Well we saw this one coming…

Well we saw this one coming…

Fortunately, on Friday morning in our Live Member Chat Room, while the markets were inexplicably heading higher, we got much more bearish in our Short-Term Portfolio (STP), bringing our hedges up over $300,000 to $1.3M so now we get to sit back and relax and we’ll see how bad the damages are going to be as Trump rolls out Round 1 (of many) of Tariffs, starting with Canada, Mexico and China.

Honestly, I’ve been saying tariffs were going to be a disaster for so long, I’m bored with it so let’s just accept what we voted for and save our complaining for the 1,000 other terrible things that haven’t happened – yet. Just to be clear, however – there is NO POSSIBLE WAY that tariffs can bring about immediate improvement as it takes YEARS for manufacturing to shift and those years require investors to believe there is a stable economic policy where it makes sense to build new manufacturing in the the US.

On the other hand, the immediate effects are US policy scares away investors with it’s now-capricious nature and deportations lock in long-term labor shortages and make it even more expensive to operate in the US and, of course, prices go up for the American People with a 25% on 40% of our imports equaling 10% Inflation and, of course, we drive our best trading partners into the arms of China – who are happy to have them join their “Silk Road” alliance.

Anyway, like I said, moving on… Also this weekend, Trump & Musk ordered a 90-day freeze on USAid which does what it sounds like – provides (provided) aid to over 100 countries which will save us almost $2Bn/month but, unfortunately, will cut off AIDS treatment to 20.6M people, reigniting the spread of the disease world-wide. It will also terminate programs for maternal health, malaria, tuberculosis treatment, school feeding, refugee assistance and humanitarian aid along with disease monitoring and outbreak response to Global health threats.

[ctct form=”12730731″ show_title=”false”]

Tens of thousands of lives will be lost in the first 90 days, making Trump potentially the deadliest president since Nixon (and no, the title is NOT a compliment, Mr. President!). That can escalate to Millions of lives if the aid is not restarted as these are programs dating back to the Kennedy Administration that have consumed 0.6% of our budget to help all those people and engender goodwill for the US around the World. Trump invites China to fill that gap. Already our National Anthem is being booed at International sporting events.

And, of course, this idiocy with abandoning heath care, disease prevention and monitoring sets us up for a repeat of Trump 1.0, when we got hit with the Covid pandemic and 1.1M Americans paid for the Administration’s incompetency with their lives (1/3 of the 3.4M people who died in the entire World, despite the US having less than 4% of the World’s population). Who would want a repeat of that? Why the people who profited from it, of course:

🚢 Based on the search results, here are the key examples of how the Trump administration and allies enriched themselves through COVID-19 spending:

Total Spending Impact

Fraud and Mismanagement

-

- Over $280 billion in COVID relief funds were stolen by fraudsters

- Additional $123 billion was lost or misspent

- Combined losses represent 10% of the $4.2 trillion disbursed5

Direct Financial Benefits

No-Bid Contracts

-

- A $750M no-bid contract was awarded to RER Solutions, which assigned just 6 employees but pocketed $340M6

- ApiJect received $1.3B in contracts and loans but failed to produce any vaccine syringes3

- Peter Navarro pressured agencies to award hundreds of millions in contracts to politically connected companies without proper vetting46

Distribution Problems

Oversight Interference

Connected Companies

Long-Term Impact

-

- Debt-to-GDP ratio projected to reach 190% by 2050

- Interest payments on COVID debt alone amount to $170B annually

- Current debt levels are highest since World War II8

The scale of potential abuse was enabled by the administration’s resistance to oversight and rushed distribution of funds without proper safeguards or competitive bidding processes.

So Trump learned, during his first Administration, that NOTHING lets you loot the Treasury like a pandemic so this time he is doing everything possible to create the conditions in which another major pandemic can break out. Covid isn’t gone – it’s just “under control” and those controls are being removed and, rather than preventing Bird Flu from becoming another Covid – Trump has halted funding on research and prevention, including FORBIDDING the CDC from sharing information with the WHO – who he is pulling the US out of. MADNESS!!!

Anyway, the people have spoken and they liked it so much the first time we now find ourselves 2 weeks into the 2nd round so let’s just lie back and enjoy it – because resistance is futile.

Obviously the Futures are not pleased with the tariffs and the Dollar has popped up to 109 so I think the Futures are only showing us the leading edge of this sell-off. Oil (/CL) blasted back to $74.50 and Gasoline $2.13 with Natural Gas $3.30 (up 10% from $3 on Friday) with Gold at $2,850 and Silver $32.35 – this is the most inflationary day we’ve had since 2022, when the Fed began getting concerned about Inflation.

Now we have a Stagnating Economy with persistent Inflation, which is called Stagflation and is one of the worst possible economic situations outside of (and usually before) a full-blown Recession.

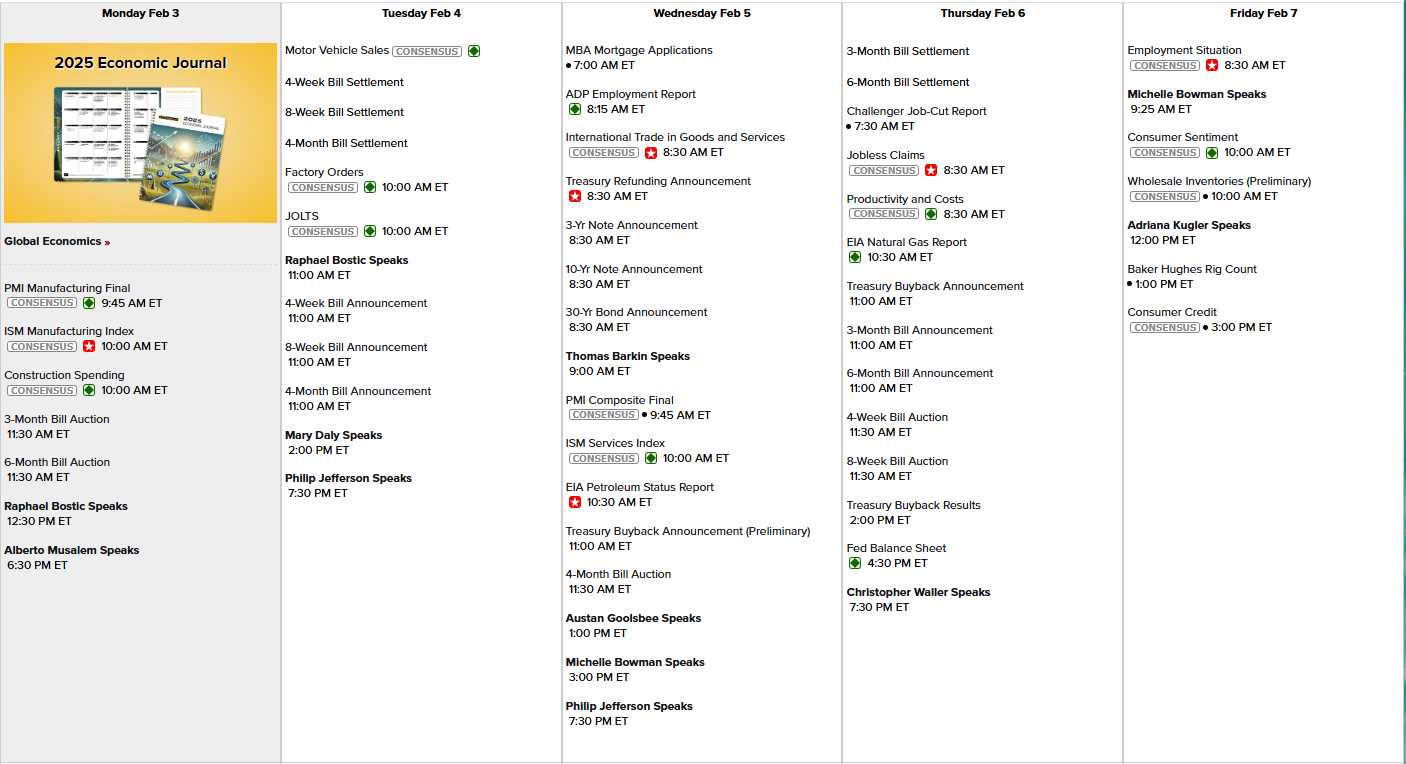

It’s a busy data week and the Fed speakers are loose with an even dozen scheduled speeches along with PMI, ISM and Construction Spending (Mon), Factory Orders and JOLTs (Tues), PMI & ISM Services (Wed), Productivity & Short-Term Auctions (Thurs) and Non-Farm Payroll, Consumer Sentiment, Wholesale Inventories and Consumer Credit on Friday:

And we are right in the thick of Earnings Season with about 1/3 of the S&P 500 already reporting and earnings growth, so far, at 13.2% (let’s keep an eye on that number) but that’s on the back of a very inflationary 4.8% increase in prices which, CLEARLY, were not necessary – as you can see from the MASSIVE earnings growth.

So is gouging the Consumers a sustainable business model? It has not been in the past but in the Oligarchy that is taking shape around us – it’s the ONLY model! Companies that have missed their earnings have fallen an average of 3.7% so far – and we can expect a lot more misses in the back 2/3 of the reports as the Tech and Financial Sectors have been carrying the first 1/3 so far.

Guidance is also a big issue as guidance for the rest of 2025 has been pegged even higher than Q1. Will tariffs change that outlook? We’ll find out the hard way…

[ctct form=”12730731″ show_title=”false”]