I've been beefing up our bullish plays on the Watch List.

I've been beefing up our bullish plays on the Watch List.

If we're going to get more bullish I thought it would be a good time to look for some bullish premises so we don't feel totally silly paying 20-year high p/e's for the S&P 500. Obviously, our main hope is that the stocks we buy will grow into their earnings so the next month's worth of reports will be key. The bar for corporate earnings is still set at very easy to beat levels yet, like this limbo-playing child, when they announce their beats of very low expectations we're going to get all excited and tell them how great they are doing.

The problem is, these are not kids who we hope may grow up one day to be President or CEOs of major companies. these ARE CEOs of major companies and they are being paid top salaries for top performance and we, the stock purchasing public, are paying top dollar for what should be SPECTACULAR performance, not beating 75% off last year's earnings by a penny!

When I am being asked to buy IBM back at it's all-time high or AMZN or BIDU or AM, PALM, NFLX, PCLN, URBN, UHS, CERN, CREE, GMCR, CY, SWM, TRLG, BKE, etc – then their performance better look like this:

Nothing against those particular companies, any individual company can be exceptional and beat the market, but – Are the companies we're buying really doing exceptional things or are have we just developed such ridiculously low expectations that we have been psychologically conditioned (and Wall Street firms employ armies of behavioral psychologists for a reason) to treat these stocks and the CEOs who run them like our children? If your child was the child in the above picture and I asked you for $20 to see her limbo show – you might pay it. If it's not your child though, would you even consider making an afternoon of it? No, of course not, for good money you expect to see the cool fire guy at the top of his game and that is what you should expect from companies trading at or near all-time highs – NO LESS!

I love President Obama but he was just given a Nobel Peace Prize simply for not being President Bush – low expectations! On Sept 17th, PALM announced that it lost 10 cents a share, not losing the 25 cents expected and gave lowered guidance for Q3. The non-adjusted loss for PALM was their 9th consecutive GAAP loss in a row. What did the stock do? Today it's up 25% with a forward p/e of 40. Why? Low expectations! And even that is based on the assumption that they will break their 9-quarter losing streak and turn a .42 profit next year. For that you are being asked to hand over $17 of your hard-earned cash for each share of this stock.

ADBE missed by a penny (3%) on 9/15 and they actually fell off their year's high of $35.78 but now they are back to $34.64 and will hopefully manage to earn $1.52 this year (p/e of 23), perhaps about right as they earned $2.07 last year and traded in the low $40s. DBRN missed on revenues on 9/16 and guided lower for 2010 to $1.15 per share and they are up 10% to $18.43 (p/e 16 if they don't guide down again). Just this Wednesday, MON announced a bigger loss than last quarter ($233M or .43 per share vs a loss of .31 last Q) and revenues were down 10% from last year and dropped 2010 forecast 10% to $3.20 a share – that was good for a 3% gain into the end of the week. LOW EXPECTATIONS!

ADBE missed by a penny (3%) on 9/15 and they actually fell off their year's high of $35.78 but now they are back to $34.64 and will hopefully manage to earn $1.52 this year (p/e of 23), perhaps about right as they earned $2.07 last year and traded in the low $40s. DBRN missed on revenues on 9/16 and guided lower for 2010 to $1.15 per share and they are up 10% to $18.43 (p/e 16 if they don't guide down again). Just this Wednesday, MON announced a bigger loss than last quarter ($233M or .43 per share vs a loss of .31 last Q) and revenues were down 10% from last year and dropped 2010 forecast 10% to $3.20 a share – that was good for a 3% gain into the end of the week. LOW EXPECTATIONS!

OK, I am done with my rant, now let's see what all the fuss is about in our new and improved economy (items copied from SAlpha Market Currents, Phil's Favorites and various other news sources):

A new survey of economists puts Q3 GDP growth at a whopping 3.2%, the best quarter since Q3 2007, and up from an estimate of 0.2% just one month ago. Which gives even more meaning to this chart from Eddy Elfenbein, according to which corporate profits as a percentage of overall GDP have plenty of upside.

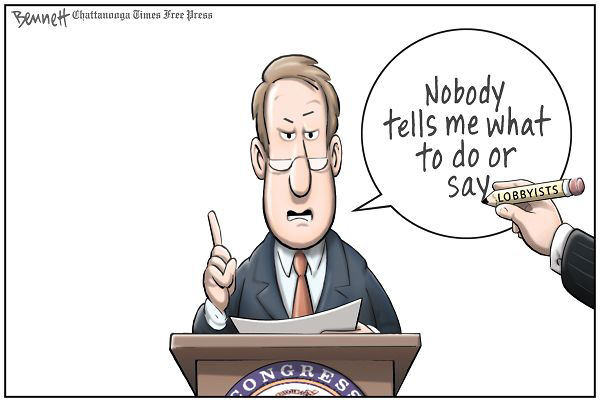

Surprise! No bank failures Friday night. Tally for the year holds at 98. Banks got rescued by a Treasury secretary more favorable to them than any in a generation. So, Joe Nocera asks, how can they shamelessly oppose consumer protection as defined by Geithner? Congress debates protective measures this week that are in danger of getting watered down.

Surprise! No bank failures Friday night. Tally for the year holds at 98. Banks got rescued by a Treasury secretary more favorable to them than any in a generation. So, Joe Nocera asks, how can they shamelessly oppose consumer protection as defined by Geithner? Congress debates protective measures this week that are in danger of getting watered down.

Lobbyists from the financial industry have paid hundreds of millions to Congress and the Obama administration. They have bought virtually all of the key congress members and senators on committees overseeing finances and banking. This is easy to confirm in black-and-white. See for yourself: here, here, here, here, here and here. Great chart from Barry Ritholtz showing ROI on lobbying efforts.

Meanwhile, every 13 seconds in America, there is another foreclosure filing. According to the Center for Responsible Lending, foreclosures are on track to wipe out $502B in property values this year. Condo prices remain fairly cheap, but it's nonetheless alarming to hear a Miami real-estate broker say: "It's really been a crazy, hectic time in South Florida. It sort of reminds you of 2005 all over again."

Speaking of paid-off Senators, John Barrasso (R-WY) was so full of crap in his anti-health care arguments that even Fox's Shep Smith had to stop and correct him. Wha'ts most interesting about this interview is while Shep talks, the Senator is like a blinking machine, I'm not sure what that means but I don't think he went on Fox expecting to run into an opposing viewpoint. Will Shep be schlepped out of town by Murdoch or is Fox realizing the need to get a little more fair and balanced? Part of Shep's commentary:

Over the last 10 years health care costs in America have skyrocketed. Regular folks cannot afford it, so they tax the system by not getting preventive medicine, and we all end up paying for it. As the costs have gone up, the insurance industry's profits, on average, have gone up 350 percent. And it's the insurance companies which have paid and which have contributed to senators and congressmen on both sides of the aisle to the point where now we can't get what all concerned on Capitol Hill all seem to [believe] and more than 60 percent of Americans say they support, a public option. Every vote against the public option is a vote for the insurance companies.

Meanwhile, House Minority Leader John Boehner told reporters, “I’m still trying to find the first American to talk to who’s in favor of the public option, other than a member of Congress or the administration… I’ve not talked to one, and I get to a lot of places and I’ve not had anyone come up to me — I know I’m inviting it — and lobby for the public option.” Well, some of Mr. Boehner’s constituents decided to take him up on his offer and rally outside his district office in West Chester, Ohio, delivering over 1,800 signatures of people in his district who support a public option.

Keep in mind that this cartoon is from 1994, 15 years of no hope and no change!!!

Aside from giving human beings health care, another major problem that has now been targeted for termination by conservatives is the Bible. According to Consevapedia: "Liberal bias has become the single biggest distortion in modern Bible translations." The eager young men at Conservapedia are p.o.'d that the Bible might be seen as too liberal. So they've come up with the Wiki-style Conservative Bible Project, to make sure the Lord doesn't go all wobbly on us and have laid out the following guidlines for rewriting the Bible so that it may be enjoyed by right-thinking people and the children they are programming:

- Framework against Liberal Bias: providing a strong framework that enables a thought-for-thought translation without corruption by liberal bias

- Not Emasculated: avoiding unisex, "gender inclusive" language, and other modern emasculation of Christianity

- Utilize Powerful Conservative Terms: using powerful new conservative terms as they develop;[4] defective translations use the word "comrade" three times as often as "volunteer"; similarly, updating words which have a change in meaning, such as "word", "peace", and "miracle".

- Combat Harmful Addiction: combating addiction by using modern terms for it, such as "gamble" rather than "cast lots";[5] using modern political terms, such as "register" rather than "enroll" for the census

- Accept the Logic of Hell: applying logic with its full force and effect, as in not denying or downplaying the very real existence of Hell or the Devil.

- Express Free Market Parables; explaining the numerous economic parables with their full free-market meaning

- Exclude Later-Inserted Liberal Passages: excluding the later-inserted liberal passages that are not authentic, such as the adulteress story.

The project lists possible approaches to creating a conservative Bible translation:

- identify pro-liberal terms used in existing Bible translations, such as "government", and suggest more accurate substitutes

- identify the omission of liberal terms for vices, such as "gambling", and identify where they should be used

- identify conservative terms that are omitted from existing translations, and propose where they could improve the translation

- identify terms that have lost their original meaning, such as "word" in the beginning of the Gospel of John, and suggest replacements, such as "truth"

AlterNet has a nice article listing the 30 conservative Senators who voted against the "Franken Ammendment" which seeks to withhold defense contracts from companies like KBR "if they restrict their employees from taking workplace sexual assault, battery and discrimination cases to court." GOP Senator Jefferson Beauregard Sessions of Alabama allowing victims of sexual assault a day in court is tantamount to a "political attack" at Halliburton.

AlterNet has a nice article listing the 30 conservative Senators who voted against the "Franken Ammendment" which seeks to withhold defense contracts from companies like KBR "if they restrict their employees from taking workplace sexual assault, battery and discrimination cases to court." GOP Senator Jefferson Beauregard Sessions of Alabama allowing victims of sexual assault a day in court is tantamount to a "political attack" at Halliburton.

In a green shoot for the oil bulls, James Hamilton notes the "daunting" challenge private oil companies face in just keeping oil production steady. Technology helps with existing fields, but it takes new discoveries just to keep up with demand. This is good for oil prices but not the companies themselves unless they get those high prices and, if they get those high prices, what happens to the rest of the economy? It's like we are doomed to repeat last year over and over again…

Chinese leaders are concerned that their nation's enormous economic expansion is becoming an excuse for foreign suppliers to inflate commodity costs. So, they hope to use their three futures exchanges to fight back. Government officials say the country is positioning its futures markets to be major players in setting world prices for metal, energy and farm commodities. By letting the world know how much its companies and investors think goods are worth,

Matt Lynn predicts a coming boom in M&A activity. This is one of the major things I need to see to get more bullish. "All the signs are that the global capital markets are gearing up for the next big thing: a wave of mergers and takeover bids. Kraft Foods Inc. is stalking U.K. confectionery maker Cadbury Plc; mining company Xstrata Plc has proposed combining with Anglo American Plc; and computer manufacturer Dell Inc. just acquired Perot Systems Corp."

U.S. banks are reducing their lending at the fastest rate on record, tightening the credit squeeze and threatening to leave many otherwise viable businesses unable to borrow money to expand their businesses, meet their payroll or refinance their maturing debts. According to weekly figures provided by the Federal Reserve,total loans at commercial banks have fallen at a 19% annual rate over the past three months, while loans to businesses have dropped at a 28% annualized pace.

Reminiscing about October crashes past, and their disturbing similarities to today (a worrisome sliding dollar) and an important difference (those times: interest rates soaring in response to inflationary threats).

In the "Not a green shoot" department:

David Rosenberg, of Gluskin Sheff, notes that on an operating (”scrubbed”) basis the price/earnings ratio of the Standard & Poor’s 500 has expanded a whopping 10 points since its March low, and stands at 27.6. Historically, Dave observes, when the economy is making the switch from contraction to expansion, as it did in the third quarter, the P/E is 15.

Trailing earnings are untouched by clairvoyance, in contrast to forward earnings, which depend heavily on projecting the future. But such estimates have their drawbacks, particularly since Wall Street forecasters are a cheerful lot predisposed toward upbeat prognostication. A year ago, equities were trading at a modest 12 times forward estimates. In fact, as Dave puts it, with perfect hindsight, the market at the time was really trading at 30 times forward earnings.

Currently, Dave reckons, the S&P 500 is priced for $83 in operating earnings, or double the most recent four-quarter trend, and normally it takes five years for profits to double from a recessionary low. Such a feat would be more than a little impressive, since revenues, for the first time ever, have registered four quarters in a row of double-digit decline. Given the going estimates for operating earnings of $48 a share this year, $53 next year, $63 in 2011 and $81 for 2012, he concludes that “the market is basically discounting an earnings stream that even the consensus does not see for another two to three years.” In Dave’s book, stocks remain more than fully priced.

How do we turn this into a green shoot? Bloomberg manages with this doozy:

Investors outside the

US are purchasing companies in the S&P 500 Index as the cheapest valuations on record, their buying power boosted by a seven-month decline in the dollar. The S&P 500 is priced at 19.9 times earnings, the biggest discount to the MSCI World Index of 23 developed countries since May 2003, according to monthly data compiled by Bloomberg. For euro-based money managers, currency translations push the cost ofU.S. stocks down to 13.6 times profits, the lowest level ever relative to global equities and a discount that dollar-based investors have never enjoyed, data compiled by Bloomberg show. The last time US stocks were this inexpensive, in 2003, the S&P 500 began a four-year, 62% advance.