Old favorite:

- Cleveland Cliffs (CLF +2.4%) Chairman, President & CEO, Lourenco Goncalves bought 50,000 shares at $19.76 on December 1.

- Total transaction value being ~$990K.

- Stock was rated Outperform at Wolfe on steel pricing strength.

- Stock has gained about 66% over the last one year and currently trades at $20.16.

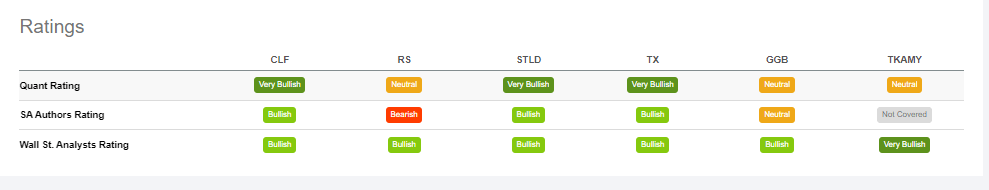

- A comparative rating against peers

- Recent Bullish commentary on the stock: 'Cleveland-Cliffs: Back Up The Truck, The Journey Is Going To Be Long'

Let's make them a new favorite again in the LTP as $20 is still under $10Bn in market cap and last year they lost $122M but the last 4Qs have been $256M, $288M, $1,197M and $1,775M so back on a path for a solid $3Bn+ which makes $10Bn a no-brainer for our LTP:

- Sell 20 CLF 2024 $20 puts for $6 ($12,000)

- Buy 50 CLF 2024 $15 calls for $8.75 ($43,750)

- Sell 50 CLF 2024 $22 calls for $5.75 ($28,750)

That is net $3,000 on the $35,000 spread that's $25,000 in the money to start with $32,000 (1,066%) upside potential at $22. Worst case is we own 2,000 shares at net $21.50 - 7.5% above the current price.