It’s Money Talk time!

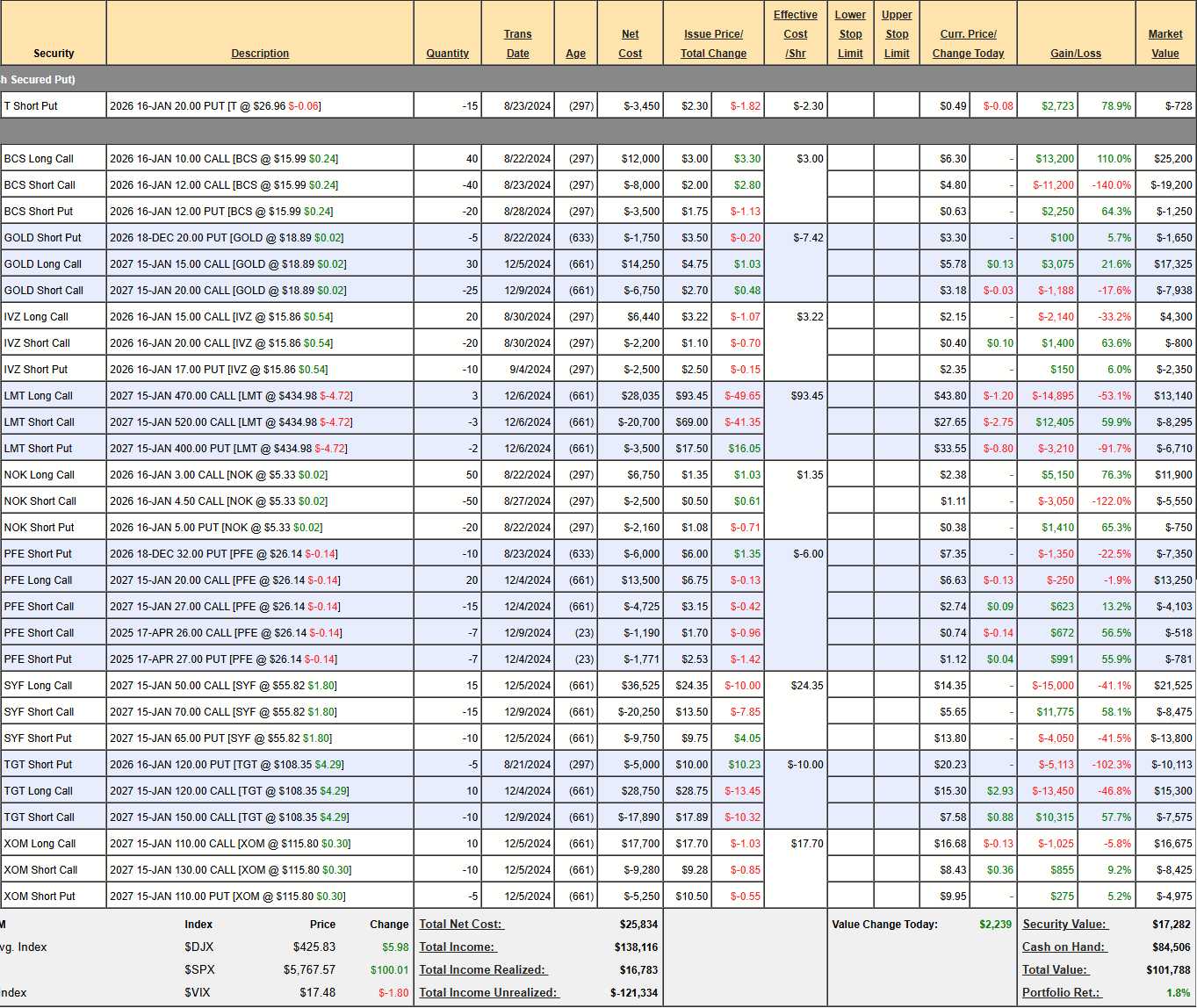

I will be on the show tomorrow (7pm) but we tape this evening and we’ve got a portfolio that’s weathered the storm and is ready to come out swinging! As of yesterday’s close, the portfolio is sitting at $101,788, with a comfortable $84,506 in cash. That’s up 1.8% so far, while the S&P’s still sulking at -1.9% – it’s as much as we can hope for in a downturn like this but, more importantly, there are stocks to buy that are down 10-20% and we have CASH!!! THAT was the whole point of our conservative entry strategy.

Our big restriction is we can only trade the Money Talk Portfolio on show days and I’m only on about once per quarter so we can’t take advantage of quick adjustments, as we did with our PSW Members when we cashed out and doubled down our hedges back on

March 6th and 7th – avoiding the worst part of the correction.

Fortunately, the portfolio held up and we have $84,506 in CASH!!! to deploy but first – we see if we want to make adjustments to our current positions (we do!):

-

- T – Short puts mean we own 1,500 shares of T at net $17.70, worst case and we have no fear of that so we’ll keep it with $728 left to gain.

- BCS – Well over our target at net $4,750 on the $8,000 spread so we have $3,250 (68.4%) upside potential if BCS can hold $12. This is great for a new trade for people who’d like to make 68.4% in 21 months!

- GOLD – Almost at our Jan target already at net $7,737 on the $15,000 spread so here we have $7,263 (93.8%) of upside potential but let’s sell 7 short June $19 calls for $1.20 ($840) – just to put a little cash in our pockets while we wait.

-

- IVZ – A bit behind schedule at net $1,150 on the $10,000 spread and here we’re going to buy more time to be right by rolling our 20 Jan $15 calls at $2.15 ($4,300) to 30 2027 $13 ($3.90)/20 ($1) bull call spreads at $2.90 ($8,700) so we’ve spent net $4,400 to move to a $21,000 spread (2.1x) with $ that’s $9,000 in the money.

We only spent net $1,740 on the original $10,000 spread and it didn’t go our way AND we still believe in our target, so we SALVAGE the position we have and now we have spent a total of $6,140 for what is now a $21,000 spread with $14,860 (242%) upside potential that is deeper in the money.

-

- LMT – They lost the F-47 contract to Boeing (of all people!) but fortunately it is a tight spread and was not terribly impacted. In fact, since we’re up 60% on the short $520 calls, let’s take a chance and buy back the 3 short 2027 $520 calls ($8,295) and, hopefully, we’ll re-cover at a higher price. Upside potential back at $520 would be $15,000 and we originally spent $3,835 and now $8,295 to buy back the calls is net $12,130 so only $2,870 (23.6%) upside potential at the moment but we’ll certainly sell more calls to flip the script on that!

That’s a big mistake options traders make – they think they are being clever buying back short calls and taking a chance but they don’t realize they are ruining their ROI – even if the trade works out. Risks like this should be TEMPORARY and goal-oriented – not major strategy shifts…

-

- NOK – Just waiting to collect our full $7,500, currently at net $5,600 so $1,900 (33.9%) left to gain in 10 months is a decent use of our funds. It’s certainly better than leaving it in cash so, if we don’t need the money or the margin – let it ride…

- PFE – We are right on track for the short April puts and calls to expire worthless and we sold them for $2,361 (131%) against our net $1,797 spread – so a very nice return over 4 months if we stay on track. Earnings are not until May so I have faith in Aprils going worthless (or near it) and, since we won’t be able to make changes, let’s sell July now. We can sell 7 July $27 calls for $1 ($700) and 7 July $26 puts for $1.30 ($910) and that makes the net of this $14,000 spread a $1,796 CREDIT (counting all short sales) – less whatever we end up paying back to the short puts and calls (if anything). That leaves us with an upside potential of $15,796 (879%) PLUS another 18 months of sales income! Aren’t options fun?!?

-

- SYF – Our 2025 Trade of the Year is off to a disappointing start. They are now STUPIDLY CHEAP so we’re absolutely going to buy back the short 2027 $70 calls for $8,475 to lock in our $11,775 gain and we’ll wait for the bounce. We can offset that by selling 10 2027 $55 puts for $9.50 ($9,500) so now we’ve spent nothing with a $1,025 credit against our original $6,525 entry so now net net we’re in for $5,500 on the (at $65) $22,500 spread that’s $5.50 ($8,250) in the money with $17,000 (309%) upside potential. SALVAGE!

-

- TGT – Another one that got too cheap and, in this case, it only costs us net $13.50 ($13,500) to roll our 10 2027 $120 calls at $15.30 to the 2027 $90 calls at $28.80 ($28,800) and we can pay for that by selling 10 more Jan $120 puts at $20.23 ($20,230) so now we’re pocketing $6,730 against our original net $5,860 entry so a net net CREDIT of $870 on what is now a $30,000 spread at $120 and we’re $18.70 ($18,700) in the money with $30,870 (3,548%) upside potential. SALVAGE!!!

-

- XOM – This one is right on track at net $3,275 on the $20,000 spread with $16,725 (510%) upside potential – great for a new trade!

After our adjustments, we’ve spent just net $2,490 of our CASH!!! (plus margin) and we have $111,952 (109%) upside potential over the next two years but we still have $82,016 left to deploy – SO LET’S GO SHOPPING!!!

Our top sectors to play the current trade war mania (along with a near-recessionary Economy) are generally Financials, Health Care, Materials, Energy and Utilities – but we’re more concerned with very strong value stocks at the moment.

We don’t know if this bounce will hold up for the next 3 months so, as we did in the beginning of this portfolio, we need to make sure we pick positions we are HAPPY to put more money into if there’s another pullback but, as always, VALUE is our guiding star:

-

- OZK is a Financial we find very attractive at $45.42 trading at less than 10x anticipated earnings. They also pay a 3.79% dividend ($1.72) so we don’t mind being assigned so let’s sell 10 2027 $45 puts for $7.50 ($7,500) which has a net buying power effect (Portfolio Margin) of $8,654.50 – so worth it. With that money in hand, we can buy 20 of the 2027 $40 ($10.60)/52.50 ($5) bull call spreads at $5.60 ($11,200) and that’s net $3,700 in cash on the $25,000 spread with $21,300 (575%) of upside potential.

-

- FL – Retail is tough but NKE is going to have to kiss FL’s ass to get back into their good graces after pulling out 5 years ago in a move that badly backfired for Nike. Also FL is trading at less than 10x earnings at $16.11 and, since we think $16.11 is stupidly cheap, we can aggressively sell 20 2027 $17.50 puts for $4.60 ($9,200) and we can buy 40 2027 $12.50 ($6.50)/22.50 ($2.80) bull call spreads for net $3.70 ($14,800) and that’s net $5,600 on the $40,000 spread that’s $3.60 ($14,400) in the money with $34,400 (614%) upside potential.

-

- WHR – It was pointed out to my by Boaty (AGI) that 60% of WHR’s revenues come from small appliances so tariffs and supply chain issues should not be as drastic as people are thinking. Certainly $95.17 is below 10x earnings and we’d be willing to ride out a storm so let’s sell 5 2027 $100 puts for $21.50 ($10,750) and we’ll use that to buy 15 2027 $90 calls for $17.50 ($26,250) and we’ll sell 10 2027 $110 calls for $9 ($9,000) and 5 short June $97.50 calls for $5.40 ($2,700) and 5 short June $100 puts for $10 ($5,000) and that will be a net $1,200 credit on the $30,000 spread with the additional income potential while we wait. Upside potential is $31,200 (2,600%) so this will be a fun one to play out!

-

- ARCB is a nice, boring logistics company and, in anticipation of trade wars causing logistics problems, we expect they will do well in the next two years. We can sell 5 of the Jan $75 puts for $11 ($5,500) and buy 10 of the Jan $70 ($13)/90 ($6.50) bull call spreads for net $6.50 ($6,500) and that’s net $1,000 on the $20,000 spread with $19,000 (1,900%) upside potential. Aren’t options fun?!?

That’s 4 new trades with $105,900 (104%) upside potential added to the $111,952 we already had. We waited patiently for a good time to deploy our cash and now we have to hope Q1 earnings season is kind to us and that tariff and trade wars don’t destroy the economy and doom us all.

Other than that – I’m very confident!