Executive Summary

As of Monday, April 14, 2025, the US-China trade relationship remains fraught with extreme tension and uncertainty following a period of rapid tariff escalations and subsequent partial modifications. The United States has imposed an effective tariff rate of 145% on a wide range of Chinese imports, combining a 125% “reciprocal” tariff with a pre-existing 20% baseline levy. China has retaliated with a 125% tariff on all US goods, declaring its intention to ignore further US escalations. A crucial development occurred late last week with the US exempting certain electronics, including smartphones and computers, from the 125% reciprocal portion, though these items remain subject to the 20% baseline and potentially other duties. Concurrently, the US has paused threatened higher reciprocal tariffs on approximately 86 other nations for 90 days, reverting them to a 10% baseline tariff.

Global financial markets experienced unprecedented volatility in response, initially plummeting on the broad tariff announcements before staging significant, albeit partial, recoveries following the 90-day pause and the electronics exemption. Market sentiment remains fragile, characterized by high uncertainty and a focus on upcoming corporate earnings for clarity.

For investors, the primary challenge is navigating the unpredictable policy environment. Key considerations include heightened inflation and recession risks stemming from the tariffs, potential corporate margin compression, and the strategic importance of supply chain resilience. Diversification strategies face new complexities as even alternative manufacturing hubs are subject to baseline tariffs.

The Q1 2025 earnings season, now underway, is critical. While Q1 results predate the most severe tariff impacts, forward guidance from corporate management will be intensely scrutinized. Companies in highly exposed sectors—including Technology Hardware, Retail, Automotive, Agriculture, and Industrials—are expected to provide cautious outlooks, detailing anticipated impacts and mitigation strategies amidst the ongoing trade friction. The credibility and transparency of management commentary will be paramount for market interpretation in the coming weeks.

Verified Tariff Status (April 14, 2025)

The first half of April, 2025 witnessed a dramatic and confusing escalation in US trade policy, particularly concerning tariffs levied against China and other major trading partners. This section provides a verified summary of the US-China tariff landscape as it stands on Monday, April 14, 2025, clarifying the applicable rates, recent exemptions, and the status of measures affecting other nations, aiming to cut through the considerable noise and uncertainty generated by recent policy shifts.

US Tariffs on China

The tariff structure imposed by the United States on goods originating from China has become exceptionally complex, layering multiple actions based on different legal authorities.

Confirmation of 145% Effective Rate: The current high tariff rate on many Chinese goods is the culmination of several actions taken in rapid succession.

-

- A baseline 10% tariff under the International Emergency Economic Powers Act (IEEPA), citing a national emergency related to trade deficits, was announced on April 2 and became effective April 5, applying broadly to most imports globally. (1)

- On top of this, an initial “reciprocal” tariff of 34% specifically targeting China was announced on April 2, effective April 9.

- Following China’s announcement of retaliatory tariffs on April 4 (10), the US announced a counter-retaliation on April 8, adding another 50% tariff to the reciprocal rate for China, effective April 9. (6) This brought the reciprocal component to 84%.

- After China matched the 84% rate (3), the US administration issued another executive order on April 9, increasing the reciprocal tariff component further by 41 percentage points to 125%, effective April 10.

- Crucially, these IEEPA-based tariffs (both the baseline and reciprocal components) are applied in addition to pre-existing tariffs. This includes the 20% IEEPA tariffs imposed in February and March 2025 related to fentanyl and migration concerns (3) and any applicable Section 301 tariffs remaining from the previous administration. (6)

- Therefore, the total effective US tariff rate on many goods imported from China reached 145% (125% reciprocal + 20% baseline IEEPA) as of April 10. (5) This figure was confirmed by White House clarifications after initial reports varied between 125% and 145%.30 The legal authority cited for these recent escalations is primarily the International Emergency Economic Powers Act (IEEPA).

Electronics Exemption Clarified: Following significant market turmoil and likely intense lobbying pressure, particularly concerning the impact on consumer technology prices (8), the US administration issued a clarification via a Presidential Memorandum and subsequent Customs and Border Protection (CBP) guidance late on April 11/early April 12. (57) This exempted certain key electronic goods—including smartphones, computers, semiconductors, memory chips, and related components classified under specific HTS codes (e.g., 8471, 847330, 8486, 85171300, 85176200, 8541, 8542) (88) from the reciprocal tariff portion (i.e., the 125% layer). This exemption was applied retroactively to April 5. It is critical to understand that these exempted goods are not entirely free of new tariffs; they remain subject to the 20% baseline IEEPA tariffs imposed in February/March 2025 and any applicable Section 301 duties. (43) Administration officials framed this not as a permanent removal but as moving these products to a different “bucket,” signaling potential future sector-specific tariffs, particularly for semiconductors. (43) This tactical adjustment likely aimed to quell immediate market panic and provide breathing room for critical industries while retaining leverage for future actions.

-

- De Minimis Changes: The administration also moved to close the de minimis loophole (Section 321 of the Tariff Act of 1930), which allowed shipments valued under $800 to enter the US duty-free. Effective May 2, 2025, this exemption will be eliminated for goods originating from China (including Hong Kong and Macau). (3) For shipments arriving via international post after this date, new duties will apply: either 120% ad valorem or a specific duty per item ($100 from May 2, rising to $200 from June 1). (36) This represents an increase from the 90%/$75/$150 rates announced just days prior. (3) This change targets the high volume of low-value shipments, particularly from e-commerce platforms like Shein and Temu. (97)

- Section 301 Status: It is important to note that the tariffs imposed under Section 301 of the Trade Act of 1974 during the previous trade disputes largely remain in effect. (6) These tariffs, ranging from 7.5% to 25% on various lists of Chinese goods, apply cumulatively with the newer IEEPA-based tariffs. The statutory four-year review of these tariffs is ongoing, with some product exclusions set to expire on May 31, 2025, unless extended. (42)

China’s Retaliatory Tariffs

China responded swiftly and symmetrically to the escalating US tariffs.

-

- Confirmation of 125% Rate: China initially announced a 34% retaliatory tariff on all US goods on April 4, effective April 10. (1) Following the US increase to 84%, China announced on April 9 it would match this rate, effective April 10. (3) Subsequently, after the US raised its reciprocal rate to 125%, China’s Ministry of Finance announced on April 11 that its tariff on US goods would also increase to 125%, effective April 12. (3)

- Scope and Stance: China’s 125% tariff applies broadly to all goods imported from the United States. (7) Significantly, Chinese officials declared that at this prohibitive level, there is “no possibility for market acceptance” for US goods, and therefore, China would “ignore” any further US tariff increases. (7) This stance appears aimed at capping the tit-for-tat tariff escalation while maintaining a defiant posture (“fight to the end” (16)) and potentially shifting the conflict towards non-tariff measures. Alongside tariffs, China implemented export controls on certain rare earth materials crucial for RF and storage applications, impacting companies like Qualcomm and Micron (7), added US firms to its “Unreliable Entities List”, and initiated trade investigations. Despite the aggressive actions, Chinese officials have simultaneously stated openness to dialogue, contingent on “mutual respect and equality“. (16) China’s decision to declare it will disregard further US tariff hikes can be interpreted as a strategic attempt to regain control of the narrative. By framing additional US levies as economically meaningless (“a numbers game” and “a joke” (27)) because the current 125% rate effectively halts imports (28), Beijing seeks to undermine the perceived leverage of US tariff threats. This allows China to project strength and potentially de-escalate the tariff war on its own terms, shifting focus to non-tariff retaliatory tools like export controls and entity lists, which may offer more targeted leverage. (7)

90-Day Pause for Other Nations

In a significant reversal on April 9, the Trump administration announced a 90-day suspension of the higher, country-specific reciprocal tariffs that were set to take effect that day for most trading partners. (1)

-

- Scope and Effective Rate: This pause applies to approximately 83-86 countries listed in the original April 2 order (excluding China, Hong Kong, and Macau). (36) Effective April 10 and lasting until at least July 9, 2025, imports from these countries are subject only to the 10% baseline tariff imposed on April 5, rather than the higher individualized rates (which ranged from 11% to 50%). (3) For example, tariffs on goods from Vietnam were paused at 10% instead of escalating to 46%, and tariffs on Indian goods paused at 10% instead of 26%. (2) Canada and Mexico remain largely exempt from these IEEPA tariffs due to USMCA, though separate 25% tariffs on non-USMCA compliant goods and specific sectors like steel, aluminum, and autos remain in effect. (3

- Rationale and Future: The administration stated the pause was granted because over 75 countries had sought negotiations and refrained from retaliation. (16) This creates a 90-day window for bilateral talks aimed at addressing trade imbalances and practices. However, significant uncertainty remains about the outcome of these negotiations and whether higher tariffs will be reimposed after July 9. (10)

US-China Tariff Rate Summary (as of April 14, 2025)

|

Tariff Type |

Rate |

Effective Date(s) |

Key Exemptions/Notes |

|

US Tariffs on China |

|||

|

Baseline (IEEPA – Fentanyl/Migration) |

20% |

Feb 4 / Mar 4, 2025 |

Applies broadly to Chinese goods.42 Stacks with other tariffs. |

|

Reciprocal (IEEPA – Trade Deficit) |

125% |

Apr 10, 2025 |

Replaced lower reciprocal rates effective Apr 9. Stacks with baseline. (1) |

|

Total Effective US Rate (Most Goods) |

145% |

Apr 10, 2025 |

Sum of 20% Baseline + 125% Reciprocal. (5) |

|

US Electronics Exemption (Reciprocal Portion) |

Exempt (125%) |

Retroactive to Apr 5, 2025 |

Specific HTS codes (smartphones, computers, chips etc.) exempt from 125% reciprocal tariff but still subject to 20% baseline & Sec 301. (43) |

|

De Minimis (<$800) Postal Tariff |

120% or $100/$200 per item |

May 2 / Jun 1, 2025 |

Replaces prior duty-free treatment for low-value shipments via post. (36) |

|

Section 301 Tariffs |

7.5% – 25% |

Various (2018 onwards) |

Apply to specific lists of goods; stack with IEEPA tariffs. Exclusions expiring May 31, 2025. (42) |

|

China Tariffs on US |

|||

|

Total Retaliatory Rate (All US Goods) |

125% |

Apr 12, 2025 |

Applies to all US imports. China stated it will ignore further US hikes. (7) |

|

Tariffs on Other Nations (US Imposed) |

|||

|

Baseline Reciprocal Rate (Most Nations) |

10% |

Apr 5, 2025 |

Applies during 90-day pause (Apr 10 – Jul 9) instead of higher reciprocal rates. (4) |

|

Higher Reciprocal Rates (Paused Countries) |

11% – 50% |

Paused (Apr 10 – Jul 9) |

Higher rates suspended during 90-day negotiation window. |

|

Canada/Mexico (Non-USMCA Goods) |

25% |

Mar 4, 2025 |

Separate IEEPA tariff related to migration/fentanyl; USMCA-compliant goods largely exempt. (3) |

|

Steel & Aluminum (Global) |

25% |

Mar 12, 2025 |

Section 232 tariffs. (5) |

|

Automobiles & Parts (Global) |

25% |

Apr 3 / May 3, 2025 |

Section 232 tariffs. |

Note: Rates are additional ad valorem duties unless specified. Total effective rates may be higher due to stacking of different tariff types (e.g., IEEPA + Section 301). Status as of April 14, 2025.

Market Reaction and Sentiment

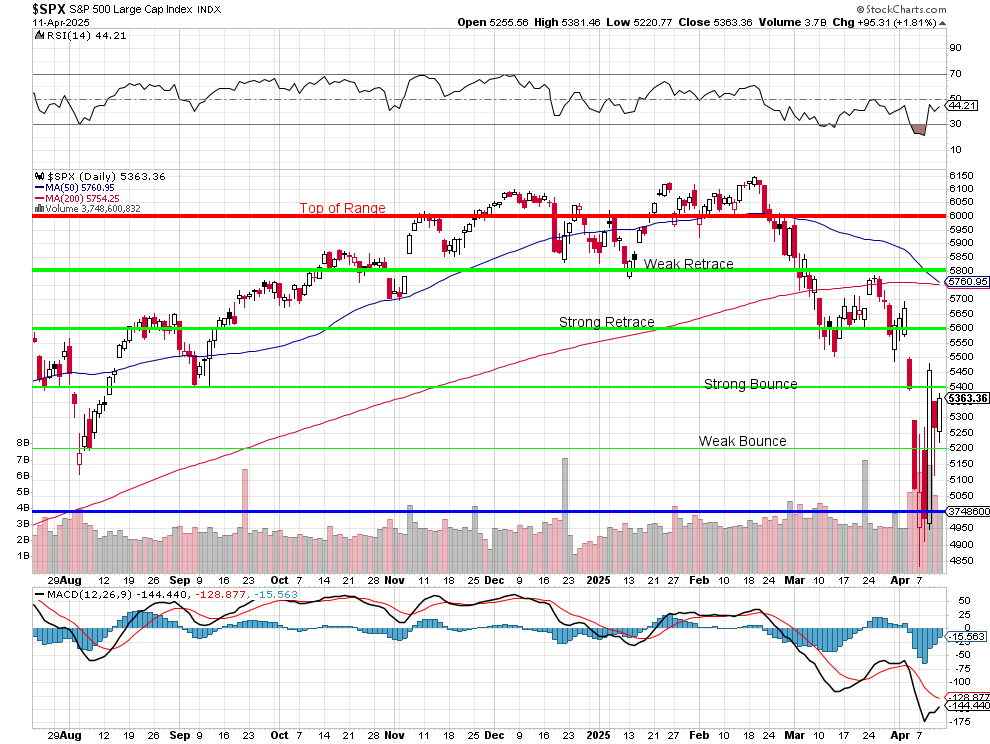

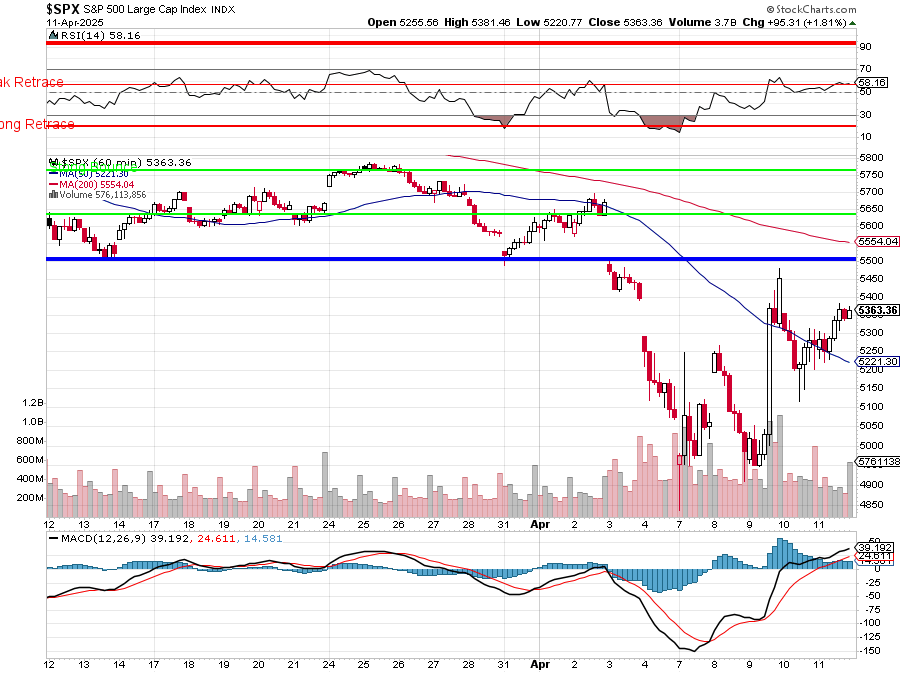

The rapid imposition and subsequent modification of US tariffs in early April 2025 triggered extreme volatility across global financial markets. Investor sentiment swung wildly, driven primarily by the perceived economic consequences of the announced trade policies and the subsequent relief provided by partial rollbacks and exemptions.

Initial Market Plunge (April 2-8)

The announcement on April 2 of sweeping “reciprocal” tariffs, including a baseline 10% levy on most imports and significantly higher rates on major trading partners like China, Japan, and the EU, immediately sent shockwaves through global markets. (105)

Index Performance: US stock indices experienced one of their worst multi-day sell-offs in recent years. In the four trading sessions following the April 2 announcement, the S&P 500 lost 12.1%, the Dow Jones Industrial Average fell 10.8%, and the tech-heavy Nasdaq Composite plunged 13.3%. (134) The S&P 500 futures market indicated the depth of concern, dropping over 3% shortly after the initial announcement. (108) The S&P 500’s 9.1% loss during that first week ranked among the worst weekly performances of the 21st century. (135)

-

Volatility: Market volatility surged, with the CBOE Volatility Index (VIX) spiking above 60 mid-week, a level indicative of extreme investor fear, before retreating significantly after the April 9 pause announcement. (136) Daily trading ranges became exceptionally wide, with the Dow experiencing swings exceeding 2,000 points on multiple days. (137)

Global Impact: The sell-off was not confined to the US. Global stock markets from Asia to Europe reacted negatively. (12) Japan’s Nikkei 225 fell sharply following the imposition of a 24% levy. (108) European indices like the STOXX 50 also saw significant drops. (136)

- Sector and Stock Reactions: Sectors perceived as most vulnerable to tariffs and global economic slowdowns were hit hardest. Technology (XLK) and Consumer Discretionary (XLY) stocks, heavily reliant on global manufacturing and consumer spending, saw steep declines. (142) Industrials, Automotive, Agriculture, and Energy sectors also faced significant pressure due to direct tariff impacts, retaliatory measures, and recession fears. (117) Major individual stocks reflected this pain: Apple shares dropped significantly, shedding hundreds of billions in market value (56); Nike shares plunged on concerns about its Asian supply chain exposure (60); Tesla faced headwinds from both US tariffs and potential Chinese retaliation (143); and industrial bellwethers like Caterpillar (108) and automakers like GM (147) also declined sharply.

Market Rebound and Stabilization (April 9-14)

The market trajectory shifted dramatically on April 9 following the White House announcement of a 90-day pause on the higher reciprocal tariffs for most countries and the simultaneous escalation of tariffs specifically on China.

-

- Pause-Induced Rally: The suspension of the most severe tariff threats against key allies and trading partners triggered a powerful relief rally. On April 9, US stock indices recorded historic gains, with the S&P 500 jumping between 7.8% and 9.5%, the Nasdaq soaring over 12%, and the Dow gaining nearly 7%. (17) Apple experienced its best single-day stock performance since 1998. (78)

- China Tariff Reality Check: The euphoria was short-lived. On April 10, markets pulled back as investors digested the reality that the US-China tariff war had significantly escalated (US to 125%, China to 84% at that point) and that the 10% baseline tariff remained for paused countries. (30)

- Electronics Exemption Boost: A further positive catalyst emerged late on April 11 and into the weekend, as the administration clarified that key electronics imports from China would be exempt from the 125% reciprocal tariff. (43) This news spurred a strong rally in technology stocks and futures markets leading into the week of April 14. Nasdaq futures were indicated up between 1.25% and 2% early this morning, with Apple futures jumping 5-6%, Dell +7%, and Nvidia +2-3%. (140) Overall US stock futures pointed about 1.5% higher early on April 14, extending the relief rally from Friday.

Current Market Sentiment (as of April 14)

As of April 14, market sentiment can be described as cautiously optimistic but remains underpinned by significant uncertainty. The electronics exemption removed a major overhang, particularly for the heavily weighted tech sector, allowing for a partial recovery in risk appetite. (58) However, the core issues persist:

-

- Uncertainty Prevails: The fundamental US-China trade conflict is unresolved and has arguably intensified with 145% vs 125% tariffs in place on many goods. The 90-day pause for other countries merely postpones decisions and creates a potential policy cliff in early July. (107) Hints of future sector-specific tariffs (e.g., semiconductors) add another layer of unpredictability. (43)

- Volatility Remains Elevated: While down from its peak, the VIX remained elevated around 40 at the end of the prior week, signaling continued investor nervousness. (136) The extreme daily swings experienced suggest markets are highly sensitive to news flow.

- Focus Shifts to Earnings: With the immediate tariff picture slightly clearer (though still precarious), investor attention is now turning squarely to the Q1 2025 earnings season for tangible evidence of corporate resilience and, more importantly, forward guidance on navigating the tariff environment. (148)

Safe Havens: The flight to safety seen mid-last week, evidenced by record gold prices (136) and significant US dollar weakness against the Yen, Euro, and Swiss Franc, moderated somewhat after the electronics exemption but underscores lingering risk aversion.

The strong market rallies observed on April 9 and April 11-14 appear largely driven by the reduction of perceived worst-case scenarios, rather than a fundamental improvement in the economic outlook or a resolution of the trade conflict. The removal of the threat of immediate, crippling tariffs across the board (via the pause) and on critical tech imports (via the exemption) provided significant relief. (162) However, this relief rally is built on a foundation of continued high tariffs on China, a baseline 10% tariff on many other nations, and substantial policy uncertainty looking forward. The market is reacting more to the absence of the most extreme negative outcomes than to the presence of genuinely positive developments.

The initial sell-off and subsequent partial recovery also highlighted how investors differentiated between sectors based on perceived tariff vulnerability. Technology, Consumer Discretionary, Automotive, and Agriculture stocks bore the brunt of the initial downturn due to their direct exposure to global supply chains, particularly those involving China, Vietnam, and Mexico, and export markets. (25) The sharp rebound in tech stocks following the electronics exemption confirmed that direct tariff impact, rather than just broad economic fears, was a primary concern for these names. (162) This underscores the market’s attempt to parse company-specific risks within the overarching macro uncertainty.

Investor Implications and Strategic Considerations

The tumultuous trade policy environment established in early April 2025 presents significant challenges and necessitates strategic adjustments for investors. Heightened uncertainty, stemming from the rapid implementation of steep tariffs, retaliatory actions, and subsequent partial suspensions, dominates the investment landscape. Navigating this requires a focus on resilience, a keen understanding of sector-specific risks, and careful consideration of both short-term volatility and potential long-term structural shifts.

Navigating Uncertainty

The foremost challenge for investors is the profound lack of policy predictability. (24) The abrupt 90-day pause on higher reciprocal tariffs for most nations, while providing temporary relief, creates a significant policy cliff edge in early July 2025. (107) This compressed timeframe for potential negotiations or further policy shifts makes long-term strategic planning exceptionally difficult for businesses (53) and could lead to deferred investment decisions. (181) Furthermore, the administration’s explicit mention of potential future sector-specific tariffs, particularly targeting semiconductors and electronics despite the recent exemption (43), adds another layer of complexity. This pervasive uncertainty makes it challenging for companies to provide reliable forward guidance, which in turn impacts investor confidence and market stability. (24) The 90-day pause, therefore, amplifies near-term uncertainty by concentrating potential policy shifts into a narrow window, rather than resolving the underlying issues.

Key Risks for Portfolios

Investors must grapple with several interconnected risks stemming directly from the tariff policies:

-

- Inflationary Pressures: Tariffs act as a direct tax on imported goods, increasing costs for businesses and consumers. Furthermore, reduced import competition allows domestic producers to raise their prices. (201) This combination is expected to exert significant upward pressure on inflation. Forecasts reflect this concern: Yale’s Budget Lab estimated the tariffs (post-pause) would raise the overall price level by 2.3% in the short run, equivalent to a $3,800 loss in purchasing power per household. (181) JPMorgan projected year-end inflation reaching 4.4% (up from 2.8%) (180), Morningstar anticipated a 0.6-1.3 percentage point increase in PCE inflation over 2025-2026 (190), and Capital Economics forecasted CPI hitting 4.5% by late 2025. (195) Specific sectors like apparel (+33% to +64% price increase estimates) (48) and automobiles (+$4,500 to +$7,600 average price increase estimates) (19) are expected to see particularly sharp price hikes.

- Recession Risk: The combination of higher consumer prices (eroding purchasing power) (48), increased business costs (potentially reducing investment and hiring), and supply chain disruptions significantly elevates the risk of an economic slowdown or recession. Major financial institutions have increased their recession probability forecasts, with JPMorgan citing a 60% chance (180), Goldman Sachs also raising odds (217), and Morningstar estimating a roughly 40% risk. (190) The tariffs represent a significant negative shock to the economy. (202)

- Margin Compression: Companies heavily reliant on imports face significant pressure on their profit margins. (60) The ability to pass on increased tariff costs to consumers is uncertain, especially in a potentially weakening demand environment. Similarly, negotiating price reductions from suppliers, particularly those in China facing their own pressures, may prove difficult. (209) This squeeze between higher input costs and potentially capped selling prices threatens corporate profitability across various sectors.

Potential Investor Strategies

In this environment, investors may consider the following strategic adjustments:

-

- Focus on Resilience: Prioritize investments in companies demonstrating financial strength (robust balance sheets, strong cash flow) and operational resilience. This includes companies with significant pricing power, often associated with strong brands or unique market positions (wide economic moats (221)), which may allow them to better absorb or pass on tariff costs. Scrutinizing management commentary during earnings calls for clear, credible mitigation strategies is essential. (63) Companies with already diversified supply chains may also be better positioned. (234)

- Sector Tilts: A nuanced approach to sector allocation is warranted. While broadly reducing exposure to heavily tariff-impacted sectors like Consumer Discretionary, certain Industrials, and Technology Hardware might seem prudent, opportunities may exist within these sectors among companies with stronger mitigation potential. Conversely, sectors perceived as less exposed, such as domestically focused services, defense (134), or healthcare, might offer relative safety, though indirect economic impacts remain a risk. (49)

- Geographic Diversification Reassessment: The traditional “China+1” strategy of diversifying manufacturing to countries like Vietnam, Mexico, and India has been complicated. (114) While these locations still offer advantages over China under the current tariff structure (10% baseline vs. 145% effective rate), they are no longer tariff-free havens. (2) Furthermore, the deep integration of these alternative hubs with Chinese supply chains for intermediate goods means tariff costs can still filter through indirectly. (234) True supply chain resilience against broad protectionist policies may require more fundamental, and costly, shifts towards nearshoring or reshoring (132), a process fraught with its own feasibility challenges and timelines measured in years, not months. Therefore, simply moving production out of China is necessary but no longer a sufficient strategy to fully insulate against current US trade policy risks.

- Long-Term vs. Short-Term Perspective: Investors should distinguish between short-term market reactions driven by news flow and policy uncertainty (63) and the potential for longer-term structural adjustments in global trade and supply chains. (142) While patience may be rewarded for long-term investors in resilient companies (221), significant near-term volatility and downside risk persist. (167)

Q1 2025 Earnings Outlook

Introduction

The Q1 2025 earnings reporting season, commencing the week of April 14, arrives at a critical juncture marked by peak tariff uncertainty. (148) While first-quarter financial results will largely reflect the operating environment before the most significant tariff escalations took effect in early April (160), the market’s focus will overwhelmingly be on forward-looking commentary. Management guidance, or the lack thereof, regarding the anticipated impact of tariffs and mitigation strategies will be the primary determinant of stock reactions. (148)

The Primacy of Forward Guidance

Given the profound policy shifts occurring just as the quarter closed, historical Q1 performance offers limited insight into the future operating reality for many companies. Investors will scrutinize earnings calls and releases for:

-

- Acknowledgement of Tariff Impact: Explicit discussion of how the 145% US tariffs on China, the 125% Chinese retaliatory tariffs, the 10% baseline tariff on other nations, and the de minimis changes are expected to affect costs, pricing, demand, and supply chains.

- Mitigation Strategies: Details on planned responses, such as price increases, cost absorption, supplier negotiations, supply chain adjustments (diversification, nearshoring), inventory management changes, or product redesigns. (63)

- Revised Outlooks: Updates to revenue, margin, and earnings forecasts for Q2 2025 and the full fiscal year. The degree of confidence, the width of guidance ranges, or decisions to withdraw guidance altogether (24) will be key signals.

Notably, analyst consensus estimates for both Q1 and full-year 2025 earnings were already trending downwards before the April tariff escalations, suggesting underlying pressures were already building. (170) The tariff situation is likely to exacerbate this trend for many companies. The manner in which management teams communicate amidst this uncertainty will be critical though the ever-changing policies of the administration will provide plenty of cover for any sort of guidance management wishes to project. Transparency regarding risks and potential responses, even if the outlook is negative, may be viewed more favorably than ambiguity or perceived unpreparedness. (148)

Sector-Specific Impacts and Commentary

Technology Hardware (e.g., Apple, Dell, HPE, Qualcomm, Micron): This sector faces multifaceted impacts.

-

- Supply Chain Exposure: Heavy reliance on China for manufacturing and assembly remains a key vulnerability for companies like Apple (estimated 80-90% of iPhones assembled in China (8)), Dell, and HPE. (78) The electronics exemption provides significant relief from the 125% reciprocal tariff, but the remaining 20% baseline tariff and potential future semiconductor-specific levies (43) still pose risks.

- Diversification Efforts: Apple’s ongoing shift towards India and Vietnam (56) is now even more critical, though these locations also face the 10% baseline tariff and their own scaling challenges (infrastructure, skills, costs). (113) Morgan Stanley estimates Apple would need to double India production to fully de-risk US supply from China. (63)

- China Market Dynamics: Apple faces intense competition from local rivals like Huawei, whose resurgence has impacted iPhone sales in China. (268) Retaliatory tariffs and rising nationalism could further dampen demand for US brands. (295) Apple reported an 11% sales decline in Greater China in its fiscal Q1 (ended Dec 2024). (280)

- Pricing and Margins: Significant price increases for products like the iPhone are anticipated if tariffs persist, potentially impacting demand. (19) BofA estimated tariffs could represent a $20 billion hit to Apple’s COGS and reduce gross margins by 500 basis points. (78) Analysts have revised Apple estimates downwards post-tariffs. (64) Potential mitigation strategies include shifting production mix to higher-margin models, eliminating lower-storage SKUs, and leveraging financing plans. (63)

- Component Suppliers: Companies like Qualcomm and Micron face impacts from China’s rare earth export controls (101) and tariffs on memory modules/SSDs. (102) Micron plans to pass costs via surcharges. Qualcomm is diversifying into automotive and IoT and acquiring assets in Vietnam to reduce China exposure. (115) Both rely heavily on China for revenue (Qualcomm ~46% in FY24, Intel/Qualcomm >30% (143)).

Retail (e.g., Nike, Walmart, Lululemon, Foot Locker): Retailers face significant pressure from tariffs impacting their global sourcing networks.

-

- Sourcing Exposure: Companies like Nike rely heavily on manufacturing in China, Vietnam, and Indonesia.108 Vietnam, a key hub (50% of Nike footwear FY24 (116)), now faces a 10% baseline tariff instead of the threatened 46%. (2) Indonesia faces 10% instead of 32%. China exposure remains critical (Nike ~24% suppliers (309), Walmart ~60% imports (311)).

- Margin vs. Pricing: Retailers face a difficult choice between absorbing tariff costs (compressing margins) or passing them to consumers (risking demand). (60) Analysts estimated the original reciprocal tariffs could cut Nike’s gross margin by 4%. Nike’s Q4 guidance already reflects margin pressure. (184)

- Inventory & Demand: Inventory management becomes crucial. (188) Concerns about weakening consumer confidence and spending, exacerbated by tariffs, impact demand forecasts. (317)

- China Market: Nike reported a 17% sales decline in Greater China in Q3 FY25 (188), citing a challenging, promotional environment and double-digit traffic declines. (223) CEO Elliott Hill noted increased aggression from competitors. (222) Nike is taking “aggressive steps” to clean up the marketplace there. (223) Anti-American sentiment is also a potential risk for US brands. (295)

- Guidance & Strategy: Nike guided Q4 revenue down mid-teens and gross margin down 400-500bps, explicitly including tariff impacts. (175) This reflects the near-term pain of its “Win Now” strategy (focusing on product innovation, wholesale partnerships, key markets like China). (175) Walmart withdrew Q1 operating income guidance due to tariff uncertainty but maintained sales forecasts, expressing confidence in navigating the turmoil and potentially gaining share. (24) CEO Doug McMillon emphasized flexibility and maintaining low prices.

Automotive (e.g., GM, Ford, Tesla): The auto sector faces direct hits from 25% tariffs on imported vehicles and parts. (5)

-

- North American Integration: High reliance on integrated supply chains with Mexico and Canada makes the sector particularly vulnerable, despite USMCA exemptions for compliant content. (130) Ford CEO Jim Farley called the potential impact “devastating“. (5)

- China Market: GM reported strong Q1 2025 NEV sales growth in China (335) but faces intense local competition (e.g., BYD) and has undertaken significant restructuring due to declining profitability of its JVs. (147) Tesla faces similar competitive pressures (338) and potential demand shifts due to tariffs.

- EV Supply Chains: Tariffs impact EV battery components and materials (342), adding complexity to the EV transition.

- Guidance & Strategy: GM CEO Mary Barra expressed confidence in mitigating 30-50% of potential tariff impacts through contingency planning, including production shifts if necessary. (155) UBS downgraded GM, cutting EPS estimates due to tariff impacts and forecasting volume declines. (156) Tesla’s Elon Musk has voiced concerns about tariffs, calling them “not trivial” and advocating for zero tariffs with Europe. (38) Tesla’s Q1 earnings call (scheduled Apr 22 (351)) will be closely watched for tariff commentary.

Agriculture (e.g., Deere, Ag Inputs): This sector is highly exposed to China’s 125% retaliatory tariffs.

-

- Export Impact: China is a critical market for US soybeans, pork, corn, and other agricultural products.1 The 125% tariff effectively closes this market (27), threatening significant export losses. USDA has already lowered export forecasts for beef and pork citing tariffs. (357)

- Market Share Loss: Competitors like Brazil are poised to gain further market share in China, particularly in soybeans. (25)

- Farmer Viability: Lower commodity prices combined with high input costs and lost export markets raise concerns about farmer profitability and viability. Potential government aid is being discussed but is not a preferred solution for farmers. Farm Bureau highlights that over 20% of US farm income relies on exports.

Industrials (e.g., Caterpillar, Boeing): These companies face headwinds from both input cost increases and export market disruptions.

-

- Input Costs: Tariffs on steel and aluminum (25% globally) increase manufacturing costs. (5)

- China Exports: Retaliatory tariffs from China (125%) make US heavy machinery (Caterpillar (144)) and aircraft (Boeing (361)) less competitive. (146) Caterpillar already reported declining sales volumes in Q4 2024, partly due to tariff impacts.

- Global Demand: Broader economic slowdown fears fueled by the trade war could dampen global demand for capital equipment.

- Supply Chain & Orders: Potential for supply chain disruptions (210) and aircraft order delays or cancellations exists. (369) Delta Air Lines already paused Airbus deliveries citing tariff uncertainty. (23)

- Guidance & Strategy: Caterpillar CEO Jim Umpleby expressed confidence in navigating tariffs due to a large US manufacturing base but acknowledged uncertainty. (328) Analysts have downgraded Caterpillar citing tariff woes. (146) Earnings calls will be watched for updated strategies.

The impact of tariffs clearly extends beyond the direct increase in the Cost of Goods Sold (COGS). Companies across sectors are likely to discuss broader consequences during their Q1 calls, including potential demand destruction if prices are raised significantly. (19) Commentary may also cover accelerated shifts in supply chain strategies as companies intensify efforts to diversify away from high-tariff regions (56), shifts in competitive dynamics (e.g., gains for less-exposed rivals (338)), and potential adjustments to capital allocation plans, such as pausing share buybacks. (156) Investors must analyze these second-order effects detailed in guidance to fully grasp the potential impact on future earnings.

Conclusion and Forward Look

As of April 14, 2025, the US-China tariff situation remains highly volatile and complex. The US maintains an effective tariff rate of 145% on many Chinese goods (combining a 125% reciprocal tariff with a 20% baseline), although key electronics like smartphones and computers have been exempted from the 125% portion. China has retaliated with a 125% tariff on all US goods and has signaled it will not engage in further tit-for-tat tariff increases. For most other countries, higher US reciprocal tariffs have been paused for 90 days (until early July), with a 10% baseline tariff remaining in effect.

Financial markets reacted with extreme volatility, initially crashing on the broad tariff announcements before partially recovering on the news of the 90-day pause and the crucial electronics exemption. Sentiment remains cautious, dominated by uncertainty over future policy actions and the potential economic fallout, including heightened inflation and recession risks.

Investors face a challenging environment requiring a focus on corporate resilience, careful sector analysis, and an understanding that supply chain diversification, while necessary, is complicated by the broad application of baseline tariffs.

The Q1 2025 earnings season is now paramount. Forward guidance provided by companies, particularly those in heavily exposed sectors like Technology Hardware, Retail, Automotive, Agriculture, and Industrials, will be critical. Management commentary on tariff impacts, mitigation strategies, demand outlooks, and supply chain adjustments will shape market expectations and potentially drive significant stock movements.

Looking ahead, the next 90 days will be crucial as the US negotiates with paused countries. The potential for further US sector-specific actions, particularly concerning semiconductors (43), remains a key uncertainty. China may also deploy further non-tariff retaliatory measures. The core US-China trade conflict shows no signs of imminent resolution, suggesting that businesses and investors must prepare for sustained geopolitical friction and economic uncertainty. Continued vigilance, adaptability, and a focus on fundamental resilience are essential for navigating this complex global trade landscape.

Works cited

- Trump’s 2025 Tariff Gambit: Economic Warfare, Strategic Improvisation and the Unraveling of Global Trade Norms – https://debuglies.com, accessed April 11, 2025, https://debuglies.com/2025/04/10/trumps-2025-tariff-gambit-economic-warfare-strategic-improvisation-and-the-unraveling-of-global-trade-norms/

- Impact of April 2025 U.S. Tariffs on Products, Industries, and E-Commerce Sellers, accessed April 11, 2025, https://www.efulfillmentservice.com/2025/04/impact-of-april-2025-u-s-tariffs-on-products-industries-and-e-commerce-sellers/

- Trump 2.0 tariff tracker | Trade Compliance Resource Hub, accessed April 11, 2025, https://www.tradecomplianceresourcehub.com/2025/04/10/trump-2-0-tariff-tracker/

- Fact Sheet: President Donald J. Trump Declares National Emergency to Increase our Competitive Edge, Protect our Sovereignty, and Strengthen our National and Economic Security – The White House, accessed April 14, 2025, https://www.whitehouse.gov/fact-sheets/2025/04/fact-sheet-president-donald-j-trump-declares-national-emergency-to-increase-our-competitive-edge-protect-our-sovereignty-and-strengthen-our-national-and-economic-security/

- Tariffs in the second Trump administration – Wikipedia, accessed April 14, 2025, https://en.wikipedia.org/wiki/Tariffs_in_the_second_Trump_administration

- Immediate Impacts, Risks, and Uncertain Future of President Trump’s Unprecedented Worldwide Tariffs – Gibson Dunn, accessed April 14, 2025, https://www.gibsondunn.com/immediate-impacts-risks-and-uncertain-future-of-president-trumps-unprecedented-worldwide-tariffs/

- China’s Comprehensive Retaliation Against U.S. Tariffs | Insights – Holland & Knight, accessed April 14, 2025, https://www.hklaw.com/en/insights/publications/2025/04/chinas-comprehensive-retaliation-against-us-tariffs

- As tariffs put trade between China and the US in peril, Chinese businesses ponder the future – AP News, accessed April 14, 2025, https://apnews.com/article/united-states-china-trade-tariff-business-volatility-223e4cd53165da6fbd64aff5652a1aff

- China and the Impact of “Liberation Day” Tariffs – CSIS, accessed April 14, 2025, https://www.csis.org/analysis/china-and-impact-liberation-day-tariffs

- Trump’s trade war timeline 2.0: An up-to-date guide | PIIE, accessed April 14, 2025, https://www.piie.com/blogs/realtime-economics/2025/trumps-trade-war-timeline-20-date-guide

- China slaps a 34% tax on all US imports in retaliation for Trump’s tariffs – AP News, accessed April 11, 2025, https://apnews.com/article/china-tariff-trade-trump-earths-02cd23e913649f32985f075058e787c4

- Trump’s trade wars deepen as China retaliates and markets fall. Here’s what to know – AP News, accessed April 11, 2025, https://apnews.com/article/tariffs-trump-trade-war-what-to-know-e40e9eae3fa951438a764733cc55c5b8

- A timeline of US-China tit-for-tat tariffs since Trump’s first term – AP News, accessed April 11, 2025, https://apnews.com/article/china-us-tariffs-timeline-trump-xi-1eeed2865dc7b14e23d7eb8069ba41ea

- Amendment to Reciprocal Tariffs and Updated Duties as Applied to …, accessed April 14, 2025, https://www.whitehouse.gov/presidential-actions/2025/04/amendment-to-recipricol-tariffs-and-updated-duties-as-applied-to-low-value-imports-from-the-peoples-republic-of-china/

- U.S. Tariffs Update – April 8, 2025 – Fredrikson & Byron P.A., accessed April 14, 2025, https://www.fredlaw.com/alert-u-s-tariffs-update-april-8-2025

- China still not ready to negotiate with US after Trump further increases tariffs, officials indicate – Fox Business, accessed April 11, 2025, https://www.foxbusiness.com/politics/china-still-not-ready-negotiate-us-after-trump-further-increases-tariffs-officials-indicate

- Trump limits tariffs on most nations for 90 days; raises Chinese import tax rate to 125%, accessed April 11, 2025, https://www.livenowfox.com/news/trump-tariffs-live-updates-plan-takes-effect-china-april-9-2025

- Trump hits back with a 125% tariff in escalating trade war with China – AP News, accessed April 11, 2025, https://apnews.com/article/china-response-us-tariffs-104-d40d497f6e07ee4163d88443cb75ab3f

- Trump’s tariffs threaten to end quarter-century era of cheap goods for U.S. consumers – AP News, accessed April 11, 2025, https://apnews.com/article/tariffs-inflation-economy-trump-c3d7a8fb870439c5c36bb61685800323

- China’s 84 percent retaliatory tariff on US goods takes effect – Al Jazeera, accessed April 11, 2025, https://www.aljazeera.com/news/2025/4/10/chinas-84-percent-tariff-on-us-goods-takes-effect

- China hikes tariffs on U.S. goods to 84%, as EU also retaliates against Trump tariffs, accessed April 11, 2025, https://www.cbsnews.com/news/china-tariffs-84-percent-retaliatory-tariff-us-products-trump-104/

- China hits back at U.S. and will raise tariffs on American goods from 84% to 125%, accessed April 11, 2025, https://www.latimes.com/world-nation/story/2025-04-11/china-hits-back-at-us-and-will-raise-tariffs-on-american-goods-from-84-to-125

- Delta Stops New Airbus A350-1000 Orders Amid Trump Tariffs – Aviation A2Z, accessed April 11, 2025, https://aviationa2z.com/index.php/2025/04/10/delta-stops-airbus-a350-orders-amid-trump-tariffs/

- Walmart execs vow it will keep delivering low prices despite tariff uncertainty – AP News, accessed April 11, 2025, https://apnews.com/article/walmart-tariffs-outlook-0a341ca973ae16b46a188585f744c3c4

- Tariff is Trump’s favorite word — but for soybean farmers, it spells trouble – Investigate Midwest, accessed April 11, 2025, https://investigatemidwest.org/2025/04/09/tariff-is-trumps-favorite-word-but-for-soybean-farmers-it-spells-trouble/

- Charted: The Average U.S. Tariff Rate (1890-2025) – Visual Capitalist, accessed April 11, 2025, https://www.visualcapitalist.com/the-average-u-s-tariff-rate-since-1890/

- China says it’s raising tariffs on U.S. goods to 125% – CBS News, accessed April 11, 2025, https://www.cbsnews.com/news/china-says-it-will-raise-tariffs-on-u-s-goods-to-125/

- China ups tariffs on US goods to 125%, calls Trump’s war a ‘joke’ – The Register, accessed April 14, 2025, https://www.theregister.com/2025/04/11/china_tariffs_latest/

- China hits back at US and will raise tariffs on American goods from 84% to 125% – AP News, accessed April 14, 2025, https://apnews.com/article/china-us-trump-tariffs-2e05057e973e1e26d1b95c5be003b4cd

- Trump tariffs updates: China hit with 145% duties as Wall Street slides – Al Jazeera, accessed April 14, 2025, https://www.aljazeera.com/economy/liveblog/2025/4/10/trump-tariffs-live-stocks-skyrocket-as-many-duties-paused

- US-China Trade War Tariffs: An Up-to-Date Chart | PIIE, accessed April 14, 2025, https://www.piie.com/research/piie-charts/2019/us-china-trade-war-tariffs-date-chart

- An Overview of the 2025 Tariffs – the American Booksellers Association, accessed April 11, 2025, https://www.bookweb.org/news/overview-2025-tariffs-1631822

- Could the iPhone’s Price Double With Trump’s New 125% Tariff? We Do the Math – CNET, accessed April 11, 2025, https://www.cnet.com/personal-finance/banking/could-the-iphones-price-double-with-trumps-new-125-tariff-we-do-the-math/

- Trump Raises Tariffs on China to 145% – Overview and Trade Implications, accessed April 14, 2025, https://www.china-briefing.com/news/trump-raises-tariffs-on-china-to-125-overview-and-trade-implications/

- China to further raise tariffs on US goods to 125% from 84% as trade war continues, accessed April 11, 2025, https://m.economictimes.com/news/international/global-trends/china-to-raise-tariffs-on-us-goods-to-125-from-84-as-trade-war-betweem-america-beijing-continues/articleshow/120199749.cms

- 2025 U.S. Tariffs Update – New Trade Policies & Ecommerce Impact | Zonos Docs, accessed April 14, 2025, https://zonos.com/docs/guides/2025-us-tariff-changes

- China Raises US Tariffs to 125% in Latest Escalation of Trade War – Investopedia, accessed April 11, 2025, https://www.investopedia.com/china-raises-us-tariffs-to-125-percent-in-latest-escalation-of-trade-war-11713392

- The week that Trump pushed the global economy to the brink with tariffs — and then pulled back – AP News, accessed April 11, 2025, https://apnews.com/article/trump-tariffs-economy-one-week-liberation-day-1aad750dc90829f07473fe17f913b8ba

- Tariffs on China raised to 125%, Rates for Other Countries Lowered to 10% for 90 days, accessed April 11, 2025, https://www.internationaltradeinsights.com/2025/04/tariffs-on-china-raised-to-125-rates-for-other-countries-lowered-to-10-for-90-days/

- Modifying Reciprocal Tariff Rates to Reflect Trading Partner Retaliation and Alignment, accessed April 11, 2025, https://www.whitehouse.gov/presidential-actions/2025/04/modifying-reciprocal-tariff-rates-to-reflect-trading-partner-retaliation-and-alignment/

- China increases tariffs on US imports to 125% from 84% amid ongoing trade war, accessed April 11, 2025, https://www.foxbusiness.com/fox-news-world/china-increases-tariffs-us-imports-125-from-84-amid-ongoing-trade-war

- A Guide to China’s Section 301 Tariffs (2025 Update) – USA Customs Clearance, accessed April 14, 2025, https://usacustomsclearance.com/process/section-301-tariffs-a-comprehensive-guide/

- Trump Tariffs Update: Here’s What’s Happening Now in April 2025 …, accessed April 14, 2025, https://www.kiplinger.com/taxes/whats-happening-with-trump-tariffs

- US suspends President Trump’s Reciprocal Tariff Policy for 90 days, except for China, accessed April 14, 2025, https://globaltaxnews.ey.com/news/2025-0868-us-suspends-president-trumps-reciprocal-tariff-policy-for-90-days-except-for-china

- U.S.-China Trade Update: Tariff Escalation and End of De Minimis Exemption – Lathrop GPM, accessed April 14, 2025, https://www.lathropgpm.com/insights/u-s-china-trade-update-tariff-escalation-and-end-of-de-minimis-exemption/

- Trump pauses steeper tariffs for most countries, while hiking levies on China. What we know – AP News, accessed April 14, 2025, https://apnews.com/article/trump-reciprocal-tariffs-higher-rates-china-9645cf4608a8c153e90bdd10263ccb01

- Stock market plummets a day after huge gains on tariff pause announcement – CBS News, accessed April 14, 2025, https://www.cbsnews.com/news/stock-market-down-trump-tariff-trade-war-04-10-2025/

- The Fiscal and Economic Effects of the Revised April 9 Tariffs | The …, accessed April 11, 2025, https://budgetlab.yale.edu/research/fiscal-and-economic-effects-revised-april-9-tariffs

- Tariffs: Estimating the Economic Impact of the 2025 Measures and Proposals – Federal Reserve Bank of Richmond, accessed April 11, 2025, https://www.richmondfed.org/publications/research/economic_brief/2025/eb_25-12

- Trump 2.0 tariff tracker | Trade Compliance Resource Hub, accessed April 11, 2025, https://www.tradecomplianceresourcehub.com/2025/04/02/trump-2-0-tariff-tracker/

- Trump Raises Tariffs on China to 104% – Overview and Trade Implications, accessed April 11, 2025, https://www.china-briefing.com/news/trump-raises-tariffs-on-china-to-54-overview-and-trade-implications/

- What You Need to Know About Reciprocal Tariffs – Miller & Chevalier Chartered, accessed April 14, 2025, https://www.millerchevalier.com/publication/what-you-need-know-about-reciprocal-tariffs

- What Every Multinational Company Should Know About … the Pause in the Reciprocal Tariffs, accessed April 14, 2025, https://www.foley.com/insights/publications/2025/04/multinational-company-pause-reciprocal-tariffs/

- Where things stand for Trump in global tariff battle – AP News, accessed April 11, 2025, https://apnews.com/article/trump-tariffs-trade-deals-china-eu-a2cfd95cb824a1d5bcdb8382756eb2d0

- China’s 125% tariff counter to Trump’s 145% levy, vows to ‘fight till end’ | World News, accessed April 11, 2025, https://www.business-standard.com/world-news/china-125-percent-tariff-us-trade-war-donald-trump-xi-jinping-125041100544_1.html

- US-China Tariff War Impact on Apple iPhone Prices & Business, accessed April 11, 2025, https://www.indmoney.com/blog/us-stocks/apple-implications-after-us-china-tariff-war

- China says US tariff exemptions ‘small step in correcting wrong practice’ | News | Al Jazeera, accessed April 14, 2025, https://www.aljazeera.com/news/2025/4/13/china-says-us-tariff-exemptions-small-step-in-correcting-wrong-practice

- Trump tariffs live: US hints at electronics levies; China says ‘no winner’ – Al Jazeera, accessed April 14, 2025, https://www.aljazeera.com/news/liveblog/2025/4/14/trump-tariffs-live-us-hints-at-electronics-levies-china-says-no-winner

- U.S. exempts smartphones, computers from global Trump tariffs – CBS News, accessed April 14, 2025, https://www.cbsnews.com/news/us-exempts-smartphones-computers-from-global-trump-tariffs/

- Sports Apparel Stocks Nosedive on News of Trump Tariffs, accessed April 11, 2025, https://frontofficesports.com/trump-tariffs-vietnam-nike-stock/

- Regulating Imports with a Reciprocal Tariff to Rectify Trade Practices that Contribute to Large and Persistent Annual United States Goods Trade Deficits – The White House, accessed April 14, 2025, https://www.whitehouse.gov/presidential-actions/2025/04/regulating-imports-with-a-reciprocal-tariff-to-rectify-trade-practices-that-contribute-to-large-and-persistent-annual-united-states-goods-trade-deficits/

- 2025 Tariffs and Their Impact on Global Trade | UPS Supply Chain Solutions – United States, accessed April 14, 2025, https://www.ups.com/us/en/supplychain/resources/news-and-market-updates/2025-us-tariffs-impact-global-trade

- Can Apple Dodge China Tariff Fallout Without Raising iPhone Prices? Analyst Sees A Path Amid Battered Retail Morale – Stocktwits, accessed April 11, 2025, https://stocktwits.com/news-articles/markets/equity/apple-analyst-outlines-3-steps-to-mitigate-tariff-impact/chfrW1FRb9J

- Analysts rework Apple stock price target amid tariff troubles – TheStreet, accessed April 11, 2025, https://www.thestreet.com/technology/analysts-rework-apple-stock-price-target-amid-tariff-troubles

- Apple’s Stock Decline Amid Tariff Concerns | by Brad Butcher | Apr, 2025 – Medium, accessed April 11, 2025, https://medium.com/@llyengalyn/apples-stock-decline-amid-tariff-concerns-7f21f284588b

- Apple Shares Slide After Tariffs Threaten to Hit Production Hubs : r/stocks – Reddit, accessed April 11, 2025, https://www.reddit.com/r/stocks/comments/1jq1aot/apple_shares_slide_after_tariffs_threaten_to_hit/

- How Apple Could Navigate Trump’s Tariffs, According to Gurman – MacRumors, accessed April 11, 2025, https://www.macrumors.com/2025/04/07/how-apple-could-navigate-trumps-tariffs/

- Apple has few incentives to start making iPhones in U.S., despite Trump’s trade war with China – AP News, accessed April 11, 2025, https://apnews.com/article/president-trump-china-tariffs-iphone-f50e1c6ba8f8cbb7c4b463720e65f3c4

- Apple Slips After Bull Slashes Price Target Over Tariff Concerns – Morningstar, accessed April 11, 2025, https://www.morningstar.com/news/dow-jones/202504072889/apple-slips-after-bull-slashes-price-target-over-tariff-concerns

- Apple Faces Price Pressure as Tariff Hikes Prompt Strategic Realignment | Investing.com, accessed April 11, 2025, https://www.investing.com/analysis/apple-faces-price-pressure-as-tariff-hikes-prompt-strategic-realignment-200659376

- Apple Stock Sell-Off Continues After China Unveils Matching Tariffs – Reddit, accessed April 11, 2025, https://www.reddit.com/r/apple/comments/1jrd2ir/apple_stock_selloff_continues_after_china_unveils/

- Apple makes unexpected move to dodge high tariff costs – TheStreet, accessed April 11, 2025, https://www.thestreet.com/retail/apple-makes-unexpected-move-to-dodge-high-tariff-costs

- Apple may hike iPhone prices as Trump tariffs on China remain high, accessed April 11, 2025, https://www.nbcdfw.com/news/business/money-report/apple-may-hike-iphone-prices-as-trump-tariffs-on-china-remain-high/3814982/

- How Will Tim Cook Navigate the 125% Tariff on China-Made iPhones? – Observer, accessed April 11, 2025, https://observer.com/2025/04/iphone-price-trump-china-tariff/

- Why Trump’s China Tariffs Are Unlikely to Get Apple to Make iPhones in U.S. | TIME, accessed April 11, 2025, https://time.com/7276647/apple-iphone-made-in-usa-china-tariffs-trade-war-manufacturing/

- Could iPhones Really Cost $3,500 With Trump’s Tariffs? We Do the …, accessed April 11, 2025, https://www.cnet.com/personal-finance/taxes/could-iphones-really-cost-3500-with-trumps-tariffs-we-do-the-math/

- Apple CEO Warns Trump About China Tariffs, Samsung Competition – VOA, accessed April 11, 2025, https://www.voanews.com/a/economy-business_apple-ceo-warns-trump-about-china-tariffs-samsung-competition/6174042.html

- Here’s how Apple could prevent iPhone prices from going up due to tariffs – Morningstar, accessed April 11, 2025, https://www.morningstar.com/news/marketwatch/20250410309/heres-how-apple-could-prevent-iphone-prices-from-going-up-due-to-tariffs

- Tim Cook’s tactical genius; here’s how the Apple CEO could outplay Donald Trump’s tariffs, accessed April 11, 2025, https://m.economictimes.com/news/international/us/tim-cooks-tactical-genius-heres-how-the-apple-ceo-could-outplay-donald-trumps-tariffs/articleshow/120101663.cms

- iPhones May Get More Expensive. Here’s Why New Tariffs Will Impact Tech Products | Chicago News | WTTW, accessed April 11, 2025, https://news.wttw.com/2025/04/10/iphones-may-get-more-expensive-here-s-why-new-tariffs-will-impact-tech-products

- Here’s how Apple could prevent iPhone prices from going up due to tariffs – Morningstar, accessed April 11, 2025, https://www.morningstar.com/news/marketwatch/202504112/heres-how-apple-could-prevent-iphone-prices-from-going-up-due-to-tariffs

- Apple Has Few Incentives To Start Making IPhones In U.S., Despite Trump’s Trade War With China – Barchart.com, accessed April 11, 2025, https://www.barchart.com/story/news/31830886/apple-has-few-incentives-to-start-making-iphones-in-us-despite-trumps-trade-war-with-china

- When—and by how much—will Apple raise iPhone prices in the US? And why a ‘Made in America’ iPhone is unlikely – The Economic Times, accessed April 11, 2025, https://m.economictimes.com/news/international/global-trends/whenand-by-how-muchwill-apple-raise-iphone-prices-in-the-us-and-why-a-made-in-america-iphone-is-unlikely/articleshow/120191506.cms

- Tim Cook says he isn’t too worried about China tariffs on iPhones – CNET, accessed April 11, 2025, https://www.cnet.com/tech/mobile/tim-cook-says-hes-not-too-worried-about-china-tariffs-on-iphones/

- Bloomberg News – Advisor Perspectives, accessed April 11, 2025, https://www.advisorperspectives.com/firm/bloomberg-news

- Apple Stock Can Weather Tariff Storm. Here’s How. – Trefis, accessed April 11, 2025, https://www.trefis.com/stock/aapl/articles/563770/apple-stock-can-weather-tariff-storm-heres-how/2025-04-07

- Apple could significantly minimize tariff headwind, says Morgan Stanley | Markets Insider, accessed April 11, 2025, https://markets.businessinsider.com/news/stocks/apple-could-significantly-minimize-tariff-headwind-says-morgan-stanley-1034571506

- President Trump Expands Tariff Exemptions List – International Trade Insights, accessed April 14, 2025, https://www.internationaltradeinsights.com/2025/04/president-trump-expands-tariff-exemptions-list/

- White House Releases List of Products Not Subject to Reciprocal Tariffs – SmarTrade, accessed April 14, 2025, https://www.thompsonhinesmartrade.com/2025/04/white-house-releases-list-of-products-not-subject-to-reciprocal-tariffs/

- CSMS # 64724565 – UPDATED GUIDANCE – Reciprocal Tariff Exclusion for Specified Products; April 5, 2025 Effective Date, accessed April 14, 2025, https://content.govdelivery.com/accounts/USDHSCBP/bulletins/3db9e55

- Trump team tries to project confidence and calm after his tariff moves rattled markets – AP News, accessed April 14, 2025, https://apnews.com/article/trump-trade-tariffs-china-economy-consumers-markets-f98046e286004507dda7ff030427a3a0

- No ‘tariff exception’ for electronics and semiconductors, Trump says | The National, accessed April 14, 2025, https://www.thenationalnews.com/business/economy/2025/04/14/no-tariff-exception-for-electronics-and-semiconductors-trump-says/

- Trump’s Tariff Exemption for Tech Products Could Be Short-Lived – PYMNTS.com, accessed April 14, 2025, https://www.pymnts.com/economy/2025/trumps-tariff-exemption-for-tech-products-could-be-short-lived/

- Trump warns China ‘not getting off the hook’ on US tariffs for electronics | Trade War News, accessed April 14, 2025, https://www.aljazeera.com/news/2025/4/13/trump-warns-china-not-getting-off-the-hook-on-us-tariffs-for-electronics

- US Tech Tariff Exemptions Are Not Permanent, With New Tariffs ‘Coming Soon,’ Commerce Secretary Says – Investopedia, accessed April 14, 2025, https://www.investopedia.com/us-tech-tariff-exemptions-are-not-permanent-with-new-tariffs-coming-soon-commerce-secretary-says-11714384

- ‘Nobody is getting ‘off the hook’…’: Trump signals end of electronics tariff exemption for China, new duties coming – The Economic Times Video, accessed April 14, 2025, https://m.economictimes.com/news/international/world-news/nobody-is-getting-off-the-hook-trump-signals-end-of-electronics-tariff-exemption-for-china-new-duties-coming/videoshow/120270731.cms

- US-China tariff war: From Shein orders to iPhones, here’s a list of items that are expected to get expensive – The Economic Times, accessed April 11, 2025, https://m.economictimes.com/news/international/us/us-china-tariff-war-from-shein-orders-to-iphones-heres-a-list-of-items-that-are-expected-to-get-expensive/articleshow/120165417.cms

- China punches back as world weighs how to deal with higher US tariffs – AP News, accessed April 11, 2025, https://apnews.com/article/us-tariffs-trump-asia-china-europe-2c40881f1fe8f04624100c12d8d05296

- BREAKING: China raises tariffs on U.S. goods to 125% : r/stocks – Reddit, accessed April 11, 2025, https://www.reddit.com/r/stocks/comments/1jwkuhb/breaking_china_raises_tariffs_on_us_goods_to_125/

- China Raises Tariffs on US Goods to 125% in Retaliation : r/Economics – Reddit, accessed April 11, 2025, https://www.reddit.com/r/Economics/comments/1jwkpi1/china_raises_tariffs_on_us_goods_to_125_in/

- China’s rare earth export restrictions threaten global chipmaking supply chains, accessed April 11, 2025, https://www.tomshardware.com/tech-industry/chinas-rare-earth-export-restrictions-threaten-global-chipmaking-supply-chains

- [News] U.S. 125% Tariff on China Risks Price Hikes for Smartphones and NBs Due to 60-70% Import Dependency – TrendForce, accessed April 11, 2025, https://www.trendforce.com/news/2025/04/10/news-u-s-125-tariff-on-china-risks-price-hikes-for-smartphones-and-laptops-due-to-60-70-import-dependency/

- China clarifies chip import rules, impacting US firms with domestic fabs – Chinadaily.com.cn, accessed April 11, 2025, https://www.chinadaily.com.cn/a/202504/11/WS67f8c053a3104d9fd381ecf5.html

- China’s possible next move in response to tariff exemptions on electronics – WWNO, accessed April 14, 2025, https://www.wwno.org/2025-04-13/chinas-possible-next-move-in-response-to-tariff-exemptions-on-electronics

- Another U-Turn: Trump reverses tariffs that caused market meltdown, but companies remain bewildered – AP News, accessed April 14, 2025, https://apnews.com/article/trump-tariffs-pause-businesses-reaction-a61a1adcaf6332f6188ae1d70664b898

- Soybeans, corn, wheat up after tariff pause – Brownfield Ag News, accessed April 11, 2025, https://www.brownfieldagnews.com/market-news/soybeans-corn-wheat-up-after-tariff-pause/

- The Recently-Announced U.S. Tariffs Followed By a 90-Day Pause: Frequently Asked Questions | Regulatory & Compliance, accessed April 14, 2025, https://www.regulatoryandcompliance.com/2025/04/the-recently-announced-u-s-tariffs-followed-by-a-90-day-pause-frequently-asked-questions/

- Breakfast News: Tariff Impact | The Motley Fool, accessed April 11, 2025, https://www.fool.com/investing/breakfast-news/2025/04/03/breakfast-news-tariff-impact/

- India-US Trade Relations Under Trump’s Tariffs, accessed April 11, 2025, https://www.india-briefing.com/news/india-us-trade-relations-under-trumps-tariffs-36416.html/

- India will gain if Apple shifts iPhone production outside China: Report, accessed April 11, 2025, https://www.newindianexpress.com/business/2025/Apr/10/india-will-gain-if-apple-shifts-iphone-production-outside-china-report

- Vietnamese garment, textile firms brace for US tariff’s impacts – Theinvestor, accessed April 11, 2025, https://theinvestor.vn/vietnamese-garment-textile-firms-brace-for-us-tariffs-impacts-d15212.html

- The Impact of Tariffs on Vietnamese Exports: US-Vietnam Trade Relations Under Trump 2.0, accessed April 11, 2025, https://www.vietnam-briefing.com/news/us-vietnam-trade-relations-trump-impact-tariffs-vietnamese-exports.html/

- Apple’s Production Strategy in Vietnam, accessed April 11, 2025, https://www.vietnam-briefing.com/news/apples-production-strategy-in-vietnam.html/

- How Trump’s Reciprocal Tariffs Could Reshape US & Global Import-Export Trends, accessed April 11, 2025, https://www.tradeimex.in/blogs/trump-reciprocal-tariffs-us-global-import-export-trends

- Trump Tariffs Push Apple, Nvidia and Other Tech Giants to Rethink Hardware Manufacturing in Asia | Built In, accessed April 11, 2025, https://builtin.com/articles/donald-trump-tech-tariffs

- U.S. tariffs on Vietnam would be a blow to Nike and other sportswear brands, accessed April 11, 2025, https://www.japantimes.co.jp/business/2025/04/02/markets/us-tariffs-vietnam-nike-sportswear/

- Sneaker and apparel retailers blindsided by tariffs on Asian factory hubs, accessed April 11, 2025, https://www.tbsnews.net/economy/sneaker-and-apparel-retailers-blindsided-tariffs-asian-factory-hubs-1107341

- Trump Tariffs on Vietnam Would Hurt Nike, Adidas, and On, accessed April 11, 2025, https://frontofficesports.com/sportswear-retailers-in-crosshairs-as-trump-announces-more-tariffs/

- Apple’s formula can mean a bumper crop: Is India ready? – The Economic Times, accessed April 11, 2025, https://m.economictimes.com/industry/cons-products/electronics/apples-formula-can-mean-a-bumper-crop-is-india-ready/amp_articleshow/120133478.cms

- Tariffs will make sneakers, jeans and almost everything Americans wear cost more, trade groups warn – AP News, accessed April 11, 2025, https://apnews.com/article/tariffs-clothing-shoes-china-vietnam-8eb3c697da9541ca849f6ed52d7279b2

- Trump tariff divides India’s electronics manufacturing industry | Today News – Mint, accessed April 11, 2025, https://www.livemint.com/news/india/trump-tariffs-india-electronics-manufacturing-apple-india-iphone-exports-electronics-manufacturing-services-11743682708507.html

- Some Americans are stockpiling $220 sneakers before Trump’s tariffs raise prices even higher | Morningstar, accessed April 11, 2025, https://www.morningstar.com/news/marketwatch/20250411254/some-americans-are-stockpiling-220-sneakers-before-trumps-tariffs-raise-prices-even-higher

- Trump’s tariff war: Asia’s winners and losers | articles | ING Think, accessed April 11, 2025, https://think.ing.com/articles/trump-tariff-war-asia-winners-and-losers/

- CNBC’s Inside India newsletter: Apple has big expansion plans in India — but Trump’s tariffs could change that – NBC10 Philadelphia, accessed April 11, 2025, https://www.nbcphiladelphia.com/news/business/money-report/inside-india-newsletter-apple-has-big-expansion-plans-in-india-but-trumps-tariffs-could-change-that/4133214/?os=vbk&ref=app

- India’s Industrial Policies: Rejecting the Old Status Quo and Creating the New, accessed April 11, 2025, https://www.cfr.org/article/indias-industrial-policies-rejecting-old-status-quo-and-creating-new

- Nike Tumbles 9% After Vietnam Slammed by 46% Tariffs – Money Morning, accessed April 11, 2025, https://moneymorning.com/2025/04/03/nike-tumbles-9-after-vietnam-slammed-by-46-tariffs/

- US tariffs on Vietnam could hit Nike, Adidas hard – Tech in Asia, accessed April 11, 2025, https://www.techinasia.com/news/us-tariffs-on-vietnam-could-hit-nike-adidas-hard

- Apple airlifts more than 1 million iPhones out of India to avoid Trump tariffs, Reuters reports, accessed April 11, 2025, https://www.cbsnews.com/news/apple-airlifts-iphones-india-tariffs/

- High tariffs could be ‘catastrophic’ for footwear and apparel … – OPB, accessed April 11, 2025, https://www.opb.org/article/2025/04/04/high-tariffs-could-be-catastrophic-for-footwear-and-apparel-companies-like-those-in-oregon/

- The Implications of Tariffs on the US Automotive Industry – o9 Solutions, accessed April 11, 2025, https://o9solutions.com/articles/the-implications-of-tariffs-on-the-us-automotive-industry/

- Closing Bell: Sports world fixes its eye on impact of tariffs, accessed April 11, 2025, https://www.sportsbusinessjournal.com/Daily/Closing-Bell/2025/04/04/

- “Liberation Day” tariffs shake global automotive supply chains, accessed April 11, 2025, https://www.automotivelogistics.media/nearshoring/what-liberation-day-tariffs-mean-for-the-automotive-supply-chain/46993.article

- US Liberation Day tariffs: Our first take on asset class impact – Julius Baer, accessed April 11, 2025, https://www.juliusbaer.com/en/insights/market-insights/market-outlook/us-liberation-day-tariffs-our-first-take-on-asset-class-impact/

- Markets News, April 8, 2025: Stocks Close Sharply Lower as High Volatility Persists Amid Concerns About Tariffs – Investopedia, accessed April 11, 2025, https://www.investopedia.com/dow-jones-today-04082025-11711039

- Markets News, April 4, 2025: Dow Drops 2,200 Points, S&P Plunges 6%, Nasdaq Enters Bear Market as Tariff Turmoil Rocks Stock Market – Investopedia, accessed April 11, 2025, https://www.investopedia.com/dow-jones-today-04042025-11709025

- Weekly market recap & what’s ahead – 14 April 2025 – Saxo Bank, accessed April 14, 2025, https://www.home.saxo/content/articles/macro/weekly-market-recap–what-s-ahead—14-april-2025-14042025

- Trump’s tariff suspension drives market volatility | Market Navigator | IG International, accessed April 14, 2025, https://www.ig.com/en/news-and-trade-ideas/weekly-market-navigator–14-apr-2025-250414

- Content List – ION Analytics, accessed April 11, 2025, https://ionanalytics.com/content-list/

- US stock market closes lower after Trump’s latest tariff threats – AP News, accessed April 14, 2025, https://apnews.com/article/trump-tariffs-global-trade-us-markets-670c72738d08073ea15cb0ac0c493618

- Wall Street futures make cautious gains as tariffs change – The Economic Times, accessed April 14, 2025, https://m.economictimes.com/markets/stocks/news/wall-street-futures-make-cautious-gains-as-tariffs-change/articleshow/120266812.cms

- US stock futures rise amid some reprieve from Trump tariffs; earnings in focus, accessed April 14, 2025, https://www.investing.com/news/stock-market-news/us-stock-futures-rise-amid-some-reprieve-from-trump-tariffs-earnings-in-focus-3982541

- Taking Apart the Tariff Impact With ETFs, accessed April 11, 2025, https://www.etftrends.com/taking-apart-tariff-impact-etfs/

- Tesla, chip stocks Intel, Qualcomm tumble as China’s retaliation stokes fears of widening trade war – The Economic Times, accessed April 11, 2025, https://m.economictimes.com/markets/stocks/news/tesla-chip-stocks-intel-qualcomm-tumble-as-chinas-retaliation-stokes-fears-of-widening-trade-war/articleshow/119987543.cms

- Caterpillar Stock Slides as China Levies Retaliatory Tariffs – Investopedia, accessed April 11, 2025, https://www.investopedia.com/caterpillar-stock-slides-as-china-levies-retaliatory-tariffs-11709218

- Apple Stock (AAPL) Sinks after BofA Cuts Price Target amid New Tariffs | Markets Insider, accessed April 11, 2025, https://markets.businessinsider.com/news/stocks/apple-stock-aapl-sinks-after-bofa-cuts-price-target-amid-new-tariffs-1034548660

- Tariff Pressure on Caterpillar Inc: Latest Trade War Impact & Stock Analysis, accessed April 11, 2025, https://www.stocktargetadvisor.com/blog/china-tariffs-on-caterpillar-inc/

- How’s General Motors Faring in China Amid Fierce Competition? – Nasdaq, accessed April 11, 2025, https://www.nasdaq.com/articles/hows-general-motors-faring-china-amid-fierce-competition

- Q1 2025 Earnings Season: A High-Stakes Test for Tariff-Era Market Sentiment – YCharts, accessed April 14, 2025, https://get.ycharts.com/resources/blog/q1-2025-earnings-season-a-high-stakes-test-for-tariff-era-market-sentiment/

- Markets News, April 10, 2025: Dow Drops 1,000 Points, Nasdaq Plunges 4% as Market Erases Big Piece of Previous Day’s Massive Gains – Investopedia, accessed April 11, 2025, https://www.investopedia.com/dow-jones-today04102025-11712593

- Trump tariffs wipe out $13 billion in Nike market value – Baystreet.ca, accessed April 11, 2025, https://www.baystreet.ca/investing/110274/Trump-tariffs-wipe-out-13-billion-in-Nike-market-value

- Tesla’s Elon Musk personally appeals to Trump to scrap tariffs: Report, accessed April 11, 2025, https://m.economictimes.com/news/international/global-trends/tesla-doge-elon-musk-made-direct-appeals-to-trump-to-scrap-tariffs-report/articleshow/120080201.cms

- Rift between Elon Musk and Trump official after former loses $300bn for first time since Nov 2024 amid rift reports? – The Economic Times, accessed April 11, 2025, https://m.economictimes.com/news/international/global-trends/us-news-trump-tariffs-elon-musk-angry-at-trump-after-worlds-richest-man-loses-300bn-for-first-time-since-nov-2024-amid-rift-reports-peter-navarro/articleshow/120092244.cms

- Tesla’s Q1 Deliveries Disappoint – Timothy Sykes, accessed April 11, 2025, https://www.timothysykes.com/news/tesla-inc-tsla-news-2025_04_10/

- NIKE, Inc. (NKE) latest stock news and headlines – Yahoo Finance, accessed April 11, 2025, https://sg.finance.yahoo.com/quote/NKE/news/

- General Motors: When Good News Isn’t Good Enough – TradingView, accessed April 11, 2025, https://www.tradingview.com/news/marketbeat:f7cbbab82094b:0-general-motors-when-good-news-isn-t-good-enough/

- UBS downgrades GM to ‘neutral’ as it sees impact on earnings from tariffs By Investing.com, accessed April 11, 2025, https://www.investing.com/news/stock-market-news/ubs-downgrades-gm-to-neutral-as-it-sees-impact-on-earnings-from-tariffs-3979359

- Tariffs live updates: Microsoft’s price target cut, Apple airlifts iPhones out of India, accessed April 11, 2025, https://www.windowscentral.com/news/live/tariffs-2025

- Walmart leaning into tariff uncertainty: ‘Positioned to play offense’ – Fox Business, accessed April 11, 2025, https://www.foxbusiness.com/retail/walmart-leaning-tariff-uncertainty-sees-opportunities

- Walmart stuns Wall Street by explaining how it can benefit from Trump’s tariffs – Daily Mail, accessed April 11, 2025, https://www.dailymail.co.uk/yourmoney/consumer/article-14588473/walmart-stuns-wall-street-benefit-rumps-tariffs.html

- For Q1 Earnings Season, It’s the Uncertain Outlook That Matters | Morningstar, accessed April 14, 2025, https://www.morningstar.com/markets/q1-earnings-season-its-uncertain-outlook-that-matters

- Walmart’s missing prices show trade chaos coming for consumers, accessed April 11, 2025, https://www.spokesman.com/stories/2025/apr/10/walmarts-missing-prices-show-trade-chaos-coming-fo/

- Nasdaq leads futures gains amid new tariff pivot, Apple jumps 6% – Investment News, accessed April 14, 2025, https://www.investmentnews.com/equities/nasdaq-leads-futures-gains-amid-new-tariff-pivot-apple-jumps-6/260104

- North American Morning Briefing: Tech Giants Power Markets Higher | Morningstar, accessed April 14, 2025, https://www.morningstar.com/news/dow-jones/202504141948/north-american-morning-briefing-tech-giants-power-markets-higher

- Stock Market Today: Stocks higher as tech powers through tariff confusion – TheStreet, accessed April 14, 2025, https://www.thestreet.com/investing/stock-market-today-stocks-higher-as-tech-powers-through-tariff-confusion

- Market Quick Take – 14 April 2025 – Saxo Bank, accessed April 14, 2025, https://www.home.saxo/content/articles/macro/market-quick-take—14-april-2025-14042025

- What CEOs talked about in Q1 2025: Tariffs, rising uncertainty, and agentic AI – IoT Analytics, accessed April 14, 2025, https://iot-analytics.com/what-ceos-talked-about-q1-2025-tariffs-uncertainty-agentic-ai/

- Q1 2025 Market Wrap: You get a tariff. You get a tariff. Everybody gets a tariff!, accessed April 14, 2025, https://centurawealth.com/blog/q1-2025-market-wrap-you-get-a-tariff-you-get-a-tariff-everybody-gets-a-tariff/

- Q1 Earnings Season Mired in Uncertainty as Banks Begin Reporting Friday, accessed April 14, 2025, https://www.wallstreethorizon.com/blog/Q1-Earnings-Season-Mired-in-Uncertainty-as-Banks-Begin-Reporting-Friday

- Walmart Retracts Income Guidance Over Tariff Concerns | PYMNTS.com, accessed April 14, 2025, https://www.pymnts.com/walmart/2025/walmart-retracts-income-guidance-over-tariff-concerns/

- Guidance to be Key Factor This Earnings Season – Nasdaq, accessed April 14, 2025, https://www.nasdaq.com/articles/guidance-be-key-factor-earnings-season-0

- 5 Things to Know Before the Stock Market Opens – Investopedia, accessed April 11, 2025, https://www.investopedia.com/5-things-to-know-before-the-stock-market-opens-april-11-2025-11713401

- Market Review: April 03, 2025 | eOption, accessed April 11, 2025, https://www.eoption.com/market-review-april-03-2025/

- Trump Backs Off Reciprocal Tariffs, Slaps 125% Duty On China – EDairy News English, accessed April 11, 2025, https://en.edairynews.com/trump-backs-off-reciprocal-tariffs-slaps-125-duty-on-china/

- ‘Anxious’: US farmers see tariffs threaten earnings – The Economic Times, accessed April 11, 2025, https://m.economictimes.com/news/international/world-news/anxious-us-farmers-see-tariffs-threaten-earnings/articleshow/120031538.cms

- March earnings update: How finance leaders are navigating tariffs – CFO.com, accessed April 11, 2025, https://www.cfo.com/news/cfo-earnings-dispatch-tariffs-lululemon-nike-five-below-volkswagen-traeger-costco-macys-target-/744052/

- Investor’s Guide to the April Tariffs | Charles Schwab, accessed April 14, 2025, https://www.schwab.com/learn/story/investors-guide-to-april-tariffs

- Navigating Asia’s new trade reality after the US tariff shock – The World Economic Forum, accessed April 14, 2025, https://www.weforum.org/stories/2025/04/navigating-asia-new-trade-reality-after-the-us-tariff-shock/

- Businesses Begin Tacking On Fees in Response to Tariffs – PYMNTS.com, accessed April 14, 2025, https://www.pymnts.com/news/retail/2025/businesses-begin-tacking-on-fees-in-response-to-tariffs/

- Q1 2025 review: analyzing the impact of tariffs and geopolitical dynamics, accessed April 14, 2025, https://www.manulifeim.com/retail/ca/en/viewpoints/capital-markets-strategy/Q1-2025-review-analyzing-impact-of-tariffs-geopolitical-dynamics