Nothing has changed.

There are rumors that Trump will reverse the tariff deals he was just bragging about last night and I hope he does as the alternative is NOT GOOD for the Economy or the Markets. In the longest Presidential address to Congress in modern history (a staggering 100 minutes), Trump delivered what amounted to a campaign rally speech filled with exaggerations, falsehoods, and economic fantasies that will do little to assuage market fears or provide clarity on the administration’s true direction.

“We inherited an economic catastrophe and an inflation nightmare.”

FACT CHECK: FALSE. The data COMPLETELY contradicts this claim. When Trump took office, the US Economy was growing at 2.3% annually in Q4 2024, with 2.8% growth for the year overall. As the IMF confirmed, this was faster than any other G7 nation. The economy had low unemployment (4%) and inflation had already fallen from its 2022 peak of 9.1% down to 3% – still above the Fed’s target, but hardly a “nightmare.”

INVESTOR IMPACT: This kind of blatant misrepresentation of economic fundamentals creates confusion in markets that crave clarity. When a president’s baseline assessment is disconnected from reality, how can investors trust his policy prescriptions? The Dow’s 670-point plunge yesterday and continued volatility today reflects this uncertainty.

“We will take in trillions and trillions of dollars and create jobs like we have never seen before.”

FACT CHECK: HIGHLY MISLEADING. This claim about tariff revenues is mathematically impossible. Total US imports last year were about $3.3 trillion. Even with aggressive tariffs, the Peterson Institute calculates that a 10% across-the-board tariff plus 60% on Chinese goods would generate only about $225 billion annually – nowhere near “trillions.”

More importantly, tariffs are paid by US importers, not foreign countries, and the costs are passed to American consumers and businesses. The 2019 trade war with China proved this conclusively, with academic studies showing that US consumers and companies bore virtually all costs.

INVESTOR IMPACT: This fundamental misunderstanding (or misrepresentation) of how tariffs function creates dangerous market conditions. Sectors heavily dependent on imports like retail (TGT -3%, BBY -13.3%), consumer electronics, and automotive manufacturers face margin compression and reduced consumer demand. Supply chains built over decades cannot be quickly reconstructed without significant economic pain.

“We will hold back on the agricultural tariffs coming into America, and our farmers… it may be a little bit of an adjustment period.”

FACT CHECK: EUPHEMISTIC UNDERSTATEMENT. Trump’s admission that farmers will face an “adjustment period” dramatically understates the pain coming their way. When he implemented similar policies in his first term, US agricultural exports plummeted as countries like China imposed retaliatory tariffs, forcing the administration to provide more than $20 billion in emergency aid to farmers.

Now, China has already announced 10-15% retaliatory tariffs on US agricultural products effective March 10, and Canada is imposing immediate 25% tariffs on $30 billion of US goods (expanding to $86 billion in 21 days). Mexico’s response is expected this weekend.

INVESTOR IMPACT: Agricultural commodities and related stocks face intense pressure. The trade war’s “adjustment period” in Trump’s first term saw farm bankruptcies spike 20% in 2019. Companies like Deere & Co, ADM, and Bunge will likely see earnings pressure, and rural banks with agricultural loan exposure face increased default risks.

“Today, interest rates took a beautiful drop, big, beautiful drop. It’s about time.”

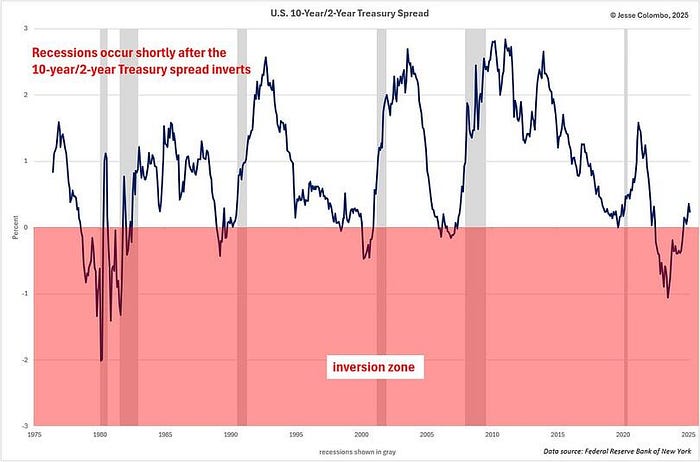

FACT CHECK: MISLEADING CONTEXT. While the 10-year Treasury yield did fall to its lowest level since October, this wasn’t a positive economic signal but rather a warning that investors are spooked about growth prospects. Bond yields typically drop when economic uncertainty rises or recession fears mount.

INVESTOR IMPACT: The yield curve behavior isn’t signaling investor confidence but rather mounting concerns that Trump’s trade policies could trigger a recession. The Atlanta Fed’s GDPNow tracker (chart above) has already slashed its Q1 forecast from +2.3% two weeks ago to -2.8% now – signaling a potential contraction that could force the Fed into emergency rate cuts.

“The egg price is out of control — and we are working hard to get it back down.“

FACT CHECK: MISLEADING ATTRIBUTION. Egg prices have indeed soared to historic highs, but attributing this to Biden’s policies is factually incorrect. The price spike is directly tied to an avian flu outbreak that has killed millions of chickens and reduced egg production. It’s a supply-side issue caused by a disease, not a policy failure.

Ironically, Trump’s DOGE initiative recently fired numerous USDA officials working on the government’s response to bird flu, only to reportedly attempt to rehire some of them when the consequences became apparent.

INVESTOR IMPACT: This type of simplistic, misleading attribution of complex economic problems to political opponents does nothing to address the actual challenges. Investors should be wary of administration policies based on such flawed analyses, as they’re unlikely to address the real issues affecting markets.

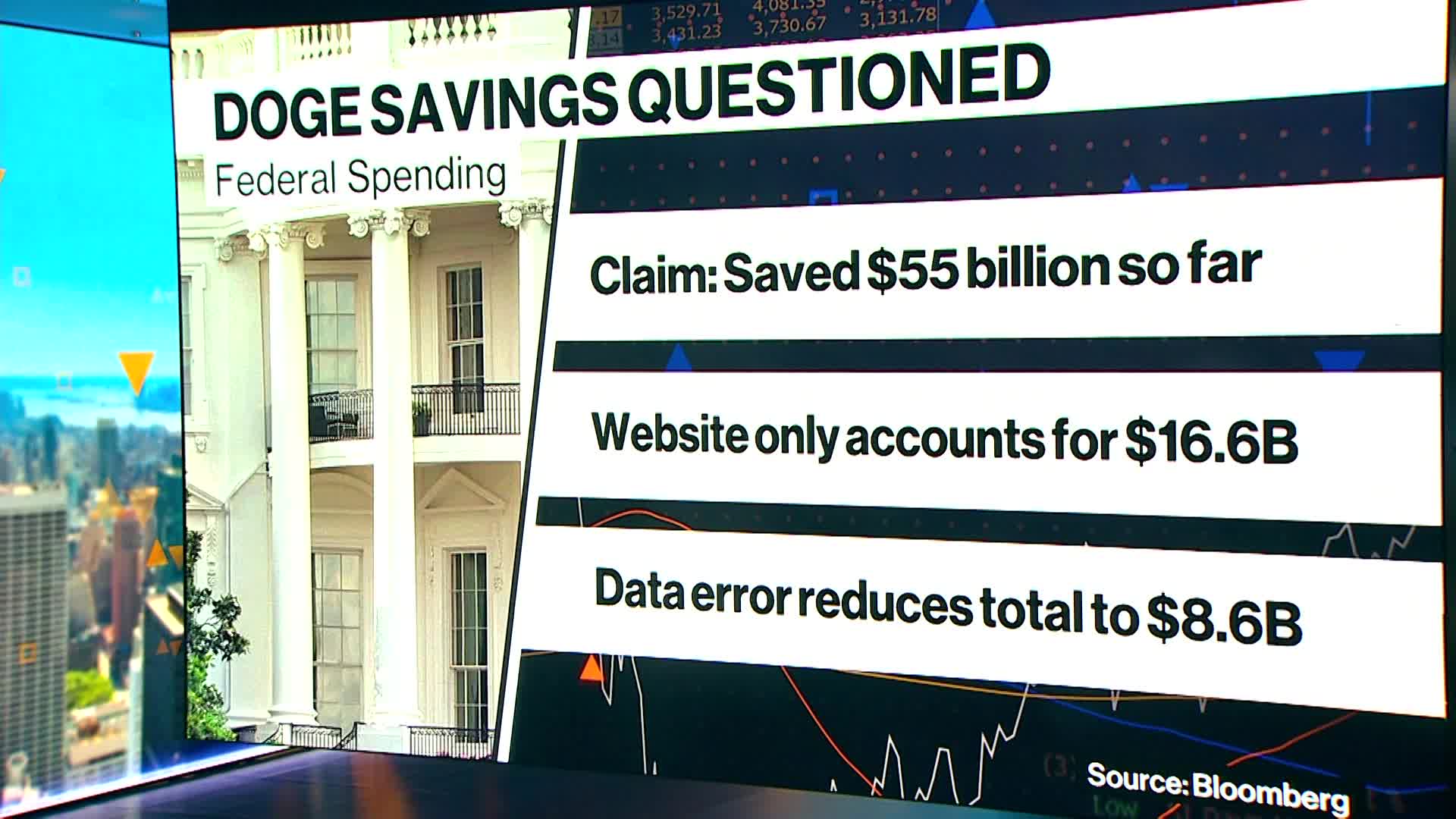

“We found hundreds of billions of dollars of fraud.”

FACT CHECK: NO EVIDENCE SUPPORTS THIS CLAIM. Trump’s praise of Elon Musk’s Department of Government Efficiency (DOGE) claimed they uncovered “hundreds of billions of dollars of fraud” in federal spending, but there’s no evidence backing this dramatic figure. DOGE’s own website claims $105 billion in savings from various initiatives, but has only published receipts for about $18.6 billion in cancelled contracts and leases.

Even these numbers contain accounting errors – for example, DOGE initially claimed an $8 billion savings from an immigration agency contract cancellation, later corrected to $8 million (a 1,000x overstatement). It is truly staggering to have the President of the United States stand up and spend 100 minutes BLATANTLY LYING to Congress and the American People – THAT is what was unprecedented about Trump’s speech.

INVESTOR IMPACT: The credibility gap here should concern investors. Government efficiency improvements are laudable, but wildly exaggerated claims suggest policy is being driven by political theater rather than sound fiscal management. Companies dependent on government contracts face unpredictable cancellations based on political considerations rather than performance or value.

“Small-business optimism saw its single largest one-month gain ever recorded, a 41-point jump.”

FACT CHECK: FALSE. According to the National Federation of Independent Business Research Center, small business optimism rose by 13 points from December 2024 to January 2025 – not 41 points. While this was indeed the largest one-month increase since monthly surveys began in 1986, it’s nowhere near Trump’s claimed figure and it’s an extremely volatile index based on sentiment surveys, not data.

INVESTOR IMPACT: This pattern of numerical exaggeration creates a troubling picture for investors trying to gauge economic trends. When basic economic indicators are routinely inflated by 5x, it becomes impossible to assess the actual state of the economy or make informed investment decisions.

“The previous administration cut the number of new oil and gas leases by 95 percent.”

FACT CHECK: MISLEADING CONTEXT. While the Biden administration did approve fewer acres for leasing (316,000 vs. 6 million under Trump), this didn’t constrain production. US oil and gas production reached record highs under Biden, and energy companies logged some of their most profitable years. The decrease in new leases was based on encouraging companies to first use millions of already-leased acres.

INVESTOR IMPACT: Energy investors should parse these claims carefully. Despite the rhetoric about regulatory changes, the energy production landscape is largely shaped by market forces, OPEC+ decisions, and global demand patterns. Energy stocks remain vulnerable to volatility from policy uncertainty.

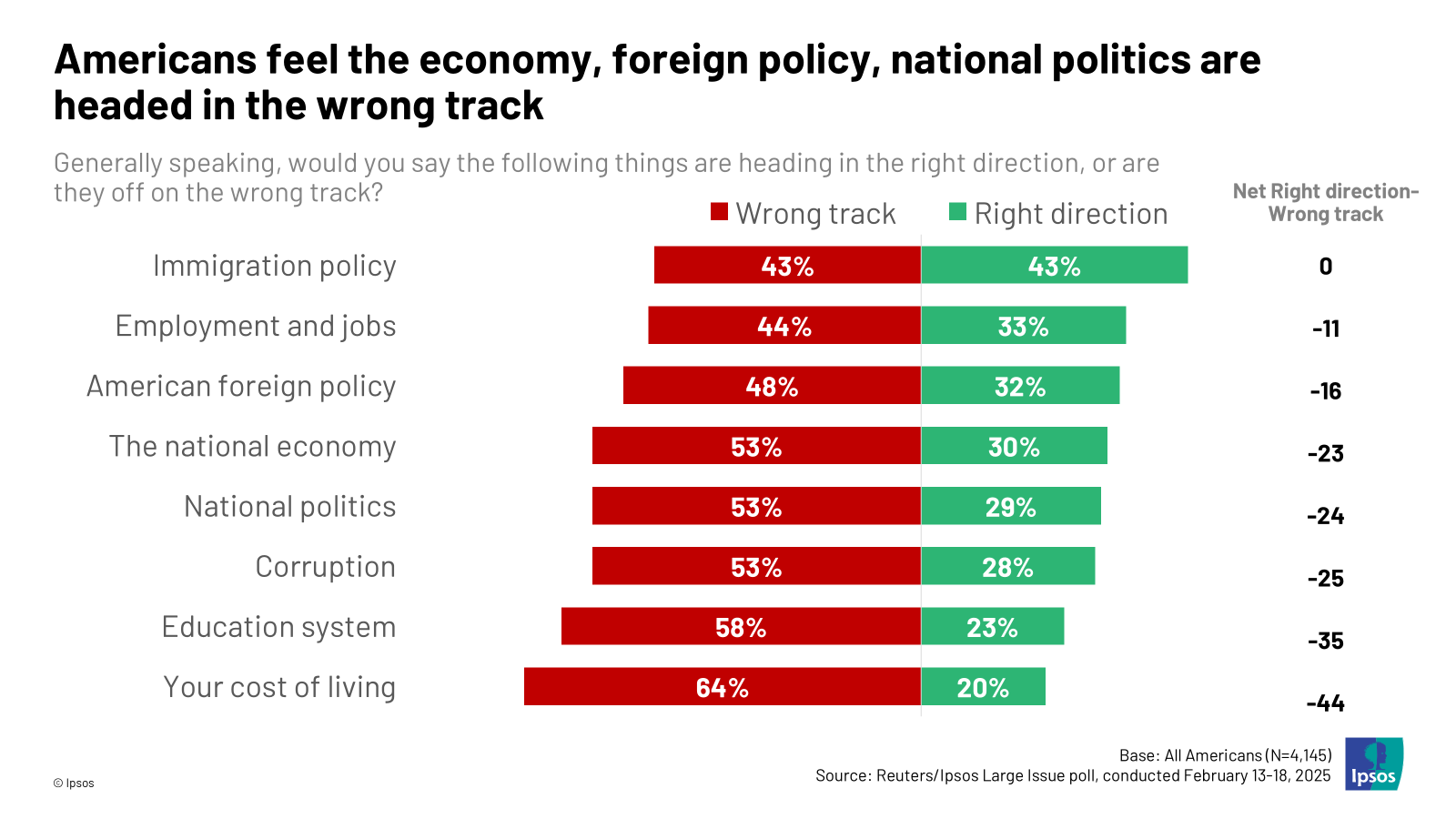

“Now, for the first time in modern history, more Americans believe that our country is headed in the right direction than the wrong direction.”

FACT CHECK: CHERRY-PICKED DATA. This claim appears based solely on a single Rasmussen (Conservative Pollster) poll showing 47% right direction vs. 46% wrong direction. Multiple other polls show the opposite: Morning Consult (55% wrong direction), YouGov/Economist (48.9%), and Marquette University (62%).

INVESTOR IMPACT: The selective use of polling data to create a narrative of overwhelming support masks the deep divisions and uncertainty that continue to affect consumer and business confidence. This disconnect between rhetoric and reality contributes to the market’s wary stance.

“Japan and South Korea and other nations want to be our partner with investments of trillions of dollars each. It’s all set to go.”

FACT CHECK: EXTREME EXAGGERATION. No evidence supports claims of “trillions” in investment from Japan and South Korea. Trump referred specifically to the Alaska LNG project, estimated at $44 billion TOTAL – not “trillions.” Japanese officials made no commitments, stating only that “if good business relations were maintained, investment in the U.S. will progress in various fields.“

INVESTOR IMPACT: Energy infrastructure investors should approach these claims with extreme caution. The Alaska LNG project has been viewed as economically challenging for years, and vague promises of foreign investment don’t change the fundamental economics. The 50x inflation of investment figures suggests a total disregard for the intelligence of the audience and is a shining example of Trump’s willingness to say anything – no matter how blatantly untrue – to mislead the voters.

The Macro Investment Picture

Looking beyond the blatant factual inaccuracies, the speech revealed several concerning trends for investors:

- Policy Unpredictability: Trump hinted at further tariff escalation while simultaneously suggesting some deals might be imminent. This whipsaw approach creates immense uncertainty for companies trying to plan supply chains and pricing strategies.

- Stagflation Risk: The combination of tariff-induced price increases (inflationary) with economic slowdown (contractionary) creates classic stagflation conditions that are particularly challenging for central banks and businesses alike.

- Geopolitical Realignment: Trump’s shifting stance on Ukraine, praise of Putin, and antagonistic approach to traditional allies like Canada and Mexico signals a fundamental reordering of global relationships with profound implications for multinational corporations.

- Fiscal Contradiction: The simultaneous promises of massive tax cuts and increased revenues from tariffs are mathematically incompatible, suggesting difficult fiscal choices ahead that will impact government bond markets.

Market Implications

The overnight market response tells the story: a brief relief rally followed by renewed volatility. The speech offered sound bites but no coherent economic framework, leaving investors to navigate the wreckage of established trade relationships without a clear path forward. Germany has become the new “safe haven” for investors – running up 3.3% after Trump’s speech – an all-time high for the DAX.

For investors, several areas deserve focus:

- Consumer Discretionary: Tariffs will disproportionately impact retail (Target, Best Buy) as higher costs force price increases in an already cautious consumer environment.

- Technology: Semiconductor and tech hardware companies face complex threats from both direct tariff impacts and potential retaliatory export restrictions.

- Agriculture: Already signaled for “adjustment,” the farm sector will likely require additional government support as export markets shrink.

- Defensive Sectors: Consumer staples, utilities, and gold continue to outperform in this environment of heightened uncertainty.

- Bonds: Yield curve movements signal growing recession concerns, with 2-year yields dipping below 4% as markets now anticipate Fed rate cuts sooner than previously expected in an attempt to stave off the coming Economic collapse.

The fundamental problem remains: when a President’s economic statements are so consistently disconnected from measurable reality, investors are left trying to trade on rhetoric rather than fundamentals – a recipe for continued volatility and market dislocations.

The fundamental problem remains: when a President’s economic statements are so consistently disconnected from measurable reality, investors are left trying to trade on rhetoric rather than fundamentals – a recipe for continued volatility and market dislocations.

As the dust settles on this first major address, one thing is clear: the chaos has just begun, and “sucker rallies” should be viewed with extreme skepticism. The real economic impact of these radical policy shifts will take months to fully manifest, with pain points certain to emerge in unexpected places.