$4,020,548!

$4,020,548!

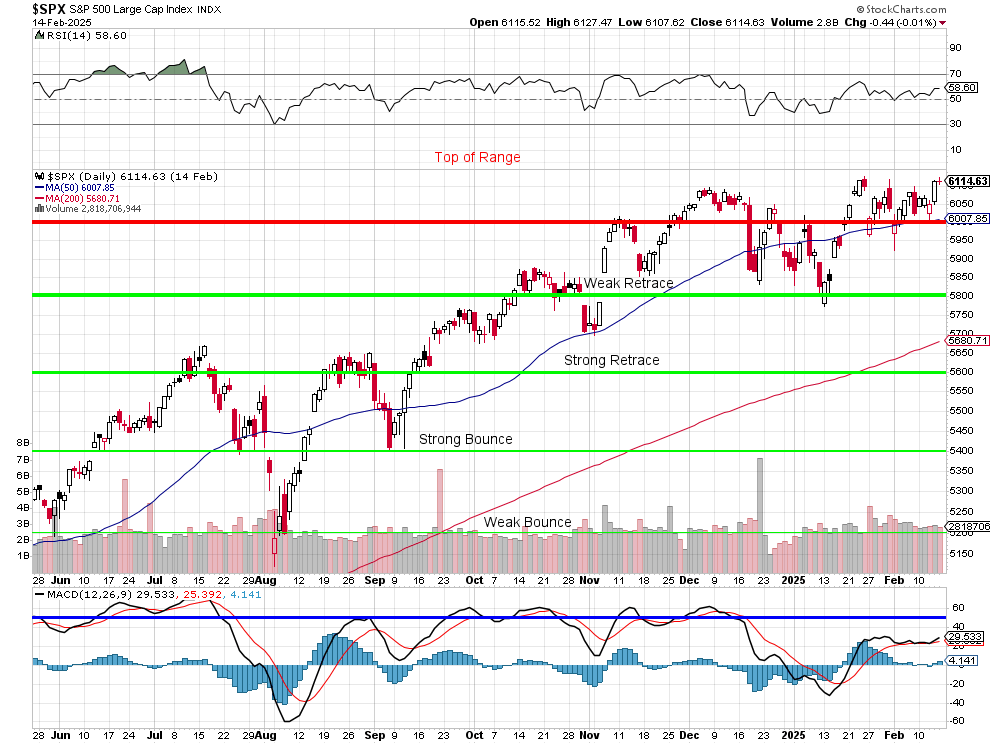

That was the total for our paired STP/LTP last month and the S&P 500 was at 5,836 at the time and now 6,114 is up 278 points (4.7%) for the month so we're bound to be doing better and we'll have to wait to see how much better when we finish our LTP Review. 4.7% is great for a month but we have been over 6,000 MOST of the time since Thanksgiving but the question is: Has the rally run its course or are we gearing up for another 20% run in the first half of 2025?

In August, our Paired Portfolios were at $2,586,535 at S&P 5,543 and we had just added a ton of new trades on the early August dip that took us down to 5,150 on the S&P 500 and THAT was a dip we were happy to buy at 20% below the current prices! As I said at the beginning of that review: "Time to go shopping!"

You don't get opportunities like that very often so you need to be prepared to pounce on them but all the pouncing in the World won't help you if you aren't PREPARED to take those opportunities. PATIENCE is the hardest lesson we try to teach to our new investors - keeping money (and margin) on the sideline for the real opportunities. The second hardest thing to teach is when to LET GO of those positions when they've run their course.

As I had said in our July review, when things were crashing down: "This is what we expect in a “real” rally – eventually we should see broader participation and that’s when our strategy kicks into high gear – patience does pay off and caution does too as our stocks are nowhere near as stretched as the leadership is at the moment."