Game on!

Especially with Copper (/HG), which is up 31.75% this year, hitting $5.2795 per pound ($10,559/ton) which will have a huge impact on industries that heavily use Copper such as Construction, Electronics, Auto Manufacturing and Electrical Generation (which is used by hungry, hungry data centers!). Dramatically higher Copper prices will lead to a slowdown in infrastructure projects as budgets are blown and THIS IS BEFORE THE TARIFFS KICK IN, which Trump just threatened to ACCELERATE!

According to Bloomberg (not Goldberg, who was given our Military Secrets in a group chat): President Trump, in February, directed the Commerce Department to open an investigation into potential copper tariffs and submit a report within 270 days. That is now expected to be resolved sooner, according to people who asked not to be identified because the discussions are confidential which, in this Administration, means they’ll still tell you if their names are confidential – because it’s reciprocal – so that must be OK, right?

The move in Copper comes as no surprise to PhilStockWorld Members as Boaty (AI) and I did a full investigation back on January 7th in the Live Chat Room, where Boaty concluded:

🚢 Your premise is well-supported by the data. Let me break down the demand drivers and best value plays:

Demand Catalysts

EV Growth Impact

– EVs use 3x more copper than traditional vehicles[1]

– EV sector expected to grow at 14.3% CAGR through 2034[5]

– Transport sector’s share of copper demand rising from 11% to over 20% by 2040[7]

AI and Data Center Growth

– Data center electricity consumption rising from 2% to 9% by 2050

– Digital copper demand increasing six-fold by 2050[7]

– Copper demand split evolving to 71% traditional/23% energy transition/6% digital by 2050[7]

Best Value Plays

Freeport-McMoRan (FCX)

– P/E ratio of 27.33x

– Strong EBITDA of $7.37B

– Reasonable debt-to-equity ratio of 1.51[4]

– Well-positioned for US infrastructure projects

Taseko Mines (TGB)

– Most attractive P/E at 10.20x

– Market cap of $600.39M offers growth potential

– Higher risk with D/E of 3.25 but most undervalued[4]

Southern Copper (SCCO)

– Largest copper reserves in industry

– Industry-low production costs

– Strong dividend yield of 2.74%

– Expected 44.1% profit growth in 2024[2]

Investment Strategy

The best value approach would be:

1. Core position in FCX for stability and US exposure

2. Smaller position in TGB for growth potential

3. SCCO for income through dividends

Price targets suggest copper could reach $10,400 per metric ton by late 2025[2], with a potential supply deficit of 848,000 metric tons[3], supporting the bullish case for these investments.

We had already put out a Top Trade Alert on the US Copper Index Fund (CPER) back on November 18th, also accompanied with Fundamental Analysis by Boaty and that index is up 32% for the year and our trade idea was:

CPER is a Copper Fund and it hasn’t been below $25 since April and only for a day or two so here’s a nice short-term play for Copper:

-

-

- Sell 10 CPER April $25 puts for $1 ($1,000)

- Buy 10 CPER April $22 calls at $4 ($4,000)

- Sell 10 CPER Jan $26 calls for $1 ($1,000)

-

That’s net $2,000 on the $4,000 spread that’s 100% in the money and if CPER is not up on Jan 17th, we simply sell 10 April calls and further lower the basis, which makes it hard to lose (though we may end up owning it if Copper fails to hold $4. Let’s put this in the STP just so we remember to track it.

We are right on track for our 100% gain so thank you Boaty – not bad for 6 months! Of course that was just the options follow-up to our Jan 2nd call on Copper (also in the Live Member Chat Room), which was:

Dollar almost 109 – still on the way to 110 and that’s putting downward pressure on things. Nonetheless, Gold is blasting back to $2,660, Silver $29.81 (told you so!) and copper dead at $4.01 but certainly /HG can be played long here with tight stops under $4 as the same China logic taking /CL higher would be taking /HG higher if not for the Dollar strength.

/HG contracts pay $250 per penny, per contract so a $1.20 gain as of this morning is $30,000 PER CONTRACT so, you’re welcome for what was pretty much our first trade idea for 2025! 😎 Now, don’t be greedy – that’s a huge run – take some profits, set some stops!

THIS is how wealthy people sail through Inflation – with Inflation Hedges like Copper or Gold, which I also banged the table on since last year and is now $3,020 – up $420 (16.1%) for the year so far and up 50% since early 2024.

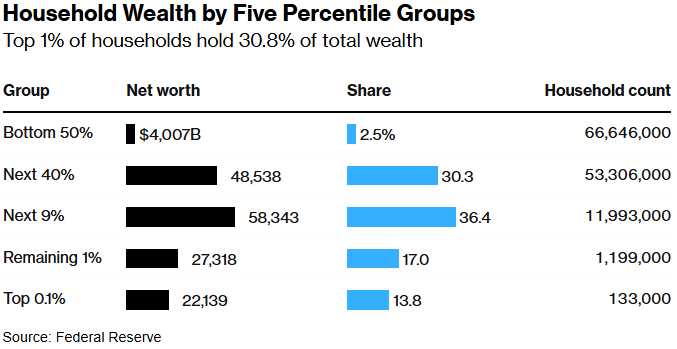

The problem, for the bottom 80%, is that you need to have spare money to place these hedges with or you are simply a victim of Trump’s tariff whims and that, unfortunately, is very much the case for the bottom 165M Americans, who live in 66.6M Households with a grand total of $4Tn in net worth or $60,000 per household vs the Top 0.1%, whose 133,000 Households have $22Tn in Net Worth or $165,413,533 per household – 2,756 TIMES more than the bottom 50%:

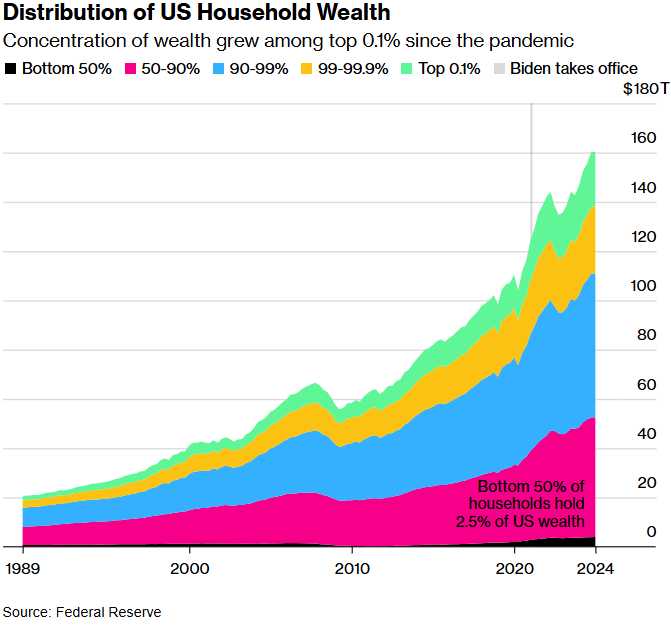

I know my Liberal rants are no longer in fashion but this is really an Economic rant as you can’t sustain this kind of inequality and, if you think “What are they going to do about it as we’ve obviously won and we have all the Lawyers, Guns and Money, as well as the votes.” – I will remind you that’s exactly what the Plantation owners also said 164 years ago (the Civil War began on April 12, 1861).

Want a simple fix?

AskTELLMake the people who have 2,756 TIMES more money to give 20% of that money to the bottom 50%. That would DOUBLE the wealth of the bottom 50% while still leaving the Top 1% with $132,330,826 per household. Would that really be so awful?

All is indeed well if you are in the Top 10% – they used to have half the wealth and now they have 2/3 of it and the pace is picking up and soon they will have 3/4 of it but then they are going to need to spend a lot more on bodyguards – as they tray to navigate the streets littered with their impoverished neighbors – some of whom may want to do more than set their Teslas on fire…

Are we great (again) yet?