Day 43!

Day 43!

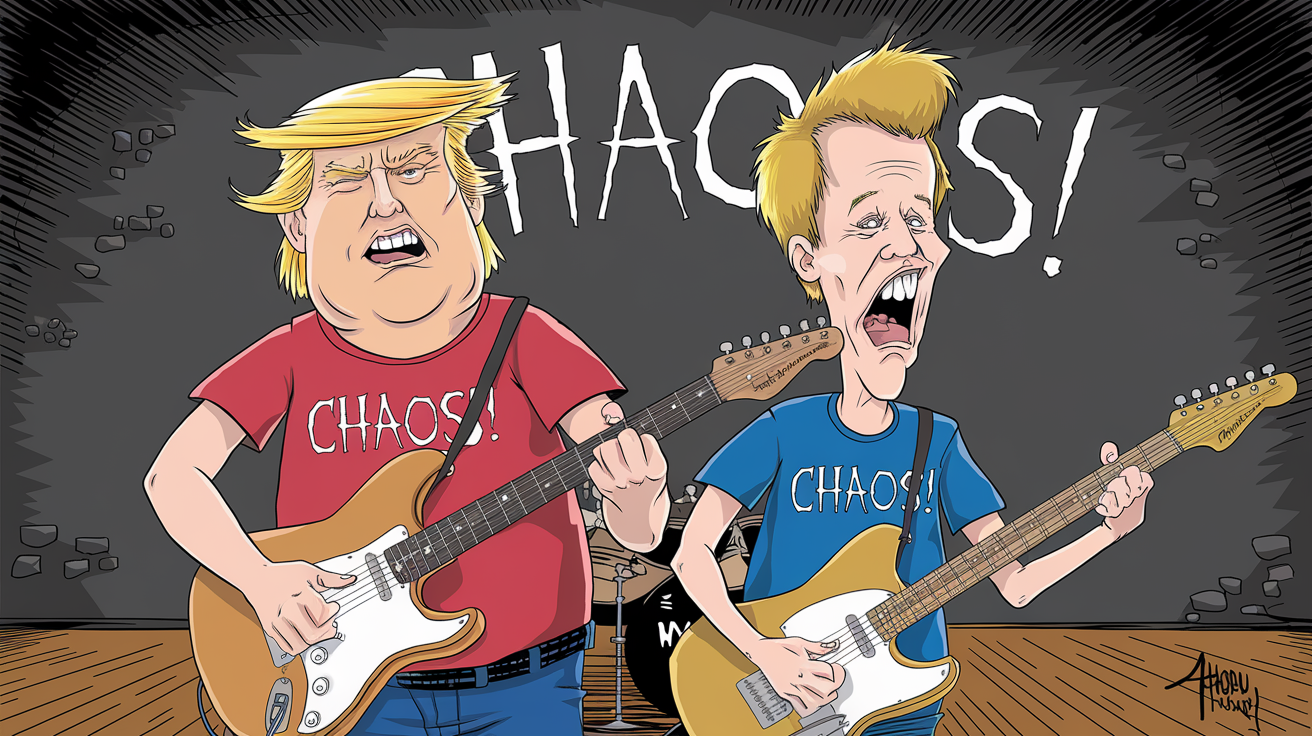

If you had asked Vladimir Putin how long it would take him to dismantle the US Economy and it’s institutions – EVEN if he had people in place at the highest levels of Government – I’m sure he would have said 6 months – at least. But, with the skill and pre-planning of the Heritage Foundation and the Project 2025 agenda they worked on a year in advance – this country has been unmade in just 43 days – it’s amazing.

Like a downturn in the market (which this has caused), all you can do it sit back and watch and wait for an opportunity to take advantage of the new trends. Guns are more available than ever and Liberals are running out and buying them in record numbers. NOT for hunting but due to “rising concerns about personal safety and a volatile political climate.”

Over 1/3 of the Democrats have now armed themselves, up from 22% in 2010 while 55% of Republicans have guns at home (but so many of them that there are 3 guns for each American overall). Still there’s a big difference between 55/22 and 55/33 – it’s almost a fair fight…

So far this year, there have been “only” 58 mass shootings (4 or more victims) in 62 days with 85 people killed and 193 people wounded around the US and that’s actually on through Feb 28th but March is starting with a bang a we have 5 incidents in the first 2 days and we’ll have to pick up the pace to match 2024’s 586 mass shootings – that’s almost two per day!

So far this year, there have been “only” 58 mass shootings (4 or more victims) in 62 days with 85 people killed and 193 people wounded around the US and that’s actually on through Feb 28th but March is starting with a bang a we have 5 incidents in the first 2 days and we’ll have to pick up the pace to match 2024’s 586 mass shootings – that’s almost two per day!

As noted by Boaty: Historically, the conditions developing in America today have proven to be powerful catalysts for widespread violence in other societies:

-

-

-

The 30% cut to SNAP benefits announced February 15th will affect 42 million Americans

-

Similar cuts in Argentina (2001) led to food riots and 39 deaths

-

Eviction moratorium ending March 31st threatens 7.7 million households

-

Research shows 1% increase in eviction rates correlates with 2.3% increase in violent crime

-

-

-

-

-

Mass deportation initiatives mirror those preceding ethnic violence in 1930s Nazi Germany

-

Removal of 14,500 career civil servants recalls Turkey’s 2016-17 purges

-

Identifying government employees based on political loyalty resembles Hungary’s institution-weakening under Orbán

-

-

-

-

-

Weimar Germany saw rising militias when unemployment reached 14%

-

Sharp increases in food prices preceded violence in 45 countries since 1970

-

Current basic food staple inflation hits 19.6% for lowest income quintile

-

-

-

-

-

46% increase in armed militia group membership since the November election

-

32% rise in concealed carry permit applications in Democratic-leaning counties

-

FBI reports 41% increase in politically-motivated threats since January

-

-

The classic warning signs identified by historians like Timothy Snyder are alarmingly present: economic desperation, institutional erosion, identification of “enemies within,” and militarization of civilian life. The Southern Poverty Law Center’s February 28th report notes that these elements create “perfect storm conditions” for civil unrest similar to historical precedents where democratic institutions were systematically dismantled during economic hardship.

I don’t want to be a bummer but I’m a professional trend-spotter and this trend is flashing bright-red as a warning sign at the moment. Losing money is one thing but losing lives is another so be a little more careful than usual out there – as things are getting much, much worse.

Now, turning our attention back to the self-made market disaster… Tariffs are upon us with the following taking place as of midnight last night:

-

-

-

New: 60% tariff on $300B of Chinese goods (up from 25%)

-

New: 25% tariff on $50B technology products

-

New: 100% tariff on Chinese vehicles, steel, and aluminum

-

Existing: 25% tariffs on $250B industrial equipment and components

-

-

-

-

-

New: 25% tariff on all automotive imports

-

New: 10% tariff on all manufactured goods

-

Existing: 25% tariff on steel (10% on aluminum)

-

-

-

-

-

New: 20% tariff on dairy products, wine, and spirits

-

New: 25% tariff on luxury vehicles

-

Existing: 25% on aircraft components, wines, spirits, and food items

-

-

-

-

-

Consumer electronics: 18-32% estimated price increase

-

Appliances: 12-22% expected retail price jump

-

Apparel and footwear: 10-15% immediate impact

-

Automotive: Estimated $3,900-5,800 per vehicle increase

-

-

-

-

-

Manufacturing: 287,000 job losses projected by year-end

-

Agriculture: $16.4B in reduced exports due to retaliatory tariffs

-

Retail: 54,000 job losses projected

-

Technology: 7.2% reduced R&D spending

-

-

China, Canada, Mexico and Europe are already retaliating so consider this JUST our half of the Tariff Wars but it’s our half that affects our country and our citizens because WE, the People, are the ones that pay Trump’s tariffs, not the countries whose goods he is taxing.

NOT including the reactions of our former allies, Trump’s Tariffs are expected to raise Consumer Prices by 1.8% in Q3, GDP will fall 1% or more, Consumer Spending will decline by 2.3% and Business Investment will drop 3.5% and that is JUST the self-inflicted damage from our own announcements – how hard is it for other countries to stop buying US Beer, Cigarettes, Cars, etc.? Europeans and Asians aren’t like us, they recycle! That means they actually pay attention to things and act together when required.

Target (TGT), for example is projecting NO SALES GROWTH for 2025 along with “meaningful” pressure on profit in the coming months. The muted outlook was accompanied by better-than-expected results for the fourth quarter. Comparable sales, including e-commerce, rose 1.5% in the period — above the average estimate and the third straight quarter of growth. Traffic rose, as did sales of apparel and hardlines like toys but that was before Trump took office and changed everything.

Target joins companies such as Walmart and Home Depot Inc. in taking a conservative outlook despite posting relatively healthy fourth-quarter results as executives try to decipher the impact of macroeconomic forces on their businesses. TGT CEO Brian Cornell said this morning that, due to tariffs, US Consumers would see “price increases over the next couple of days.” “We’re going to try to make sure we can do everything we can to protect pricing,” he said, “but there’s a 25% tariff and those prices will go up.”

Target joins companies such as Walmart and Home Depot Inc. in taking a conservative outlook despite posting relatively healthy fourth-quarter results as executives try to decipher the impact of macroeconomic forces on their businesses. TGT CEO Brian Cornell said this morning that, due to tariffs, US Consumers would see “price increases over the next couple of days.” “We’re going to try to make sure we can do everything we can to protect pricing,” he said, “but there’s a 25% tariff and those prices will go up.”

Other economic red flags include expectations that US inflation will remain high and the sharpest decline in consumer confidence since 2021. High grocery prices are squeezing lower-income consumers. In fact, Best Buy (BBY) just warned in their guidance as well and the hits are going to keep on coming in future Retail Reports.

It couldn’t be more clear – these companies are telling you that Q4 was great and Q1 is already looking like a crisis. What changed? You know me – I don’t like to point fingers. We report and YOU decide but America is already getting a case of Buyer’s Remorse – and it’s only day 43 out of 1,461 – IF we last that long…