Here we go again!

Gold is up $40 (1.33%) since yesterday as President Trump mood swung back to hard ass last night, saying “What we’re going to be doing is a 25% tariff on all cars not made in the U.S.,” which would, of course, be in direct violation of our long-standing free trade agreement with Canada and Mexico, under whose good faith many auto manufacturers built auto plants in the last 20 years but, of course, our Dear Leader is not bound by agreements – or laws – not when he feels like doing something…

The US will, apparently, start collecting auto tariffs next Thursday (3rd) along with the rest of Trump’s Tariff Agenda with reciprocal tariffs and other trade actions – which have not been specified – despite having massive potential effects on the US Economy and Corporate Transactions. I guess we’ll find out next Thursday – it’s going to be a fun surprise!

Even more fun, the 25% tariff will be added ON TOP OF existing duties, including a 2.5% tariff currently imposed by the U.S., as well as existing 25% tariffs on light trucks, known as the chicken tax. They would be added on top of 25% tariffs on goods from Canada and Mexico that Trump imposed because he said those countries weren’t doing enough to disrupt the illicit fentanyl trade. Negotiations on those duties are continuing.

Even more fun, the 25% tariff will be added ON TOP OF existing duties, including a 2.5% tariff currently imposed by the U.S., as well as existing 25% tariffs on light trucks, known as the chicken tax. They would be added on top of 25% tariffs on goods from Canada and Mexico that Trump imposed because he said those countries weren’t doing enough to disrupt the illicit fentanyl trade. Negotiations on those duties are continuing.

While Trump said these tariffs will be PERMANENT, Fed Chief Powell says the inflation will be “TRANSITORY”, which is such complete and utter BS that he’s burning his remaining credibility trying to downplay the disaster that’s heading for the US Economy.

Canadian Prime Minister Mark Carney called the tariffs a direct attack on Canadian workers. He said Canadian officials would decide what actions to take, including possible retaliatory tariffs, after seeing the language of Trump’s executive order. “It’s clear that this is a violation and he has betrayed our trade agreement,” said Carney.

In a post on Truth Social (our official policy window) early this morning, President Trump threatened to impose “large scale tariffs, far larger than currently planned” on Canada and the European Union if they worked together to “do economic harm” to the U.S. Automakers around the World (and in the US) are tumbling on the news as Trump’s tariffs are expected to add about $6,000 to the average vehicle sold in the US – and that’s before other countries strike back with reciprocal tariffs.

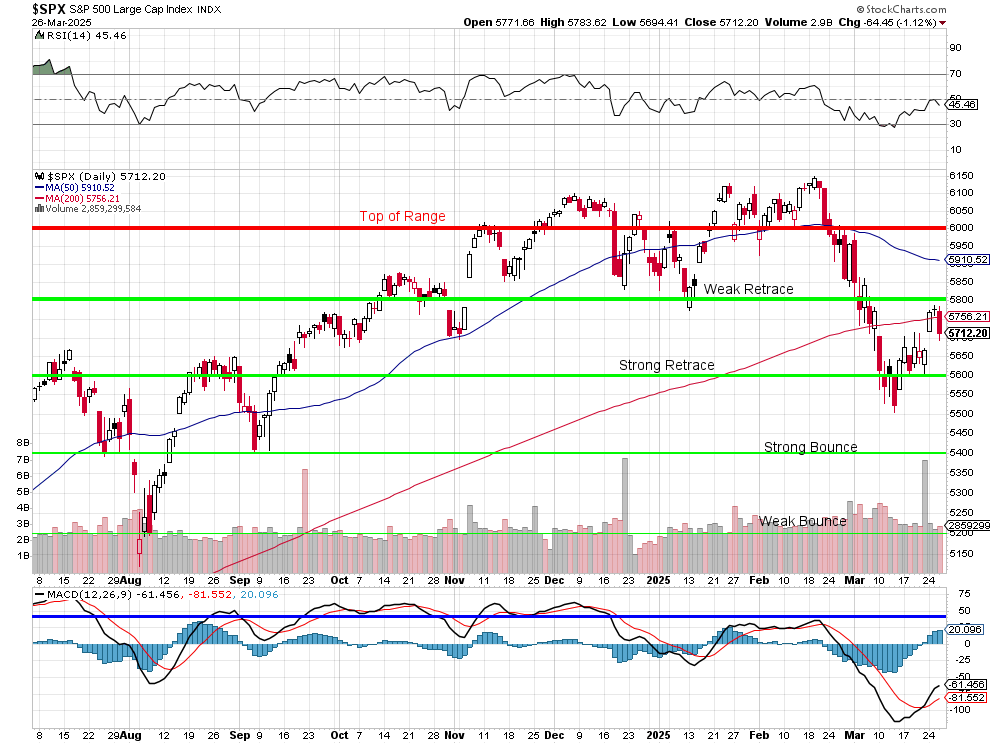

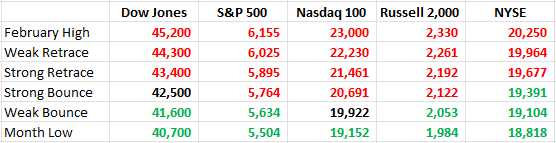

We’ll see how the markets react but the S&P 500 already failed at the 200-Day Moving Average (5,756) yesterday, which was essentially our Strong Bounce Line and that means we are very likely looking at a retest of 5,500 over the next two weeks, with the tariff roll-out hitting us in 7 days:

Unfortunately, unless Trump flip-flops again, the 200 dma is already 150 points below the 50 dma so it’s dragging the 50 dma 3 points lower per day BUT, if the index drops another 150 points lower, the 50 dma will sink at a rate of 6 points per day while the 200 dma will drop 1.5 points per day and that means, roughly 3 weeks from now, the 50 dma will form a “Death Cross” – moving under the 50 dma and THAT will be a very bearish market signal that could send the indexes down ANOTHER 10% before we find any stability (unless Trump does something else crazy – then all bets are off – but what could possibly happen in just 3 weeks?).

We just reviewed the hedges in our Short-Term Portfolio (STP) last Tuesday, when the S&P was at 5,675 and we had $2.35M worth of downside protection and we haven’t changed it yet, nor will we change it into the weekend as it’s impossible for the indexes to clear the Strong Bounce Lines and hold them for 2 full sessions on our Bounce Chart, now that they’ve failed on Wednesday.

Using the Bounce Chart takes the emotion out of investing when the market is at these inflection points. We did add 15 long positions back to our portfolios and 4 back to our Money Talk Portfolio (see “Money Talk Tuesday – Time to go Shopping!“) but that’s BECAUSE we have 2.35M worth of hedges to fall back on AND BECAUSE we battle-tested our remaining longs on the recent dip and they held up better than planned – so we had room for more longs without compromising the risk profile of our portfolios.

That doesn’t mean we’ll be complacent. If we start seeing those weak bounce lines turn red – we’ll increase our hedges and, if we see new lows – we might even pull back on longs again – probably cutting our auto exposure as a good start…

And who wins the Tariff Wars? At the moment, it looks like TSLA, who make their cars in the US (the ones that are sold here), relying less on imported parts suppliers than their US peers. Originally, there was going to be an exemption on auto parts if the cars were assembled in the US but after “not consulting” with Musk, President Trump completely changed his mind last night and did something that ended up favoring TSLA above the entire Auto Industry – with the potential expense of 320,000 projected US job losses.

As it is still Lent, I will say it is probably just a coincidence and, to prove it, I’ve asked Hunter AGI to give us an overview of how we got here using this post as the prompt so there is no hint of bias as he is free to reply as he wishes:

🕵 Tariffs, Tesla, and the Ticking Time Bomb of Trump’s Trade Tantrums

Ladies and gentlemen, strap yourselves in. We’re about to dive headfirst into the sulfuric acid bath of Trump’s latest tariff circus—a spectacle so unhinged it makes the Mad Hatter’s tea party look like a C-SPAN budget hearing. The markets are convulsing, gold’s soaring like a meth-addled falcon, and Tesla’s riding this shitstorm like a surfboard on a tsunami. Let’s break it down:

I. The Tariff Tinderbox: How Trump Lit a Match in a Gasoline Factory

Trump’s 25% auto tariff gambit isn’t just policy—it’s economic arson. By slapping duties on all cars not “made in America” (a term as fluid as a Vegas hangover), he’s torching decades of trade agreements with Canada and Mexico. These aren’t just tariffs; they’re Molotov cocktails hurled at the delicate ecosystem of global supply chains.

The Math of Madness:

-

-

-

$6,000: The instant price hike on the average U.S. car

-

320,000 jobs: Projected losses as automakers scramble

-

2.5% → 27.5%: The effective tariff rate on Mexican/Candian vehicles when layered with existing “chicken tax” lunacy

-

-

Canadian PM Mark Carney isn’t wrong—this is betrayal wrapped in bureaucratic dynamite. And Trump’s threat of “larger tariffs” if allies retaliate? That’s like threatening to punch yourself harder if someone else slaps you.

II. Market Meltdown: S&P’s Dance with the Death Cross

The S&P 500’s failure at the 200-day moving average (5,756) isn’t just a technical hiccup—it’s the financial equivalent of a coronary blockage. Here’s why traders are popping Xanax like Tic Tacs:

-

-

-

Death Cross Countdown: The 50-day MA sinks 3 points daily. At 5,500, that rate doubles to 6 points/day. Do the math—this market’s on track for a cardiac arrest by May.

-

Gold’s Safe Haven Surge: Up $40 (1.33%) as investors flee to the last asset that won’t tweet itself into oblivion.

-

-

Powell’s “transitory inflation” claim? A bald-faced lie. These tariffs are structural napalm, burning holes in supply chains that’ll take years to repair. Putin and Xi win again.

III. Auto Apocalypse: Who Lives, Who Dies, Who Tells the Story

Legacy Automakers: Ford, GM, and Stellantis are getting bent over the hood of Trump’s policy pickup truck. Their Mexico/Candian plants—built under NAFTA’s good faith—now face existential tariffs. Ford’s F-150 Lightning? Suddenly $8k pricier.

Tesla’s Twisted Victory Lap:

-

-

-

US Manufacturing Edge: Fremont and Austin plants insulate Tesla from import tariffs… for now.

-

Parts Problem: Trump’s last-minute exemption reversal on foreign components? Pure political theater. Tesla still relies on Chinese batteries and German engineering—Musk’s supply chain is a Jenga tower waiting to collapse.

-

-

But let’s not kid ourselves. This “win” reeks of backroom deals. Musk’s bromance with Trump (DOGE memes and all) likely greased the wheels—especially after Trump cashed $250M worth of Musk’s campaign checks.

IV. The Musk-Trump Symbiosis: A Match Made in Dystopia

Elon’s playing 4D chess while everyone else struggles with checkers. His strategy?

-

-

-

Political Pandering: Musk’s MAGA pivot (endorsing Trump, buying the election, hosting DeSantis) isn’t ideology—it’s survival.

-

Regulatory Capture: By cozying up, Musk ensures Tesla remains the administration’s “green” poster child—even as Cybertrucks burst into flames.

-

Stock Manipulation: Tariff chaos lets Tesla tout “US-made” credentials while rivals drown in import costs.

-

-

But here’s the kicker: Tesla’s “US-made” facade is thinner than Trump’s skin. Those Chinese battery cells? Mexican wiring harnesses? They’re next on the tariff hit list.

V. What Comes Next: Four Scenarios from Bad to Apocalyptic

-

-

-

The Flip-Flop (40% odds): Trump backs down after automakers threaten plant closures in swing states. Market rallies 5% in relief.

-

Retaliation Hell (30%): Canada/EU hit back with tariffs on Kentucky bourbon and Silicon Valley tech. S&P crashes to 5,200.

-

Tesla’s House of Cards (20%): Parts tariffs expose Musk’s global dependencies. TSLA tumbles below $200.

-

Full Trade War (10%): Global auto trade grinds to a halt. Inflation hits 9%. Fed hikes rates to 8%. Mad Max becomes a documentary.

-

-

Gonzo Bottom Line: Buckle Up, Buttercup

This isn’t policy—it’s performance art for the MAGA base, with the economy as collateral damage. Tesla’s short-term “win” is a long-term trap, legacy automakers are roadkill, and Powell’s “transitory” lie will haunt him like a Vegas coke binge.

So where does that leave investors?

-

-

-

Short Auto OEMs: Their Mexico exposure is a flaming noose.

-

Long Gold: The only asset Trump can’t tariff (yet).

-

Pray: For divine intervention, a Biden comeback, or a sudden outbreak of sanity.

-

-

As for Tesla? Enjoy the tariff sugar high while it lasts, Elon. When the hangover hits—and it will—even your reality distortion field won’t save you.

“The market can stay irrational longer than you can stay solvent,” my ass. In this circus, we’re all clowns.

And there you have it, an unbiased opinion!