What to talk about first?

February is ending with a bang as the US looks to auction off $300Bn worth of bills and bonds – right on the heels of a huge market correction on Friday – way to inspire confidence in the bidders, right? Not only that but the Dollar is down 3% for the month and those bonds are backed by Dollars – any takers? So far, demand at auctions has been surprisingly strong – but God help us all if it falters!

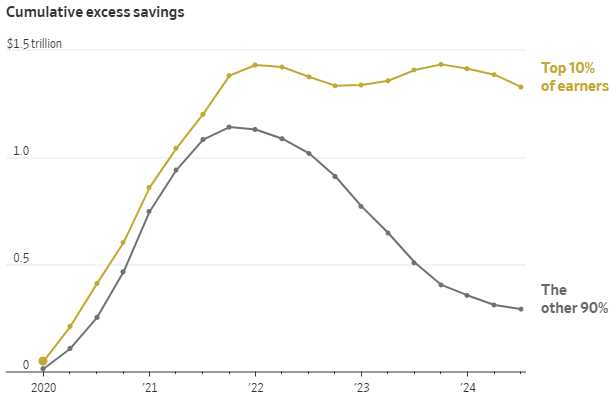

Already faltering is the savings of the bottom 90%, which is now just $300Bn per quarter vs $1.3Tn for the Top 10%. Never in the history of the Planet Earth has Income Inequality been so pronounced as the United States in 2025 – and that’s according to the Wall Street Journal!

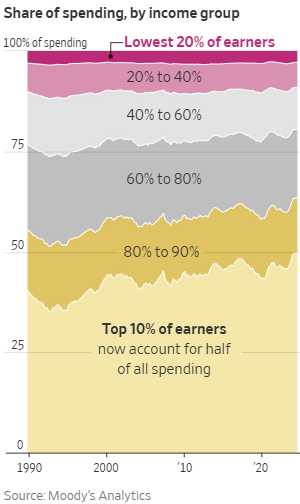

Despite socking away $1.3Tn PER QUARTER for a rainy day, the Top 10% are now responsible for 50% of all consumer spending – and that’s $875Bn per quarter. See – it does trickle down! That’s right, the Top 10% spend $26,515 on stuff per person (33M) every 3 months while the other 297M of us get to spend $2,946 each. What inflation?

Despite socking away $1.3Tn PER QUARTER for a rainy day, the Top 10% are now responsible for 50% of all consumer spending – and that’s $875Bn per quarter. See – it does trickle down! That’s right, the Top 10% spend $26,515 on stuff per person (33M) every 3 months while the other 297M of us get to spend $2,946 each. What inflation?

In the 90s, the Top 10% spent 1/3 of the money which was 2/6 for those of you with advanced math degrees but now it’s 3/6 – 75% more for them while the bottom 90% went from 4/6 to 3/6 – 25% less for everyone else. That’s the math, folks…

When you are being outspent 10 to 1 by your wealthy neighbors, that explains why you can’t find a good house or a cheap car or a good seat at a concert – you simply do not have what it takes to compete in the game of Capitalism. You also don’t have what it takes to compete in the voting booth – unless you still believe in the fairy tale of “one man, one vote” like a kid clinging on to Santa Clause 3 years after his Bar Mitzvah. Face it, you barely have what it takes to compete at the grocery store! $2,946? Give me a break!

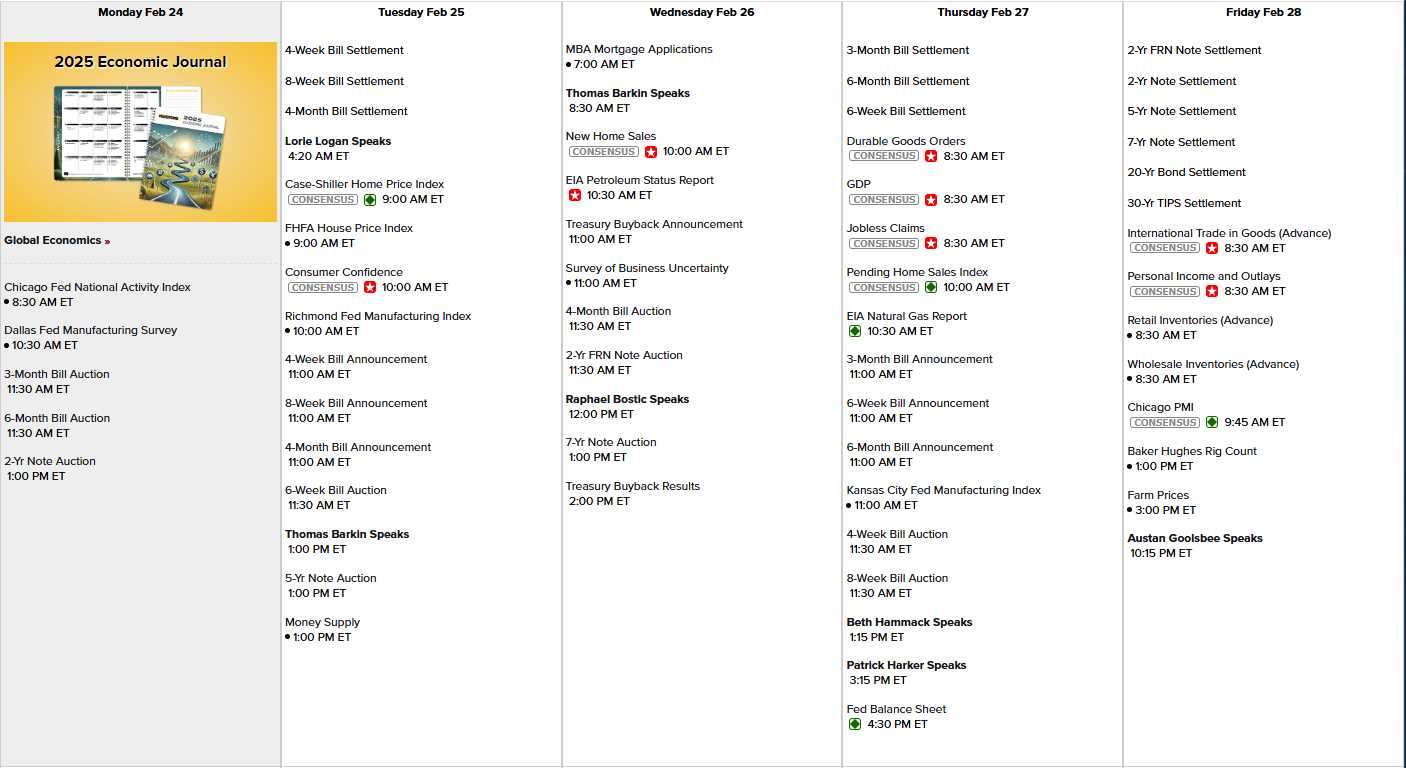

We’ll see how confident the Consumers are tomorrow morning (10am) but it depends who you call and, since the bottom 20% can’t afford phones – that kind of skews the polling numbers, doesn’t it? This morning’s Chicago Fed Report came in at -0.3% – plunging from +0.18 in December and we have the Dallas Fed at 10:30 but a month of Trump has already gotten millions of Federal Workers fearing for their jobs while DEI rollbacks have done the same for minorities and women in all US job rolls and, of course, raids and “ID Checks” have got millions more living in fear – even in their homes (which are being raided by Dr. Phil) and their workplaces – nowhere is safe from ICE these days and they are just getting started!

Fortunately, people hiding from Immigration Agents tend not to pick up the phone when pollsters call to ask them how they feel about the economy and we’ll see how the White People feel tomorrow – along with Home Prices and the Richmond Fed and after Lorie Logan but before Thomas Barkin and, most importantly, BEFORE the 5-Year Note Auction. Wednesday Barkin Speaks again before the open and Bostic speaks before the 7-Year Auction so SOMEBODY is worried enough to crank up the spin machine….

Thursday is GDP along with Durable Goods, Pending Home Sales and KC Manufacturing but I can tell you GDP is going to suck because the running, up-to-date data from the Atlanta Fed’s GDP Nowcast is showing a MASSIVE pullback since we swore Trump in for his second term yet NONE of the leading Economorons have lowered their 2.3% estimates:

Hard numbers come in on Friday in the form of Personal Income & Spending and PCE Prices, which were 0.3% in December but likely heating up for January and then we get the Chicago PMI on Friday too along with Farm Prices and Goolsbee bats clean-up for the Fed on Friday morning.

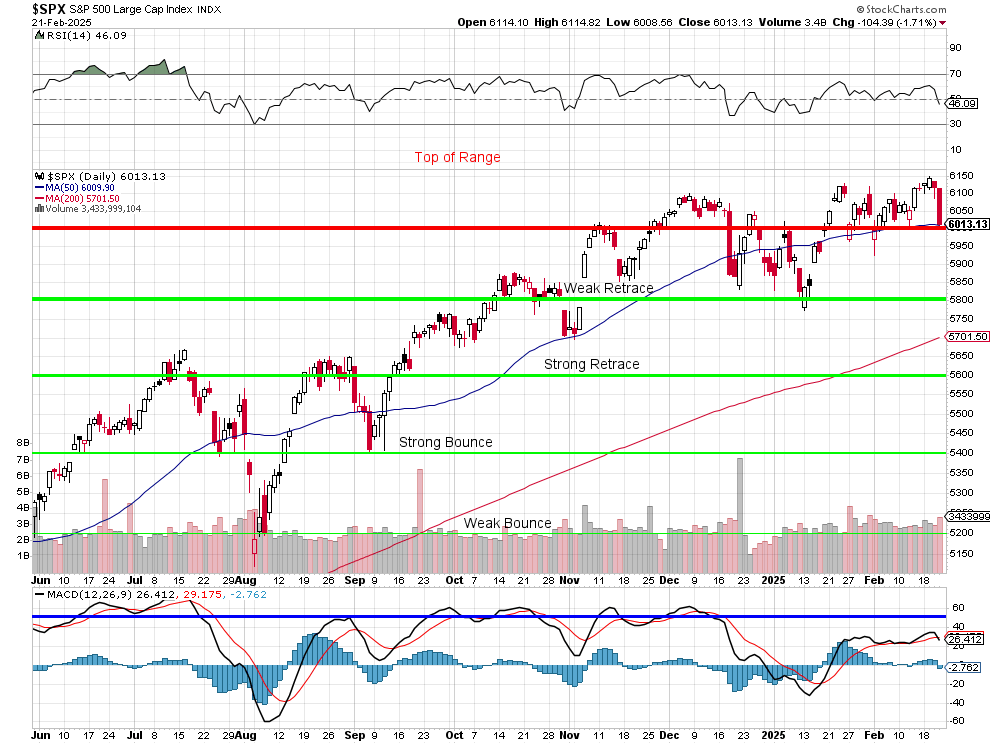

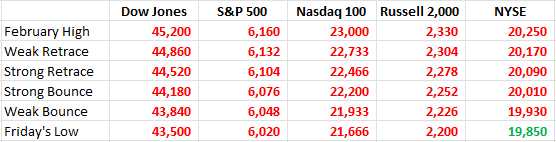

And look, there are earnings reports too – leaning into Small Cap and Retail – it’s going to be a trick week for the Russell 2000. And, speaking of bounce lines – let’s take a look at the indexes and see what it’s going to take for them to win our respect back after last week’s horror show:

Using our fabulous 5% Rule™, it’s very simple to see if we are just bouncing or recovering. The short version is that we generally have a week to recover before real damage sinks in but, in this case, the drop on Friday was so dramatic that, if we don’t get back over the strong bounce line (and hold it) by tomorrow’s close – then we are almost certainly consolidating for a move lower:

Everything is red so anything green will be an improvement and the Dow Futures are at 43,800 – so there’s a green box already! And there’s the bell so we’ll talk about Buffett and his $335Bn cash pile, which is one guy having more than the ENTIRE bottom 165M people in this country. We’ll see what he chooses to do with it – but it probably won’t be used to buy eggs.

And that brings us to Germany, where Friedrich Merz held off attacks from Trump, Musk and the Right Wing Germans (all working together to tear down our ally), who declared in his victory speech “It should be a priority to strengthen Europe as fast as possible so that we gradually achieve independence from the U.S. It’s clear that the Americans, at least this American administration, are largely indifferent to the fate of Europe.”

There go 75 years of US relationship-building in Europe out the window – and it’s only day 35! The big winner, of course, is Vladimir Putin – the spy/President/Dictator who backed Trump, who is handing him Ukraine on a platter along with disbanding NATO and working to push our traditional allies out of power by supporting right-wing nationalists to run against them.

Unfortunately, money doesn’t buy elections in Europe – yet – but give them a few years and I’m sure the Oligarchs will prevail there too.