Well it’s certainly spreading…

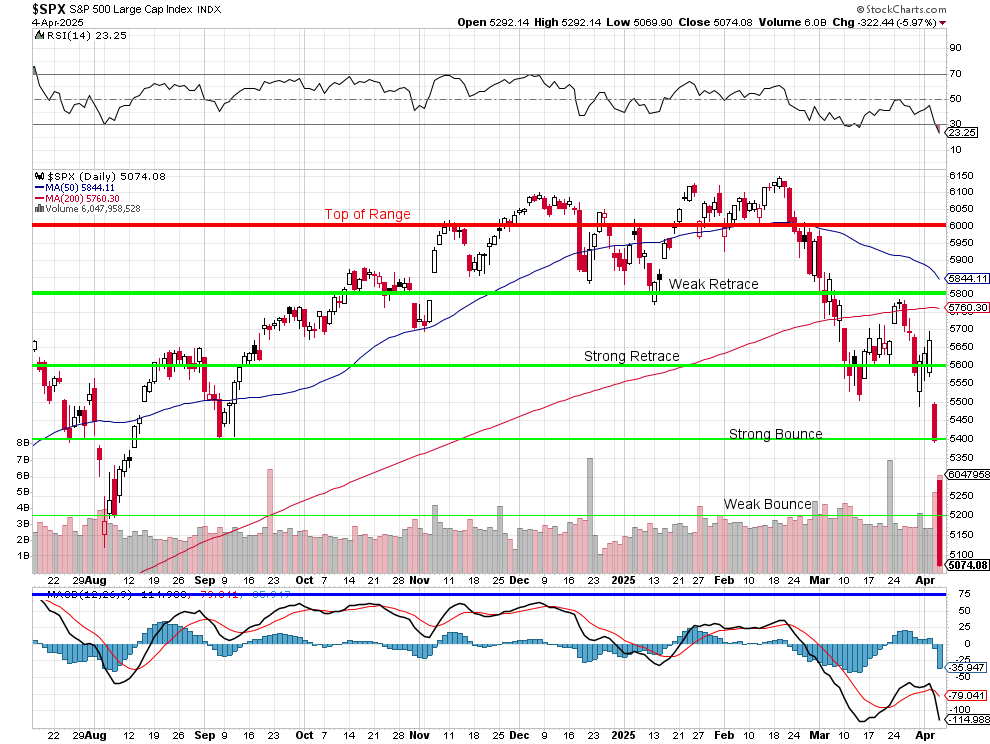

After retaliating last week with 34% tariffs on US Goods, China’s Hang Seng Index plunged 3,021 points this morning – from the 50-day moving average to the 200-day moving average and that’s NOTHING as we lost our 200-day moving average (5,760 on the S&P 500) two weeks ago and we closed Friday at 5,074, which was down 686 points (11.9%) and that’s ONLY AFTER FALLING FROM 6,150 for a 1,076 (17.5%) total drop – though “total” is a silly word as the S&P was down another 200 points (3.9%) earlier this morning but now “only” down 76 points as of 7:23 so yay?

When Trump says to China “This hurts us more than it hurts you” HE MEANS IT! With the S&P trading 800 points below the 50 dma – it is falling at a rate of 16 points per day (Math!) and the gap between the 50 dma and the 200 dma is 84 points so next Tuesday, if things don’t drastically improve, the 50-day will cross below the 200-day and form what is known as a “Death Cross” – basically the worst possible technical signal (as if we need more bad news).

I’m not a TA guy, TA is nonsense but 90% of the market follows TA and, as I say to our Members, if the guy in the robes says “Amen” in a church then it’s a good bet almost all the people in the pews will say “Amen” and we don’t need to be believers to make money on that bet, do we? So we will all get down on our knees and pray it doesn’t happen but, if it does – we’d better be prepared for Armageddon!

You can see where the bounce lines are – they are the same ones we’ve been using all of last year because we NEVER thought the S&P was worth 6,000 and now it may not even be worth 5,000 as this tariff situation is new and it will certainly have an impact on Corporate Earnings and less earnings means lower valuation – especially when the market was expecting 15% earnings growth in 2025 before Trump was sworn in – but that was under the “horrible” Biden Administration – thank goodness we switched to President Gozer, right?

You can see where the bounce lines are – they are the same ones we’ve been using all of last year because we NEVER thought the S&P was worth 6,000 and now it may not even be worth 5,000 as this tariff situation is new and it will certainly have an impact on Corporate Earnings and less earnings means lower valuation – especially when the market was expecting 15% earnings growth in 2025 before Trump was sworn in – but that was under the “horrible” Biden Administration – thank goodness we switched to President Gozer, right?

We’ll find out about earnings starting Friday as we hear from big banks like JPM, BLK, WFC, BNY and MS. Carmax (KMX) should be interesting as used cars are likely to do well vs tariffed cars but, unfortunately for the consumers, the PARTS to fix those used cars are going to go through the roof (and that’s a hidden cost to auto dealers, who make most of their money on service contracts and have no way to offset skyrocketing parts costs).

We will be scrutinizing the early earnings calls to hopefully get some hints as to how the companies expect tariffs to impact their earnings. We’ve used up $800,000 of our $2.35M worth of protection in our Short-Term Portfolio hedges (see our March 18th review) and we took some off the table on Friday – in case Trump was feeling lenient but that’s not the case and (8am), the Futures are still down about 2.5% and the VIX is 48 so – nobody is calming down – yet.

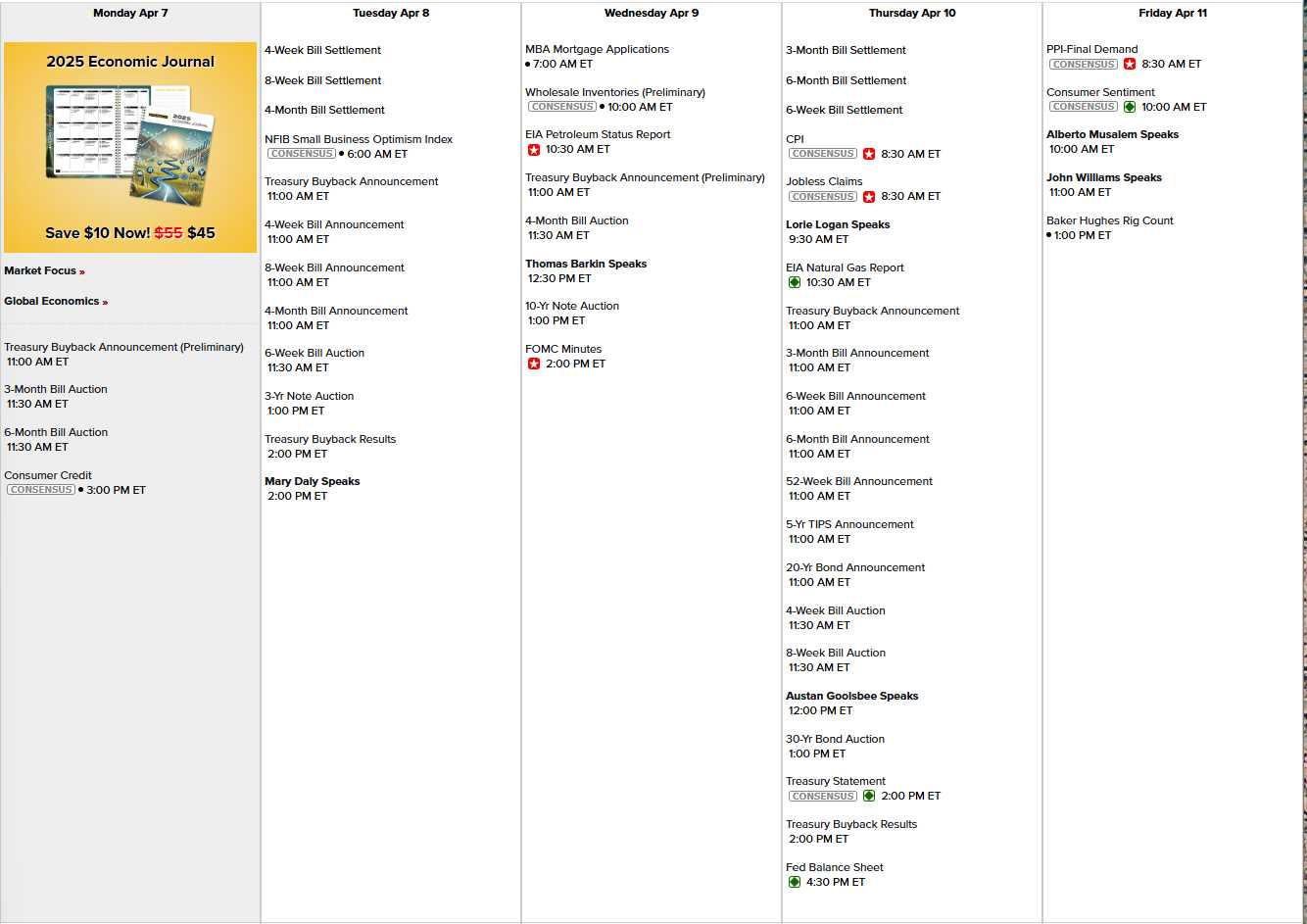

On the Data side, we have Fed Minutes on Wednesday and 6 scheduled Fed Speakers. At the moment, leading Economorons are now expecting 5 (Five?) rate cuts this year – and there are only 6 meetings left and Powell just said he’s in no hurry to lower rates and Trump just passed massive price increases on pretty much everything we buy so DREAM ON idiots…

“Half my life’s in books’ written pages

Storing facts learned from fools and from sages” – Aerosmith

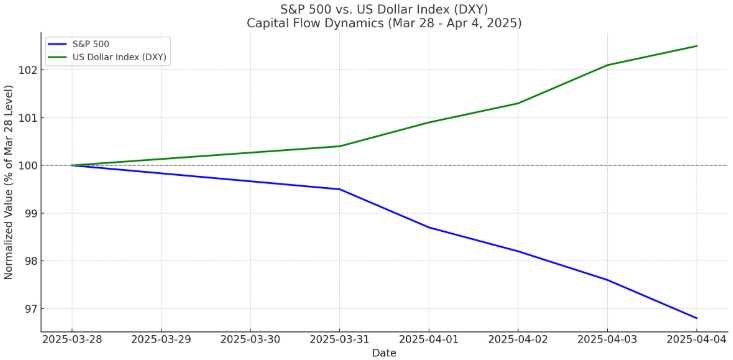

We have Consumer Credit today, Small Business Optimism, CPI, PPI and Consumer Sentiment and many, many, MANY note auctions and hopefully our foreign friends still want to buy US Paper or we are DOOMED! We discussed this over the weekend however and the fact of the matter is – there is literally nowhere else to put all the money that is pouring out of the market.

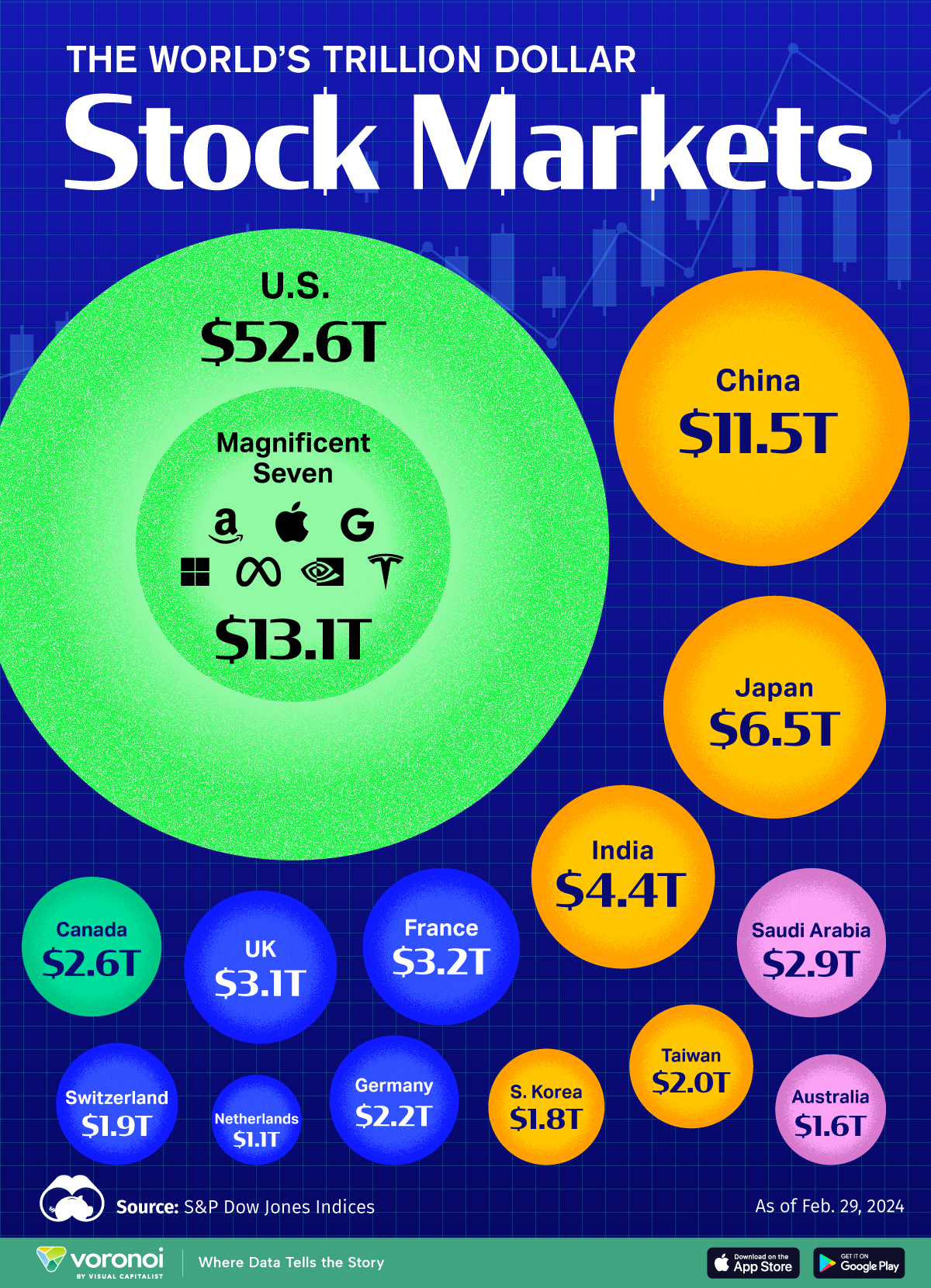

So where is $6Tn (and counting) going to go? If you are not going to put it into real estate, your choices are very limited because Japan’s ENTIRE Market Cap is $6.5Tn so, if you put your $6Tn into Japan, you would run up their equities 100% on average and then you’d be paying ridiculous multiples for Japanese stocks.

All of the UK is $3.1Tn (as of last year, which we’re pretty much back to) and Canada is $2.6Tn and they too are liquidating along with China (-13% TODAY!) so where are all these Trillions of Dollars, Pounds, Euros, Yuan and Yen supposed to go if not real estate? Well, there’s always US debt and we’re borrowing another $600Bn this month but that’s still a drop in the global bucket of CASH!!! that is now sloshing around…

So maybe Trump is a genius? We should have no trouble selling our notes this week as people panic into our paper and there’s really nowhere else for the money to go – other than back into US Equities at some point – even if earnings do turn out to be disappointing. I don’t think we’ll be racing back to S&P 6,000 but I also think we’ll avoid hitting 4,000 because, in the end – nobody’s dead – it’s just higher prices and there will be winners and there will be losers but Commerce will continue under whatever new rules we settle down with.

As the Chinese like to say: “May you live in interesting times…” – it’s a curse!