$42,018!

$42,018!

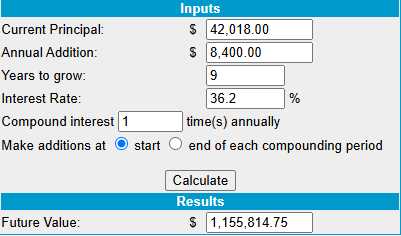

Surprisingly, we are UP $2,476 since our Feb 11th review and that includes our $700 monthly contribution, of course. Overall, we’ve put $21,700 into the portfolio over 31 months and we’ve just about doubled – up $20,318 (93.6%), which is an average of 36.2% per year, which means we are less than 9 years away from our $1M goal – 20 years ahead of schedule!

That means you can start now, with a fresh $42,018 and then put in $700/month ($8,400/year, $75,600 total) and PRESTO!!! You are a Millionaire. Yes it is slow, yes it is tedious but IT WORKS!!! That is the point of this portfolio – to teach the old adage that “slow and steady” can indeed win the race.

Usually, this is a very low-touch portfolio but on Friday, we were expecting more downturn so we cut NOK, PARA, T, WBA, STLA, BXMT (puts only) and TRVG – leaving us with a whopping $25,184 to deploy and, hopefully, it’s time to go shopping but first we’ll need to see a good bounce from the indexes.

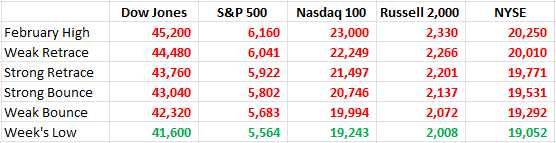

Our new bounce chart (with new lows), now looks like this:

Keep in mind those greens on the bottom line are free because those were the lows – so we can’t be below them! So this is as bad as a bounce chart can get and the rule of thumb is that, if we can’t make and hold the Strong Bounce Lines by Friday (usually we give it a week but 4 days is good), then we are more likely to be consolidating for a move lower – not higher.

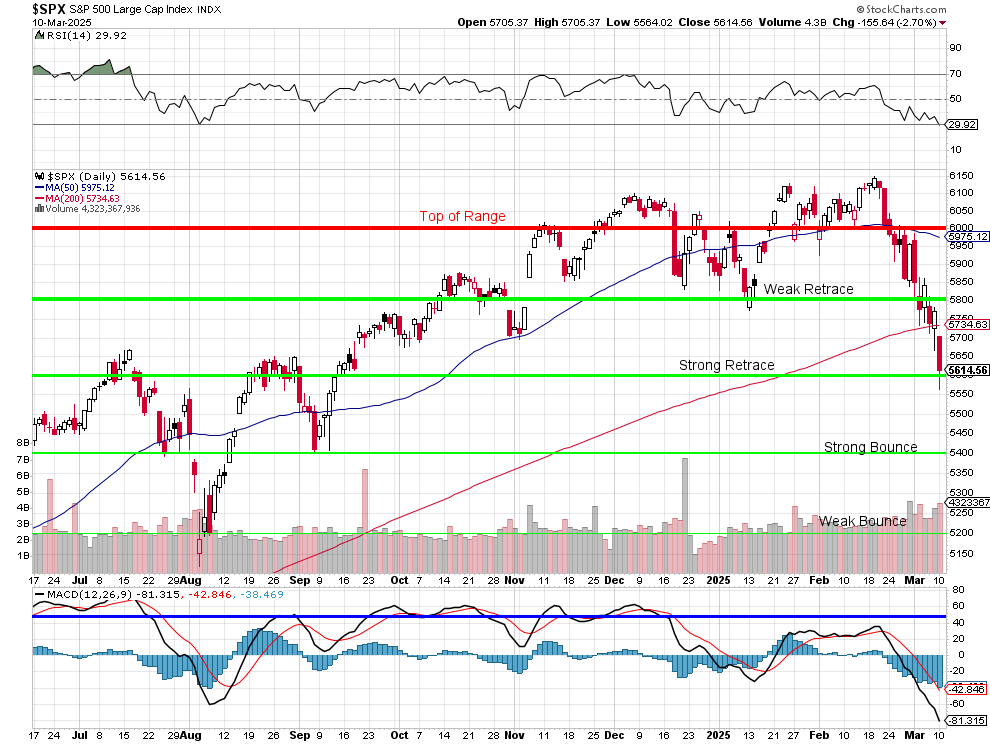

On the S&P 500 Chart, we can see the break below the Weak Retrace last week, followed by the pause at the 200-day moving average and then the break below to the next support (Strong Retrace) yesterday. These are the same lines we used all of last year to predict the movement of the indexes using our fabulous 5% Rule™. So there will certainly be nothing impressive about a Weak Bounce (5,683) off the Strong Retrace Line but a Strong Bounce (5,802) would have to break back over the 200 dma and the Weak Retrace Line – THAT would be impressive but also not likely, unfortunately.

Trump is having an meeting with 100 CEOs of companies including AAPL, WMT and JPM today but it’s actually the “normal” “Business Roundtable” but hope springs eternal that Trump will wave his magic wand and “fix” things but he met with Tech Leaders yesterday and that certainly didn’t help so I’m not expecting much today. Nonetheless, the Futures are up a bit in anticipation but we’re not going to fall for it – that’s what the Bounce Chart is for – to take the emotion out of our trading at these inflection points.

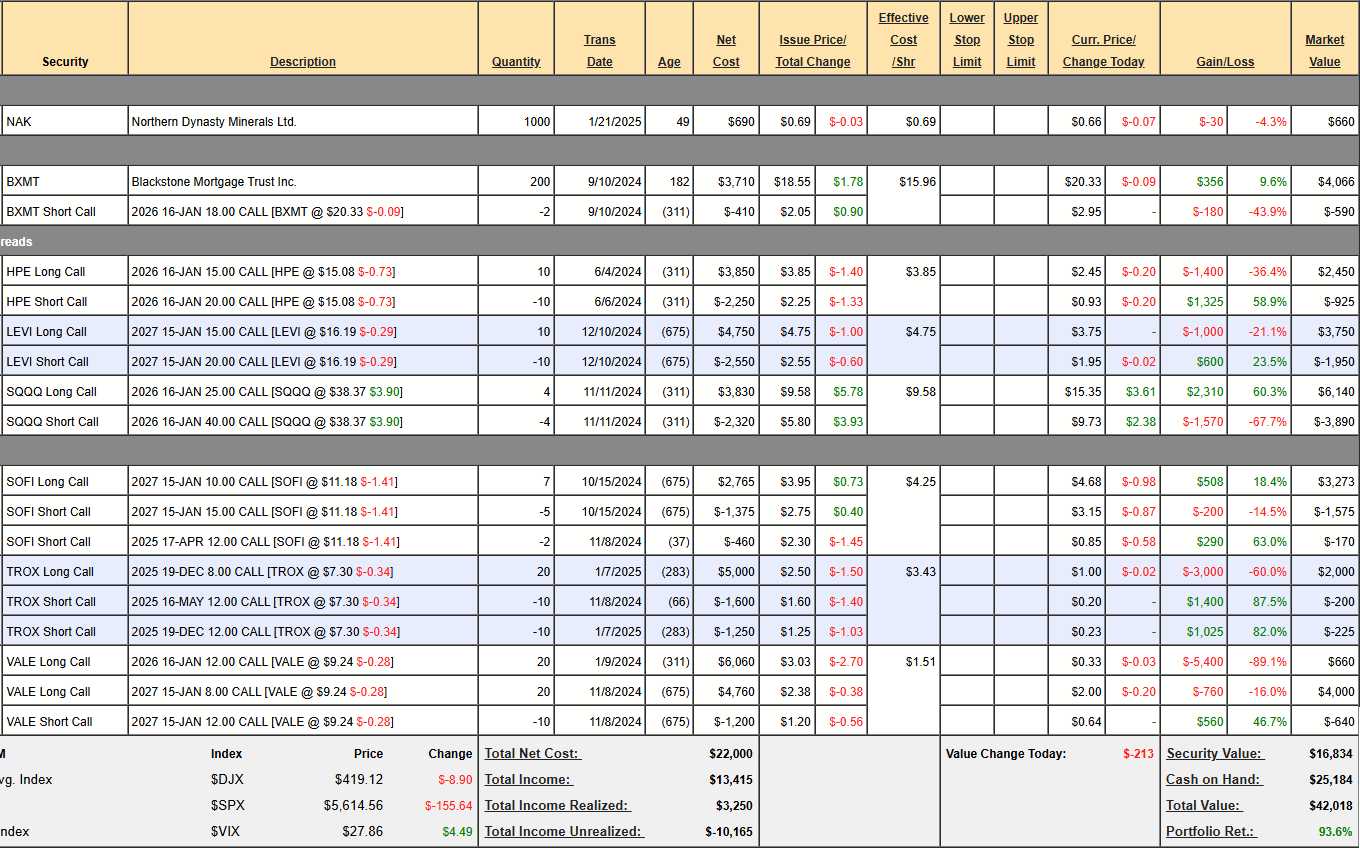

With that being said, let’s take a look at our $700/Month Portfolio and see where we stand:

Keep in mind, these are the positions we committed to last week with the expectation that the market could drop another 20% and our intention is to ADD to the positions for the long-term. We should look to deploy our capital for that purpose before going after new positions so let’s take a very careful look at what we have:

-

- NAK – Our premise here is that Trump will reduce or eliminate the environmental considerations (toxic run-off that can impact the salmon population) that have been holding back the mining for over a decade. It’s a relatively small-potato item that we did not expect to be addressed in Trump’s first 100 days so – patience – but notice what happened last time Trump took office.

-

- BXMT – Paid a nice 0.47 dividend on Dec 31st. We’re over our call-away target at $18 ($3,600) and the spread is net $3,476 so we will make $124 at $18 PLUS 4 x $94 ($376) in dividends is $500, which is 14.3%. We COULD do better but we don’t need the cash so no reason not to keep it for now.

You know, there are some traders who would be TRILLED to make 14.3% a year on such a simple, reliable trade – you guys are spoiled!

-

- HPE – We just discussed last week how this is a bit of a falling knife but $15 was the base for our original trade so let’s buy another year by rolling the 10 Jan $15 calls at $2.45 ($2,450) to 10 2027 $15 calls at $3.35 ($3,350) for net $900. That buys us another year to bounce back and, once the short Jan $20s expire, we will get our $900 back selling 2027 whatevers.

-

- LEVI – Also back at the bottom of the range and our decision is simple (after first deciding to keep the stock, of course) – can we roll $1 in strike lower for 0.50 or less? The 10 2027 $15s that we have are $3.75 and the 2027 $10s are $6.85 for net $3.10 – too much! BUT, the $13s are $4.80 and net $1.05 ($1,050) for a $2 roll isn’t bad – so let’s do that!

Since we KNOW we like to roll down $1 for 0.50 – we don’t need to wait for a perfect bottom because, if it goes lower – we’re happy to roll it again!

-

- SQQQ – We are $13.37 in the money so, if the Nasdaq stays down, we’ll net $5,348 but the current net of the spread is just $2,250 so we have $3,098 worth of downside protection and another potential $652 if SQQQ goes over $40. That’s money we have coming to us at this level so we can certainly afford to spend a few Dollars improving the positions.

-

- SOFI – Earnings were a nice beat and this bank keeps growing but caught up in the downturn. Fortunately, we sold the April $12 calls and those are back on track. I’d like to buy 3 more 2027 $10 calls for $4.68 ($1,404) and sell 2 2027 $17s for $2.75 ($550) for net net $854 and we’ll make that back selling a few extra short calls when we bounce back.

-

- TROX – This is SO STUPIDLY CHEAP that I want to buy back the short May ($200) and Dec ($225) calls, which are up over 80% and we’ll give them a chance to bounce. While it’s tempting to double down – this is not that kind of portfolio.

-

- VALE – Very disappointing but also very cheap. We already added the new 2027 half-covered position and we’re waiting for a bounce to sell short-term calls. The June $10s are 0.33 which isn’t much but if we can sell 101 days for $500, that’s $3,000 we can generate while we wait on the net $4,020 position and that makes it much more likely we can profit – so the potential is still there – we just have to be patient.

So we’ve spent $3,229 of our $25,184 adjusting our positions and that leaves us with a nice $21,955 left to spend. Taking a look at our Watch List, I see BAX, CIM, CLF, CNH, F, FF, FL, GOLD, IVZ, JWN, KEYLA, KLG, KHC, MGM, MP, MRNA, NLY, OLN, PFE, RKT, SONY, TNDM, TWO, VRTS & XRX as potential fits – so there’s PLENTY of things we can buy – but not yet.

Even as I’ve been writing this, the Futures turned down again so CASH!!! is still king and, if anything, I’m tempted to add more hedges more so than buying new longs – sadly.

Small Business Optimism (and we mainly have small caps here) dropped to 100.7 in Feb from 102.8 in Jan and that is NOT GOOD! So let’s watch our Bounce Chart and make sure things are all clear before diving back into the pool but I do think we’ll be rolling more longs before it’s time to add new positions.

Be careful out there.

— Phil