We told you so:

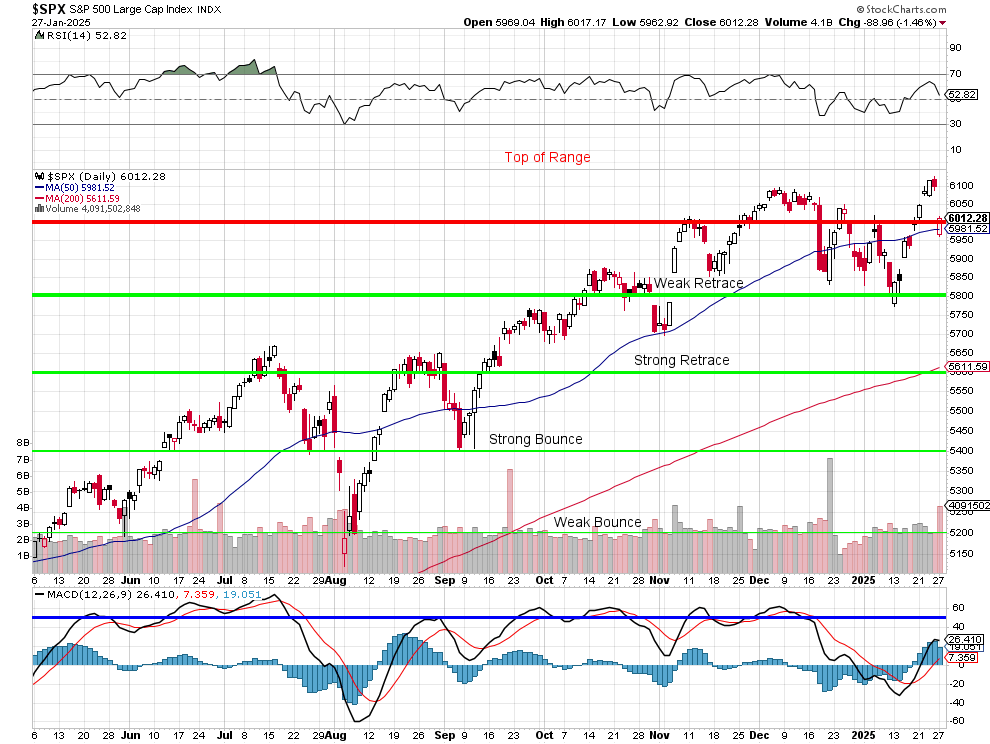

30 times earnings is simply too much to pay for the S&P (or any stock, for that matter) and that’s what our “Top of Range” line has represented on our S&P chart since last summer. While the S&P 500 may drift over the line – it’s really just the way a river may get a little higher than the banks, once in a while, but then it tends to fall back in line.

The underlying values need to grow to justify a permanent move to a higher level (something TA people simply don’t understand and, unfortunately, almost everyone is a TA person these days) before we can start redrawing our price targets and our price targets aren’t even VALUE targets – which are a lot harder to move.

We only own AAPL and META in our 6 PSW Member Portfolios and both of those stocks gained ground yesterday, with AAPL gaining 3.18% and META up 1.9% in what was otherwise a relative disaster for the Nasdaq 100. That’s fortunate because Apple is 7.5% of the ENTIRE market cap of US stocks and Meta is about 2.5%. We also like GOOG/L but we’ve been too concerned that AI will replace search and, although GOOG/L is building AI – how are they ever going to generate $350Bn with 90% market share like they do with search and ads (which AI is not big on – yet)?

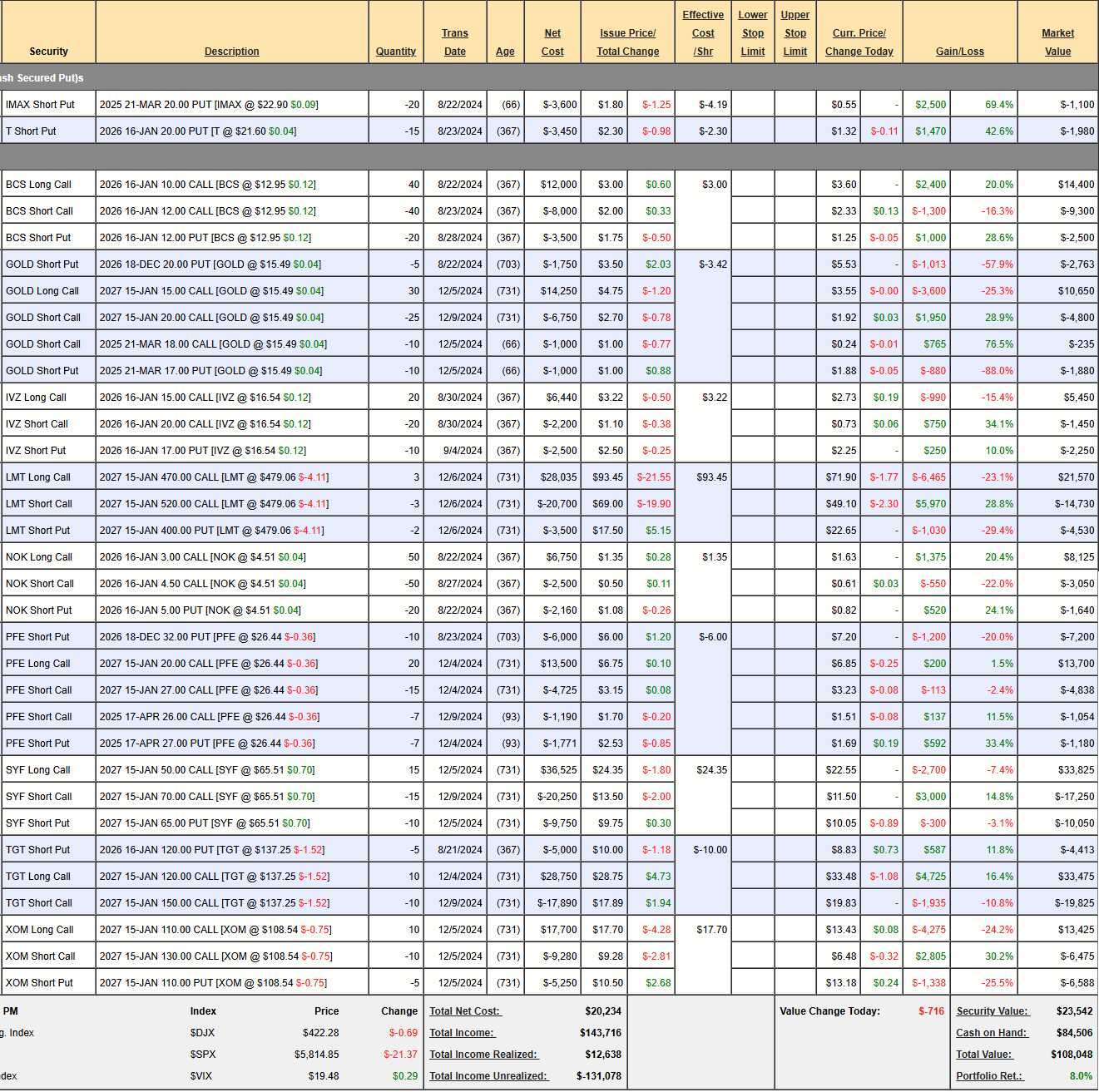

In volatile markets like these, it’s convenient for us to look at our Money Talk Portfolio, which we only trade once per quarter, live on Bloomberg when I’m on the show. The last time I was on the show was Dec 3rd, well before the last portfolio review on Jan 14th when our new (Aug 21st) Money Talk Portfolio was up 8%:

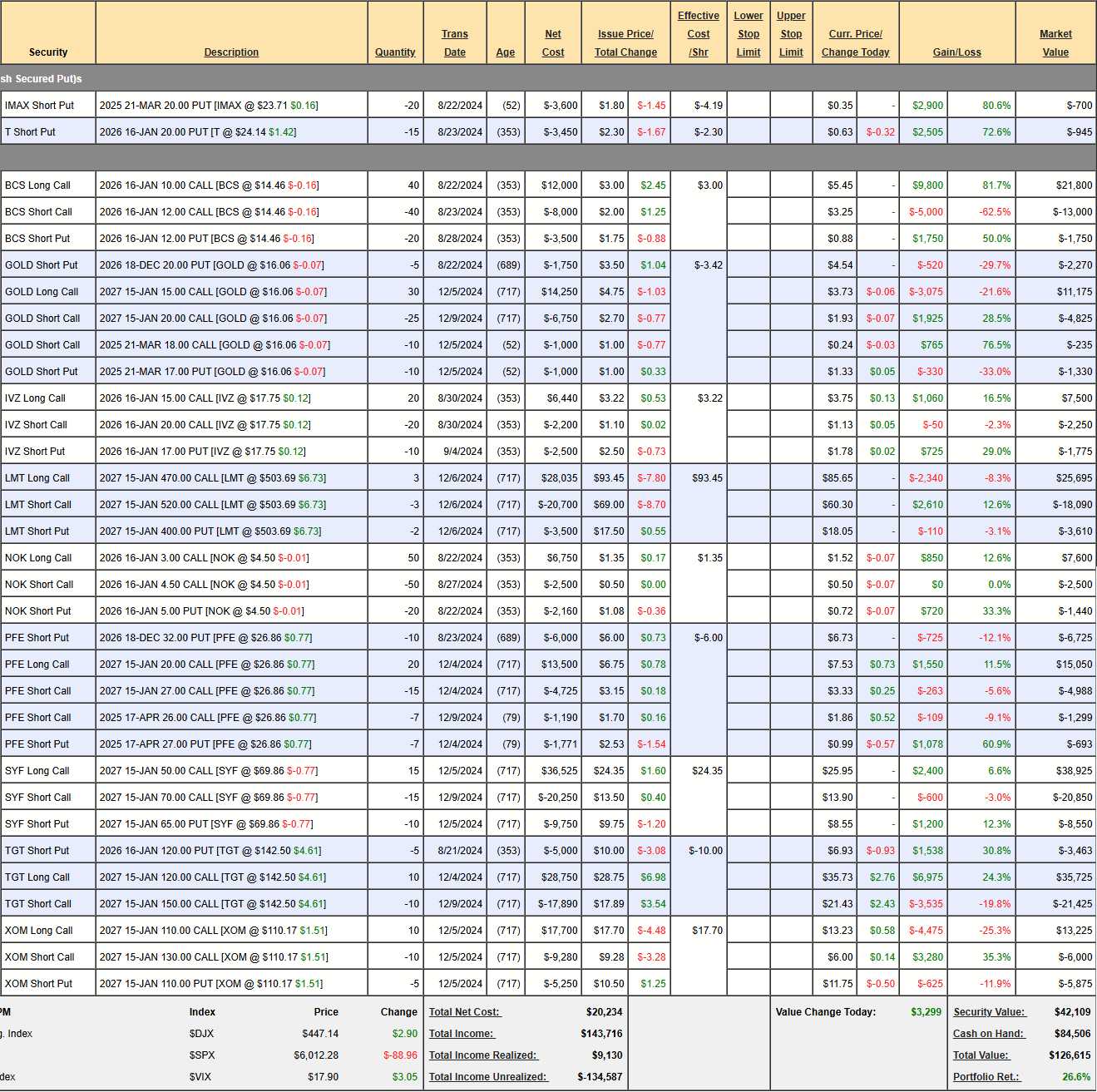

Since we don’t touch the MTP between shows, it’s an excellent benchmark to see if our trade selections hold up well in a downturn and, I’m very happy to report that, in the past 2 weeks, the Money Talk Portfolio not only held up but exceeded our expectations with an $18,567 (18.5%) gain and we are already at $126,615 (up 26.6%) in month 5!

The MTP is our “Bulletproof” Portfolio, meant to survive most market conditions from quarter to quarter so our selections are not what’s hot and sexy but what is smooth and steady – choosing VALUE over momentum and, most importantly, following the example of our Butterfly Portfolio and always selling lots and lots of premium BECAUSE the only absolutely sure thing in the markets is that ALL PREMIUM EXPIRES WORTHLESS.

[ctct form=”12730731″ show_title=”false”]

In fact, you will notice that, as a new(ish) portfolio, we only held net $23,542 in net positions and $84,506 (78.2%) in CASH!!! That’s because we expected a market downturn into my March show appearance and we wanted to have plenty of cash on the sidelines. Also, with any new portfolio, we don’t want to jump in all at once. Now those positions are at $42,100 – gaining 78.8% (the same $18,567) in two weeks.

The positions you see here still have $98,526 (77.8%) of upside potential if we hit our goals – and we are well ahead of schedule on that front! Of course we’ll add more positions and make adjustments along the way – it’s always a fun ride – even though it’s an ultra low-touch portfolio.

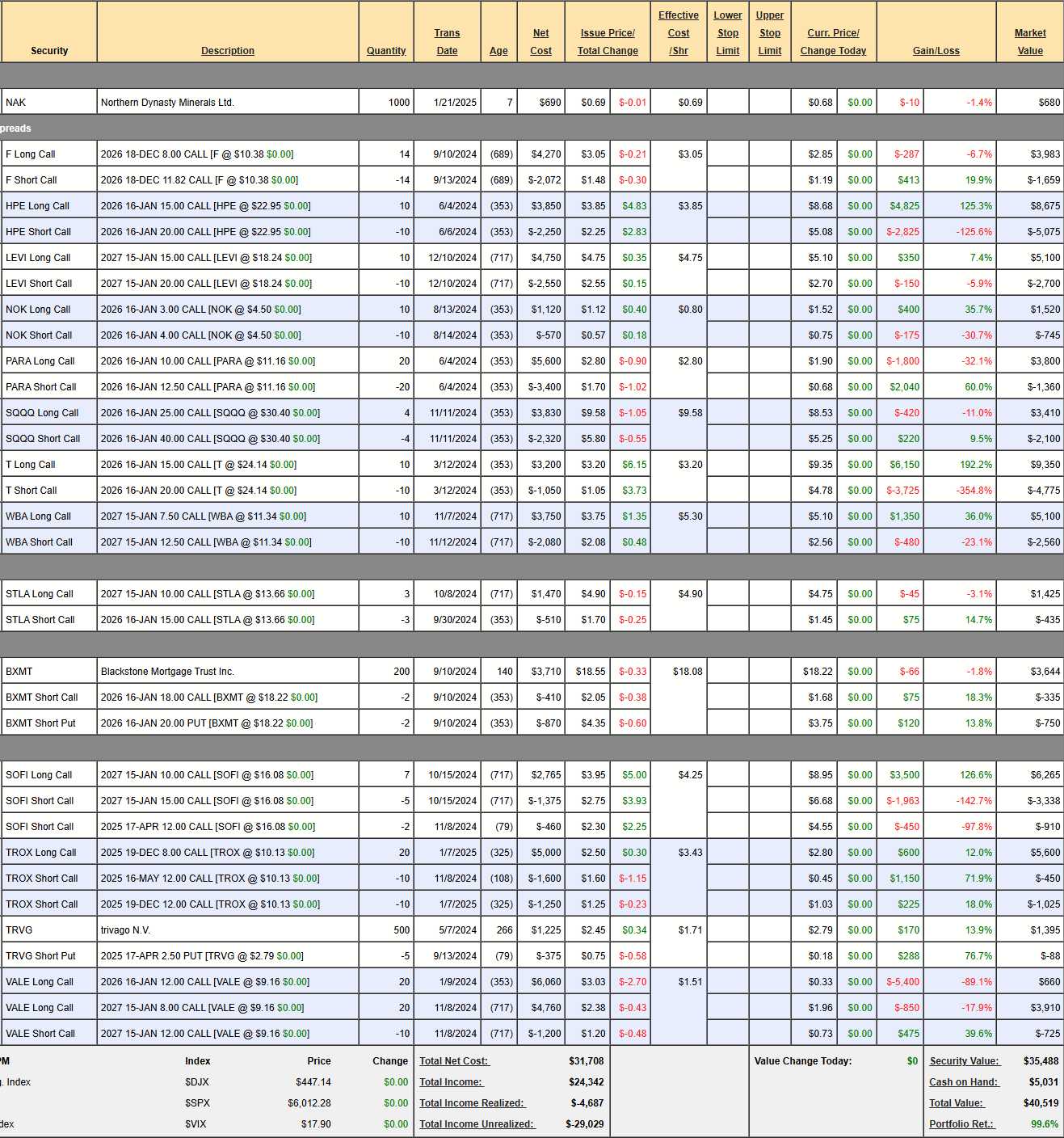

Another low-touch Member Portfolio at PSW is our $700/Month Portfolio, which is in month 29 and, as of our last review on Jan 7th, we were up 77.1% at $35,952 after suffering a set-back as the Russell had fallen 5% and, by it’s nature, this portfolio is heavy into small caps.

I told our Members not to worry and we used half of our cash making adjustments to take advantage of what we thought was a bottom at Russell 2,200 and that sure worked out because now the RUT is back at 2,300 and the $700/Month Portfolio is at $40,519 – up $4,567 (12.7%) in 3 weeks and up 99.6% overall – very much on track for our $1M goal and certainly still early enough for you to join in!

We should always take advantage of these pullbacks to assess our positions and make sure they are holding up as they should (especially with our hedges) during a downturn – that helps us refine our process and make better and better picks down the road.

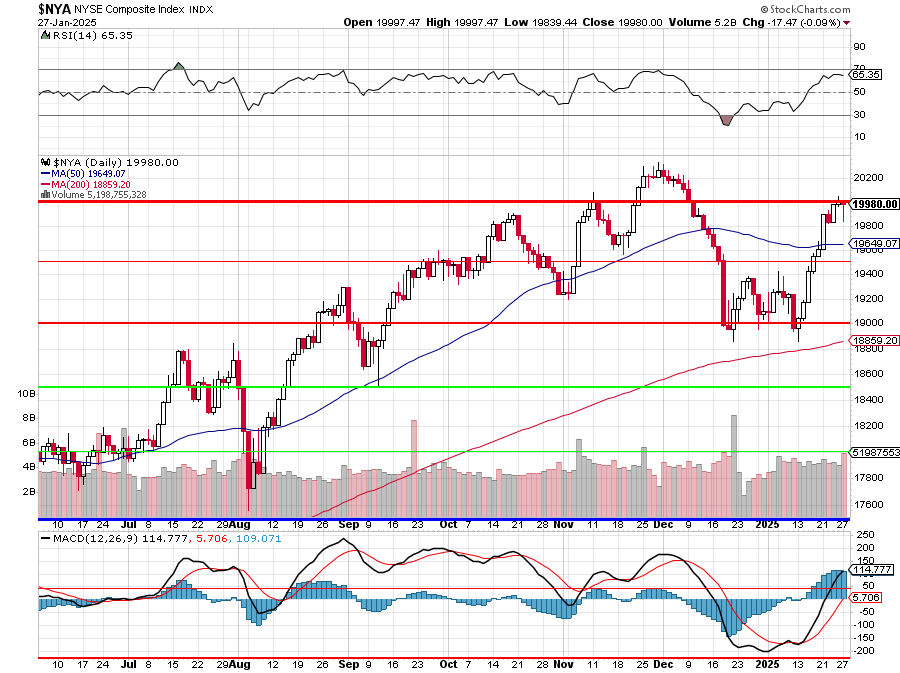

Now, getting back to the indexes, like the S&P 500, the NYSE is testing a critical level at 20,000, which is also the top of our expected range and, as you can see, the RSI is at 65.35, which is close to 70, which is a very reliable point that indicates the index is overbought. At the bottom of the chart, the MACD indicator also looks a bit overbought and, like the S&P 500, 20,000 is also about 30x in the NYSE and paying 30x for an index is BONKERS (the technical term).

Why? Because 30x means you are getting 3.3% for a risky stock investment while a “riskless” bond investment is paying you 4.5% or more. 30x means it will take you 30 years to get your investment back and yes, hopefully the stock will grow into its valuation but there’s also the risk that something as simple as yesterday’s repricing of AI stocks can drop the PE back to 20x – costing you 1/3 of your investment – that does not happen with bonds unless rates rise drastically.

With 12-15% earnings growth ALREADY priced in to earnings this year – it would be incredible if stocks beat those expectations. Even this morning, reality is starting to bite with misses from BA, KMB, PCAR, SAP, SYF, XRX and NEP and that’s 7 out of 18 (38.8%) and that’s NOT what you expect from a 30x market, is it?

We’ll see how the week plays out but Durable Goods were down 2.2% this morning and November was revised down from -1.1% to -2% as well so MUCH WORSE than we were led to believe but blame Boeing (huge miss today) as ex-Transport, November was “only” down 0.2% and up 0.3% in December.

We will see how Confident the Consumers are feeling at 10 am – In December it was 104.7 and Leading Economorons predict a jump to 108.1 this month but I think they are being overconfident in their confidence predictions – we’ll see.