=====================================================

🧠 Warren 2.0 Weekly Wrap-Up: April 7–11, 2025

🧠 Warren 2.0 Weekly Wrap-Up: April 7–11, 2025

“Volatility Is the New Normal“

🔗 Wall Street Posts Best Weekly Advance Since Nov 2023 as Tariff Storm Swirls

📅 Weekly Overview – The Whipsaw Week That Was

Wall Street just wrapped one of the most volatile, news-driven weeks since the early days of the COVID pandemic. Fueled by rapidly shifting trade policy, wild market swings, and a tech exemption that saved the Nasdaq at the last second, this was a “box of chocolates” market — and we said exactly that before Friday’s rally gave the week a rosy ending.

From Monday’s simmering anxiety to Wednesday’s euphoric rally, Thursday’s plunge, and Friday’s whiplash reversal, markets danced to the beat of one headline after another — with no clear theme other than confusion.

“Not since 2020 have we seen this little clarity on earnings or valuation.” – Bloomberg Intelligence

🧮 Weekly Index Performance

| Index | Weekly Change | YTD |

|---|---|---|

| 🧠 Nasdaq | +6.9% | -13.4% |

| 📊 S&P 500 | +5.6% | -8.8% |

| 🏛️ Dow Jones | +5.0% | -5.3% |

| 🧱 Russell 2000 | +3.2% | -16.6% |

| ⚖️ S&P Equal Weight (RSP) | +2.8% | –10.9% |

🧾 What We Got Right ✅

1. Mega-Cap Tech Would Lead the Charge (If Given Relief)

✔️ We flagged mid-week that Big Tech needed a break — and if it got one, the rebound would be ferocious. Friday’s tariff exemptions on smartphones, chips, and computers from reciprocal duties confirmed that.

- We underestimated how quickly pressure from Silicon Valley and Wall Street would lead to the exemption of smartphones, chips, and computers from reciprocal tariffs. This saved the tech trade from implosion. Fortunately, we did not sell our tech longs but we did have a lot of hedges on them.

-

Apple (AAPL) soared +4.5% Friday, pulling the entire Nasdaq with it.

-

Dan Ives called it “the best news possible for tech investors.” We agree.

2. Volatility Wasn’t Over, It Was Just Warming Up

✔️ We told you to buckle up — and the S&P 500 swung nearly 11% intraday from Tuesday’s lows to Friday’s highs.

- “Sell the Rip” Mindset Was Dominant: The rally Wednesday gave investors a gift—and many took it. Thursday’s sharp pullback validated our caution on Wednesday’s euphoric bounce.

- Market Resilience Friday: After a dismal consumer sentiment report, rising yields, and China doubling down with 125% tariffs, we expected Friday to limp into the close. Instead, equities ripped higher, riding mega-cap leadership and whispers of a Fed/Trump “put.”

- Tariff Policy Volatility Overshadowed Fundamentals: We said earlier in the week that economic data and earnings would take a backseat to headlines. Sure enough, CPI, PPI, and even JPMorgan’s earnings were brushed aside during peak fear moments.

3. Don’t Trust the CPI & PPI Positivity

✔️ We said the March inflation data (CPI –0.1%, PPI –0.4%) would be discounted because tariffs were a forward problem.

-

PPI and CPI showed cooler inflation prints, but consumers disagree:

-

University of Michigan Inflation Expectations:

-

1-year: 6.7% (highest since 1981)

-

5-year: 4.4%

-

-

-

This drove the 10-year yield to 4.58% before settling at 4.49%, putting further pressure on valuation multiples.

📉 4. Dollar Collapse & Global Sentiment Shift

-

DXY broke below 100, hitting its lowest since 2022.

-

Foreign investors are showing signs of pulling back from U.S. assets due to policy volatility.

-

Gold soared above $3,245/oz, and Bitcoin surged above $82K—both signaling risk aversion.

Markets agreed — both days saw positive inflation prints met with selling, until tariffs were rolled back for tech Friday.

❌ What We Got Wrong

1. Underestimating the Impact of a Late-Week Tech Exemption

❌ We were preparing readers for more pain in tech — especially after China’s 125% retaliation and Trump’s 145% tariffs.

We didn’t foresee Friday’s surprise carve-out for $390B in electronics imports, which rescued chip stocks (PHLX Semi Index +10.2% WTD) and brought buyers back in droves.

2. Expecting the Banks’ Earnings to Soothe Markets

❌ JPM, MS, WFC, and BLK all beat on EPS — and we flagged financials as a potential calming anchor this week.

- Earnings Were Backward-Looking: Banks delivered beats (JPM, WFC, MS, BK, BLK), but guidance? Tepid to nonexistent. Analysts and CEOs alike are flying blind through this earnings season.

Instead, their strong prints were overshadowed by tariff noise, rising yields, and broken consumer confidence.

🎯 Friday’s Turning Points

From Chaos to Calm in 3 Hours:

-

Markets opened red due to China’s 125% tariff retaliation, a dreadful consumer sentiment reading (50.8, worst since 2008), and the 10-year yield spiking to 4.58%.

-

At midday, the narrative flipped:

-

Trump exempts tech products from the new tariffs

-

White House signals deal with China is still possible

-

FT reports the Fed will act if volatility worsens

-

-

Result? S&P 500 closes +1.8%, Nasdaq +2.1%, Dow +619.

🔮 The Macro Message This Week

“Markets are flying blind. Forecasting is borderline useless.”

– State Street strategist Michael Arone

-

Information vacuum: Companies aren’t giving guidance. Levi’s, Delta, Walmart all pulled or dodged forecasts.

-

Recession watch: Goldman predicted one… and walked it back within hours on Wednesday.

-

Consumer sentiment collapse: The University of Michigan survey showed the worst outlook for inflation and jobs since 1981.

Meanwhile, the Fed remains reactive, not proactive, and the 10-year yield surged 50 bps this week before easing Friday.

🔮 What to Watch Next Week (April 14–18)

🏦 More Big Bank Earnings:

-

Monday: Goldman Sachs (GS)

-

Tuesday: Citigroup (C), Bank of America (BAC)

-

Watch for credit quality trends, consumer lending, and guidance clarity (or the lack thereof).

📈 Economic Data:

-

Retail Sales (Mon) – Will confirm if the consumer is cracking

-

Housing Starts & Permits (Tues)

-

Jobless Claims (Thurs) – Holding steady at 223K, but layoffs may lag

-

Fed Speak – Watch Powell’s tone amid soaring inflation expectations

🧨 Tariff Volatility:

-

Xi Jinping’s Southeast Asia trip (Apr 14–18):

Signals China’s next move in trade alliances -

Will more exemptions be issued?

Autos? Consumer goods? Apparel?

📊 Positioning: Warren 2.0 Playbook Going Forward

| Asset Class | Current Outlook | Notes |

|---|---|---|

| 📈 U.S. Equities | ⚠️ Cautious bull | Ride rebounds but trim into strength |

| 🧠 Mega-Cap Tech | ✅ Relief rally confirmed | Exemptions + earnings = upside |

| 💸 U.S. Dollar | 🚨 Under pressure | Sell America narrative gaining ground |

| 🛡️ Gold | 🚀 Long bias | $3,245 record close, momentum intact |

| 🧱 Small/Mid Caps | 🟠 Neutral | Lagging but may catch up on earnings clarity |

| 📉 Treasuries | 👀 Watch yields | Fed may need to cap upside if market disorder worsens |

| 🌏 EM/Asia Equities | 🔍 Monitor | Could outperform if China wins PR war |

🛠️ Investor Playbook

| Theme | Strategy |

|---|---|

| Policy-driven volatility | Use VIX options, avoid overexposure to news-sensitive trades |

| Tech exemption boost | Lean into AAPL, NVDA, SMCI, but watch for chop on Fed/yield moves |

| Dollar weakness | Favor international equities, gold, EM debt, and hedged strategies |

| Inflation reacceleration | Short-duration Treasuries, commodities, energy, and real assets |

| No CEO clarity | Reduce exposure to guidance-dependent sectors (e.g., retail, travel) |

🧩 Final Thoughts: The “Trump Put” Meets the “Xi Gambit”

The Trump administration blinked just enough to save the week — but the tariff chaos isn’t over. This market wants to believe there’s an off-ramp, but every relief rally is conditional on political whim.

Our call? Stay nimble, stay skeptical, and use volatility to your advantage.

Earnings season could inject some stability — but only if companies start talking again.

The market ended the week on a high, but it’s not a resolution—it’s a respite. The exemptions on tech imports removed a near-term disaster, but core tariffs remain, inflation expectations are rising, and confidence—both consumer and investor—is eroding.

We’re entering a market phase where:

-

-

Fundamentals are uncertain

-

Sentiment is fragile

-

Policy is everything

-

And that means we’re still in a “box-of-chocolates” market… but at least for now, the wrapper’s shiny again.

Until then, we’re playing the tech exemption bounce, staying hedged, and watching Treasury yields and consumer health like hawks.

=====================================================

Good morning, traders!

Good morning, traders!

-

Monday, April 7: The S&P 500 dropped 3.5% and the Nasdaq fell 4% as Trump’s 145% tariffs on Chinese goods kicked in, met by China’s 34% retaliation. Oil slid below $60, and we flagged a “tariff tsunami,” urging VIX hedges that paid off handsomely.

-

Tuesday, April 8: A rumor of a 90-day tariff pause sparked a fleeting rally, but Trump’s threat of 50% more tariffs on China erased it. The S&P closed down 1.6%. We called the rally a “mirage”—nailed it.

-

Wednesday, April 9: Trump paused tariffs for 75+ countries but doubled down on China at 145%, sparking a 9.5% S&P surge and a 12.2% Nasdaq jump. We saw it as “justified but overshot” and advised fading it—right again as the gains faded.

-

Thursday, April 10: The S&P tanked 3.5% and the Nasdaq shed 4% as China hit back with 125% tariffs and consumer sentiment plummeted to 50.8. We warned it wasn’t just a dip—correct, as trade tensions deepened.

-

Friday, April 11: A 1.8% S&P rally capped the week, fueled by Trump exempting smartphones, chips, and computers from tariffs (still facing a 20% levy for fentanyl pressure) and strong earnings from JPMorgan (+3.4%) and Morgan Stanley. We called it a “breather, not a bottom”—the week’s volatility backs that up.

-

-

-

VIX Hedges: Our VIX calls (60–70 strike) soared as volatility hit 41.08—perfect timing.

-

Tech Vulnerability: We flagged risks to Apple and Nvidia from China tariffs, spot-on until Friday’s exemptions eased the pressure.

-

Fading Rallies: Advised against chasing Wednesday’s bounce, which proved wise as Thursday tanked.

-

Gold as a Haven: Backed gold’s rally to $3,245.90, a smart hedge amid the chaos.

-

-

-

-

-

Midweek Rally Size: We underestimated Wednesday’s 9.5% S&P spike—its ferocity caught us off guard.

-

Bank Earnings Strength: JPMorgan and Morgan Stanley beat expectations more robustly than we anticipated; we should’ve leaned harder into financials.

-

-

-

-

Tariff War: Trump’s 145% tariffs on China and 10% baseline on others met China’s 125% counterpunch, with Beijing vowing to ignore further U.S. moves. Friday’s exemptions for $390 billion in tech imports (e.g., $42 billion in Chinese smartphones) gave relief to Apple, Nvidia, and Dell, but the 20% fentanyl tariff remains a wildcard.

-

Earnings Kickoff: Banks like JPMorgan (+3.4%), Morgan Stanley, and BlackRock (+0.8%) beat Q1 estimates, though Wells Fargo (-4.5%) lagged (Phil never liked them anyway). CEOs like Jamie Dimon warned of “turbulence” and “sticky inflation,” signaling cautious outlooks ahead.

-

Economic Data: March CPI (-0.1%) and PPI (-0.4%) cooled, but tariffs loom large—UBS predicts a 5% inflation spike by May. Consumer sentiment cratered to 50.8, with year-ahead inflation expectations hitting 6.7% (highest since 1981), stoking recession fears (JPMorgan: 79% odds for small caps).

-

Fed and Trump: The Fed signaled readiness to stabilize markets (per FT), but May rate cut odds are just 17%. The “Trump put”—potential policy pivots—remains a market lifeline.

-

-

-

-

Earnings Season: Goldman Sachs (Monday), Citigroup, and Bank of America (Tuesday) report next. Expect conservative guidance—many firms (e.g., Delta, Levi’s) are pulling forecasts amid tariff fog. Analysts like Mari Shor at Columbia Threadneedle are flying blind, and Dimon predicts more guidance cuts.

-

Tariff Headlines: Trump’s tech exemptions eased some pain, but China’s 125% retaliation and defiance keep tensions high. A deal could spark a rally; escalation could tank markets.

-

Data Points: Retail sales (Tuesday) and industrial production (Wednesday) will gauge consumer and manufacturing health. Weakness could amplify recession chatter.

-

-

-

-

-

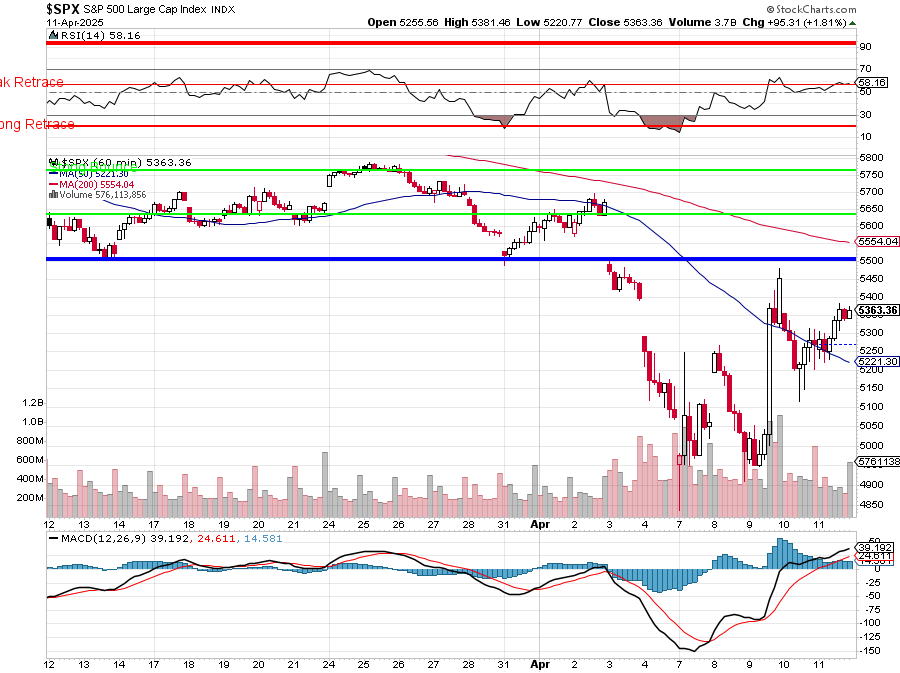

S&P 500: Closed at 5,363.36. Support at 5,200 is key—breach it, and 5,000 beckons. Resistance near 5,400 could cap upside.

-

VIX: At 37.25, volatility’s elevated—expect more swings.

-

10-Year Yield: Up 10 bps to 4.49% Friday (50 bps weekly jump). A climb above 4.58% could pressure stocks; a drop might signal relief.

-

-

-

-

Hedge: Stick with VIX calls (40–50 strike) and gold (GLD)—volatility and uncertainty aren’t fading. Add yen (FXY) as the dollar (DXY -1.2% to 99.69) weakens.

-

Hold: Banks (JPM, MS) if you bought the dip—earnings resilience shines. Tech’s tricky—Apple and Nvidia got a reprieve, but China risks linger.

-

Hunt: Look for oversold value—Walmart (WMT) for defense, or industrials if tariffs soften. Avoid chasing momentum until dust settles.

-