5,638.94

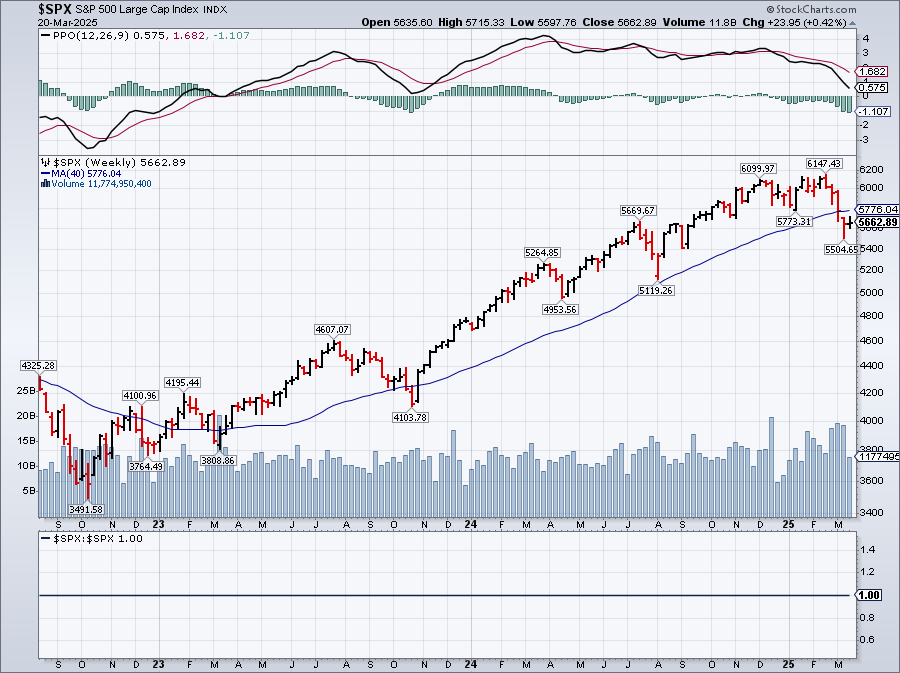

THAT is the number that matters today. It’s where the S&P 500 closed last Friday, in it’s 4th consecutive week of declines – since this stock market roller coaster peaked out at 6,147.43 – back on Feb 19th – 30 days after Trump took power, just before America lost her innocence and became a global pariah, now 60 days into the new Administration. I’d love to go into detail but I’ve given up criticizing Trump for Lent. In my defense, I thought Lent was 8 days, tops, like Passover or Hanukkha…

It’s been a roller coaster week and this morning it looks like we’re opening down 17 (it’s 8am – so who knows what for the next 90 minutes) and that would be 5,645 – still 7 points over the danger zone. We have NO DATA today, so that should help as most news has been bad news on that front with Leading Economic Indicators dropping 0.3% in February, accelerating January’s 0.2% decline – yet another reminder that Q1 is SUCKING!

As you can see from the 10-minute S&P 500 chart above, there’s really not much point to the day’s trading until the last minutes as we get these HUGE volume spikes into the close and NOT ONE OF THEM was positive. Today, however, is a Quadruple Witching Day, an event that happens on 3rd Friday of each quarter where when four types of derivative contracts (stock options, stock index options, stock futures, and stock index futures) expire simultaneously, often leading to increased volatility and trading activity.

$5.5 TRILLION worth of S&P Quarterly Options expire today along with $1.4Tn worth of Single-Stock Options, $420Bn worth of ETF derivatives (and how many words have two “v”s in them?) along with $180Bn worth of VIX contracts – all have to be unwound by end-of-day!

This derivatives tsunami explains why the S&P chart looks like a seismograph recording aftershocks from Trump’s regulatory earthquake. While we will be focused on “5,638.94“, institutional algos are laser-focused on S&P 5,600 (our Strong Retrace Line), VIX 22.50 (up 20% for the week and signaling a degree of panic) and QQQ $480 with 24,873 open contracts (now $2.75 – $6.84M) expiring at 4pm.

That means we can expect today’s circus to feature the scrambling of 1.2M March SPY options migrating to April, May and June and other quarterly options unwinding can lead to some very volatile moves into the close and the finale will be about 40% of the day’s volume in the last 60 minutes as algos roll $9Tn worth of total positions. Quad witching doesn’t create trends – it amplifies existing ones. With the S&P down 8.3% since Trump’s Day 30 peak, today’s mechanical rebalancing could either make us or break us BUT, since the Strong Bounce Line is way up at 5,764 – making it seems out of reach for today.

Meanwhile, earnings are a 3-ring circus all of their own with Nike (NKE) stinking up the joint (see Hunter’s “The Agonizing Death Rattle of the Swoosh Empire: A Gonzo Autopsy of Nike’s (NKE) Corporate Implosion“) and dropping 7% pre-market. FedEx (FDX) lowered their guidance with a 5% drop in Freight and they are down 9.2% (so far). Micron (MU) is off 3.3% despite record Revenues as margins begin to contract and they are carrying 158 days of inventory – miles above their 120-day target.

I would love to say Lennar (LEN) picked up the slack but no – they are down 5.25% – again with disappointing guidance – a rapidly growing theme in the last few weeks of earnings reports and that does not bode well for Q1 reporting – which is right around the corner.

Remember when I said “Beware the Ides of March?” THIS has been that week!

The good news is – we survived…

Have a great weekend,

— Phil