Thank God for hedges!

Thank God for hedges!

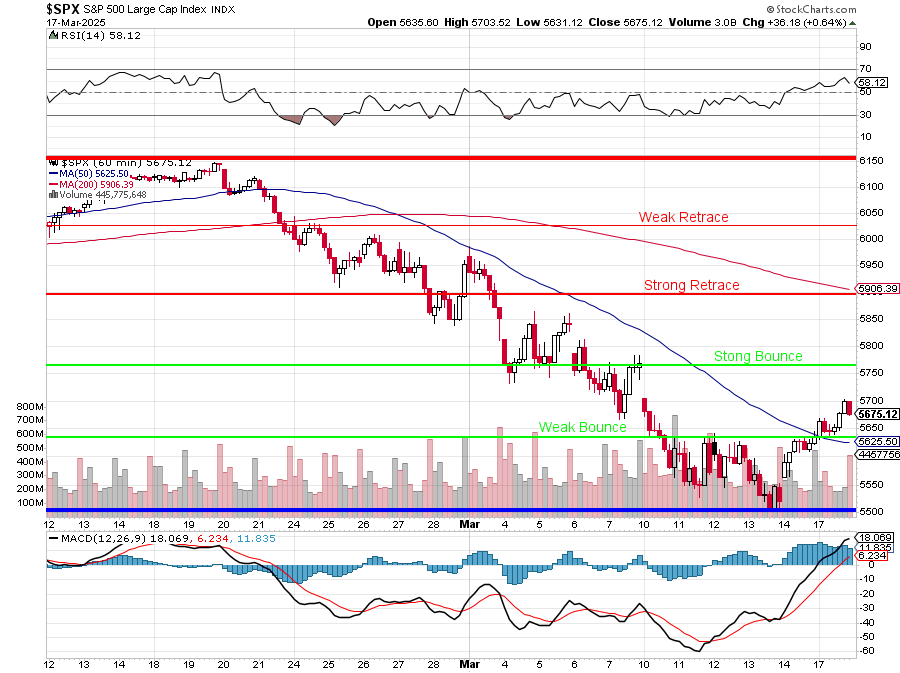

Timing helps too. In our February Portfolio Review, we had just crossed the $4M mark for our paired Long-Term & Short-Term Portfolios (LTP/STP) and the S&P 500 was sitting at just under it's all-time high (the next day!) at 6,114 and we had just begun to protect our positions and add to our hedges in anticipation of the coming correction.

At the time we thought a 20% drop would be off the table but we EXPECTED a 10% drop (the one we just got) but, since then, Tariffs, Measles, Bird Flu, Inflation, Consumer Confidence, Trump and Musk (and Government Spending Cutbacks) have us leaning more towards a 20% drop overall - despite the recent 3.6% bounce.

Fortunately, in our Short-Term Portfolio Review, we added $347,500 more protection in SQQQ and pulled some short calls from TZA - flipping us much more aggressively short and then, on March 6th, we doubled down to over $2M worth of protection as we began to fail the Strong Bounce Line.

Certainly we have no regrets as the weeks that followed have been a bloodbath. Here's the 1-month performance chart for the S&P 500 - a veritable sea of red with tariffs to be enacted in two weeks.

By cutting back our positions, selling more short calls against our longs and doubling down on hedges - we simply skipped the carnage - which is actually better than "riding it out", which we were originally prepared to do but the drop had such an obvious catalyst (tariffs/trade wars), that we were confident in our timing and decided to step away from the cliff.

Now comes the hard part - when do we get back in?

Short-Term Portfolio Review (STP): $1,071,937 is up $362,145 (51%) since our last review and that's how it should be as these are our hedges.