If we don’t bounce here we’re F’d!

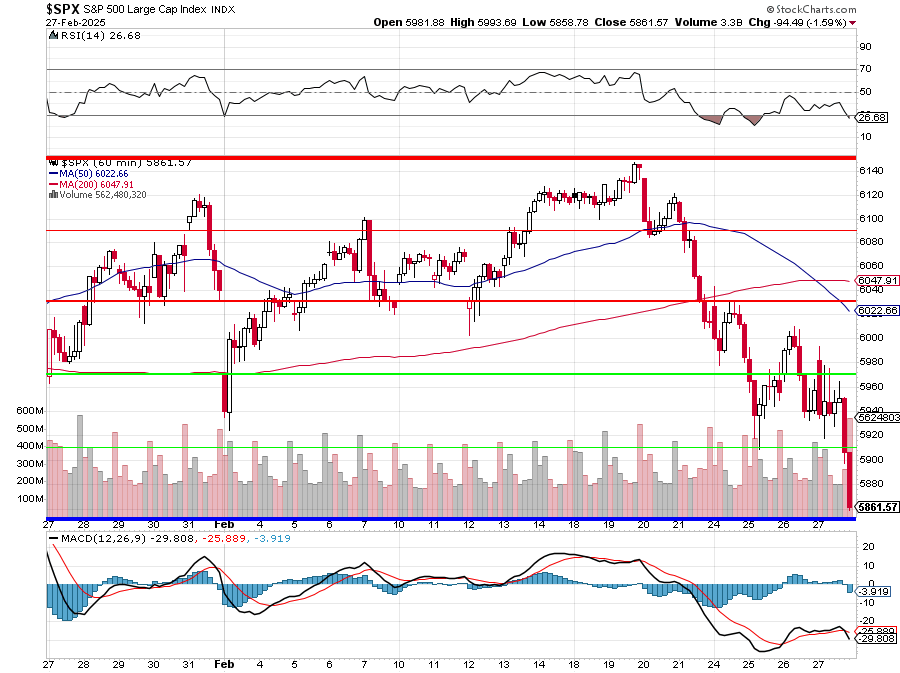

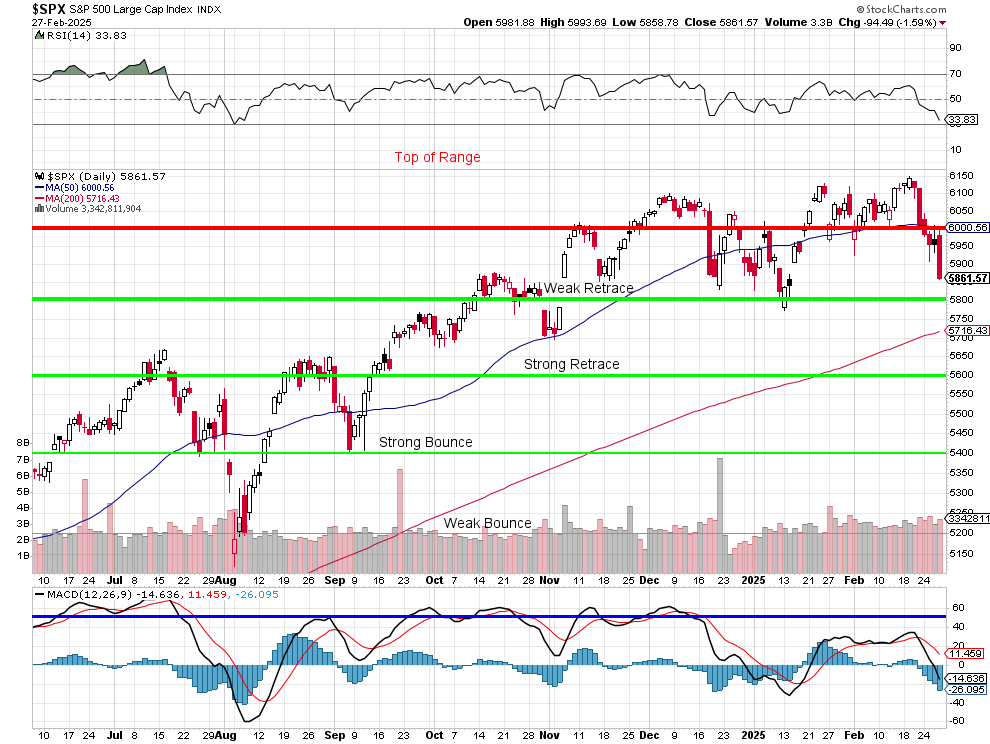

Below this 5% Rule™ box is another one that goes from S&P 5,850 to 5,550 but that’s already below the long-term support at 5,600 and the 200 dma at 5,716. We already warned you last week that it would be terrible if we failed the 50 dma at 6,000 but that ship has now sailed and you can see that the 50-hour moving average has now formed a “Death Cross” below the 200-hour moving average and that is NOT GOOD – though it’s a short-term indicator BUT (and this will amaze you with simplicity), if it doesn’t reverse quickly IT BECOMES A LONG-TERM INDICATOR!

See how easy TA is to understand? None of those BS chart patterns – just simple mathematical observations and a rudimentary understanding of HOW and WHY charts are drawn and PRESTO! – we can see the future!

Yes, this is the same 5% Rule Chart we used last year and the reason we never adjusted the top of our range at 6,000 (the tag drifted) is because the FUNDAMENTALS – especially the recent earnings – did not justify an adjustment. The run to 6,200 (our next line – if we needed it) was an overshoot, which is why, in our Short-Term Portfolio (STP) Review last Tuesday – we decided to press our hedges by 50% to $1,717,000 against a 20% drop, keying on the Russell and the Nasdaq.

At the time, our STP was at $700,792 (from a $200,000 start) and yesterday we finished at $1,004,920 – a $304,128 (43.3%) that has more than offset the losses in our long portfolios (so far). We expected to gain $1.7M on a 20% drop and we have a 5% drop and we picked up $300,000 – so that’s about right as there’s also premium in our hedges that needs to burn off.

At the time, our STP was at $700,792 (from a $200,000 start) and yesterday we finished at $1,004,920 – a $304,128 (43.3%) that has more than offset the losses in our long portfolios (so far). We expected to gain $1.7M on a 20% drop and we have a 5% drop and we picked up $300,000 – so that’s about right as there’s also premium in our hedges that needs to burn off.

But we don’t really want our hedges to double up. We WANT the market to recover, the hedges just give us time to sit back and see if the 200 dma (5,716) holds and it we have tariffs being implemented next week and I predict more gutting of our Government and no grand earnings reports to save us so down we shall drift – searching for a bottom.

I wish I could say I have confidence in 5,700 holding on the S&P but tariffs are a TAX on the already struggling consumers – who have already been pushed to the limit and Government Spending is 36% of our GDP so a 10% cut in Government Spending is a 3.6% cut to our GDP which JUST yesterday was tracking 2.4% so 2.4% – 3.6% is NEGATIVE 1.2%. THIS IS JUST MATH, FOLKS!

Then there are layoffs. There are 3M Government Employees and laying off 10% of them puts 300,000 people out of work and, last month, we only had 140,000 job gains and our best month in the past 12 was 310,000 jobs so cutting 300,000 jobs ON PURPOSE is a lot and it also makes the Government harder to run and that means the 2.7M people you don’t cut (assuming Musk stops at 10%) will NOT magically become 10% more efficient and that means that the $6.3Tn (90%) that the Government has left to spend will not be distributed efficiently and that will delay projects and further impact employment.

Then there are layoffs. There are 3M Government Employees and laying off 10% of them puts 300,000 people out of work and, last month, we only had 140,000 job gains and our best month in the past 12 was 310,000 jobs so cutting 300,000 jobs ON PURPOSE is a lot and it also makes the Government harder to run and that means the 2.7M people you don’t cut (assuming Musk stops at 10%) will NOT magically become 10% more efficient and that means that the $6.3Tn (90%) that the Government has left to spend will not be distributed efficiently and that will delay projects and further impact employment.

And, of course, Government Funding is not 100% of most contracts. A lot of Government funding is in the form of stimulus (heard of it?) that SUPPLEMENTS private contracts – like Intel getting $8Bn to build $20Bn worth of Fab Plants in the US, which leads to jobs and competitiveness in our country. If you pull the $8Bn, the other $12Bn doesn’t get spent and there are no jobs, no factories, no American competitiveness.

The INTC supplement, under Biden’s CHIPS Act, was a massive project, expected to create 20,000 construction jobs, 10,000 direct and 50,000 indirect jobs with suppliers and supporting industries and those are long-term jobs as chips that were produced overseas would now be produced in the US. This is exactly the kind of thing Governments SHOULD be doing – building things, not destroying them!

8:30 Update: Those employees are 0.9% more expensive than they were last month as, of course, chasing down 7-11 clerks, dishwashers and farm hands with army guys tends to create a labor shortage and shipping immigrants off to Gitmo for the crime of wanting to fill those jobs also puts a damper on Personal Spending, which fell 0.2%. So our Corporate Masters end up paying more for Employees and collecting less from Consumer – what an amazing way to start off the first quarter and no, they did not expect this on their recent conference calls.

PCE Prices are up 0.3% in January, same as December but core PCE Prices, which is the Fed’s main indicator, are up from 0.2% to 0.3% – a 50% jump in a month and that plus higher labor costs means there is NO WAY we are seeing a Fed rate cut until the second half of this year – if ever.

I’m sure the Chicago PMI will be similarly disappointing at 9:45 – check in in our Live Member Chat Room for all the updates and our strategy going into this very scary weekend.

Have a good one,

-

- Phil