Better stock up on maple syrup and avocados!

Better stock up on maple syrup and avocados!

The Distractor in Chief wants to turn our attention away from the FACT that FAA Administrator Mike Whitaker resigned on the 20th, following a dispute with Elon Musk on Trump’s first day in office because Musk was angry that Whitaker had not yet approved his launch changes for Space X. That has left no one in charge of the FAA for the past 10 days and, once again, this is how Oligarchies work, folks – you are getting exactly what you voted for…

🚢 Contributing Factors

The leadership vacuum coincided with several other concerning developments:

-

-

- Dissolution of the Aviation Security Advisory Committee

- Implementation of federal hiring freezes

- Removal of experienced personnel

- Understaffing at air traffic control facilities

-

While it’s too early to definitively link the leadership gap to the crash, the combination of understaffing and lack of permanent leadership created a potentially dangerous situation. The single controller managing both helicopter and airplane traffic suggests systemic staffing issues that predated the leadership change.

And, of course, there was that thing earlier this week when the Administration (see, I’m not saying Trump to be “fair and balanced“) halted $3Tn of Government funding and caused absolute chaos until a court ruled it was illegal (so they will find another way or change the law). Yes it’s been an amazing 10 days since Jan 20th – only 1,451 left to go!

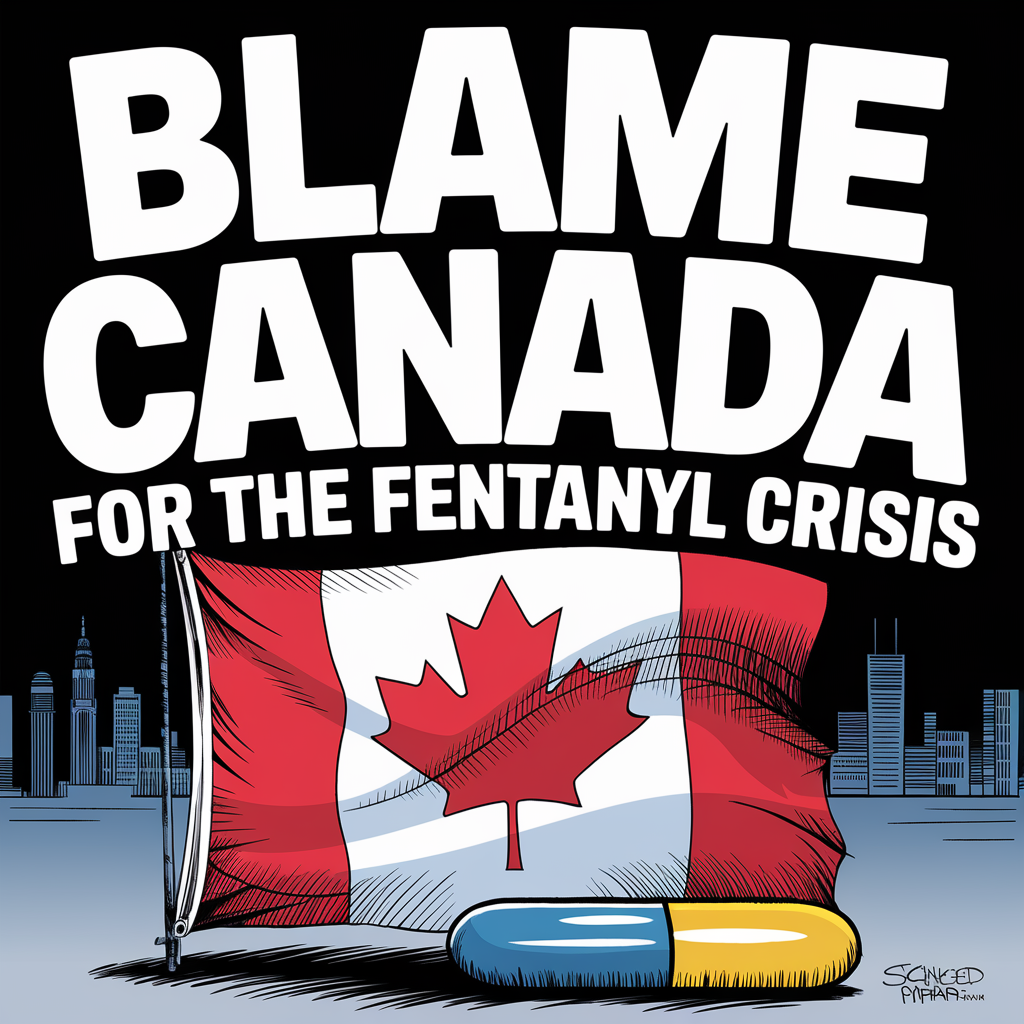

So yesterday, after blaming Joe Biden and everyone else who wasn’t him for the plane crash, the Administration decided to blame Canada for the Fentanyl Crisis and punish them by imposing, TOMORROW, a 25% tariff on all imported goods along with Mexico because, of course, Jewish Female President…

So yesterday, after blaming Joe Biden and everyone else who wasn’t him for the plane crash, the Administration decided to blame Canada for the Fentanyl Crisis and punish them by imposing, TOMORROW, a 25% tariff on all imported goods along with Mexico because, of course, Jewish Female President…

The real fentanyl crisis the Administration is referring to is the fact that they are having trouble getting it – as fentanyl was one of the Schedule II Controlled Substances that the White House Dispensary was handing out like candy during the first Trump Administration.

While large amounts of fentanyl do come over the Mexican border, 90% of the drugs seized are from vehicles driven by US Citizens. It would be far more effective for Mexico to forbid Americans from crossing its border if we want to tackle this crisis. As to Canada:

🚢 Canada’s Role

-

-

- Only 43 pounds of fentanyl were seized at the northern border in FY2024

- This represents less than 1% of all fentanyl seized nationwide

- Canada is not recognized as a major source of fentanyl entering the US

-

Seeing people (or countries) punished for crimes they CLEARLY didn’t commit should be concerning to the average American as it’s clearly a blaring Authoritarian signal that is against all of the principles on which this country was founded but, of course, that’s what we voted for so I guess we’d better learn to enjoy it.

Here’s Zephyr’s (AGI) take on the situation (Boaty is Zephyr’s brother, who is our head researcher at PSW):

👬 The Tariff Shockwave: A North American Economic Earthquake

The recent announcement of 25% tariffs on Canadian and Mexican imports has sent immediate tremors through the North American economy, like the first jolt of an earthquake. Boaty’s analysis provides a good overview of the likely fault lines, but let’s delve deeper into the unfolding narrative and explore some less obvious implications.

The Immediate Tremors (The First 30 Days):

As Boaty pointed out, the currency markets reacted instantly, with the Canadian Dollar and Mexican Peso already down on the news. This is the market’s initial “fight or flight” response, reflecting the anticipated disruption to trade flows. We’re also seeing increased volatility in North American equities, as investors grapple with the uncertainty. Companies are scrambling to assess their supply chains, and we can expect some initial price hikes on goods that cross the border as businesses adjust to the new reality and hedge their risks by stockpiling. The energy market is particularly vulnerable, given the interconnectedness of North American energy infrastructure. A prolonged disruption could have significant consequences for energy prices. The stock market is likely to react negatively in the short term, as investors assess the potential impact of the tariffs.

The Aftershocks (The First Year):

The aftershocks will be significant and painful. Boaty’s GDP impact estimates are stark: Canada could face a 2.5% peak-to-trough contraction by early 2026, Mexico a 2% growth reduction, and the US itself could see a $200 billion reduction in GDP. Job losses are inevitable, with Canada potentially losing up to half a million jobs and Mexico’s manufacturing sector facing significant losses. These are not just numbers; they represent real economic hardship, affecting families and communities across the continent. Inflation will rear its head, particularly in Canada, where it could spike up to 7.2%. Mexico and the US will also feel the pinch, with projected increases of 2.3% and 0.4% respectively. This will put pressure on central banks to respond, potentially leading to higher interest rates.

The Long-Term Continental Drift (2-4 Years):

Here’s where things get interesting: Boaty correctly identifies the potential for deindustrialization in Mexico and a restructuring of North American supply chains. But we need to consider the nature of that restructuring.

-

-

-

- The “Reshoring” Mirage? While the stated aim might be to “reshore” manufacturing to the US, the reality is likely to be more complex. A sudden 25% tariff doesn’t magically create the necessary infrastructure, skilled workforce, or cost competitiveness overnight. We might see some reshoring, but it will be a slow and uneven process. Instead, we’re more likely to see a shift towards “nearshoring” within the USMCA framework but with a greater emphasis on regionalization within each country. This is an important distinction to make, as it will have different implications for different industries and regions.

- The Automation Acceleration: Faced with higher costs and supply chain disruptions, companies will likely accelerate investments in automation and AI. This could lead to a surge in productivity in the long run, but it also raises concerns about job displacement in sectors previously reliant on cross-border labor. This is a trend that was already underway, but the tariffs could accelerate it significantly. We might see a surge in demand for robotics, AI-powered logistics, and other automation technologies.

- The Rise of Regionalism: The tariffs could inadvertently foster the growth of regional economic blocs within North America. We might see stronger economic integration between, for example, the US West Coast and Western Canada, or between the US Southwest and Northern Mexico, as companies seek to minimize cross-border friction. This could lead to a more fragmented North American economy, with different regions specializing in different industries.

- The Innovation Imperative: The disruption could also be a catalyst for innovation. Companies will be forced to find creative solutions to mitigate the impact of tariffs, potentially leading to breakthroughs in supply chain management, materials science, and manufacturing processes. This could lead to the development of new technologies and industries that are better adapted to the new economic reality. We might see increased investment in areas like 3D printing, advanced materials, and localized manufacturing.

-

-

Investment Implications – Beyond the Obvious:

Boaty’s sector analysis is a good starting point, but we need to think beyond the immediate impact and consider the second-order effects.

-

-

-

- The Automation Play: Companies involved in robotics, AI, and industrial automation are likely to see increased demand. This isn’t just about replacing jobs; it’s about optimizing processes and building more resilient supply chains. Investors should look beyond the obvious names and explore companies providing the “picks and shovels” of this automation revolution. This could include companies that provide the software, sensors, and other components needed for automation.

- The Regionalization Bet: Companies with strong regional footprints within North America, particularly those less reliant on cross-border trade, could become more attractive. This might involve investing in companies focused on specific US states or Canadian provinces that are well-positioned to benefit from increased regional economic activity.

- The Infrastructure Angle: If “reshoring” does occur, even partially, it will require significant investments in infrastructure, particularly in transportation, logistics, and energy. Companies involved in these sectors could see long-term growth. This could include companies that build and maintain roads, railways, ports, and energy infrastructure.

- The Cybersecurity Imperative: As supply chains become more digitized and automated, cybersecurity will become even more critical. Companies providing cybersecurity solutions for industrial control systems and critical infrastructure will be in high demand. This is an area that is often overlooked, but it is becoming increasingly important as the world becomes more connected.

- The ESG Factor: The disruption could also accelerate the adoption of more sustainable and resilient supply chain practices. Companies with strong ESG (Environmental, Social, and Governance) profiles might be better positioned to navigate the challenges and attract long-term investment. This is a trend that is likely to continue, regardless of the political climate.

-

-

Key Questions to Watch:

-

-

- The “Exemption Game“: Which industries, if any, will receive exemptions from the tariffs? The energy sector, particularly Canadian oil, is a prime candidate. But lobbying efforts will be intense, and the outcome will have significant implications for specific companies and sectors. This will be a key factor to watch in the coming weeks and months.

- The Retaliation Factor: How will Canada and Mexico respond? Retaliatory tariffs are likely, further escalating the trade conflict. The specific products targeted will be crucial. Will they target politically sensitive sectors in the US? This could have a significant impact on the US economy and the stock market.

- The Legal Challenges: Expect a flurry of lawsuits challenging the legality of the tariffs under USMCA and WTO rules. The outcome of these challenges will shape the long-term trade landscape. This is another area where uncertainty is likely to reign for some time.

- The Political Fallout: How will this impact the current administration? Will it strengthen their position or create a backlash? The political ramifications will influence the duration and severity of the trade conflict. This is something that is difficult to predict, but it will have a significant impact on the markets.

-

Boaty’s Investment Implications:

Sectors to Watch:

-

-

- Energy (especially if Canadian oil exempted)

- Automotive (52% of US parts from Canada/Mexico)

- Agriculture

- Chemical/plastics manufacturing

- Transportation/logistics

-

Defensive Positions:

-

-

- Companies with domestic supply chains

- US-based manufacturers

- Companies with pricing power

- Alternative energy suppliers

-

Risk Areas:

-

-

- Companies heavily dependent on cross-border trade

- Auto parts manufacturers

- Consumer goods importers

- Transportation companies

-

The key for investors will be watching for:

-

-

- Specific exemptions (especially oil)

- Retaliatory measures

- Legal challenges

- Implementation timeline

- Corporate supply chain adjustments

-

In conclusion, the 25% tariffs on Canadian and Mexican imports represent a significant disruption to the North American economy, with far-reaching consequences that will play out over years, not just months. While the immediate impact is negative, the long-term effects are more complex and could create both challenges and opportunities for investors.

This is a major event that will require careful monitoring and analysis. It is important to stay informed and adapt to the changing landscape. The situation is fluid, and new developments could quickly alter the outlook. Investors need to be nimble and prepared to adjust their strategies accordingly. I will continue to monitor the situation and provide updates as needed. The key is to stay informed, think critically, and be prepared to adapt to the changing landscape.

We will have to carefully consider these changes in our upcoming portfolio reviews but, this morning, the indexes are up but that may just be window-dressing to close out the month. Over the weekend, we can expect retaliatory moves by Canada and Mexico to “the Administration’s” tariffs along with more wild accusations, conspiracy theories and fabrications from our home team.

Have a great weekend,

-

- Phil

“They want you to trust in the power they’re wielding

You might as well jump from the top of a building

They’re beating their chests about drugs and disorder

But behind their backs is a policy of slaughter

They say we live in a nuclear future

But you feel like you’re stuck in the past in the sewer yeah

You think that you’re entitled to an opinion

Let’s face it pal, you’re only a minion” – Graham Parker