Well, that lasted a day.

Well, that lasted a day.

Not the rally, that seems OK at the moment but the Israel-Hamas Ceasefire Agreement is less than 24 hours old and already Israel is refusing to vote on it as Hamas balked on portions of the agreement and Israel signaled their disappointment by launching airstrikes that killed over 70 more people in Gaza, injuring hundreds more.

At least earnings season is off to a good start with JPM up 33% from last year, GS up 43%, C up 50%, WFC up 50% and today we hear from BAC, MS and USB. Actually, BAC made 0.82 vs 0.70 last year, FHN 0.43 vs 0.32, MTB $3.86 from 2.74, PNC $3.77 from $3.16, USB $1.07 vs 0.99 and MS $2.22 vs $1.13 (huge!) and UNH made $6.81 per share from $5.83 last year - than you for your contributions - but it's still not enough to justify their 34x 2024 earnings and down they go!

We were so excited about bank earnings, we couldn't wait and we picked up OZK yesterday as a Top Trade Alert for our Members, ahead of their earnings this evening. Tomorrow morning, we close our first earnings week of 2025 with CFG, FAST, HBAN, SLB, STT, TFC and WBS. Very few misses this week - we're off to a great start!

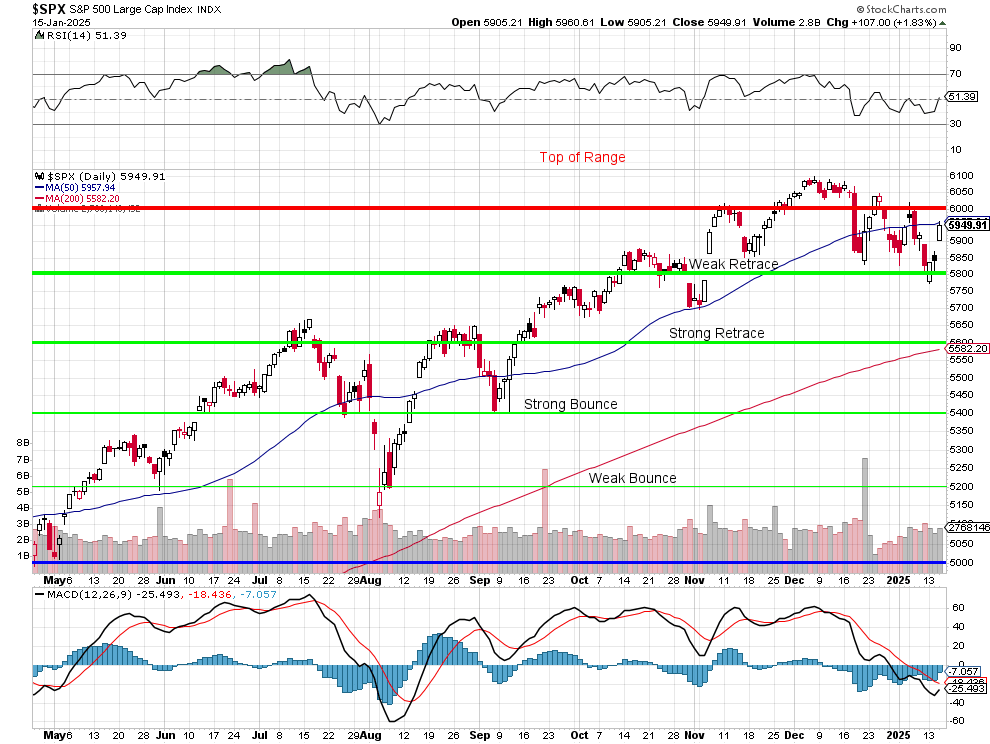

Despite all the good news, the S&P 500 is still struggling to get back to 6,000 - failing right at the 50-day moving average at yesterday's close. Failing it for the week is going to make the 50 dma look like serious resistance and that can lead more people to decide to sell so we're going to need some seriously good reports next week, which is shortened by Monday's holiday (MLK).

This morning we'll see how Retail Sales ended up in December but they were already up 0.7% in November and that is going to be hard to beat.