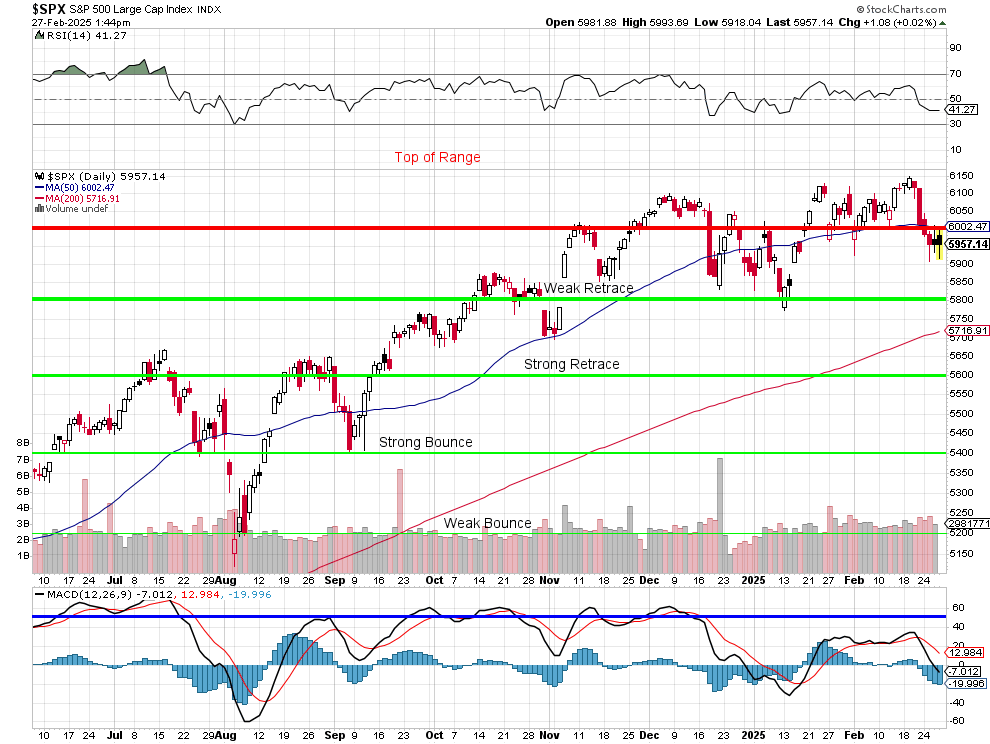

Our last Watch List was published on November 20th, following up on our main list (like this one) from Dec 27th, 2023 and now it's time to take another look at which stocks are still worth our attention - and which ones we need to act on. The S&P was kissing 4,800 in December and 5,200 in July and we were hitting the 6,000 line in November - and that is STILL were we are - NOTHING has happened!

Our last Watch List was published on November 20th, following up on our main list (like this one) from Dec 27th, 2023 and now it's time to take another look at which stocks are still worth our attention - and which ones we need to act on. The S&P was kissing 4,800 in December and 5,200 in July and we were hitting the 6,000 line in November - and that is STILL were we are - NOTHING has happened!

And that makes sense because we said 6,000 was going to be the top of our range - at least until after Q1 earnings (still in progress) and Q1 earnings have not actually been that great - but that does not mean we can't find bargains...

When we add a stock to one of our Member Portfolios, it generally begins with the sale of a put, to give us an even lower net entry price (see “How to Buy a Stock for a 15-20% Discount“) and then we build a position from that over time (see our Strategy Section). With the entire S&P 500 up 11% since September, bargains are certainly harder to find – but they’re out there…

For our Watch List, we look for Blue-Chip type companies with low debt, low p/e and reasonable anticipated growth. I’m including legacy prices in the descriptions (in the brackets), so we’ll know at what price we began watching – regardless of the date we began.

We're going to start with what worked and what didn't in 2024 and THEN we'll move onto the macro view and THEN we'll move on to the analysis and, HOPEFULLY, we'll be done with this post around Thanksgiving - so expect to come back frequently for updates...

We're starting off with a review of last year's picks because those who forget the past are condemned to repeat it - though 2024 was a fantastic year for our portfolios, so maybe we should skip this step?