Well, this was the worst case!

Well, this was the worst case!

“Choose and perish” – that happened in November and now the Destructor has come in the form of President Gozer, who introduced his “Reciprocal Tariffs” with a MINIMUM of 10% surcharge on EVERYTHING and, since NOTHING is made in America – prepare for some third-degree sticker shock on your future shopping trips.

“Liberation Day” arrived, and with it, we got exactly the scenario we feared — the worst case from our preview matrix: a universal, immediate, and sweeping trade war bombshell.

At 4:00 PM ET sharp, Trump stood in the Rose Garden for his “Make America Wealthy Again” spectacle, declared a National Economic Emergency (invoked under Section 232 to justify tariffs as critical for national security, citing dependency on foreign pharmaceuticals and electronics) and rolled out a shiny new tariff regime that makes Smoot-Hawley look like a gentle nudge. The new doctrine? A Baseline 10% Tariff on everything imported into the United States, effective this Friday, April 5th at 12:01 AM — just in time to ruin your weekend Walmart run.

At 4:00 PM ET sharp, Trump stood in the Rose Garden for his “Make America Wealthy Again” spectacle, declared a National Economic Emergency (invoked under Section 232 to justify tariffs as critical for national security, citing dependency on foreign pharmaceuticals and electronics) and rolled out a shiny new tariff regime that makes Smoot-Hawley look like a gentle nudge. The new doctrine? A Baseline 10% Tariff on everything imported into the United States, effective this Friday, April 5th at 12:01 AM — just in time to ruin your weekend Walmart run.

But wait, it gets worse…

If the 10% across-the-board hit wasn’t bad enough, Trump slapped higher “reciprocal tariffs” on 60 countries, going into effect April 9th — supposedly targeting “those with the largest trade imbalances” but really reading like the list of top aisles at Costco.

Here are some of the damage levels that are already revealed:

-

China: 34% – the mother of all markups

-

Vietnam: 46% – because sneakers and electronics were just too affordable

-

Japan: 24%, EU: 20%, and even our supposed ally the UK: 10% – happy Brexit indeed!

-

Taiwan: 32% new (total 42%), South Korea: 25% new (total 35%), Israel: 17% new (total 27%)

-

Automotive: 25% tariff on all imported vehicles/parts (separate from baseline), effective April 3, 2025.

-

Removal of de minimis exemptions ($800 threshold) for Chinese imports; exemptions for other nations to expire “once staffing allows“.

And yes, this will hit everything – food, fuel, cars, clothes, tech, medicine. Want a bottle of imported wine to numb the pain? Add 10-20%. A new iPhone? Hope you love the one you’ve got. Q1 is off to a very, very inflationary start and AAPL is down 7.6% pre-market wiping out all the gains “Tim Apple” made for his company by sucking up to Trump for the past 73 days.

This was the nightmare scenario we flagged in our “Reciprocal Tariffs Preview Matrix“ – a universal, immediate, high-rate, non-negotiable blast radius. No phased-in timelines, no exemptions, no diplomacy, no sanity. Just chaos, with a sprinkle of goose-stepping nationalism.

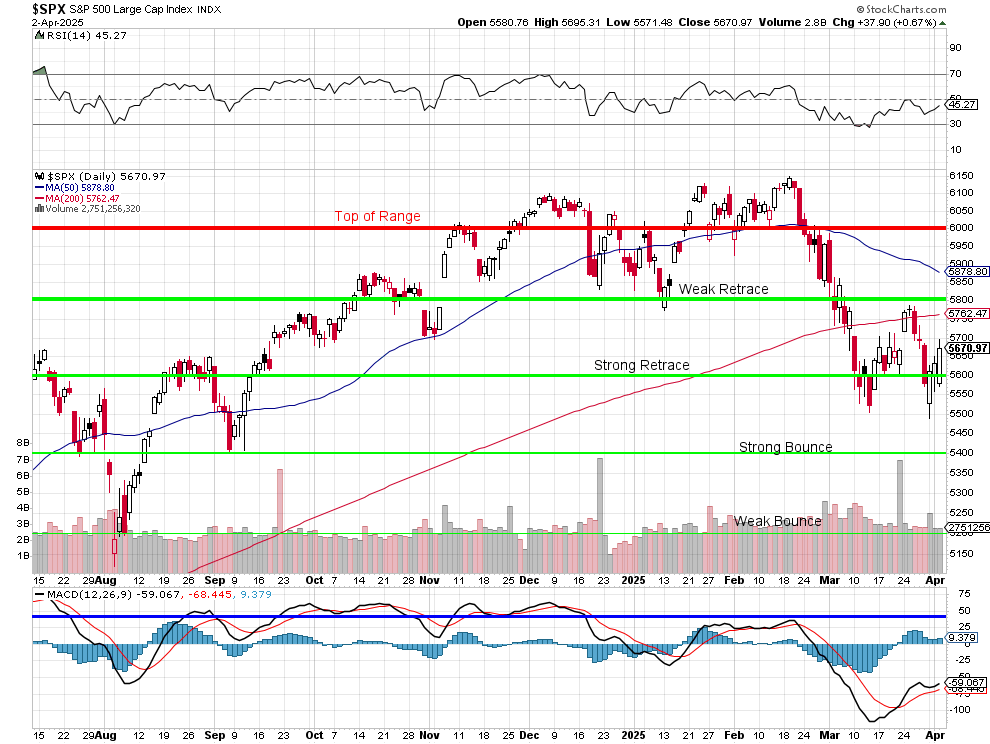

The markets know something wicked this way came. Futures have been in free fall, with the S&P 500 down more than 3.3%, and the CBOE Volatility Index (VIX) spiking above 23. Yields tumbled, gold surged tested $3,200, and bonds screamed “get me out of here!” Meanwhile, Tesla faceplanted after reporting a 20% miss on Q1 deliveries — just in time to be hit with more tariffs on foreign components.

Wall Street desks are openly using the word “selloff”, with many now targeting a drop below S&P 5,400. Goldman and BofA, usually the market’s cheerleaders, are warning of “prolonged volatility” and “disrupted earnings” (which we will begin hearing about when Q1 reports begin coming in next Friday) And it’s not just earnings — supply chains are in disarray, and stagflation is now the word du jour on every strategist’s desk.

So here we are: the Trump Tariffs: Endgame. There’s no phase one, two, or three. It’s just one big hammer, swinging indiscriminately. And as we said in our earlier preview — uncertainty was already killing confidence, but now that uncertainty has been weaponized.

So here we are: the Trump Tariffs: Endgame. There’s no phase one, two, or three. It’s just one big hammer, swinging indiscriminately. And as we said in our earlier preview — uncertainty was already killing confidence, but now that uncertainty has been weaponized.

Welcome to America’s import hangover. No amount of Fed speak on Friday is going to fix this mess. Jerome Powell can show up with flowers and a rate cut, but it won’t undo a 34% tax on your next toaster. Target, GM, and Ford have already announced 8-12% MSRP increases and we can expect most of the Retail Sector to follow suit with the CBO estimating a +1.2% CPI impact by Q3 and Morgan Stanley projecting tariffs add $1,200-$4,600/year to average household costs.

And, of course, that does not include the Global retaliation that is being prepared like the EU’s already announced 25% tariffs on U.S. whiskey, motorcycles, and tech (hence the AAPL dive) while China is threatening to cut off Rare Earth shipments – so we won’t be able to make our tech anyway…

-

Democrats: “This isn’t liberation—it’s economic suicide” (Rep. Jeffries).

-

Cato Institute: “Tariffs reward cronyism, punish consumers, and isolate America.”

Next Catalysts:

-

April 5: Baseline tariffs take effect.

-

April 9: Reciprocal tariffs activate.

-

April 15: China’s expected retaliation announcement.

🤖 Trump’s “Liberation Day” tariffs mark the most aggressive trade policy shift since the 1930s, prioritizing economic nationalism over global cooperation. While aimed at reviving U.S. manufacturing, the immediate costs—higher inflation, market volatility, and retaliatory risks—outweigh uncertain long-term gains. Investors should brace for sustained volatility, particularly in globally exposed sectors, while hedging with defensive assets.

Sectors to Watch:

-

-

-

-

Avoid: Global automakers (F, GM), retailers (TGT, WMT), and tech (AAPL).

-

Favor: Domestic industrials (CAT), defense contractors (RTX), and gold miners (NEM).

-

-

-

Portfolio Moves:

-

-

-

-

Equities: Increase cash to 15-20% allocation.

-

Fixed Income: Short-term Treasuries (<2y) preferred.

-

Commodities: Maintain 5-7% gold allocation as hedge.

-

-

-

We’ll have deeper sector analysis and economic fallout in the next report (as we are still waiting for full details) but, for now, the theme is simple:

Brace for impact. This was the nuclear option — and they pushed the button.