What a month it has been!

What a month it has been!

As I said back in March - "Thank God for hedges!" and we have since gained AND CASHED IN over $1M worth of our $2.35M worth of hedges - leaving us with PLENTY of CASH!!! to redeploy to our longs, which are still on sale.

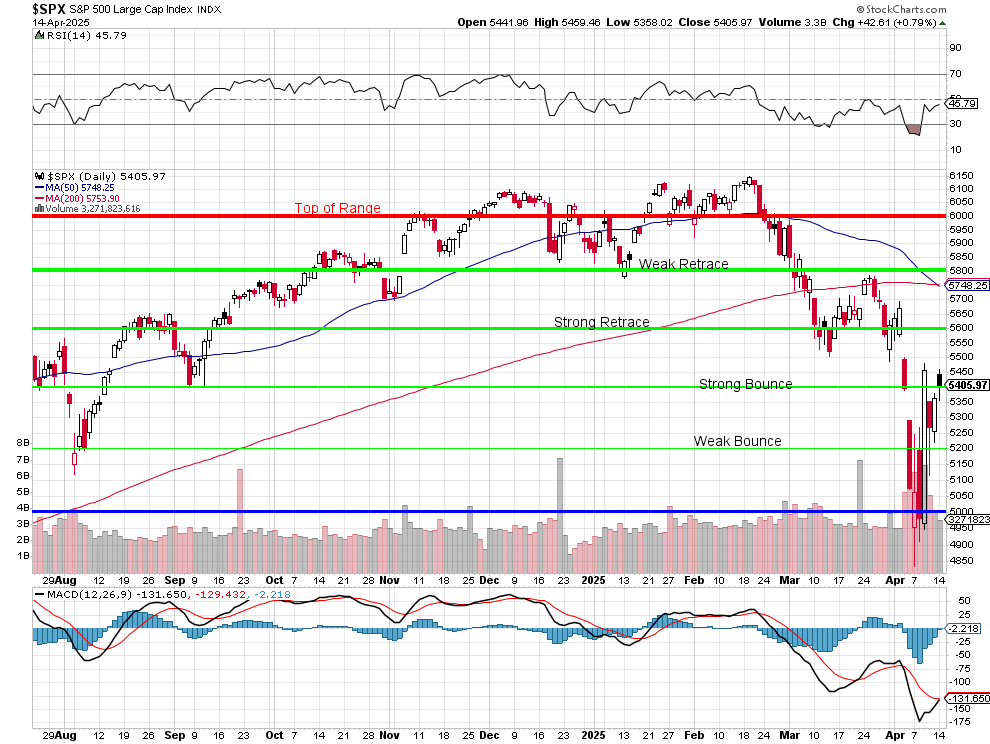

We are NOT out of the tariff woods yet - not by a long shot and overall, the S&P 500 is still 270 points (4.7%) below where we were last month (18th) and we're resting on our Strong Bounce Line but heading into a Death Cross that officially struck the S&P yesterday at 5,750 - 345 points above where we are now (5,405). With looming Tariffs (90 days), a Stagnant Economy, Inflation and uncertain Corporate Earnings - I can't say I'm enthusiastic about getting back to our highs:

While our system of Being the House - NOT the Gambler means we don't need an up market to make money, we do have to be in position to make money and - if we have to give up on our prior targets (because the Fundamentals of the Economy have been changed) and that means we'll need to spend quite a bit of money adjusting our positions and then we'll have to spend more money hedging those positions (because we're certainly not "safe" from Trump changing his mind between now and lunch) and here's how stocks have performed over the past 30 days:

As we expected, Health Care, Utilities and Consumer Defensives are doing OK but let's not get too excited as Consumer Defensives are only making up about half of the previous month's losses. Even Energy has collapsed, indicating nowhere is safe in this downturn and this is with tariffs mostly on PAUSE - 88 days from now we could be right back in a doom spiral!