:max_bytes(150000):strip_icc()/Term-Definitions_IV-3e90aaab2e7a42b4a50211aaa927c078.jpg) Implied volatility is one of the most misunderstood aspects of options trading, yet it has a significant impact on the pricing of options contracts. Many traders experience confusion when an option loses value even when the stock price remains relatively unchanged. This phenomenon is often due to implied volatility crush—a concept every options trader must grasp to avoid unnecessary losses and, more importantly, to capitalize on market opportunities.

Implied volatility is one of the most misunderstood aspects of options trading, yet it has a significant impact on the pricing of options contracts. Many traders experience confusion when an option loses value even when the stock price remains relatively unchanged. This phenomenon is often due to implied volatility crush—a concept every options trader must grasp to avoid unnecessary losses and, more importantly, to capitalize on market opportunities.

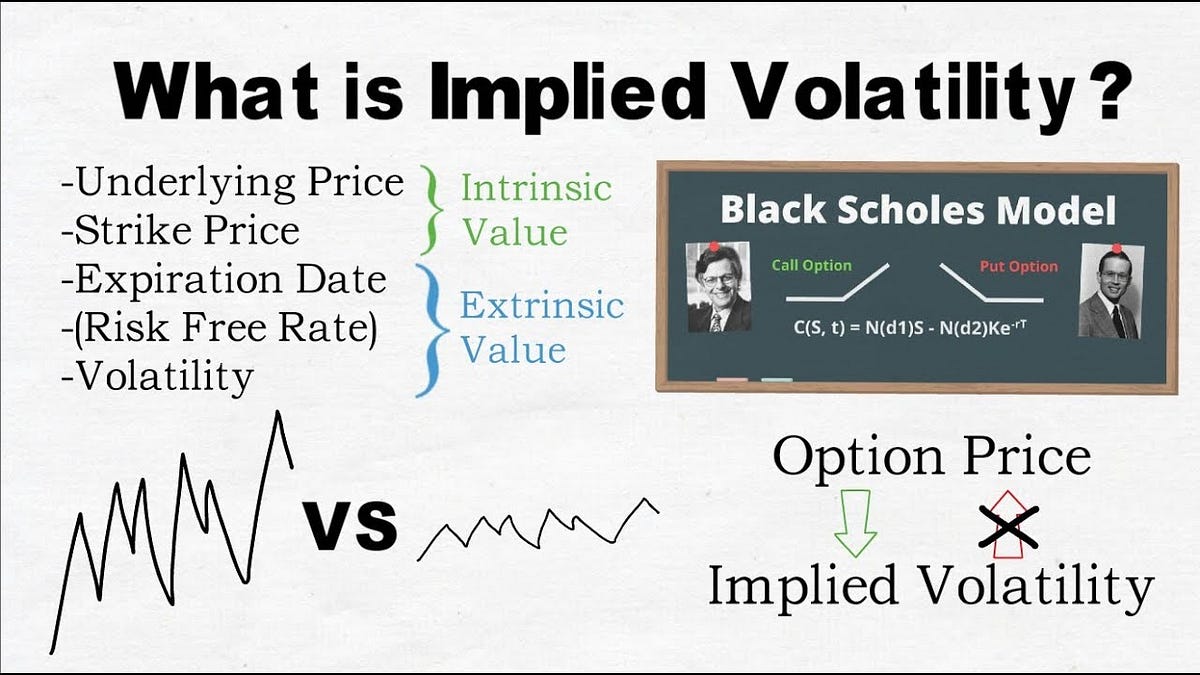

What is Implied Volatility?

Implied volatility (IV) represents the market’s expectations for future price movement in a stock or asset. When IV is high, option prices become inflated, reflecting uncertainty. When IV is low, options tend to be cheaper, indicating lower expected volatility.

Key Characteristics of Implied Volatility:

-

High IV: Often occurs before major events like earnings, economic reports, or geopolitical developments.

-

Low IV: Typically follows these events once uncertainty is removed.

-

IV Crush: A rapid drop in implied volatility, which leads to a decline in option premiums, even if the stock price remains unchanged.

How Implied Volatility Impacts Option Pricing

Traders often assume that if a stock price moves in their favor, their option position will automatically gain value. However, options are priced based on multiple factors, and implied volatility is a major component of that pricing.

Example Scenario:

-

A stock trades at $100 before earnings.

-

You buy a $105 call option for $5, with a high IV factored in.

-

The company reports earnings, and the stock moves up to $102.

-

However, the IV collapses post-earnings, reducing the option price to $3.50, despite the stock moving in the expected direction.

This loss occurs because the implied volatility drop had a greater impact on the option’s value than the stock’s minor price increase. This is why buying options right before earnings can be risky—the implied volatility crush can offset any gains from a modest stock movement.

How to Profit from Implied Volatility

Since we know that IV tends to spike before earnings and drop afterward, we can construct trades that benefit from IV crush rather than fall victim to it.

Strategy: The Diagonal Spread

One effective way to take advantage of IV crush is by using a diagonal spread, which involves:

-

Buying a longer-term option (which is less affected by IV changes).

-

Selling a short-term option (which is highly inflated due to high IV).

Example:

-

Buy a June $100 call for $10

-

Sell a February $105 call for $6

-

Net cost: $4

Why this works:

-

The short-term option benefits from IV crush, reducing its value significantly after the event.

-

The longer-term option retains more of its value since IV affects longer expirations to a lesser degree.

-

The trader profits from the difference in how each leg of the spread is affected.

This strategy ensures that, even if the stock price remains stable, the drop in IV works in your favor, rather than against you.

Key Takeaways

-

Understand IV Crush: Avoid buying options with inflated IV before major events unless you have a solid reason to do so.

-

Use Spreads to Offset IV Risks: Diagonal and calendar spreads are excellent ways to mitigate the impact of IV changes.

-

Always Analyze IV Before Trading: If an option seems expensive, check its implied volatility—it might be overinflated due to an upcoming event.

-

Take Advantage of High IV: Selling high-IV options can provide a significant edge in options trading.

Mastering implied volatility is essential for options traders who want to move beyond basic strategies and develop a deeper understanding of market pricing dynamics. By incorporating IV analysis into your trades, you can significantly improve your consistency and profitability.

Stay disciplined, trade smart, and make volatility work for you!

All the best,

Phil