In this three-part series, Phil Davis joins Greg Bonnell of BNN Bloomberg to break down the volatile start to 2025. From rising tariffs to shifting investor sentiment, Phil offers a sharp take on how to navigate uncertainty with a value-driven approach.

- Episode 1: Market volatility, tariff risks, and where investors should look for opportunity.

- Episode 2: Portfolio resilience in a down market, stocks that are relatively strong, and why Phil is bullish on gold.

- Episode 3: Four detailed trade setups in Bank OZK, Foot Locker, Whirlpool and ArcBest.

Update on the PSW's MoneyTalk Portfolio

Timeline:

0:03 – Portfolio performance flat in a down market

0:40 – Stocks that performed well, portfolio strategy

1:00 – Defensive investment strategy based on Trump policies

1:52 – Lockheed underperforms

2:00 – Gold outlook and Barrick Gold investment thesis

2:50 – Risk to gold if global stability returns

3:20 – Market risks including tariffs and tourism impact

4:20 – Charts no longer reliable due to fundamental shifts

Looking for market opportunities amid tariff tensions

Timeline:

0:00 – Market shift since record highs in February

0:28 – Tariffs as the key cause of market volatility

1:00 – Stocks now presenting value opportunities

1:48 – Canada–U.S. trade impact and uncertainty over tariff policy

2:58 – Market rebound after five down weeks and technical levels explained

3:52 – FedEx earnings and weak consumer confidence raise concerns

4:08 – Canadian investor risks from U.S. tariffs and retaliations

4:30 – Sector-specific risks: autos, steel, energy

5:10 – Defensive and logistics-related plays for Canadians

5:45 – Sector outlook: financials, REITs, gold miners

Four New Trades for the MoneyTalk Portfolio

Timeline:

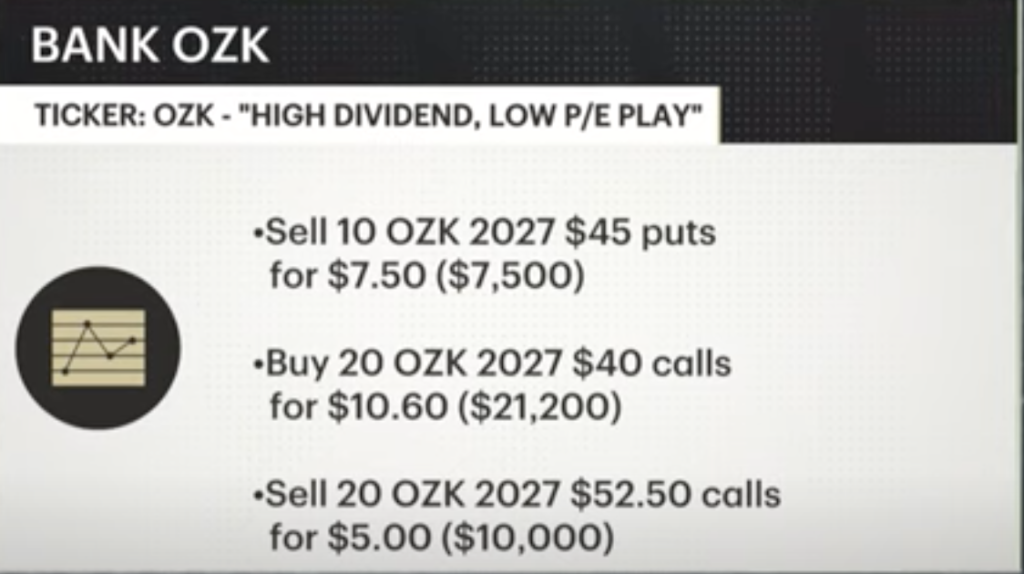

0:00 – Trade idea: Bank OZK (Bank of the Ozarks)

1:55 – Risk analysis of Bank OZK trade

2:35 – Foot Locker and Nike relationship

4:25 – Whirlpool Corporation and tariff impact

7:15 – Income strategy using Whirlpool options spread

8:20 – Trade idea: ArcBest and logistics sector opportunity

Trade Ideas: