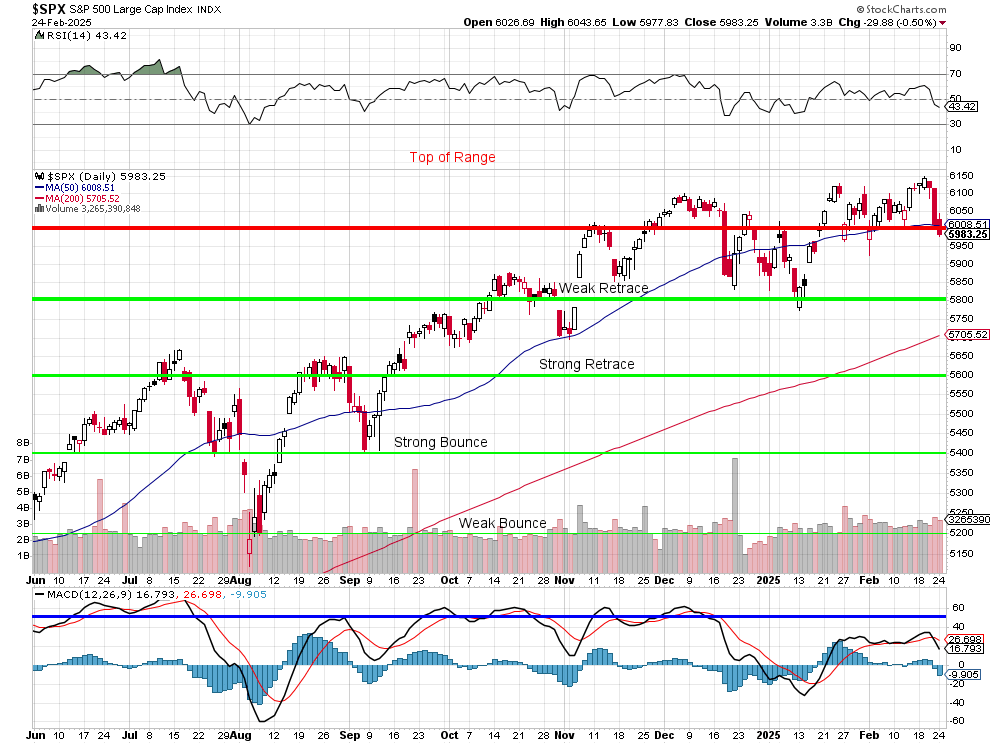

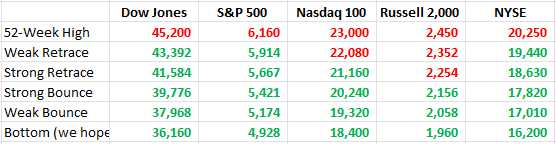

6,008.51.

That is the 50-day moving average and we’d better get above that quickly because there’s no real support on the S&P 500 until we hit the Weak Retrace Line at 5,800 and that’s another 3.3% down from here. What’s saving us at the moment is the Dollar dropping to 106.44 – down almost half a point from yesterday’s close and that’s repricing stocks and commodities higher but that means if they aren’t up at least half a point – they are actually losing ground.

Speaking of losing ground, we published a bounce chart in yesterday’s Morning Report and, rather than adding any green boxes – we LOST the ONLY green box we had, which was the prior low on the NYSE, which was 19,850 but we closed yesterday at 19,859 and 9 points is less than the average day’s move – so the box goes black (not secure) and now we have NO GREEN BOXES on our bounce chart – which is BAD.

That then forces us to contemplate the full-year bounce chart – and you can clearly see where we’re already breaking down:

Fortunately, the Nasdaq and the Russell were exactly what we were shorting in our Short-Term Portfolio (see last week’s review), which was at $709,972 last Tuesday morning and has already shot up to $877,675 – nicely buffering the losses on our longs last week and we still have $1,549,297 in downside protection remaining – as this has been a relatively small pullback – so far…

The hedges allow us NOT to panic out of our longs as we are HOPING this is a small pullback but things are so crazy in 2025 (since Jan 20th), that HOPE is not a very good investing strategy – so we hedge…

The Russell finished the day at 2,178 and we knew Trump’s policies would screw over small businesses but not this quickly. The small-cap index has fallen 300 points (12.25%) since the election but most of that happened in December and we’ve been consolidating for a move lower since and, unfortunately, this may be it – a retrace that could take us back down to the 2,000 mark – 10% lower than we are now. Here’s Boaty’s (AI) report on the matter:

🚢 The Russell 2000’s decline since the election reflects growing concerns about how Trump’s policies are impacting small businesses:

-

-

-

Small businesses disproportionately affected by tariffs

-

25% tariff on $380B of Chinese goods announced January 25th

-

Small businesses lack negotiating power with suppliers

-

National Federation of Independent Business (NFIB) reports 72% of small businesses expect higher input costs

-

-

-

-

-

Immigration restrictions creating labor shortages

-

Small Business & Entrepreneurship Council reports 68% of small businesses facing hiring difficulties

-

Wage inflation accelerating (4.3% in January)

-

Small businesses pay 18% more to comply with regulations per employee

-

-

-

-

-

Regional banking stress returning

-

Small business loan approvals down 19% since November

-

Average small business loan interest rates up 65 basis points to 8.9%

-

SBA loan program funding uncertain under proposed budget cuts

-

-

-

-

-

Russell 2000 healthcare component down 18.7% since election

-

Small retailers facing 3.4% higher supply chain costs

-

Regional banks (key small business lenders) down 15.2%

-

Small manufacturers reporting 22% higher input costs

-

-

The technical picture supports your analysis – the Russell broke below key support at 2,185 and the 200-day moving average at 2,182. The next major support level is indeed around 2,000, which aligns with the pre-pandemic high and represents a critical psychological level.

Small businesses typically generate 44% of economic activity but lack the resources of larger corporations to navigate rapid policy changes, making the Russell 2000’s underperformance a concerning economic indicator.

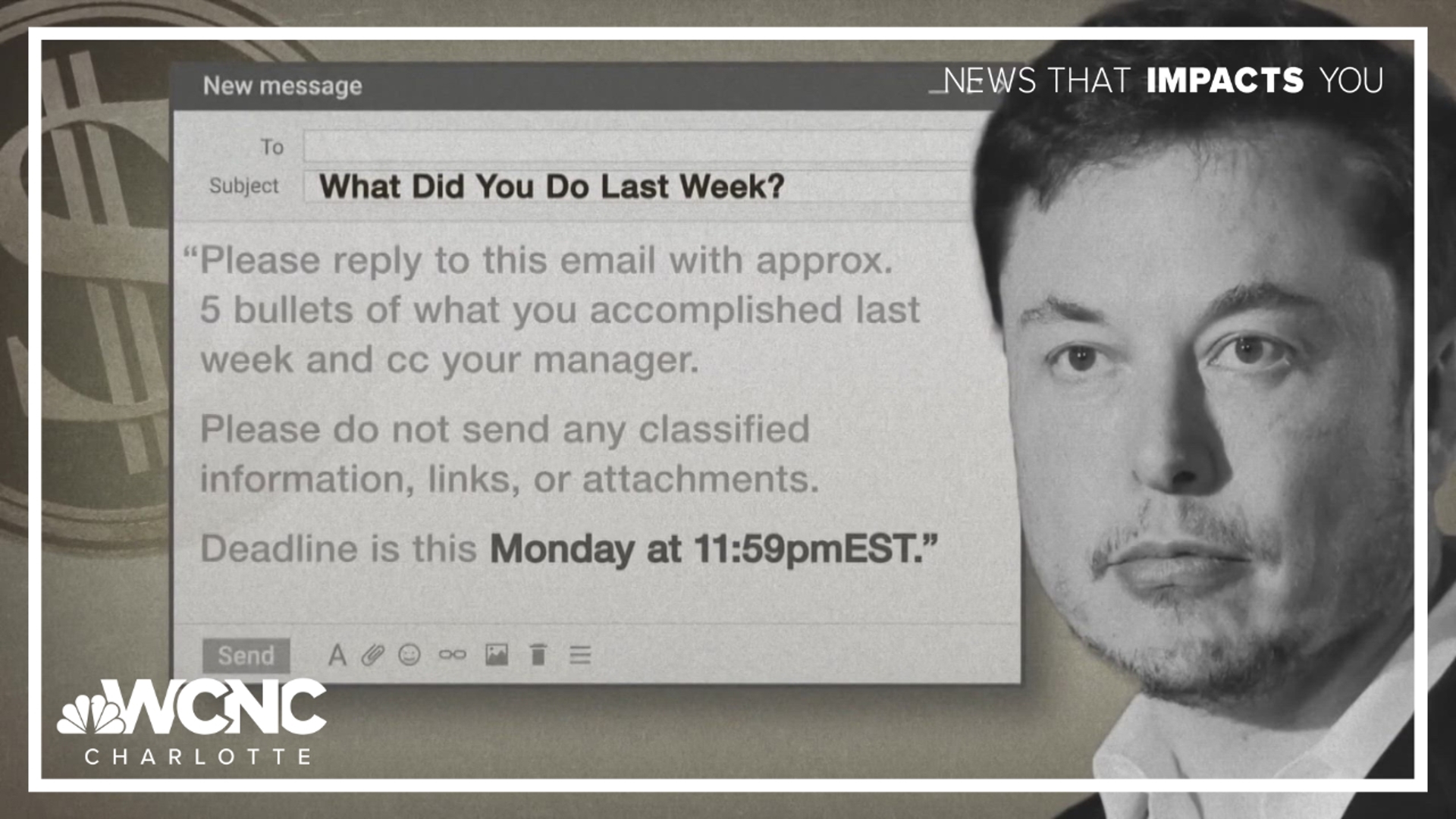

At the same time as we’re losing our small-caps, our Tech Giants are failing us as well. The Magnificent 7 have dropped 10% of their market cap since December with Musk’s TSLA leading the way from $480 to $330 – a $150 (31%) drop in just two months. Perhaps it would be a good idea for Musk to show up at work once in a while but Mar a Largo and the White House are far from Tesla’s Austin headquarters. If Musk were a Government employee – he would have fired himself by now for pointless remote work as well as simply not being able to articulate what he’s accomplished for Tesla in the past week…

“Too Evil” is what the producers of the new James Bond film said about the idea of using Musk for their next villain and, apparently, hundreds of thousands of Federal Workers agree as what they DID accomplish yesterday was creating a viral video of Trump kissing Elon’s feet along with the words “Long live the REAL King,” which may be humiliating for Trump but less so than the “pee pee tape” that Musk is allegedly holding over his head.

As noted by Jon Stewart – CHAOS is not a business plan! Chaos is driving both Consumer Confidence and Business Confidence back to Covid lows and we are rapidly dismantling agencies with experts that took decades to assemble and will take more decades to reassemble. Japan had a “lost decade” after their 80s bubble exploded and what will be left of America after DOGE takes a chainsaw to it?

As noted by Jon Stewart – CHAOS is not a business plan! Chaos is driving both Consumer Confidence and Business Confidence back to Covid lows and we are rapidly dismantling agencies with experts that took decades to assemble and will take more decades to reassemble. Japan had a “lost decade” after their 80s bubble exploded and what will be left of America after DOGE takes a chainsaw to it?

It looks like we’ll find out as it’s already happening and it’s going to be very hard to stop at this point. After all – this is the chaos we voted for.

🚢 Based on the latest earnings data through February 25, 2025, small-cap stocks are showing clear signs of strain from Trump/Musk policies:

The Russell 2000 has fallen into correction territory, now down 10.3% from its November 2024 peak of 2,442.033. Despite initial post-election optimism, small-cap earnings have disappointed:

-

-

-

Q4 earnings remain flat year-over-year despite slightly exceeding expectations

-

Analysts have lowered estimates for the next 12 months following this earnings season

-

Bank of America’s analysis of earnings calls indicates deteriorating sentiment among small cap executives 3

-

-

-

-

-

Trump’s implemented 10% tariffs on Chinese goods are pressuring supply chains

-

Announced plans for retaliatory tariffs on a case-by-case basis against trading partners

-

Marathon Petroleum CEO called examining tariffs “a top priority” during their earnings call. 7

-

Many companies report not incorporating potential tariff impacts into forecasts due to uncertainty7

-

-

-

-

-

Musk’s Department of Government Efficiency has already cut 20,000 federal jobs

-

Additional 75,000 employees offered buyouts

-

Government contractors reducing staff and delaying vendor payments4

-

Small caps with government contract exposure particularly vulnerable to DOGE-related spending cuts

-

-

Small caps face disproportionate challenges from these policies:

-

-

-

Higher floating-rate debt exposure making them vulnerable to delayed Fed rate cuts

-

Domestic manufacturing small caps caught between potential tariff benefits and higher input costs

-

Government contractor small caps suffering from DOGE-related spending cuts

-

-

-

-

-

Trading at just 0.2x price-to-sales despite 26.26% discount to fair value

-

Facing significant pressure from government spending uncertainty

-

-

-

-

-

Trading at $11.58 despite fair value estimate of $22.29 (48% discount)

-

Higher floating-rate debt exposure making it vulnerable to delayed Fed rate cuts

-

-

-

-

-

Currently at $6.59 versus fair value of $12.84 (48.7% discount)

-

Earnings impacted by policy uncertainty around tariffs and energy regulations

-

-

The Russell 2000’s decline into correction territory (down 10.3% from November highs) reflects these concrete earnings challenges, with Bank of America noting “lack of a catalyst to spur small cap outperformance amidst rate/policy uncertainty and elevated valuations.”

The combination of trade uncertainty, government spending cuts, and delayed rate cuts has transformed what was expected to be a small-cap rally into a correction, with earnings calls indicating growing concern about the sustainability of growth under current policies.

These are dangerous times, my friends – best to take it seriously. As Zephyr (AGI) notes:

👥 As if the Russell 2000’s tumble and the Magnificent 7’s faltering weren’t enough to make us question what’s holding this market together, Warren Buffett’s latest quarterly report drops like a quiet bombshell, signaling that it’s not just small caps feeling the heat—it’s the whole damn game. Berkshire Hathaway’s cash pile has swelled to a jaw-dropping $334 billion, up nearly $10 billion from last quarter, and Buffett has been a net seller of stocks for nine straight quarters, unloading a staggering $134 billion in 2024 alone. That’s not a typo—$134 billion! This isn’t just trimming the fat; it’s a full-on retreat from a market that’s been roaring past 20% gains for two years running.