More inflation!

More inflation!

PPI is up 0.4% vs 0.3% expected and core PPI is back to 0.3%, up from 0% in December and Final Demand is 3.5 – the highest level since early 2023. There’s no denying it – inflation is back. Oops, not back as it now seems December PPI has also been revised higher so it was never 0.3% – it was ACUTALLY 0.5% so AN OPTIMIST (who has no sense of reality) would say PPI is now DOWN from 0.5% in December to 0.4% in January.

The best way to look at it is Annually and the year/year PPI is now 3.3% vs 3% in December – a 10% jump for the month. That’s not good. Service PPI jumped to 4.03% and that’s the highest since Feb 2023, led by Transportation and Warehousing costs though Goods Prices jumped 0.6% in December led by Gasoline (up 9.7%) but Fish and Dry Vegetables dropped 14.7% – saving us from a really catastrophic number.

I don’t why people are shocked, PPI has been trending up since June of 2023 and since Jan of 2024 at the core and I know I’m still shocked every time I go to the grocery store (and don’t even ask about the steak I splurged on last week!). This is the reality Americans are forced to deal with and the Consumers are becoming less Confident and the Small Businesses are becoming less confident as they are simply running out of disposable income while Trump and Musk are going to lay off Millions of (suckers) voters.

[ctct form=”12730731″ show_title=”false”]

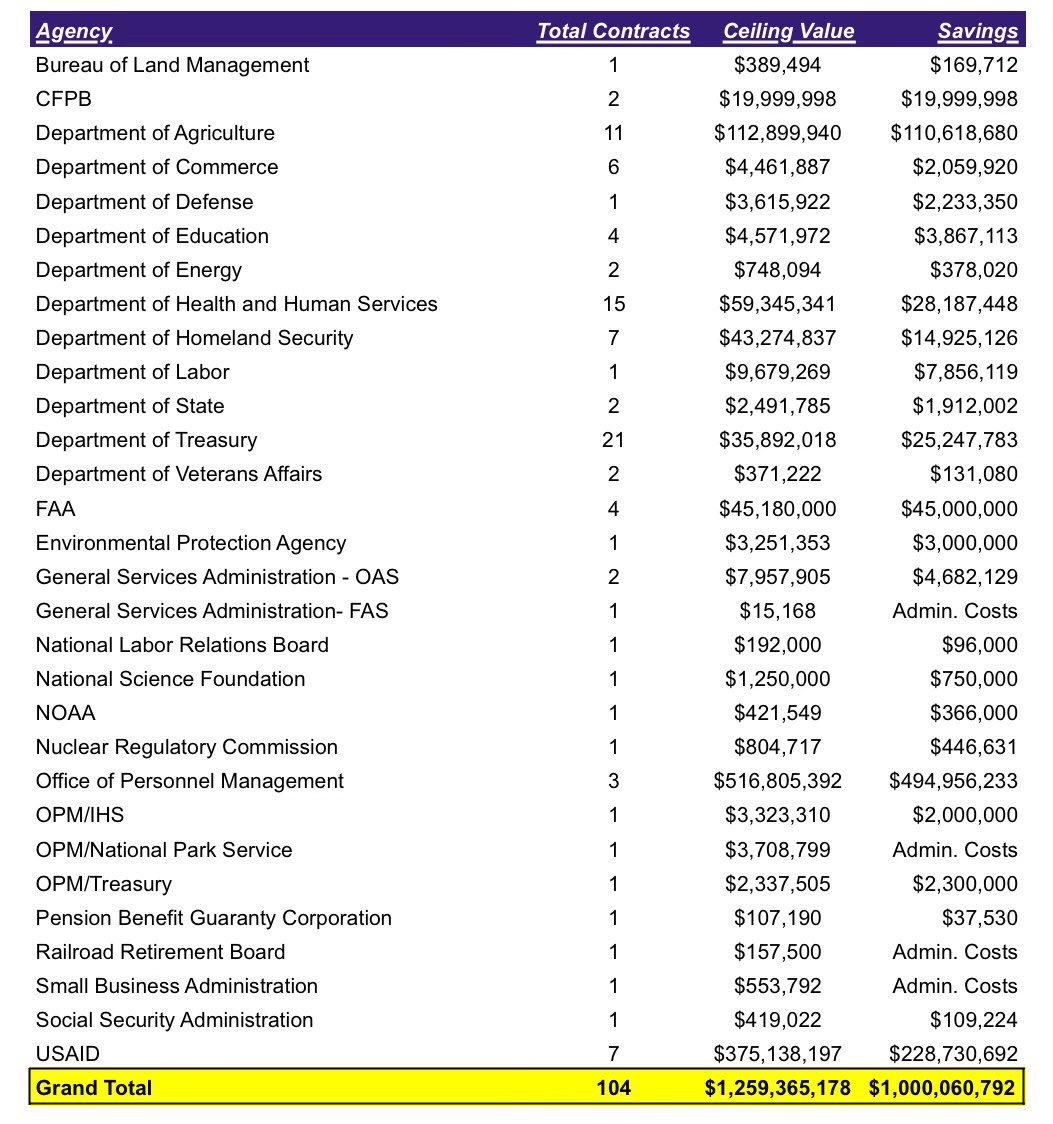

Speaking of Musk, for all of his bluster, his DOGE Department has only saved us $1,000,060,792 so far. That is 0.000142% of our $7,000,000,000,000 Federal Budget and that has to be some sort of record for the most chaos and disruption caused for the least amount of money.

This is DOGE’s own transparency report too, not an “attack” by their enemies – real or imagined. If Musk really wants to learn how to cut costs, he should bring in experts from Health Insurance Companies, who denied 850M claims in 2024. And, while 75% of appeals are successful (because they never should have been denied) only 1% of the people who are denied actually appeal – which makes denying claims the most profitable business strategy for the Insurance Companies.

Patients who fight denied claims must marshal evidence from medical studies, navigate dense paperwork and spend hours on the phone during what is often one of the most difficult times of their lives. “Because a lot of people won’t appeal, won’t call, don’t have the knowledge to sit on the phone—a lot of those go away,” said Dr. Ezekiel Emanuel, an oncologist and medical ethicist at the University of Pennsylvania.

United Healthcare (UNH), who are down one CEO, made $14Bn in 2024 on $400Bn in Sales and they have certainly changed their ways as they now project $450Bn in Revenues in 2024 and over $27Bn in profits – just shy of a 100% increase in profits by charging 12.5% more! Why not make it 20%? Well that’s exactly their plan for 2026!

At $486Bn in market cap ($528.30), UNH is trading at 18x projected earnings and you know Trump isn’t going to reign them is so why fight it when you can buy a share of the company and let them pay for your insurance premiums? Just make sure you also hire a legal team in case you need to actually process a claim!

We already have UNH in our Long-Term Portfolio from the December dip to $500 and, on December 18th, our opening trade for Members was:

This ($500) is a good price for them at about 17x and we don’t have them in the LTP so, let’s add the following:

-

- Sell 5 UNH 2027 $500 puts for $70 ($35,000)

- Buy 15 UNH 2027 $500 calls for $100 ($150,000)

- Sell 15 UNH 2027 $600 calls for $60 ($90,000)

That’s net $25,000 on the $150,000 spread with $125,000 (500%) upside potential and it either moves higher and we start selling short-term calls or it moves lower and we improve the spread (and sell short-term calls) – just an initial entry.

It’s only been two months but, at $528, the short $500 puts are $52.50 ($26,250) and the $500 ($108.50)/600 ($60) bull call spread is net $48.50 ($72,750) for net $46,500 and that’s already up $21,500 (86%) and covering our Health Insurance bills with another $103,500 (222%) of remaining upside potential.

And that trade wasn’t even the best one of the day as our Morning Report (sign up here so you don’t miss them!) we had the following Trade Idea for CSCO:

With the acquisition of Splunk (AI Infrastructure), 27% profit margins and growing subscription revenues, we like CSCO as a long-term play and a fun thing you can do with options is say “I wish I had a chance to buy CSCO when it was $45” and I can say to you – like the ghost of Christmas whichever one says: “Why you still can! Through the magic of options!” That’s right, Ebeneezer – you can sell the 2027 $47.50 puts for $2.50 and that puts $2.50 in your pocket and nets you into the stock for $45 – a Christmas miracle!

From a value perspective, however, I’m happy to own CSCO at net $53 so we like the following spread as a new trade:

-

-

- Sell 10 CSCO 2027 $60 puts for $7 ($7,000)

- Buy 15 CSCO 2027 $50 calls for $12.50 ($18,750)

- Sell 15 CSCO 2027 $65 calls for $5.50 ($8,250)

-

That’s net $3,500 overall on the $22,500 spread so there’s $19,000 (542%) of upside potential if CSCO can make it over $65 by Jan, 2027. We risk being assigned 1,000 shares at $63,500 (if we lose 100% of the spread) but anything over $54 makes us a profit. In fact, the spread is currently $13,395 in the month – that’s off to a very nice start!

That is the power of using stock options in place of stocks – we use far, FAR less cash to make our trades and we leverage our upside so a 10% gain in CSCO can make us 542%. If we were to buy 1,000 shares of CSCO for $58,900 and it hit $65 ($65,000), we’d only make $6,100 – NOT $19,000 – THAT is what I mean by useful leverage!

CSCO just had earnings and they are still heading higher (another 6% this morning) and those $60 puts are already down to $4.70 ($4,700) while the $50 ($19.60)/65 ($9.50) bull call spread is net $10.10 ($15,150) and that’s net $10,450, which is up $6,950 (198%) already and well on our way to the full $22,500, which means it still has $12,050 (115%) upside potential as a new trade – don’t say I never gave you anything for Christmas!

See – USEFUL LEVERAGE!

If you want to learn how to trade like this every day – come join us inside.

[ctct form=”12730731″ show_title=”false”]