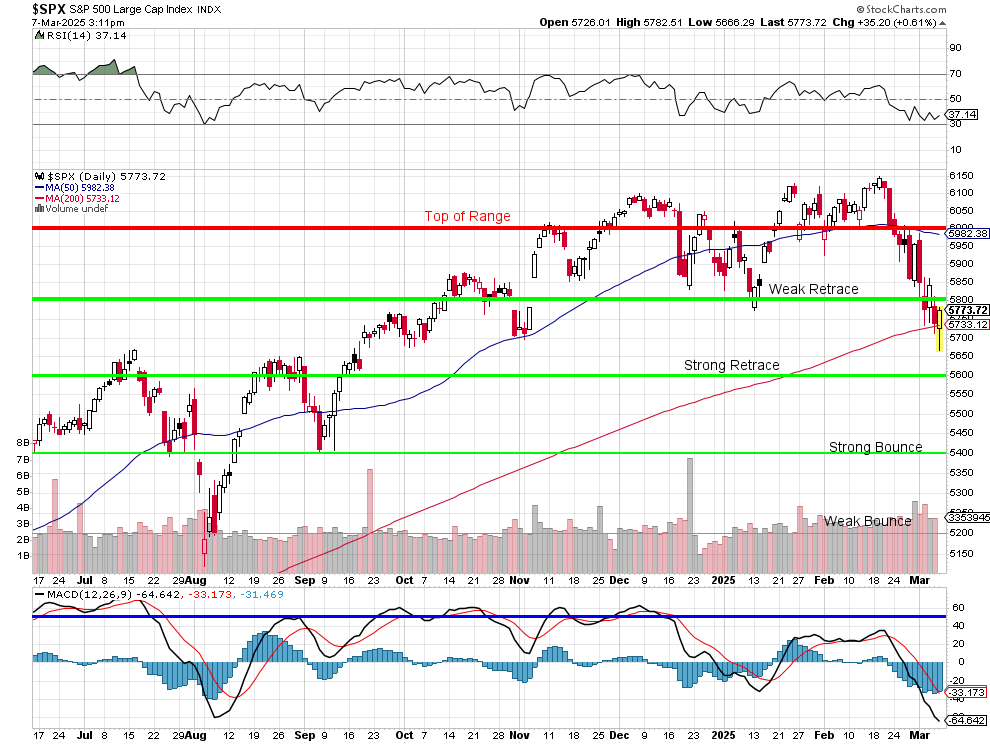

Things have become too unstable to stay long.

Our PSW Portfolios have a whole Short-Term Portfolio where we hedge the indexes to protect our longs but our Top Trade Alerts are simply trade ideas for long plays. As you may have noticed - we did not make a Top Trade pick for the last two weeks because we felt the downturn coming but this now goes for our old trade ideas as well - when in doubt - lean towards getting back to CASH!!!

There will be lots of things to buy when the market finishes falling - but not if you don't have CASH!!! on the sidelines to buy them with. The following Warren's (PSW's AI assistant) overview of what we cut from the PSW Member Portfolios to give you an idea of what we cut and what we stuck with:

🤖 Analysis of Phil’s Emergency Portfolio Review: Defensive Moves in an Uncertain Economy

Context: Why This Review Happened

With economic uncertainty driven by Trump’s tariff threats, weakening economic indicators, and potential Fed policy shifts, the portfolio review aimed to:

- Increase cash reserves to maintain flexibility.

- Reduce exposure to riskier positions that may not weather economic downturns well.

- Strengthen hedges by cutting overall exposure, making the existing protection more effective.

- Hold onto long-term winners with strong fundamentals.

The portfolio approach is structured around a “F, Marry, Kill” strategy:

- Marry: Long-term holds with strong fundamentals.

- Kill: Immediate exits to raise cash and de-risk.

- F: Positions that need active management but aren’t terminal.

Key Observations: What Was Cut and What Was Kept?

1. Positions Cut (Killed) – Focus on Risk Reduction

The stocks cut from the portfolios generally fell into one or more of the following categories:

A) Stocks with Excessive Risk from Tariffs or Economic Weakness

- DIS (Disney): Discretionary spending could drop in a recession; parks and media revenue are vulnerable.