We did not think the Fed was bullish.

We did not think the Fed was bullish.

Not only that but Powell’s comment that tariffs would only cause “transitory” inflation harkened back to Covid-times (5 years ago), when Powell said the inflation (which we are still fighting today) would be TRANSITORY. It amazes me that he would use the same word he used in what is universally considered the biggest mistake of his career but that just shows you how terrified everyone in Government is of upsetting the President.

While the Fed held rates steady they cut their Quantitative Tightening program (reducing their balance sheet) from $25Bn a month to $5Bn a month – a pace that will now bring them back from $7Tn to $1Tn over the course of 1,400 months (116.66 years – a nod to lord Trump). Perhaps “transitory” is Powell’s sad cry for help – his warning to America that he’s being forced to make the statement and doesn’t believe a word of it himself.

Unlike pandemic-driven supply shocks, tariffs introduce structural distortions that linger. Higher input costs for steel, aluminum, and consumer goods ripple through production chains, embedding inflation into final prices and Powell knows this as well as anyone on the planet.

🚢 Why Slow QT Now?

-

-

-

-

Liquidity Concerns: The Treasury is operating under a debt ceiling constraint, forcing it to draw down cash reserves at the Fed to fund obligations. This injects liquidity into markets, complicating QT efforts.

-

Market Stability: The Fed fears excessive tightening could destabilize financial markets, reminiscent of the September 2019 repo crisis when liquidity dried up unexpectedly.

-

Political Pressure: Trump’s administration has made clear its preference for loose monetary conditions to offset the economic drag from tariffs and other policy changes.

-

-

-

Implications of Slowing QT

-

-

-

-

Inflation Risks: A slower pace of QT leaves excess liquidity in the system, potentially fueling inflation even further.

-

Credibility Erosion: The Fed’s inability to decisively unwind its pandemic-era interventions undermines its long-term credibility as an independent institution.

-

Market Distortions: Artificially low long-term rates could create bubbles in equities and real estate while mispricing risk across financial markets.

-

-

-

We are less than two weeks away from Trump’s tariffs going into effect and the fact that he wimped out on March 2nd is fooling traders into thinking he’ll back down on April 2nd as well. It’s possible – Trump might go through the next 4 years kicking the tariff can down the road – one month at a time but, if he doesn’t… Then we’re looking at 25% tariffs on Canada and Mexico and 20% on China and 50% on steel and aluminum and Reciprocol Tariffs on EVERYONE ELSE – whatever that actually means.

We are less than two weeks away from Trump’s tariffs going into effect and the fact that he wimped out on March 2nd is fooling traders into thinking he’ll back down on April 2nd as well. It’s possible – Trump might go through the next 4 years kicking the tariff can down the road – one month at a time but, if he doesn’t… Then we’re looking at 25% tariffs on Canada and Mexico and 20% on China and 50% on steel and aluminum and Reciprocol Tariffs on EVERYONE ELSE – whatever that actually means.

Core Inflation, currently at 2.8%, is projected to be back around 3.5% with Tariffs. That is the point at which the Fed began TIGHTENING to get inflation under control. Forget rate cuts – we should be expecting rate HIKES in a rational world. Powell saying that a permanent 10% tariff will cause “transitory” inflation indicates some kind of fantasy where the prices of goods drop 10% to offset the tariffs. In reality, it’s simply 1984-styled Double-Speak where a lie, if repeated often enough, begins to sound like the truth.

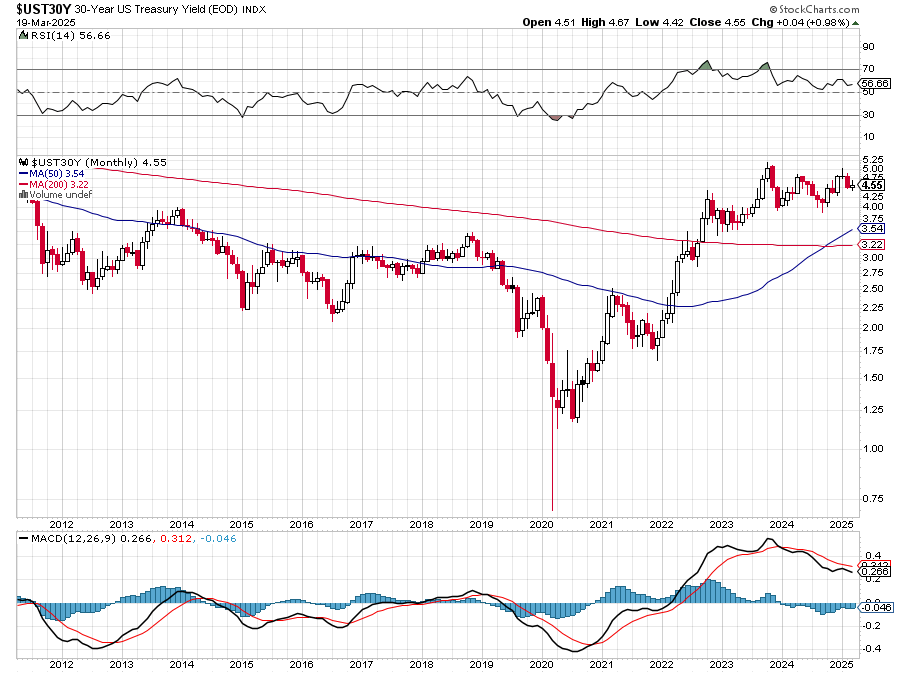

The rest of the World isn’t buying Trump & Powell’s bullshit. Last week (13th), 30-Year Bonds were auctioned off at 4.623% and Foreign Buyers took only 60% of the debt, signaling a waning International appetite for US debt amid tariff-induced uncertainty. Though it is back to 4.55% this morning, note the bullish cross of the 50-day moving average – we are just one small policy mistake away from 5%:

5% on $38Tn in debt is $1.9Tn per year in interest payments alone. THAT is the path we are on by adding inflationary tariffs and, even worse, pretending there won’t be any negative consequences – like children who have never learned basic math or science making statements that are prima facie ridiculous. When adults are involved – we call it INCOMPETENCE!

That will be $900Bn MORE than we’re currently paying for debt service and the $1Tn we are currently paying is 150% more than we paid last year – THAT is how fast this is becoming a crisis (which no one is talking about). So, essentially, the Administration is cutting Government and cutting services and cutting budgets (including health and education) in order to spend more money paying interest on the debts they are making worse with those same policies. MADNESS!!!

All this interest money funnels out to the Banksters (and their Top 1% owners/depositors), who are simply loving Trump’s policies of redirecting (I’m not saying robbing as it’s still Lent) money from the poor to the rich in every possible manner. And, of course, all this weakens the Dollar and the weak Dollar reprices stocks higher and THAT was the main reason we had a “rally” yesterday:

That’s been reversing this morning as the analysis (like ours) of the situation matters more than the rhetoric and the same overseas crowd that wasn’t buying bonds last week is interested in buying Dollars at 103 because, in reality, the Fed can’t lower rates under these circumstance and there’s nothing coming down the pike that looks like these circumstances are going to change between now and the May 6th Fed meeting – and that’s going to give tariffs a whole month to show their actual effects.

Or, HOPEFULLY, Trump is full of crap and he’ll find another excuse to back down on the tariffs and all this worry will be for nothing? That’s what the dip-buyers are thinking – their investing premise is the US has no cohesive policy, a weak to the point of non-existent Congress and Judicial branch and a President whose word can’t be trusted from minute to minute. Does that really make you want to invest in US markets?

GOLD is where the money is going at the moment – up 55% since last year and up 16.66% in Q1 (so far). So up 39% in 2024 and up 16% in Q1 of 2025 is accelerating twice as fast since team Trump took charge while the once-mighty Dollar is down 6.66% (funny how that keeps coming up) as well.

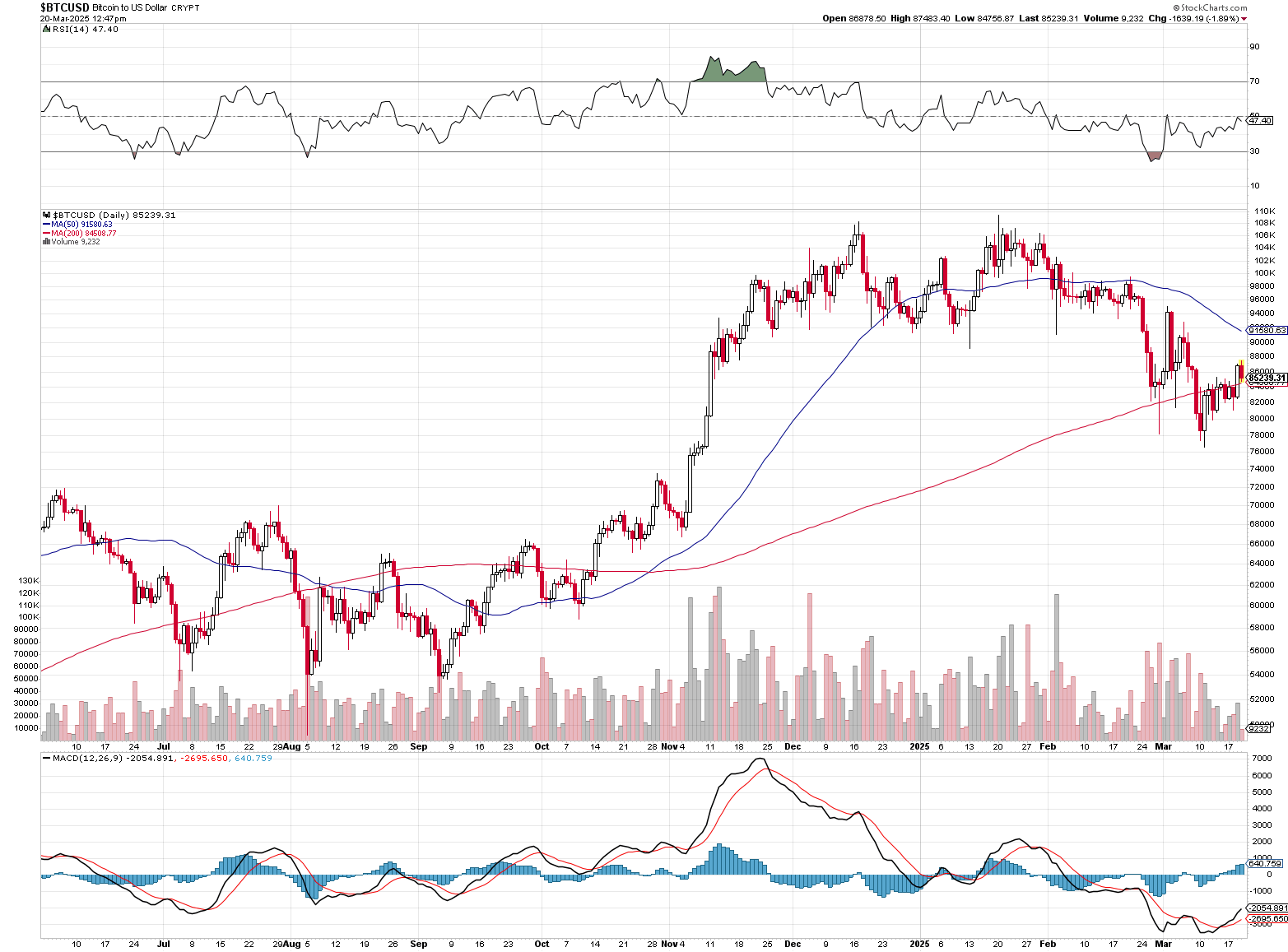

Bitcoin, on the other hand, which Trump has been promoting, is DOWN 13.32% (exactly double 6.66%) since Trump took office. Note: I am not “bashing” Trump, these are just the reference dates (and Satanic signs) we are observing!

And, keep in mind, we’re paying no attention at all to the elephant in the room – Corporate Profits. We went into 2025 with expectations of 15% gains in Corporate Profits but now it looks like the Q1 Economy is SHRINKING by 2.4% and that is led by extreme cuts in Government Spending – which is 20% of our GDP! Seriously, are people not able to connect these dots?

Not only that but our Big Tech leaders, who make up 34% of the S&P 500 and 52% of the Nasdaq are spending $325Bn (two years worth of income) on AI development and, if that doesn’t pay off, it will be an Economic mistake that makes the Dotcom crash look like a pothole…

Those stocks are down 20% for the year, which is 3 x 6.66%! 😈😈😈

We got bearish last month and have made money during the downturn – even as the stocks on our Watch List have gotten cheaper (see this week’s Portfolio Review) and one of the reasons we trimmed our long positions was so that we would have money to bargain-hunt in new sectors and, at the moment, we’re thinking Energy, Materials, Utilities and HeathCare should be good places to direct our efforts until the tariff uncertainty and earnings reports resolve themselves (a bit).

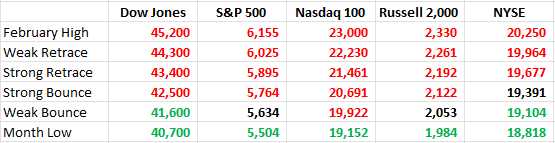

We still haven’t held any Strong Bounce Lines for a full day and we need at lest 2 days of green there to even consider buying. We’re more likely to lose boxes today than gain them and there is NO WAY we are heading into the weekend more bullish so, kids, stop asking “Are we there yet – We are NOT!”