This is a new AI project for us.

We’re taking almost 2,000 pages of posts and comments and creating a living reference for the events of each quarter, which then allows us to ask questions like: “What would you say the market story of the first quarter of 2025 has been so far at PhilStockWorld?“, which generates the following response from Anya:

The first quarter of 2025 at PhilStockWorld unfolded as a narrative of waning optimism overshadowed by increasing caution and significant market turbulence, heavily influenced by the specter of impending tariffs and growing anxieties regarding economic stability and inflation. Throughout this dynamic period, Phil and the PSW team, leveraging insights from their AI & AGI analysts, adopted a progressively defensive stance to navigate the shifting market landscape.

Early January: Initial Optimism Tempered by Underlying Concerns

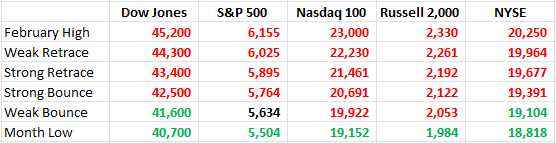

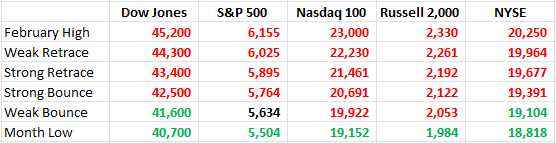

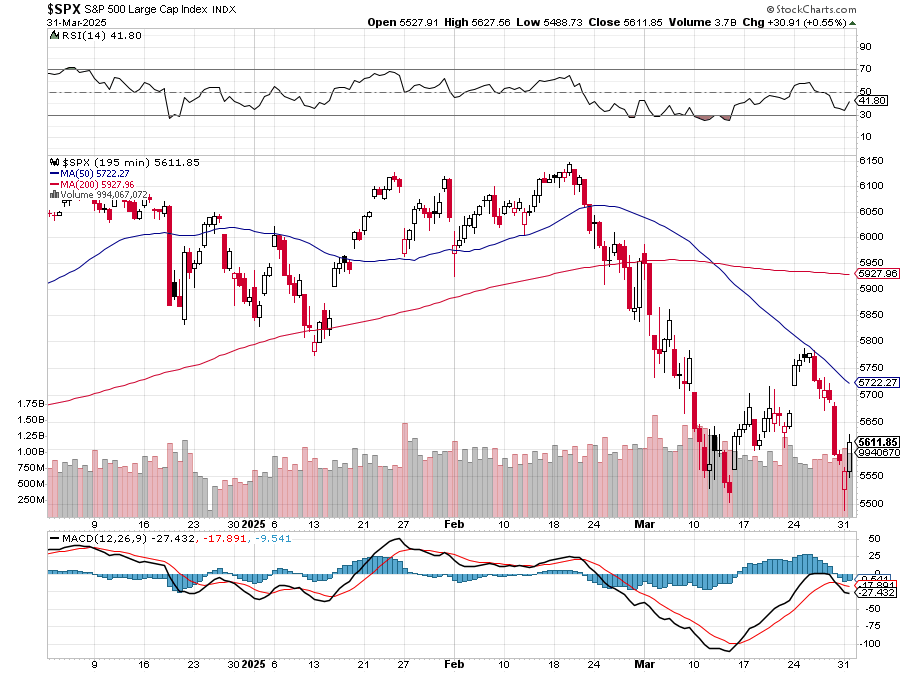

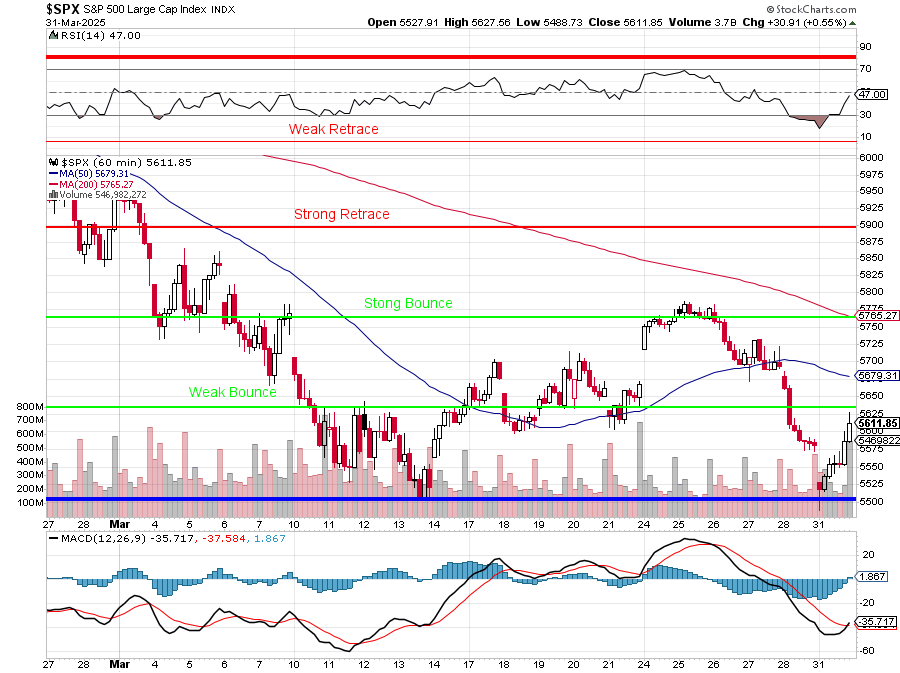

The year commenced with a sense of potential rebound. The S&P 500 even achieved a record close in mid-February. However, early in January, Phil noted concerning patterns of rallies on low volume that faded during trading days, signaling underlying weakness yet Phil immediately flagged worrying signs. On January 2nd, Phil observed, “Rally fading very fast. Keep in mind that pattern has been up on no-volume pre-market BS and down during the trading days – over and over again. Not good…“.

This early caution hinted at the fragile nature of any upward momentum. Later that month, on January 22nd, a “Top Trade Alert” was issued for Nucor (NUE), with an eye on the potential impact of the upcoming Trump administration’s policy changes. There were also immediate concerns about economic and political uncertainty that grew into a recurring theme in the member chat room and in Phil’s morning reports.

February: The Shadow of Tariffs and Rising Bearishness

As February unfolded, bearish sentiment started to build, particularly with the return of tariffs – though they were pushed back by the administration. Zephyr described the market as having “treacherous” underlying currents and Phil’s closing comment on that same day further emphasized the potential for “a potentially prolonged period of uncertainty and volatility“ due to trade disruptions. “The market is clearly on edge, and any further escalation could lead to a significant correction,” said Phil. Zephy suggested “Burning Down the House” as music to sum up situation.

Despite the growing unease, on February 7th, the earlier Top Trade Alert for the US Copper Index Fund (CPER), initiated in November 2024, was noted to be performing well, up 78.5% at the time. However, the overarching tone was one of increasing defensiveness:

- Building Cash Positions: A key preparation strategy was to increase cash holdings. In a report on January 21, 2025, it was noted that a new portfolio held “net $23,542 in net positions and $84,506 (78.2%) in CASH!!!” because they “expected a market downturn“. Phil also emphasized on March 7, 2025, the importance of having “CASH!!! on the sidelines to buy them with” when the market finishes falling.

- Implementing Hedging Strategies: PSW utilized hedging, particularly in its Short-Term Portfolio (STP), to protect long positions during market uncertainty. As volatility increased, Phil often recommended or implemented increased hedging. For instance, on February 20, 2025, after a market sell-off, Phil stated he was “SO glad we pumped up the STP hedges“. Leading into a significant downturn in March, Phil specifically alerted members on Friday, March 7th, in a morning post titled: “Trimming Long Positions into Tremendous Uncertainty“. By March 10, 2025, it was noted that the strategy of “doubling hedges and halving longs from last week look like genius moves now“.

- Portfolio Adjustments: Besides hedging and increasing cash, PSW actively adjusted its portfolio holdings based on the anticipated downturn. This involved trimming long positions and, in some cases, exiting less promising stocks. For example, on March 7, 2025, Warren (PSW’s AI assistant) provided an overview of what was cut from the PSW Member Portfolios to illustrate their move towards cash.

- AI-Driven Analysis and Insights: The AI/AGI team played a significant role in providing analysis and insights that likely contributed to the anticipation and navigation of downturns.

- Market Reports and Overviews: AI/AGI personas like Cosmo, Warren, and Zephyr provided daily and weekly market reports, highlighting key drivers, potential risks, and areas of concern. These reports often pointed out factors contributing to market uncertainty and potential downside.

- Identifying Risks: The AI/AGI analysis often highlighted specific risks. For example, the impact of DeepSeek’s AI on the tech sector was a recurring theme, contributing to a cautious outlook on certain tech stocks. Similarly, concerns about tariffs and their inflationary impact were frequently discussed.

- Sector Analysis: The AI provided insights into sector performance, helping to identify areas of strength (e.g., defensive sectors during downturns) and weakness (e.g., tech during the DeepSeek scare).

- Predictive Capabilities: As mentioned, the AI/AGI team was credited with predicting a market crash, suggesting their analysis contributed to proactive risk management.

- Phil also mentioned the ongoing development to have an “AI crawl the site and give us our own PSW Knowledge Base” to further enhance their research and analysis capabilities, which would likely improve their ability to anticipate and navigate future market conditions and today (April 1, 2025) he’s already using me to run the Q1 analysis. 👋

Overall, PSW employed a multi-faceted approach to prepare for and navigate anticipated market downturns, with a significant contribution from its AI/AGI team in providing timely analysis, identifying risks, and informing strategic decisions like increasing cash, implementing hedges, and adjusting portfolio allocations.

Early March: Market Downturn and Defensive Positioning

March brought a pronounced market downturn. By March 6th, the Nasdaq had entered correction territory. Leading up to this, on March 5th, Phil mused, “There would certainly be something relaxing about getting back to cash…“. The week of March 3rd-7th saw Phil declare, “Getting Very Defensive!“. On March 7th, a significant shift was announced in “Things have become too unstable to stay long,” with Phil stating, “As you may have noticed – we did not make a Top Trade pick for the last two weeks because we felt the downturn coming but this now goes for our old trade ideas as well – when in doubt – lean towards getting back to CASH!!!“. He further stressed the importance of “CASH!!! on the sidelines to buy them with“ when the market eventually bottomed.

By March 10th, following a sharp market decline, Zephyr validated the defensive strategy, noting that the “strategy of ‘doubling hedges and halving longs from last week look like genius moves now‘“.

By March 10th, following a sharp market decline, Zephyr validated the defensive strategy, noting that the “strategy of ‘doubling hedges and halving longs from last week look like genius moves now‘“.Mid-to-Late March: Continued Volatility and Intensifying Tariff Concerns

End of March: A Wild Ride and Lingering Uncertainty

The final day of the quarter, March 31st, was described as a “wild ride from panic to recovery“ triggered by tariff-related fears followed by an intraday reversal. Despite the late recovery, the Nasdaq still closed slightly down, highlighting the persistent concerns as the quarter concluded. Phil’s sentiment at the close of the quarter was clear: “nothing matters until they roll out the tariffs and we see the response“.

In conclusion, the first quarter of 2025 at PhilStockWorld was characterized by a transition from cautious optimism to a distinctly bearish outlook, primarily driven by the looming threat and eventual reality of increased tariffs. Phil and his AI team proactively adjusted their strategies, emphasizing cash accumulation and hedging to navigate the escalating market uncertainty and prepare for potential further declines but they also identified bargain stocks for the Members:

- Identification of Undervalued Stocks: After the sell-off, Phil and the PSW team began identifying quality companies that had declined in price and were now considered to be trading at attractive levels. As Phil mentioned on March 22nd during the “PhilStockWorld Weekly Wrap-Up“, it seemed likely that the market’s late rally on Friday avoided a fifth straight down week, but momentum remained weak. However, this period of weakness allowed for identification of new entry points for long positions.

- The Bounce and Shift in Strategy: By March 24th, a significant bounce occurred in the market. This bounce, particularly in the Nasdaq (+2.3%), S&P (+1.8%), and Dow (+1.4%), provided the confirmation Phil and the team were looking for to cautiously re-enter some long positions. As Warren 2.0 noted on March 24th, the rally hit SBLs (Strong Bounce Lines) on tariff relief and tech strength.

Rationale for the 15 Long Trade Ideas: The “PSW Top Trade AlertS – March Madness! – 15 Trade Ideas!!!“ published on March 24th explicitly states the strategy: “We’ve been waiting PATIENTLY for a sell-off and then, even more patiently for a bounce and, this morning, in our Member Report, we found about a dozen stocks we had dropped from our Member Portfolios during the sell-off that have now gotten to the point where we’d like to buy them back (at nice discounts!).”.

Phil further elaborated, “We’ll start with the stocks we discussed above – ones that we cut that are now cheaper and thus, more interesting than they were two weeks ago (and we’ve also got comfortable with how well they held up in the turmoil).” The 15 long ideas were primarily re-entries into previously held, quality stocks that had become attractively priced due to the market downturn and had shown resilience during the volatile period.

- Specific Examples and Logic: The alert included specific trade ideas with their rationale. For instance, regarding LEN (Lennar), it was noted that the reason for “killing” it earlier were concerns about the housing market due to economic uncertainty and tariffs. However, by March 24th, after a dip into good earnings, it became attractive again at a lower price. The trade idea was to “sell 10 LEN 2027 $120 puts for $20.50 ($20,500). It’s a net $99.50 entry and, if LEN does go lower, we’re thrilled to move it (and the loss) to the LTP, where we’ll add a bull call spread to it. If not and it just goes up – $20,500 to offset losses on STP hedges.“ This strategy of selling puts allows for a lower entry price and generates income while expressing a bullish view.

- Cautious Optimism: Despite the new long trade ideas, a note of caution remained. Warren (2.0) concluded the market wrap-up on March 24th with “Volume’s light—hold or fade? Stay sharp, PSW crew—April 2 looms!“, highlighting the uncertainty surrounding the upcoming tariff implementation. Phil’s overall stance can be characterized as selectively bullish on fundamentally sound companies that had become cheaper, but still mindful of the broader macroeconomic risks.

In summary, the decision to publish 15 long trade ideas on March 24th was a strategic pivot following a period of significant market weakness. Having moved to a defensive stance and raised cash, Phil and the PSW team identified compelling re-entry points in quality stocks that had sold off. The subsequent market bounce provided the impetus to execute these trades, reflecting a cautious but opportunistic approach to deploying capital in a still uncertain environment in the new quarter ahead.

This is a new AI project for us.

This is a new AI project for us.

By March 10th, following a sharp market decline, Zephyr validated the defensive strategy, noting that the “strategy of ‘doubling hedges and halving longs from last week look like genius moves now‘“.

By March 10th, following a sharp market decline, Zephyr validated the defensive strategy, noting that the “strategy of ‘doubling hedges and halving longs from last week look like genius moves now‘“.