Holy cow, it’s only day 4!

Holy cow, it’s only day 4!

Already, aside from no longer ending the Ukraine war or lowering grocery prices or following the Project 2025 agenda he “never heard of“, Trump is already backing down on Tariffs – putting off Canada and Mexico until “at least” April and now he’s saying he’d “rather not” impose tariffs on China – which was a promised day one action.

Whether or not we ever believed Trump would do anything he promised (history has certainly taught us not to expect that) and whether or not we thought the policy would be idiotic anyway – the issue is that lots of traders do believe in Trump and what he says and what he “stands for” and his wishy-washy lack of follow-through and/or simple inability to get things done has economic consequences for all of us.

“We have one very big power over China, and that’s tariffs, and they don’t want them,” the President told Sean Hannity in an interview that aired Thursday. “And I’d rather not have to use it. But it’s a tremendous power over China.”

Yes, because as Teddy Roosevelt famously said: “Talk softly and don’t use the stick.” Of course Trump had said he’d put 60% tariffs on China during the campaign but China restricted the export of rare metals to the US an Elon cried and they both backed off on that and switched to kissing China’s ass – also completely reversing the TikTok ban that Trump himself had initiated the call for in his first term.

Anyway, it doesn’t matter WHY promises were broken or WHY policies flip-flopped in the past week or WHO is responsible – the net effect is the same as the US Dollar – the thing everything is priced in fell from 109.25 to 107.68 (1.4%) but it was already falling from 110 the week before in anticipation of Trump and that’s down 2% in two weeks and THAT is why eggs (and everything else) are getting MORE expensive, not less and it doesn’t matter how much Donny stomps his feet and throws a tantrum at Davos – this is the ECONOMIC REALITY of what he and his lackeys are doing – weakening the Dollar – a 2% tax on our life savings is going to hurt – it’s the true cost of all this idiocy (so far).

There’s a reason 45 out of 46 Presidents don’t enact dozens of policy changes per day – it causes chaos and uncertainty! Even George Washington, who started from scratch only made a few, carefully thought-out changes with Bi-Partisan support during his term in office.

From 110 to 107.50 is the 2.5% Rule™ and, of course, that means we expect 0.5 bounces to 108 (weak – which provided some support on the way down), 108.5 (strong), 109 (strong retrace – also mild support on the way down) and 109.5 (weak retrace – now far away). Very simply, if the Dollar finishes the week below the weak bounce (108) – then we are likely consolidating for a move even lower next week and Trump’s weakening Dollar is a stealth tax on ALL Americans – robbing us of $2.5Tn of our buying power in just a few days!

THAT is how much it costs we, the people, to enrich the Oligarchs. The first time Trump took office, the Dollar was at 103 and, by the end of his first year (before Covid, so that’s not an excuse), he had driven it down to 89 – a 13.6% drop in the buying power of YOUR ENTIRE NET WORTH. Good times, right?

A weak Dollar DOES boost our exports but it makes imports much more expensive and by the time Biden did take office, the Dollar was still floating at 90 but Biden’s policies were Dollar-strong and the Dollar went up to 110 – a 22% increase in our Dollar-priced wealth and yes, that made imported goods very cheap – so we bought more of them. That’s not really a big deal, is it?

The real danger isn’t just the immediate 2% loss – it’s the compounding effect over time. When Trump previously drove the Dollar down from 103 to 89, that 13.6% decline meant that a $100,000 savings account lost $13,600 in purchasing power, it meant that monthly mortgage payments required more inflation-adjusted Dollars and that wage increases, even if they happened, bought less in real terms.

This stealth tax of Trump’s hits hardest at Middle-Class Americans who hold most of their wealth in Dollars rather than hard assets or foreign currencies. While the wealthy can hedge through various International Investments, Bitcoin, Gold and Real Estate, the average American’s wealth silently erodes with each Dollar decline.

The stark contrast between Biden’s Dollar-strong policies (90 to 110, +22%) and Trump’s Dollar-weak approach isn’t just about Trade Policy – it’s about the fundamental stability of American household wealth.

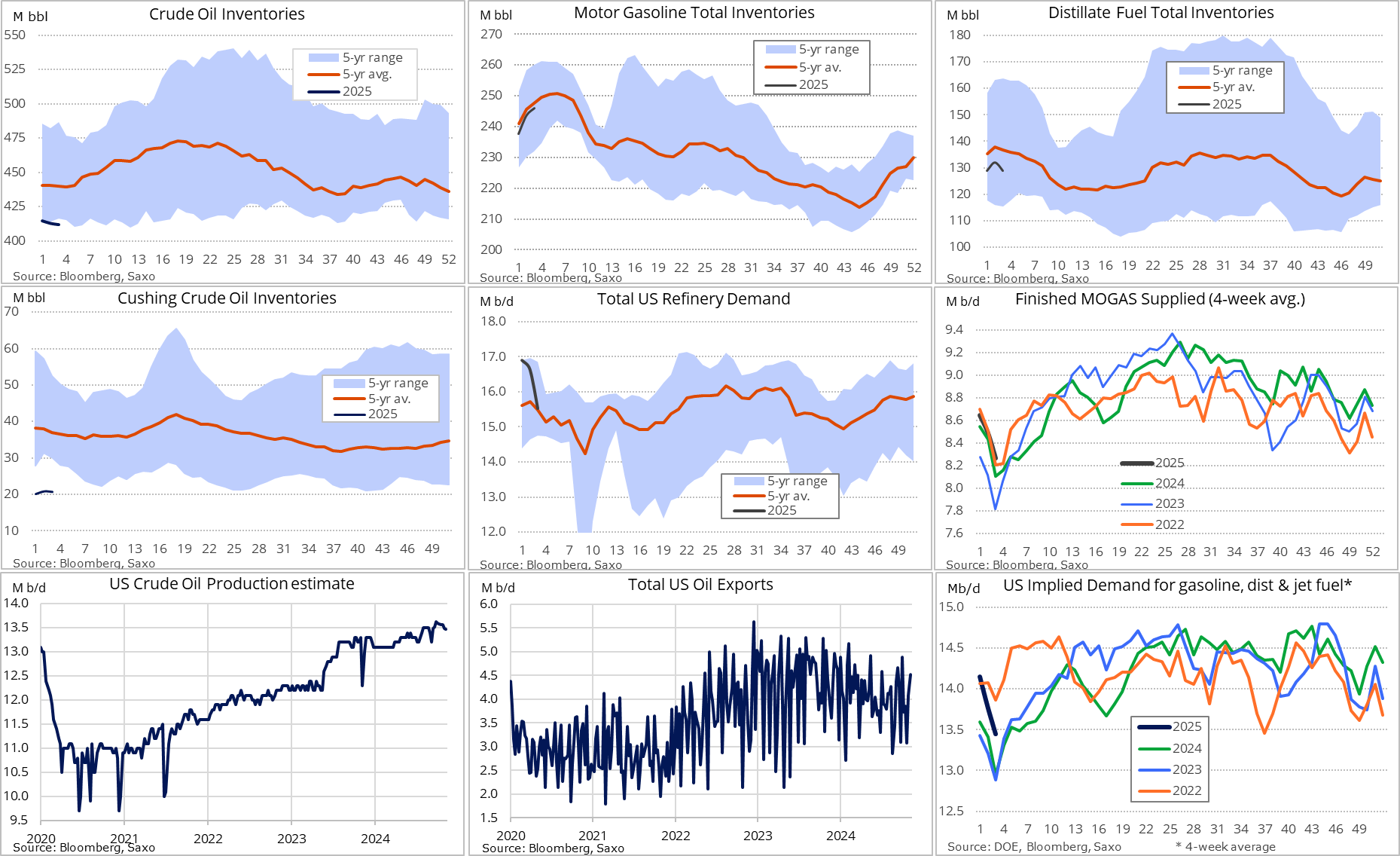

Take Oil, for example, despite MASSIVE builds in oil since Christmas due to lack of demand (electric cars, solar and wind energy, heat pumps) thanks to Biden’s energy incentives (which Trump has halted), Oil prices were going up – yet we are VERY COMFORTABLY SUPPLIED in every storage category:

We are the largest oil-producing nation in the World – so much so that we are EXPORTING 5.17Mb of petroleum EVERY DAY to other countries yet Trump has declared a national fuel emergency in order to suspend all regulation on oil drilling and exploration in the US to please his Energy Masters – who paid $1Bn (that we know of) to buy his platform during his campaign. That is another inflationary stealth tax Trump has imposed on the American people – one you pay at the pump every time you fill up your tank.

Policies DO matter and they affect us a lot faster than we think. Not only do the policies steer us on a different course but they can undermine our wealth and purchasing power in ways that may not seem obvious at first, but have major repercussions down the road.

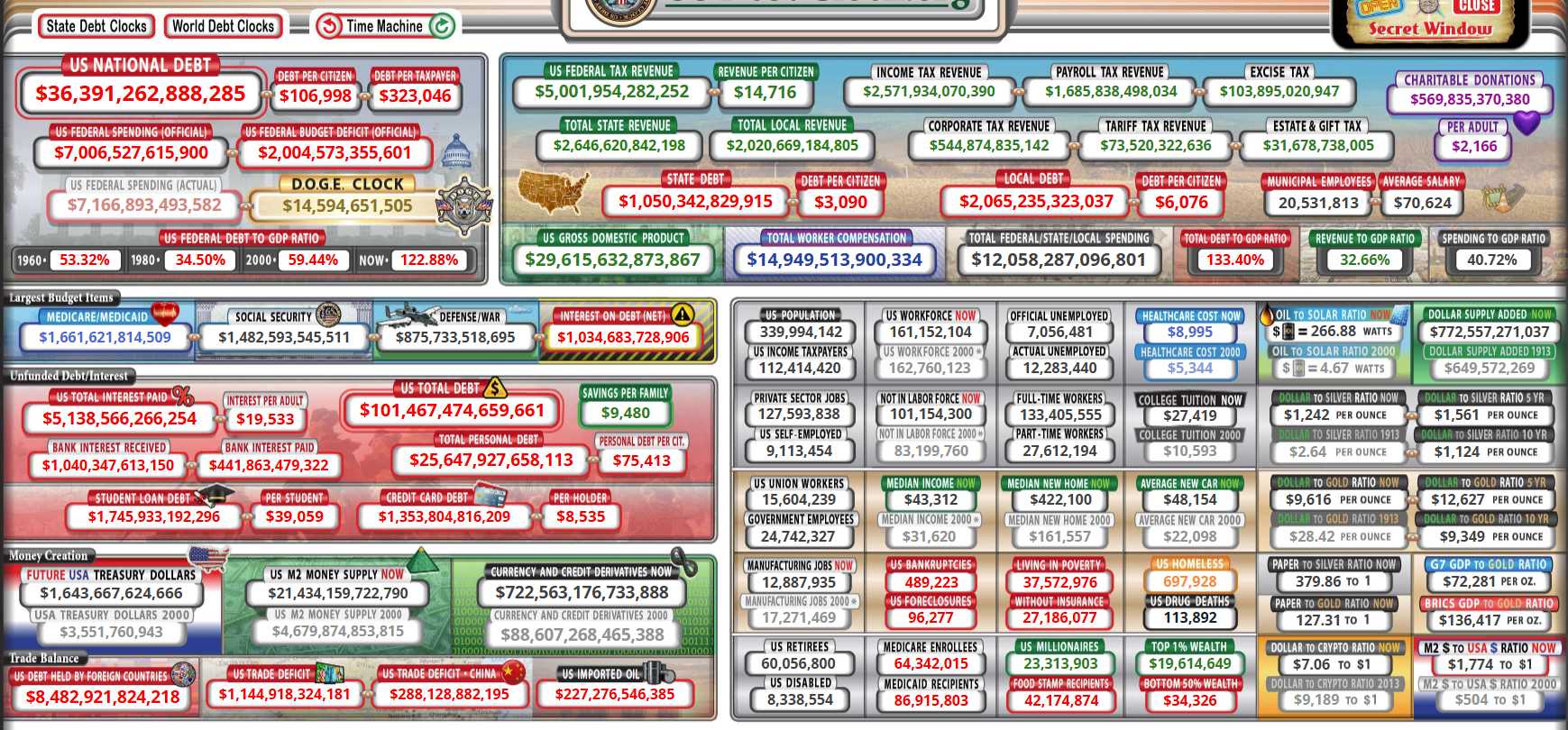

Trump said A LOT of things that were not true at Davos yesterday so I thought we should reflect ACCURATELY on where we are on Day 4 of Trump’s 2nd term so that, as the years roll by, we can take an accurate look back and see how the President is doing. Here’s where we stand and the new DODGE Clock is measuring the savings that can be attributed to that department:

$36.39Tn in debt! A $2Tn Deficit and DODGE has already knocked off $14Bn – go Elon! Federal Spending is an amazing $7.16Tn – that is bigger than the ENTIRE GDP of any other nation on Earth other than China. We collect $5Tn in taxes but only $544Bn (10%) from Corporations – the other 90% is paid by us Citizens but Trump says that’s too much – and proposes cutting the top Corporate Tax Rate to 15%.

Well, what are you sitting here for – go incorporate!

Have a great weekend,

-

- Phil

[ctct form=”12730731″ show_title=”false”]