and unlikely) but the week before that was post-Christmas and New Years (Dec 29 to Jan 4) and who the hell was applying for a mortgage that week?

That’s a good example of how useless data is without context yet our entire Economic Policy is driven by out of context data and the more we rely on machines to analyze this data – the less likely it is for Analysist to notice these anomalies – and that suits us just fine – because those anomalies are exactly the kinds of things we like to take advantage of!

[ctct form=”12730731″ show_title=”false”]